The New Wealth Revolution: How MRC Empowers You to Dominate the AI and Digital Economy Era

Good evening, future investors of Diamond Ridge Financial Academy!

I’m Charles Hanover. I’m really excited to stand with all of you in this era where the world is changing fast, and technology is quickly reshaping the wealth map. Right now, the economy is shaky, policies are shifting all the time, and the old way of thinking about assets is falling apart. Only by looking at trends from a higher level can we truly ride through the cycles and take control of our own future.

In tonight’s class, we’ll go over this week’s global market trends, dig deep into the tech revolution and policy boosts behind the MRC project, and help everyone see its key role in the new AI-driven economy. Even more importantly, I’ll walk you through step-by-step how to grab this once-in-a-lifetime chance, powered by both tech and policy changes, to get ahead and sprint toward your own hundredfold asset growth!

This week, the UK stock market stayed weak. The FTSE 100 Index had some small rebounds, helped by hopes for a US-China trade deal, but those gains were super fragile and kept getting wiped out by the end of the day, showing that market confidence is seriously lacking. Even though energy prices bounced back a little and some policy talk cheered people up, the deep structural problems in the UK economy haven’t gotten any better. Government borrowing is out of control, bond yields are climbing, fiscal pressure is getting worse, and the latest PMI dropped big to 48.2, clearly showing the UK economy is sliding into a real recession. On top of that, consumer spending is getting hit hard, with the Apr GfK Consumer Confidence Index dropping to -23, the lowest in a year. That shows people really don’t want to spend, which is putting even more pressure on the market.

As for the US stock market, it stayed in an enormous sideways range this week. There were some short-term rebounds helped by good tech earnings, but underneath, uncertainty and systemic risks are still building up. Trump kept pressuring the Fed and flip-flopping on tariffs, which really shook investors’ faith in the Fed’s independence and the future of global trade. The US kept sending out softer signals, but China kept pushing back, making the market mood even shakier.

At the same time, Fed officials started hinting at a possible rate cut in Jun, showing even more clearly that economic pressure is getting heavier. With the IMF, JPMorgan and others all cutting US growth forecasts, plus signs of money flowing out and companies laying people off, this US market rebound looks more like an emotional bounce than a real trend reversal. All in all, both the UK and US markets showed weakness this week, and they’re still facing a mix of policy chaos, a worsening economy, and fragile financial systems.

On the surface, this rebound in the US stock market seems to be boosted by a softer tone on US tariff policies, giving the market a short burst of buying energy. But if you look at it from another angle, it’s not hard to see that this week’s rally, especially in the Nasdaq, was actually driven more by the strong rise in the crypto market.

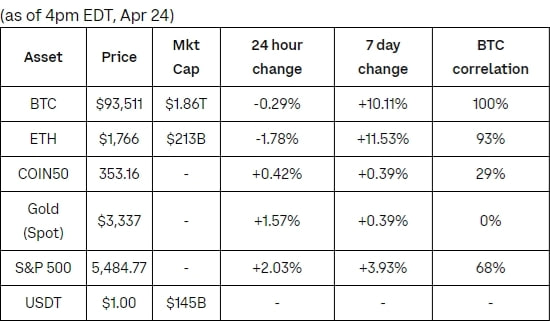

Since last week, BTC has jumped over 12%; this week, it broke past $95K, now hovering around $94K.

With BTC leading the way, the whole crypto market is surging, and that’s helped the Nasdaq bounce almost 5%.

Behind this move, the market is starting to reprice the future potential of the digital asset sector.

This kind of link between stocks and crypto isn’t random. More and more public companies are adding crypto to their asset holdings, so when crypto prices shoot up, the stock prices of companies holding digital assets also jump, helping push the Nasdaq higher, too. For example, companies like MicroStrategy, Coinbase and Marathon Digital have all seen their stock prices go up by double digits recently. This spillover effect, from rising digital assets to tech stocks, is becoming one of the big drivers in the market.

What’s even more important is that as these public companies keep buying up BTC, the supply of BTC on exchanges is dropping fast, making prices climb even more due to supply and demand imbalance.

Data shows that the amount of BTC available on exchanges has fallen to just 2.6 million coins, the lowest since November 2018. Since the US election last Nov, public companies have added over 350,000 BTC to their holdings.

MicroStrategy alone grabbed 107,000 coins in just two weeks, now holding over 530,000 coins, averaging a monthly net increase of 42,000 coins.

These big holders aren’t just buying more steadily. They’re also holding tightly, making BTC even more scarce in the market.

On-chain data shows eight public companies now each hold over 10,000 BTC, and they’ve kept adding over the past six months. Even more importantly, the mNAV (meaning the company’s market value compared to its BTC holdings value) for these companies mostly sits between 1.4 and 2.25 times, meaning once the market starts a new bull run, these companies could have hundreds of billions of dollars worth of buying power ready to unleash.

Outside the US, Asian companies like Metaplanet in Japan and HK Asia Holdings in Hong Kong are also speeding up their BTC buying.

Metaplanet even clearly said they plan to double their BTC holdings this year to over 10,000 coins.

The steady inflow into spot BTC ETFs is another big push for this rally.

