Seizing the Future: How MRC Is Redefining Wealth Creation in the Age of AI and Digital Finance

Good evening to all future investors at Diamond Ridge Financial Academy!

I'm Charles Hanover, and welcome to this class in a time full of significant changes and huge opportunities. Right now, the global economy is going through major ups and downs. Policies are clashing, the old asset system is getting revalued, and capital is quietly moving away from the old world and into a brand-new digital one. At this key moment, every investor has a choice: either sit back and watch your assets lose value or take action and grab the top spot in the new cycle. Only those with vision, clear thinking and bold moves can stand out in this global wealth shift and catch the real gains this era brings.

Tonight, we'll start by looking at what's going on in the market, take a deep dive into MRC's strategic role in the AI and crypto trend, and I'll walk you through how to use smart asset allocation to lock in key positions early and build a strategy that can handle all kinds of market cycles, even the tough ones. This isn't just a talk about opportunities; it's a forward-looking plan for the future of wealth.

Today, the UK stock market was pretty weak overall. The FTSE 100 tried to climb but got stuck and ended near yesterday's close. That shows people are still worried about where the economy is headed. Some stocks, like Rolls-Royce, had a short-term boost, but major sectors like energy, banking and manufacturing stayed under pressure. Falling export demand and low business confidence are making recession fears worse. The Bank of England is stuck choosing between cutting rates and fighting inflation. Most people expect a more relaxed policy soon, but the risks of a slowdown are already showing. The UK market is starting to feel the pressure of a mid-term adjustment.

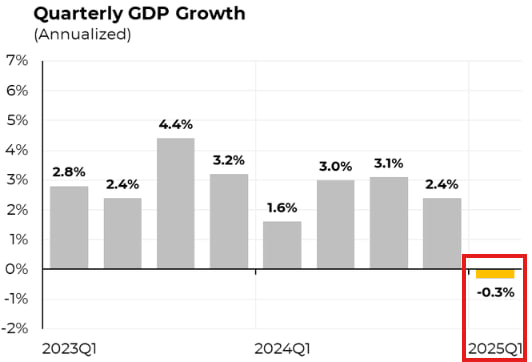

In the US, the stock market has had a slight bounce today thanks to tech stocks, but overall, things still look weak. Last week's jobless claims were way higher than expected, the highest since February. Ongoing claims hit a three-year high, which shows layoffs from tariff pressure are kicking in. Surprisingly, the Q1 GDP shrank by 0.3%, proving that stagflation was starting to show up. Even though the market is trying to stay hopeful about tariff news, mixed signals from the Treasury and trade officials are adding more doubt. With jobs weakening and the economy shrinking, even if tech stocks are up because of crypto and AI, the bigger risks are still there. US stocks are caught between tough policy and a slowing economy, and signs of more trouble are becoming clearer.

From an investment point of view, there are two key things that really drive money flow: one is the long-term trend of tech development, and the other is the short-term strategies that governments use to handle economic changes. These two things are closely tied together, shaping the deeper reason behind the capital market's ups and downs and deciding the direction and pace of how we plan our investments. Looking back at this year's market moves, since mid-February, US stocks were the first to take a sharp dive, which quickly dragged down stock markets around the world. The real reason wasn't just one thing but a mix of worsening traditional economic fundamentals and Trump's aggressive tariff policies.

This round of market pullback can clearly be split into two stages: the first stage came from the fear of a traditional economic slowdown and the quick rollout of "equal tariffs," which triggered a wave of selling. The three major US indexes each dropped over 20%, pulling Europe, Asia and other key markets down too. The second stage came when policies started to show signs of easing, leading to a technical rebound. But so far, the market still hasn't recovered even half of its losses. This weak rebound clearly shows that the global economy has entered a real recession cycle, and the stock market has shifted from a rising trend to a falling one.

