Seizing the Digital Wealth Revolution: Why MRC Represents the Gateway to the Next Decade of Capital Migration

Good evening, future investors of Diamond Ridge Financial Academy!

I’m Charles Hanover. It’s a great honour to be here with you in this advanced investment class, especially at such a key moment when the global order is being rapidly reshaped and capital rules are going through major changes. Right now, the traditional financial system is being hit hard; fiat currencies are losing value, stocks and bonds are under pressure, and economic outlooks are sliding. At the same time, a new wave of global capital shift has started, driven by AI and supported by crypto as a new system.

Especially after a big policy shift in the US, crypto has moved from a grey area into a regulated and legal space. The combination of AI and blockchain is no longer just a tech experiment; it’s now part of national strategy. This gives us a once-in-a-lifetime chance to build wealth. Global capital is pulling out of the old system and heading toward a brand-new financial world built on tech, rules and data.

We’ll start by looking at the stock market tonight, then break down MRC’s role in this big shift. We’ll dive into the tech it’s based on, the policy support it enjoys and why it has massive growth potential. And with the “pre-IPO” coin distribution set up before the new token hits the market, I’ll guide you to lock in your position in this AI + digital asset boom and grab a front-row seat in the next big wave of wealth change.

Today, the UK stock market is mostly weak and shaky. AB Foods dropped 8% after its sugar division gave a poor outlook. AstraZeneca and BP also fell 4% and 3.6%, showing that company profits are under pressure. On top of that, Brent crude dropped below $65, which dragged energy stocks down even more and hurt the market mood. HSBC beat earnings expectations and gave a short lift to the market, but overall, warning signs from the global economy are getting stronger, copper supply is tight, US consumer confidence took a dive, and rising trade tariff risks are all putting pressure on the outlook.

In the US, stocks bounced a bit today, but the market still looks shaky. Even with five days of gains bringing short-term optimism, foreign investors are still pulling out of US assets. The dollar is under pressure from outflows, showing that people are worried about America’s twin deficits and unclear policies. Earnings were mostly better than expected, but companies like GM pulled future guidance because of tariff hits. That shows global trade issues are now really hurting business confidence and planning. Consumer confidence dropped again to 86, marking the longest decline since the financial crisis. That shows weak demand and growing worries about the economy. Overall, the short-term rebound in UK and US stocks can’t hide the deeper risks in the bigger picture. Over the mid to long term, structural changes are still ahead.

Compared to that, even though global stock markets are still going through heavy swings, crypto has shown a level of strength and independence we've never seen before in this round of big-picture economic changes. Not only has it stood firm against overall market pullbacks, but it's also started to clearly rise, step by step, becoming a go-to asset for value in this new age. From tech breakthroughs to looser regulations and now a full-on capital revaluation, crypto is making a major shift from a "speculative side bet" to a "mainstream asset class" that investors are seriously adding to their portfolios.

Since the start of this year, as the US policy stance has become more friendly, BTC prices have taken off right after the election and become the first asset class to show gains from the policy shift. Even though it had a quick drop after Trump's inauguration, that classic "buy the rumour, sell the news" dip, it bounced back fast and even helped push the Nasdaq up again. This marked BTC's return as a serious part of the value pricing system. At this point, BTC is no longer just a hype tool. It's now seen by more and more investors as "digital gold," a way to hedge against shaky policies and falling fiat value.

The "global equal tariffs" policy carried on by the Trump team has become a spark that's hurting global consumer confidence and cutting into company profits. Since the first round of tariffs kicked in this Feb, we've seen a growing link between the S&P, US bonds, gold and BTC. And since Apr, the sharp ups and downs in US stocks versus the steady rise in crypto really highlight how fast money is shifting and how deep this new pricing wave is starting.

At the same time, global liquidity is flipping fast from tight to loose. Europe and China have already started easing up, and both the Fed and the US Treasury have been sending signals that they're ready to open the tap. History shows that most of BTC's big rallies happened during times of strong global liquidity, and even during tight phases, it only dipped for a bit. So, when the world's big central banks go loose again together, crypto could be the first to take off in the next round of gains.