The latest data shows that since Jan 2025, the most significant one-day inflow into spot ETFs hit 18,000 BTC.

This ongoing inflow of institutional money not only gives BTC prices solid support but also shows that traditional finance is getting a lot more comfortable with digital assets.

At the same time, state governments in the US are moving faster to pass BTC reserve laws.

Arizona, New Hampshire, and Texas have all entered the second phase of legislation, which aims to include BTC in their state reserves.

According to Bitcoin Laws, the US government now holds over 183,000 BTC, about 0.92% of the total supply, worth more than $16.4 billion.

As these laws take effect, it’ll get even easier for US businesses and institutions to add BTC to their portfolios, creating a powerful synergy between policies, capital and assets that keeps pushing up demand for crypto.

Not only BTC but also the entire blockchain asset system are reaching a turning point of deep revaluation and accelerated development. In its latest report, Citibank pointed out that by 2030, the global stablecoin supply is expected to grow to $1.6 trillion under the base case and up to $3.7 trillion under the optimistic case. Citi clearly stated that blockchain has now entered its own "ChatGPT moment", with areas like stablecoins, decentralized finance (DeFi) and data assetization quickly reshaping the global financial infrastructure. This not only signals a shift in capital flows but also marks the brewing of a new financial paradigm revolution.

At the same time, real estate tokenization is also rising rapidly as another important branch. A report released by Deloitte Financial Services Center stated that by 2035, the global real estate tokenization market could reach $4 trillion, with an annual growth rate as high as 27%. Tokenization can significantly improve the transaction efficiency of real estate assets, lower settlement and management costs, and break traditional financing barriers through blockchain systems, expanding the range of investors. In the future, processes like real estate funds, property transfers and capital flow management will all be executed automatically through smart contracts, completely reshaping the basic logic of the real estate investment and financing system. This trend will no doubt offer blockchain technology a wider application space and further strengthen crypto assets as the "new generation asset foundation".

However, some students may still not have a clear enough understanding of the long-term meaning of this investment opportunity. Looking at recent policy moves, whether it's the gradual easing of U.S. tariff policies, the promotion of BTC reserve bills across different states or the repositioning of digital assets by major global financial institutions, they are all sending the same strong signal: the crypto market is standing at an extremely important breakout point. And this opportunity is far beyond the scattered market swings of the past few years.

Specifically, policy changes are especially important. Just this Thursday, the Federal Reserve officially cancelled the regulatory guidelines that restricted banks from offering crypto asset and dollar token services and, at the same time, updated the expected standards for these businesses. The core of this reform is to change the strict pre-approval system into a regular supervision system, greatly lowering the barriers for banks to enter crypto-related businesses. Meanwhile, the Federal Deposit Insurance Corporation (FDIC) also withdrew two previously issued restrictive policy statements, and the Office of the Comptroller of the Currency (OCC) had already completed its withdrawal earlier. This series of actions shows that U.S. financial regulators are collectively sending positive signals to the crypto asset field, aiming to support innovation and stimulate the vitality of the new financial system.

Moreover, the Chairman of the House Financial Services Committee, French Hill, mentioned in his latest statement that during the Easter break, the House has been working overtime, deeply negotiating with major industry participants, SEC and CFTC, and is about to announce a new draft of the FIT21 market structure bill. The newly established legal framework will offer a clearer and more inclusive legal environment for the crypto market, particularly by establishing streamlined channels for critical areas such as new coin issuance, stablecoin management, and DeFi project compliance. This will undoubtedly impart strong policy-driven momentum to the entire digital asset market.

Even more noteworthy is that the U.S. Securities and Exchange Commission (SEC) has also shown signs of easing through real actions. For example, the SEC is withdrawing its ICO securities lawsuit against blockchain company Dragonchain, which is the most symbolic policy relaxation in the crypto field since the start of this year. This means that new coin investments, represented by ICO (Initial CoinOfferings), will see a new explosive opportunity. It can be expected that the next two months will bring the most certain structural opportunities for the crypto industry in the short term.

At this golden moment when policies, capital, and technology are all resonating together, the MRC project is undoubtedly one of the most representative and explosive opportunities. As a functional token focusing on four main areas: AI, metaverse, humanoid robots and data assetization, MRC not only has a solid technical foundation and a clear direction for industry applications but also rises with the strong support of policies, holding an absolute first-mover advantage in its track. It is not simply relying on hype but has already built a complete underlying technical framework and application ecosystem with real strength to lead the next wave of the digital economy.

Recently, some students have asked me about the principle of the new token ICO, and some are concerned about whether MRC has private placement issues. To help everyone better understand, I will also take this chance to explain it clearly.

First, what is ICO? ICO stands for Initial Coin Offering. It is very similar to IPO (Initial Public Offering) in the traditional financial market. Before a company goes public, it will sell a certain portion of shares to the public or selected investors to raise funds for development. ICO is when a blockchain project team issues their own digital tokens to raise resources for project development and ecosystem building. Investors who participate during the subscription phase of the ICO, much like purchasing early shares during an IPO, benefit from the earliest price advantage and the potential for substantial future returns.