Why do we follow the stock market so closely, especially US stocks? The reason is simple. Right now, over 80% of global assets are securitized and traded through stock markets. In other words, an asset's "market value" doesn't just show its true worth. It also shows how much people in the market recognise it. If an asset has high value but can't move around easily, its price won't reflect that value. On the flip side, the more people are willing to hold, trust and trade an asset, the more valuable it becomes in the market and the more likely it is to keep going up in price. That's exactly why US stocks matter so much; they're not just the barometer of the capital market but the world's main "trading plaza" where money moves the most.

But because the traditional capital market is so centralized and heavily leveraged, it's also getting more fragile when facing macro policy shifts and economic ups and downs. That's why we're seeing more and more money flowing into a fast-growing new space: the crypto market. This trend isn't just about excited retail investors. We're also seeing moves from governments, big banks and even sovereign wealth funds. So why is crypto getting so much attention and money during this global economic slowdown? It's because the blockchain tech behind it isn't just the cutting edge of data processing, value flow and trust in the digital age. It also offers a totally new way to store value, going beyond old-school money systems.

The fundamental logic of crypto assets encompasses both 'intrinsic value', such as data ownership, trustless base protocols, distributed storage for AI training data, and value-sharing platforms, and 'transactional value', which refers to their ability to facilitate real-time global money transfers, manage cross-border payments, handle digital IDs, and execute smart contracts via blockchain. What sets crypto assets apart from traditional financial instruments is their inherent liquidity. They are not issued or controlled by central institutions; instead, they grow organically through shared technology and network effects. As more participants join the network, its resilience increases, and trust in its value permeates the entire financial system.

At the same time, compared to fiat currencies that can be printed anytime, the scarcity and transparency of crypto make it more valuable in the long run. Traditional paper money can be printed without limit due to stimulus policies, causing devaluation, rising prices and even triggering systemic inflation and debt crises. However, major crypto assets like BTC have a fixed supply written into the code, so they can’t be printed at will. That’s why, in times of extreme policy uncertainty and fading trust in fiat, more and more institutions and countries see it as “digital gold.” In fact, we’re already seeing traditional assets like bonds, real estate and funds being turned into tokens and traded on-chain through blockchain tech. This trend isn’t just about tech upgrades. It’s also a clear sign that the system is actively accepting the digitalisation of financial assets.

In the past two years, traditional finance giants like BlackRock, Fidelity, and Bain Capital have been diving into the crypto market, but not on a whim. Whether it’s launching spot BTC ETFs, building stablecoin clearing systems or kicking off RWA on-chain projects, the core logic behind these moves is simple: they’ve already realised that in a world where tech is evolving fast, and decentralisation is here to stay, whoever controls the crypto asset standards, account systems and clearing rules will likely take the lead in the next wave of financial power shifts. It’s not just about locking in tech gains early; it’s also a fierce battle for future financial dominance.

Looking deeper at global economic trends, what really drives long-term value shifts is the tight link between tech and finance. Especially now, with global power reshuffling and traditional models losing steam, the US is playing a two-sided game. On one hand, it pushes for “equal tariffs” to limit other countries’ export advantages. On the other hand, it’s rolling out crypto regulations at high speed. From the White House’s March release of a “National Strategy for Crypto” to the SEC starting digital asset roundtables and the Treasury and Commerce Departments openly backing new financial tech, the US is clearly trying to become the “global capital of crypto assets.”

The meaning behind all these policy moves isn’t hard to get. On one side, the US is making a system-level push to stay the tech leader. On the other, with its high debt and deficit, it’s trying to use digital currency systems to shift financial pressure and debt risks, hoping to gain the upper hand in the next economic cycle. It’s just like what happened after the Bretton Woods system collapsed when the gold-backed money system gave way to the credit-based one. Now, with blockchain as the base and trustless systems as the core, a brand-new currency system is quietly rising. You could say, with both tech and policy pushing forward, crypto has gone from the edge of finance to centre stage, becoming the most explosive asset class in today’s structural shift.

