Seizing the Future: How MRC Unlocks the Next Great Wealth Migration in the Era of AI and Digital Assets

Hello, future investors of Diamond Ridge Financial Academy!

I’m Charles Hanover. I’m really excited to walk side by side with all of you during this time when the global landscape is changing fast, and the rules of capital are being deeply reshaped. Right now, even though the markets look like they’re getting more volatile on the surface, what’s really happening underneath is a huge, quiet wave of global asset migration driven by tech innovation, supported by policy benefits and marked by a reset in value systems. The old asset structures are breaking down, and new wealth rules are taking shape.

Tonight, we’ll start by looking at the latest market trends, break down the core logic behind the global wealth shift during this economic transition, dive deep into the true principles of new token investments and help you catch the historic starting point of wealth creation with MRC!

Today, the UK stock market showed a weak, choppy trend overall. Even though the FTSE 100 briefly went up in early trading in hopes of better US-China trade relations, the rise didn’t have strong support. This week, Trump kept pushing tough tariff policies, making people even more worried about a global recession. The MSCI USA Index has dropped 11% this year, creating the biggest gap with other major markets in the past 30 years. Brent crude oil prices bounced back, giving the energy sector a short-term boost, but the big picture still looks gloomy. Real estate, retail, and tech sectors stayed under pressure. In the UK, retail sales in April improved slightly from March, but the outlook remains negative. Sales expectations for May keep getting worse. Weak consumer demand, plus a worsening macro environment and policy uncertainty, means UK stocks are still stuck under triple pressure.

Over in the US, stocks moved differently during the day. The Dow Jones went up a bit, but the Nasdaq and S&P 500 slowly turned lower, showing that investors are getting more worried about the uncertain macro environment. Trump’s back-and-forth tariff policies and the ongoing breakdown of the US-China talks are making global trade tensions even worse. Since April, both the Dow and S&P 500 have been dropping, showing that this market pullback isn’t just a short-term thing; it’s the result of a slowing economy and rising policy risks happening together. Big firms like Goldman Sachs and Barclays have already cut their investment forecasts and warned that stagflation risks are rising fast. As policy uncertainty keeps hurting business confidence, US stocks are facing both a reset in valuation logic and structural downward pressure. The future still looks tough.

This week, we will see the true "super data week," with major economies like the US and UK set to release key economic data, including unemployment rates and PMI. As essential indicators of the global economy, these data releases will undoubtedly directly impact market sentiment and asset prices. What's especially noteworthy is that April marks the first full month to reflect the impact of Trump's "global equivalent tariffs" policy, so the data this week will clearly show the actual changes in the global economy under the pressure of tariffs. This will be a crucial indicator for future market trends. Risk sentiment is rising, and the curtain on asset re-pricing might be quietly opening.

Particularly, front-end indicators like manufacturing and consumption will provide a more direct view of the slowdown, or even contraction, in economic activity. Looking at the overall performance of today's stock market, it's clear that the market is already deeply concerned about the upcoming data, with a spreading sell-off sentiment. Especially for stocks that surged last week without support from crypto connections, most of them are leading the decline today, with significant losses.

If the sharp adjustment in the global stock markets over the past two months was triggered by the tariff policy, the confirmation of continued global economic recession will truly start the long-term downward trend in the stock market. Based on the typical paths of financial crises, once the economic recession trend is established, stock market downturns usually last for more than two years. For example, the burst of the internet bubble in 2000 and the subprime crisis in 2008 both followed a macroeconomic downturn, combined with balance sheet contraction and collapsing consumer confidence, leading to adjustment periods lasting 20 to 30 months. Given the current economic and policy environment, this recession cycle is likely to fully align with the rate-cutting cycles that major central banks in the US, UK and elsewhere are about to begin. In other words, as central banks around the world enter the rate-cutting phase in the coming months, the structural decline in global stock markets will deepen and persist.

In fact, signals for the rate-cutting cycle are accelerating. This month, the European Central Bank led the way, starting a new round of rate cuts under the heavy pressure of Trump's tariff policy, aiming to support the economy through monetary easing. Once the data released this week fully confirms the trend of economic slowdown or even recession, the Fed and other major central banks will likely speed up the pace of rate cuts. As history has shown, whenever the US enters a high-rate cycle, and the Fed starts cutting rates quickly, it is usually accompanied by severe asset price adjustments.