However, it is important to note that not all tokens are fully tradable immediately after the ICO ends. To prevent oversupply and big price swings at the beginning, project teams usually set lock-up mechanisms, such as team lock-up, institutional investor lock-up and ecosystem reward pool lock-up. These lock-up arrangements help stabilize the price and ensure the long-term stability of the project. That's why many students find that the actual number of tokens available at launch is far less than the total token supply.

As for the private placement issue that everyone cares about, private placements are usually divided into offline and online in the crypto industry.

Offline private placement means that before the official public ICO, the project team privately sells tokens to a few large institutional investors, strategic partners, or internal team members. This kind of subscription is not open to the public, just like how internal employees or early investors can get early shares before a traditional company IPO. Usually, the offline placement price is lower, but the lock-up period is longer. It belongs to an internal capital arrangement.

Online private placement is open to selected high-net-worth individuals or investors who meet certain conditions. For example, some exchanges open special subscription channels for investors who pass KYC and meet asset requirements. Although it is open to individuals, competition is still fierce, and the chance of winning is not high. Online private placement can improve the project's transparency and liquidity while bringing in more high-quality funds.

As for institutional private placement, it is usually quietly completed before the project is publicly announced. Top institutions and strategic investors often lock in a large number of high-quality tokens early through long-term cooperation, which not only provides stable funding support for the project but also gives strong backing to the token's future price performance.

Now, let's get back to the most crucial topic: MRC's specific financing situation. The total supply of MRC is 800 million tokens, among which 160 million tokens are for ICO public offering. Out of these 160 million tokens, 70 million tokens are currently available for subscription on exchanges, while the remaining 90 million tokens belong to the private placement portion. Based on the previous explanation of placement mechanisms, it should be clear that these 90 million privately placed tokens are made up of two parts: one part is online placement for large investors, meaning it is open to investors who hold a certain amount of assets and pass strict verification, the other part is offline placement for institutions, meaning that some top institutional investors had already completed their strategic layout before the project's large-scale public subscription began.

This structure is actually a very healthy and beneficial distribution model for MRC. The early participation of more institutions and large investors not only provides solid financial support for the project but also greatly improves the quality of MRC's future market circulation. Compared to scattered small investors who frequently trade and easily cause price fluctuations, large funds tend to hold steady and make long-term plans, which helps to stabilize short-term market emotions and create a stronger upward trend.

More importantly, the deep involvement of institutions and large investors is itself the best endorsement of MRC's project quality. Truly, top-level capital is never attracted by mere concepts; they care about technical strength, industrial application ability, policy alignment and long-term growth potential. MRC has won the strong support of these capital forces precisely because of its four major industry layouts: AI, metaverse, humanoid robots, and data ownership, combined with the historical trend of global digital economy transformation.

Therefore, looking at the future, whether it is liquidity, trading depth or price support, MRC has a very solid foundation for growth. Investors who manage to grab original shares during the subscription phase are already standing on the strategic high ground before most people even realize the opportunity.

Looking back at history, every era-defining investment opportunity, whether it was early BTC, early ETH or early Nvidia and Tesla, was never seized by those who waited until "everyone knows," but by those who acted decisively and made bold bets when the trend was just beginning. Today, MRC is undoubtedly such a new entry point that could lead to the next decade of the digital economy cycle.

So, dear students, when you truly understand the basic logic of ICOs, the value of placement mechanisms, and the signals behind institutional layouts, you should realize that MRC is not just a short-term profit project. It is a core ticket into the future digital asset system, a profound opportunity to reshape your asset structure. This subscription layout phase is not just about chasing short-term profits but also about holding real quality assets with true influence when the wave of intelligence and the digital economy fully arrives.

Tonight’s share ends here. In this round of communication, we systematically reviewed the global market dynamics for this week, deeply analyzing policy benefits, capital flow and asset structure changes. It is clear that the world is at the intersection of the technological revolution and the reconstruction of the financial system. In this transformation, MRC, with its technological depth and wide application in AI, metaverse, data ownership and humanoid robots, is quickly standing out and becoming a new high ground for global capital to layout.

What’s even more critical is that MRC today not only follows the overall trend of the AI technological revolution, becoming the data and value infrastructure supporting the entire AI industry ecosystem but also, thanks to the significant loosening of cryptocurrency policies and the accelerated digitization of global assets, has now positioned itself at the centre of the strongest capital wave of the times. Whether from industry logic, policy push or capital structure, MRC is undoubtedly the most explosive and most certain super asset right now.

For this reason, I emphasize once again: If you truly understand the level of opportunity in front of us today, you should act without hesitation, mobilize all resources you can and seize the hundredfold profit window MRC brings. Every decision you make now, every bold action you take, could, in the coming years, create a unique and unprecedented asset transition path for yourself.

Remember, in this era of deep integration of technology and finance, true wealth opportunities do not belong to those who wait but to those with courage, vision and the ability to lay for the future. MRC is the most dazzling, most certain and most worthy super variable to fight for in this era’s wealth reshuffle.

Let’s join hands and seize this digital era’s wealth feast, and in the grand voyage of the future intelligent economy, write a legendary chapter for every prepared individual.