Instead of saying crypto's 4-year cycle is driven by "halving," it's more accurate to say it moves with big macro events and global liquidity shifts. 2012 was the eurozone debt crisis, 2016 was Brexit, 2020 was the COVID pandemic, and now we're entering a new risk cycle centred on a "US dollar trust crisis." Long-term US bond yields keep climbing, money is quietly moving away from dollar-based assets, and we're seeing more central banks cutting US bonds and adding gold and BTC instead. This trend of "de-dollarisation" is a real reaction to the fear that fiat money will keep losing value, and it's the deep reason why BTC is becoming a trusted store of value beyond government control.

On the policy front, the US is also going through the most serious system shift in crypto history. The White House has appointed a "crypto czar", set up a national digital asset council, started planning a strategic BTC reserve, cancelled rules like SAB-121, and the SEC has been dropping lawsuits against major crypto-related companies. This all shows the industry is moving from a time of heavy crackdowns into a time of real system-building. Even though crypto prices are still shaken a bit by the ups and downs in traditional finance during this big policy turnaround, the fundamentals behind it are changing in a big, game-changing way. And once that delayed energy finally kicks in, the next surge could be huge.

What really decides whether crypto can move past the hype and step into a long-term growth path isn’t news buzz or market trends. It’s whether the core applications actually land and stick. In Q1 2025, the real economic value of L1 blockchains crossed $1.5B, with the yearly rate pushing toward $6B. At the same time, actual revenue from on-chain services and DeFi apps topped $3B and stablecoin settlement volume hit a new all-time high, with daily active addresses climbing steadily. These numbers clearly show that crypto is no longer a hype-driven market. It’s becoming a real on-chain economy. On leading chains like ETH, Solana and MRC, key sectors like AI, DePIN, Web3 payments and data ownership have seen strong tech development and solid capital backing, fueling serious industry-level growth.

This isn’t just another wave of hype; it’s a whole new round of “digital economy infrastructure building”, driven by real tech and aiming to reshape systems. Just like electricity, the internet and mobile networks changed how society works and how wealth is built, and the combination of crypto and AI is now rewriting how global capital flows. Digital assets aren’t just volatile price bets anymore. They’re the lifeblood of a new financial system, powering upgraded governance, redefined value chains and a full rework of how global wealth is spread.

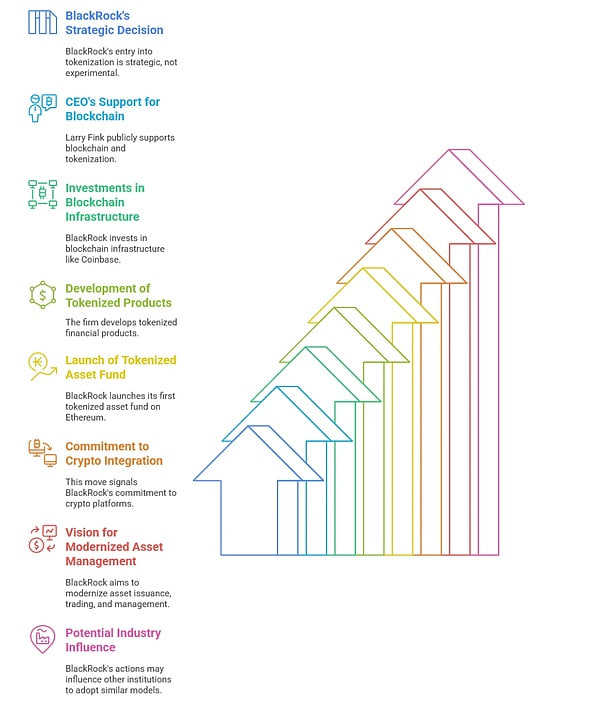

A lot of investors still don’t realize that the old-school investment tools they rely on are becoming completely outdated. In a world where high inflation, low growth, and fragmented financial systems all exist at once, traditional markets with high barriers, slow systems, and heavy centralisation are now among the biggest blocks to regular people building wealth. Giants like BlackRock and Fidelity are leading the shift. They’re not chasing trends or gambling on hype; they’ve made a clear, strategic move into asset tokenisation because they truly see where things are going.