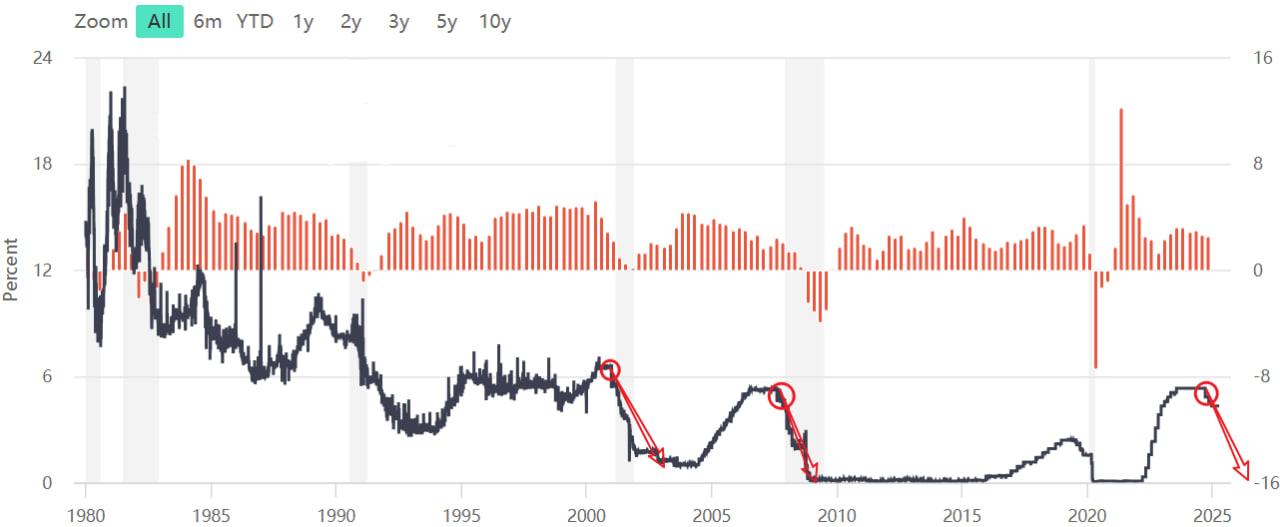

As shown in the chart above, the interest rate fluctuation graph clearly shows that during the two financial crises in 2000 and 2008, the US Federal Reserve's benchmark interest rate experienced a sharp drop. At the same time, the US stock market and major global indexes also faced severe declines. Currently, the US benchmark interest rate is at a historically high level, while the economic fundamentals are showing signs of loosening. Once the Fed starts accelerating rate cuts in June, the market will anticipate the recession and may quickly enter a structural downtrend in global stock markets.

In such a macro environment, the logic of asset allocation is also undergoing profound changes. Whenever the global economy falls into recession and central banks worldwide start large-scale rate cuts, along with the continuous depreciation of fiat currencies, traditional safe-haven assets, such as gold and other hard currencies, will experience a prolonged strengthening cycle.

What's most noteworthy is that cryptocurrencies, representing the cutting edge of human technology, are becoming the "digital gold" of the new era. They have shown greater resilience and potential for appreciation than traditional safe-haven assets in resisting systemic risks. This is the fundamental reason behind Bitcoin repeatedly hitting new all-time highs, ETH steadily rising and mainstream crypto assets continuing to strengthen. Capital is actively moving out of traditional assets like stocks and bonds and flowing into the two main defensive areas: gold and crypto. Once this migration of capital gains momentum and inertia, it will further raise the scarcity and value expectations of crypto assets, speeding up the arrival of a new upward wave.

In fact, major global economies, led by the US, have also keenly captured this trend. The policy stance has quietly shifted from strict suppression of the cryptocurrency market in the past few years to actively supporting and planning for it, even directly pushing forward the digitalisation of assets. President Trump personally led the way in issuing cryptocurrency, clearly stating the intention to use crypto assets as new reserves and trading tools, triggering the first wave of the US and global asset digitalisation trend.