At the same time, it also reflects that the asset system of the next fifty years will no longer have stocks as the sole core but will shift towards a digital asset form dominated by crypto. Major assets like BTC and ETH, after being ETFized last year, have already opened up a “bridge” to connect with traditional markets. Emerging narratives like AI concepts, DePIN infrastructure, RWA asset tokenization and data rights confirmation are building the “underlying logic” of this new financial world. Especially since US policies are pushing forward AI and crypto together, you’ll notice that no matter how tough tariffs are, there’s almost a deliberate avoidance of restricting the AI field. Instead, they’re building a freer value transfer system for future tech industries through another crypto channel. This is typical strategic regulation, closing off the old system while opening a path for the new one.

What’s even more noteworthy is that the current movements in the capital markets are a clear reflection of the real path of this structural shift. In the past, we were accustomed to the rhythm of “stocks driving crypto”. For instance, when tech stocks were robust, BTC often rose as well. However, after February of this year, the situation flipped. Under the influence of Trump’s tariff policies, the three major US stock indexes saw significant declines, while BTC and ETH took the lead in creating an independent market, even pushing the NASDAQ into a rebound before the stock market had stabilized. This logic of “crypto supporting tech stocks” not only demonstrates the shift in funding preferences but also confirms the irreversible trend of capital structure leaning towards digital assets.

Before the US stock market opened today, the crypto market had already surged by about 2%, followed by a rebound in the NASDAQ and Dow. Notably, the companies leading the rebound are those deeply tied to crypto assets like MSTR (one of the companies with the most BTC reserves) and WULF (a new player combining AI and mining). Their movements increasingly mirror the sentiment of the crypto market. This phenomenon underscores how crypto is reshaping the value recognition in the entire capital market: more and more institutions and companies are tokenizing part of their stock-like assets, packaging them into digital assets, and putting them on a chain for more efficient and flexible capital operations.

Of course, this current resonance between the stock and crypto markets is only the “asset mapping” stage as digital assets move from the edge to the mainstream. In the long run, as policies further tilt, crypto assets will gradually detach from their reliance on the stock market and move towards an independent circulation system. Once a stable and trusted global on-chain settlement system is in place, crypto assets will truly take on the dual roles of “value measurement” and “settlement medium”, becoming digital alternatives to traditional financial assets. That’s why the current stage isn’t just a tech upgrade but a profound shift in the underlying wealth structure. Whoever can lead the switch from traditional assets to crypto assets will control the initiative and distribution rights for the next decade or even several decades.

If you miss this window, in the next five to ten years, assets still tied to the old systems and paradigms might face sharp devaluation or even lose all their value. This trend’s evolution doesn’t depend on individual understanding; it’s not a theoretical deduction or market hype but a natural process of historical laws. Just like how the internet’s restructuring of information spread has already caused traditional print media to largely disappear, blockchain’s impact on the financial system will inevitably cause traditional asset models that rely on centralized institutions, manual clearing and trust intermediaries to collapse. This is the core point I’ve been stressing over the past three months: we are standing on the critical eve of the global financial order’s reconstruction, and the US policy shift is undoubtedly the strongest driver accelerating this change.

To truly understand the nature of this trend, we need to go back to the basics of investing: the core of investing has never been about short-term price swings but about buying into a long-term future of systematic growth. Right now, from tech trends to policy directions, the most certain asset logic is the crypto market built on “AI + Blockchain.” This isn’t just some short-term hype driven by market buzz. It’s a mid to long-term structural opportunity backed by both the US government and global capital institutions. Since the beginning of this year, a huge amount of money has been pouring into AI-related tokens, not just because AI is the engine of the next productivity revolution, but because AI’s automation and intelligence naturally require a financial system that’s decentralised, programmable and verifiable; crypto assets are the perfect match. And MRC sits right at the heart of this big moment.

MRC isn’t just an AI-themed token; it’s a full-blown ecosystem with tech support, data infrastructure and a closed-loop financial setup. The vision it carries goes way beyond just launching a new token. On a micro level, MRC has built the world’s largest humanoid robot network, blending virtual and real worlds; it doesn’t just collect high-frequency data from the real world; it also carries out AI tasks by turning instructions into physical actions. On a macro level, this model basically rebuilds the global service industry’s data coordination system. It’s a real preview of the future machine economy. When MRC expands into healthcare, education, manufacturing, logistics, and energy, the flow of data, computing power, and money it connects could unlock a new smart industry with tens of trillions of dollars in potential.