BlackRock’s CEO, Larry Fink, has said more than once in public that tokenisation is the most game-changing thing in finance since ETFs. It makes it possible to settle everything like stocks, bonds, and real estate on-chain, letting money flow 24/7 and completely changing how fast and how smoothly the financial system runs. BlackRock has invested in Coinbase, built out pro-level crypto asset custody, and is pushing forward in real-world assets (RWA), stablecoins like USDB, BTC ETFs and tokenised money market funds like BUIDL. They’re going all-in on a future where everything is on-chain.

Even more important, BlackRock has already laid out three key moves for its tokenisation strategy: First, rebuild asset custody systems so that on-chain and off-chain asset management can fully merge. Second, help build a global legal network by working closely with sovereign regulators in Europe, the Middle East and more to get crypto licenses worldwide. Third, design use-case-driven products that break up high-barrier private investments into token forms that anyone can trade, finally breaking the “rich people only” rules in traditional finance and making investing open to everyone.

This isn’t just a rebrand. It’s a full-on system shift from top-level rules to bottom-level tools.

What we really need to think about is: where will this revolution eventually land? The answer clearly goes beyond just better efficiency. It’s about changing how value and work are structured. The Web2.5 phase, centred on Real World Asset (RWA) tokenization, is building a new financial system in a more practical way. It maintains the familiar structure and habits of Web2 while slowly adding Web3’s decentralized systems and value-based rewards. This creates a more accurate link between capital and data. In this setup, AI and DePIN networks play a key role: on the one hand, AI can handle asset pricing and risk ratings on its own, making due diligence way faster; on the other hand, DePIN networks connect real-world energy, computing power and IoT devices to crypto, giving digital assets real-world backing and finally bridging the gap between on-chain and off-chain value.

That’s why we also have to pay attention to a new focus: whoever sets the standards will shape the future. In tomorrow’s financial system, the standards for digital identity, asset tokens and on-chain data control will be the core centres of power. Big players like BlackRock are already trying to lead this shift by jumping in early and helping shape the rules for RWAs.

That’s where MRC’s strategic value comes in at this stage. As an infrastructure project built on the merge of AI and blockchain, MRC is creating the world’s largest humanoid robot data network. It not only solves how data ownership works in the real world but also completes the full loop from AI command to real-world execution in the metaverse system. BlackRock already took a strategic spot in MRC’s early token allocation, becoming a key part of its token structure. This means MRC has strong support from the world’s biggest asset manager and has been part of the global tokenization strategy since day one.

Looking ahead, the mix of AI and RWA will be the key force in reshaping the global economy. MRC, as the bridge between AI computing power, data ownership, and on-chain systems, won’t just be another new asset; it’ll be a core platform for the digital asset system of the future. This isn’t just a short-term chance for investors with a long-term vision. It’s a rare strategic starting point that could define how your wealth grows over the next 10 years. If you move early while the trend is still forming, once the structure locks in and the cycle hits, you’ll be in a position to grab massive capital gains.

What’s more, MRC is still in its subscription phase, and the progress bar has already passed 3400%. What does that number mean? This means that there are already more than 34 times the money chasing the limited number of MRC tokens available. And by crypto market standards, it’s common for a new token to jump at least 3x after listing. So, if you join through the regular subscription, your short-term return could hit over 100x on paper. This kind of chance is one of the rarest golden windows in the whole crypto investment cycle.

In other words, investing in MRC right now is essentially a race to secure as many shares as you can. Even before the subscription opened, I emphasized that the biggest risk with new token launches isn’t losing your money because the subscription price is fixed and designed to protect investors. The real key is who can secure the most tokens by acting swiftly and investing more capital. The more tokens you hold, the more you’ll benefit when the price takes off later.

That's exactly why many people who have already joined the Subscription are actually feeling both excited and nervous. On the one hand, they're glad they caught this big wealth opportunity brought about by the AI revolution. On the other hand, they're starting to worry. Since the Subscription is so insanely popular and way more money is coming in than expected, they fear they might only get a small portion of the actual allocation and won't be able to make the most out of the gains. This kind of worry makes sense because when a big opportunity shows up, the ability to lock in more shares directly affects how much wealth you can build in the end.