At the same time, top financial consortia like BlackRock, Fidelity and SoftBank have been actively buying crypto assets in the past two weeks and are further expanding their digital asset exposure through stock market financing. Even more notable is that some seemingly traditional tech giants, like SoftBank and Nvidia, have not only increased their investment in artificial intelligence but have also actively positioned themselves in AI tokens and blockchain projects, aiming to lock in the future battleground of the smart economy.

According to multiple authoritative crypto media outlets, global giants like SoftBank, Fidelity and Nvidia have already formed strategic partnerships with Metaverse Robotics. This cooperation is not just a joint development at the technical level but fundamentally involves participation in data ownership, smart contract execution and asset circulation mechanisms. More importantly, these giant institutions have already secured a large number of high-quality MRC tokens to ensure they are in a favourable position when the AI + blockchain ecosystem explodes. It can be said that their deep involvement has greatly enhanced the credibility and development potential of the MRC project, further confirming the accelerating global digitalisation of assets across various fields. This is the fundamental reason why the MRC subscription phase is so popular, and the subscription progress has far exceeded expectations.

According to the data, the MRC subscription progress bar has already exceeded 3000%, and the subscription demand continues to rise. This presents an exciting opportunity for every investor who successfully participates in the subscription, with the potential to gain at least 30 times the return in the early stages after listing. This return expectation is not only strong but also continuously growing, adding to the thrill of the investment. Many new members may have questions about why a 3000% subscription progress bar can be used to estimate a potential premium of over 30 times. In fact, the principle is very simple, taking the structure of MRC's current ICO as an example. The total issuance is 800 million tokens, with 160 million tokens allocated for public subscription. Out of these, 70 million tokens are available to ordinary investors, while the remaining 90 million tokens are allocated to institutions and large investors.

When the subscription progress bar reaches 3000%, it means that over 30 times the funds are competing for these 70 million tokens available for public subscription. Since the subscription price is fixed, when demand for tokens far exceeds supply, the supply-demand imbalance quickly drives up market expectations. Once listed, the market circulation price will naturally be pushed higher. It's like a fixed-price auction. When the number of people bidding increases and everyone wants a share, the market's recognition of the asset's value increases sharply, pushing the secondary market to form strong premiums.

Of course, from the investment return perspective, although the hot subscription means that the premium space after listing will be larger, it also means that the actual share each investor can win will decrease. To put it simply, this is like a pre-sale of apples. If 100 apples were pre-sold and only 100 people participated, each person would get one apple. However, when 3,000 people compete, the portion each person gets naturally becomes much smaller. This is the real situation with the current MRC subscription: the premium space is very attractive, but the competition for the available shares is fierce.

However, for investors who are truly willing and have a keen eye, this does not mean the opportunity is lost. It is actually a key moment for positioning. In the MRC project's subscription logic, the amount of funds invested and the timing of the subscription are the two main factors that determine the allocation. The more capital invested and the sooner the subscription is completed, the higher the weight in the allocation system. In other words, the more funds you have and the quicker you subscribe, the higher the chance of winning. This is the so-called "capital priority, time priority" principle. The project adopts this mechanism to encourage early participation and ensure consistency between the capital layers and project expectations, which further guarantees the price stability and growth potential of MRC after its listing.

Therefore, for every student who truly wants to achieve a wealth leap in this digital asset boom, the key actions now are twofold: first, maximize your subscription capital to secure more shares; second, speed up the subscription process to ensure a higher chance of winning under the time priority mechanism. Only by doing this can you occupy the most favourable position in the future wealth feast after MRC is listed and maximize your returns.

Of course, some members may want to apply for the large investor allocation because they belong to the high net-worth client group. It's undeniable that large investor allocation has many advantages in terms of price, rights distribution, and other factors. However, it's important to note that whether one can apply for a large investor allocation is not solely determined by asset size. The project team needs to evaluate it comprehensively based on factors like overall subscription pace, capital contribution, account activity and more. So, there are still certain factors to be considered when determining the large investor allocation. Moreover, based on the internal subscription process of the MRC project, participation in regular subscriptions in the early stages is also an important reference when selecting candidates for large investor allocation later on. If someone didn't participate in the regular subscription at the beginning, even if they have a lot of capital later, they might not get the chance for the large-scale directed allocation.