However, the deeper value is that MRC’s mission was never just about one piece of tech; it’s about becoming a key force in reshaping the global financial system. In traditional finance, asset ownership, transfers, incentives and governance all rely heavily on centralised clearing networks. MRC rebuilds this with its blockchain base, shifting how value is created, moved and realised fully onto the chain, breaking down the old system’s barriers. Once this shift is complete, the global financial system won’t depend on sovereign credit or human trust anymore. It’ll be built on smart contracts and on-chain protocols as the new form of digital trust.

Of course, the true meaning of MRC is not just to take part in one narrow tech space. Its design and strategy are about redefining the connection between finance and computing at the base protocol level. When we say MRC is driving a shift in global financial models, it’s not just some big slogan; it’s about rebuilding the whole foundation so that value moves from “trusted by people” to “recognised by code”, creating a future financial system where machines work together without needing a middleman, but still totally trustworthy. MRC blends asset ownership, value incentives and on-chain governance deeply, building a real AI-powered value internet.

In this journey, MRC isn’t just handling “payments” anymore. It’s more like the “blood system” and “nervous network” of an AI-driven society. It connects everything from data input, model use and task execution to service payments, so the whole process, from running AI models and sharing knowledge to real-world action, can all be powered through MRC tokens. This kind of base-level currency is a preview of how digital governance might work in a future AI society; it’s the deeper reason behind MRC’s explosive rise.

That's exactly why the market didn't just treat MRC as some "hot concept"; people showed real trust by putting real money into it. Just yesterday, MRC's regular subscription progress bar hit an insane 3800%, meaning demand was over 38 times higher than the total supply. Some members saw MRC's early market premium shoot past 38x and got super excited; others started to get anxious, worried that with the subscription being so hot, they might get fewer tokens, and their actual returns could get watered down. In their eyes, not being able to secure more solid tokens now means they could get left behind when it's time to cash out in the future. That's also why a lot of members are now focusing on the "next round of opportunity", which is the MRC allocation phase.

But for members who aren't familiar with how allocation works, it's essential to understand the basics. Institutional allocation actually happened early on in the project; it was part of a strategic partnership where capital partners locked in core tokens at a super-low price during one or two funding rounds in return for offering tech, resources, branding or traffic. These institutions not only helped the project survive early on but also supported the market and helped grow the ecosystem. The current round of institutional allocation is just these same strategic investors adding more to their position. Their tokens are already locked in and aren't open to public investors anymore.

Of course, if we take that logic a step further, large-holder allocation isn't just a "battle of capital". It's really a game of "influence and resource power." MRC is a star project right in the middle of the AI + blockchain wave, and every part of its launch plan, token release, allocation setup, and listing path shows a tug-of-war between top-tier players. In other words, whoever gets in early and locks tokens early is basically starting at a much higher position in this new wealth cycle. Especially now, with BTC and AI both driving the big picture, the race to find "the next high-growth token" is getting crazier by the day. Since MRC checks all the boxes, tech value, policy trend, and real-world use, it's already seen as the market's next breakout starting point.

According to the latest announcement, MRC will officially open the allocation channel soon. As soon as that news dropped, the market heated up fast, especially among large investors and early subscribers, with competition over tokens getting fierce. At the same time, I've also felt that shift in energy. Over the past few days, many members have messaged me privately, hoping we can use our Business Academy's collective identity to secure more large-holder allocation spots. In fact, a good number of people on our team already qualify as large holders, and we also have strong, long-term partners with solid funding and resources. If we can present ourselves as a bundled group to the project team, our chances in the allocation round will go way up, and we'll have real leverage in the negotiation.