At the same time, some members with stronger financial power are actively applying for priority allocation as major buyers, getting ready to fight for their slice of the directed sale. That's definitely a smart move. After all, with this kind of special allocation, it's pretty much a 100% guaranteed win. As long as you qualify for the directed sale, you can lock in top-quality MRC shares and lay down a solid foundation for long-term returns and safety.

Of course, it's important to note that direct sales aren't available to everyone. It's split into two main groups. The first is institutional allocation, which is for strategic partners who joined the Metaverse Robotics project early and offered capital, tech or resources. These partners not only got early access at low prices, but they also carried the job of helping stabilize the token price before it hit the market. The second is large-holder allocation, which is for high-net-worth individual investors who meet certain asset sizes and investment qualifications.

Whether it's institutional or large-holder allocation, the project team is really trying to bring in top-tier capital that can offer long-term support. You can see this idea clearly in the Dogecoin case. Elon Musk was brought in as a major early investor, and his involvement brought global attention and huge hype, pushing Dogecoin's price up more than 300 times. The logic is simple: when strong investors and celebrity names join early, they boost the token's exposure and credibility big time, setting the stage for a huge market run later on.

Looking at the bigger business picture, how a project distributes its fundraising plays a key role not just in token supply and price stability during launch but also in how far the project can grow in the future. A healthy funding structure can keep prices stable early on by reducing selling pressure, and it also gives the team enough money to grow the ecosystem and bring real-world use cases to life. This kind of win-win model is exactly what helps great projects stand out from the crowd.

Specifically for MRC, the institutional allocation part has basically been locked in and now serves as a solid foundation for the project. Meanwhile, the large-holder allocation is dynamically filtered and prioritized based on the size of funds, the pace of subscription, and overall contribution. In other words, for any investor who truly wants to build a deep position in MRC, there are only two right and realistic strategies:

First, keep increasing your capital through regular subscriptions to raise your allocation chances and base position.

Second, actively apply for large-holder allocation to get into the higher priority distribution system and confidently lock in more original shares.

It's important to note that when applying for large-holder allocation, The first requirement is that you join the regular subscription and reach a certain level of participation. The project uses this basic standard to judge investor commitment and loyalty. So every time you join a regular Subscription, you're getting one step closer to earning the large-holder status.

Many members have already picked up on this and started asking me if I can help them apply for the whale allocation. I totally understand how eager everyone is to make the most of this MRC opportunity. To help every member of our team get the best possible returns from this MRC investment, I'm trying to have deeper talks with the project team, hoping to secure a portion of the large-holder allocation for our group.Even though the competition is fierce, I'll do everything I can to fight for more resources and chances for every member who's serious about the future.

At the end of the day, MRC isn't just a short-term money-making play. It's a once-in-a-decade, maybe even once-in-20-years, opportunity to ride the core wave of AI and blockchain coming together to reshape global digital assets. And the people who make it to the top in a shift like this are always the ones who saw it early and moved fast. Right now is the best window to shape your asset map for the next 10 years.

That's all for tonight's session. In this round of discussion, we broke down the deep logic behind the major shifts in the global economy, made it clear that crypto assets are taking an unstoppable lead in the global capital race, and we also walked through MRC's strategic setup, focusing on the two main wealth-building paths: regular subscription and large-holder allocation. Every move you make to grab shares now is setting the foundation for a major leap in your future wealth. This isn't just short-term investing, it's long-term transformation.

If you're serious about maximizing your MRC position in this smart economy boom, make sure to reach out to your dedicated assistant right away. We'll give you full step-by-step guidance on how to subscribe, help you understand the large-holder application process and evaluation criteria and build a custom plan that fits your capital and holding goals, making sure you stay ahead in this digital asset revolution.

Let's move forward together, grab hold of this once-in-a-generation opportunity with MRC and be the first to sail into the new era of smart economy and digital finance, riding the waves, breaking through and creating your own legendary future!