Therefore, instead of spending valuable time waiting for the qualification review, it's better to seize the most certain opportunity available right now, expand your capital investment and actively participate in the current stage's regular subscription. In the project's logic, any capital invested in the subscription not only directly impacts the chance of winning but can also lay the foundation for securing better resources in the future. In simple terms, securing a subscription spot is the safest, most efficient and most realistic wealth-building strategy right now.

This opportunity is even more precious, especially in the context of the ongoing global economic downturn. As global economic activity slows down, major economies face multiple shocks from policy conflicts, consumption shrinkage and industrial chain restructuring, over 80% of traditional assets could experience a systemic collapse in the next year. Whether it's stocks, bonds, real estate or traditional financial derivatives, all will be caught in the wave of asset price revaluation. For every asset owner, the biggest concern is no longer how to grow wealth but how to protect the wealth they already have.

In this situation, only core assets representing the forefront of technology, artificial intelligence, metaverse, blockchain-based functional tokens and some highly scarce defensive assets like Bitcoin and gold can maintain resilience during turbulence and even grow against the trend. MRC is one of the most explosive assets at the intersection of this technological revolution and financial transformation. It not only carries the dual dividends of artificial intelligence large models and the underlying architecture of the metaverse, but it also uses blockchain to achieve global certification and value circulation, truly creating the value centre for the next era.

It's important to emphasize that as the global production system accelerates its digitalization and the process of data becoming assets continues to speed up, the deep integration of crypto assets with artificial intelligence, IoT (Internet of Things) and other fields is releasing unprecedented energy. Over the next decade, as AI technology spreads across industries like finance, healthcare, manufacturing and education, human society's dependence on smart interaction and digital collaboration will grow rapidly, and the way value is exchanged will inevitably evolve from the traditional currency system to a decentralized, high-efficiency new form supported by blockchain and smart contracts. This trend is almost irreversible, and crypto assets are the core hub of this global migration.

That's why now is the perfect window to use MRC as a bridge for completing the digital transfer of personal assets. By actively participating in the MRC subscription, you can turn traditional assets exposed to depreciation risk into digital assets with huge growth potential. Plus, you'll hop on the fast track of the tech and finance fusion era, securing the most advantageous strategic position in the upcoming global economic restructuring. Keep in mind, in every major asset transformation wave, the ones who truly make the leap are those who dare to adjust their asset structure ahead of time.

What's even more important is that MRC opens up far more than just a simple token market. It essentially gives investors a golden gateway to participate in multi-trillion dollar industries like AI, the metaverse, data rights, humanoid robots and more. In other words, holding MRC isn't just owning a token; it's having the capital ticket to enter the world's largest growth sectors in the future. Only by strategically allocating funds and actively investing in MRC can you truly lock in the compound growth effects brought about by this super industry boom and achieve a deep leap in your assets.

To sum up, MRC is not only an asset with enormous growth potential but also a rare structural opportunity in the global digital economic transformation. It's not just opening the door to technological innovation in the AI era but also providing a shortcut for farsighted investors to cross cycles and achieve asset leaps. And those who will truly win in this revolutionary change are the ones who dare to take bold action when the trend first forms. Now is exactly the time to act decisively and give it your all.

That's all for tonight's share. In this round of discussion, we not only systematically analyzed the root causes of global market turmoil but also clearly concluded, through studying historical patterns of global interest rate changes, that traditional assets will continue to be under pressure in the next two years. On the other hand, digital assets, especially core assets like MRC that deeply align with the tech revolution, will become the biggest winners in the next wave of wealth reshaping.

Following the current trend, MRC not only has short-term explosive appreciation potential but also long-term investment value for continuous growth. What it carries is the power of the tech industry explosion, the engine of the rise of the digital economy system, and the core variable in the global asset structure reshaping in the future. If you've realized this, don't miss out on this once-in-a-lifetime opportunity.

If you want to seize MRC's AI-driven wealth wave, please contact your dedicated assistant now. We will not only assist you in completing the MRC subscription but also provide every prepared investor with a systematic, executable strategy to multiply wealth by 100 times, helping you take the lead in the upcoming smart economy wave and achieve a true wealth leap.

Now is the best time for you to take that decisive step. Let's seize the trend together and embrace the future!