That's why I reached out to the project team right away to request early access to the allocation channel for our Business Academy members. Right now, our talks are getting serious. The overall strength of our academy, how active our members are, and the results from our past collaborations all help our case. What we're doing now is turning that "collective strength" into real early-stage tokens. Keep in mind, since institutional allocations are fully locked and regular subscriptions are already done, this MRC large-holder allocation window is basically the only way left to lock in tokens at a low price and secure a shot at big future returns. And this kind of opportunity is super rare, and it won't last long.

At the end of the day, all partnerships come down to one thing: exchanging resources and building trust. Whether it’s developed countries like the US pushing to legalise crypto or the SEC hosting round after round of “crypto-asset meetings”, or top institutions like BlackRock and Fidelity jumping deep into the blockchain, none of this is because they were “moved” by a specific token. It’s because they clearly understand one thing: in this new wave of financial change, whoever builds the standards and controls the entry to assets will enjoy decades of system-level rewards. That’s exactly why both institutional and large-holder allocations are just value swaps between the project and its key partners. I want to use this MRC allocation to win a system-level starting point for the core members of our Business Academy.

Over the past year or so, our team has grown together with our members, and quite a few of them have already built up their initial capital. Now, some of them actually meet the large-holder standards and are eager to join MRC's early structure in a meaningful way. I've already entered official talks with the project team on behalf of our group as a "collective investor from the Business Academy", and I'm aiming to secure a strategic allocation just for us. If things go well, this could be a real "extra return window" that we win for everyone in the academy.

However, to actually get this batch of allocated tokens, each member has to book their spot in advance. We'll use the total number of signups to help apply for more quotas to meet everyone's needs. The reason this round of allocation is called a "40x better chance than regular subscription" is simple: with the same amount of money, we can get dozens of times more original tokens and then ride MRC's natural price surge after listing to unlock the biggest possible profits.

Let's do a simple calculation. If you put $200K into the regular subscription, and with the current hit rate sitting at 3800%, the average win ratio is about 1 out of 38. That means you might only get around 1,000 MRC tokens. If MRC goes up 100x after listing, that investment will bring you about $500K. But if you put the same $200K into a large-holder allocation and get a full allotment at a much lower cost, your token amount could be 30 to 50 times more than a regular subscription. That means your final profit could break past $10M. This is exactly why allocation is seen as the true "power path to wealth" in the crypto market.

This is what I keep reminding everyone: If you missed out on BTC's early gains, if you regret not being part of the TRUMP story from 0 to 400x, then MRC might very well be your next and most important chance to turn things around. Unlike TRUMP, MRC not only has strong brand recognition but also AI-based tech, real-world business use cases and long-term ecosystem planning. It's not a flash-in-the-pan speculative token but a complete value loop with sustainable growth potential, the "new financial infrastructure for the digital age."

The opportunity is right in front of you, and whether you can truly seize it depends on one thing: action. If you want to lock in your own original tokens through this round of allocation and stand at the top of the wealth pyramid where the digital economy and AI meet, contact your dedicated assistant now to submit your allocation request. Based on the gathered requests, we’ll apply for a larger allocation from the project team, giving those who are prepared, have good judgment and take action more priority. This way, MRC’s growth benefits will not only belong to the “early institutions” but also to everyone here who has the foresight.

That’s all for tonight’s session. In today’s discussion, we approached it from the perspective of global macro transformation, delving deep into the systemic risks of traditional asset structures under high inflation, low growth and technological explosion. We further clarified the strategic value of crypto assets, particularly MRC, in this process of “old order collapse and new order rise.” Moreover, we thoroughly analyzed the funding logic behind the explosive heat during the MRC allocation phase and the token benefits hidden in the upcoming allocation stage. Using realistic investment scenarios, we helped you understand the true leverage between prioritizing participation in the allocation and asset transition.

Opportunities never wait for everyone to be ready; they quietly arrive and then slip by silently. Today, what you face isn’t an information gap but an execution gap. If you have faith, take action now.

Let’s work together to lock in the core tokens for the future AI era during this golden window of global economic transformation and wealth change. In MRC’s long-term growth path, find your own leap channel. Seizing the trend is seizing the future. I look forward to joining you as pioneers and benefit harvesters in this technological revolution in the future MRC ecosystem.