MRC and the Rise of Functional Tokens: Seizing the Smart Capital Shift in a Digitized World

Good evening to all future investors of Diamond Ridge Financial Academy!

I am Charles Hanover. Welcome to this era of classroom full of change and opportunity. At present, the global economy is turbulent, policy games are intense, and the traditional asset system is facing an unprecedented revaluation. Every investor stands at the crossroads of fate. It is only by having a forward-looking vision and seeing the direction of trends that we can take the initiative in this deep reshuffling and seize the structural dividends given by the times.

In tonight’s class, we will start from market trends, systematically explain the investment prospects of MRC, and guide everyone to master how to seize more low-priced chips through asset allocation, achieving a key leap toward financial freedom.

Today, the overall performance of the UK stock market remains weak, reflecting that the market still lacks confidence in macro fundamentals. From the industry structure point of view, although traditional safe-haven sectors like gold mines and utilities provided brief support, the continuous decline in bank stocks and export-oriented enterprises became the main drag. British auto exporter Innotech hit a four-year low due to warnings about U.S. tariff risks, further highlighting the fragile impact brought by external policy uncertainty on the UK’s economic structure.

At the same time, the UK is facing multiple challenges, such as an expanding fiscal deficit, weakening consumer spending, and a full-scale decline in PMI data, which makes the overall market lack the foundation for a trend-based rise. The current pattern leans more towards structural rebound rather than sustained strength. In the future, we still need to stay alert to the amplifying effect of internal and external risks working together.

In the U.S. stock market, although today saw a continued intraday rebound led by tech stocks lifting the index, overall upward momentum still appears weak. The President of the Cleveland Federal Reserve hinted at a possible rate cut in June, injecting some optimism into the market. However, Trump’s proposed “tiered tariffs” on China once again intensified global trade tensions. Treasury Secretary Bassett’s previous remarks about a “major agreement” were also denied by the Chinese side, causing market expectations of policy easing to cool down quickly.

Bridgewater Fund more directly pointed out that current U.S. policies are triggering an accelerated global capital outflow, and the risk of economic recession is rising. Although durable goods orders surged, it was mostly a rush before tariffs took effect and can’t be seen as a trend-based improvement. In addition, the options market continues to send out strong risk-aversion signals, reflecting that institutions remain highly cautious about future volatility.

Under the current background, from the perspective of global capital flows, crypto is no longer just a symbol of digital technology’s future but is becoming a core channel for asset transformation and value revaluation in the real world. Crypto assets, once seen as financial edge innovations, are now rapidly moving to the centre stage of global capital allocation. They are attracting large-scale entry from sovereign funds, tech giants, and traditional financial institutions, gradually evolving into an emerging lowland asset chased by global capital.

Many people who haven’t looked deeply into crypto might feel confused: why has this asset class, which was questioned just a few years ago, suddenly become a global favourite? In just a few years, from the U.S. government to international financial groups, from regulatory policies to market capital, almost everything is now building around crypto. Looking back at how policies have changed over time, it’s clear that the rise of the crypto market is no accident. It’s the result of global structural shifts and policy battles.

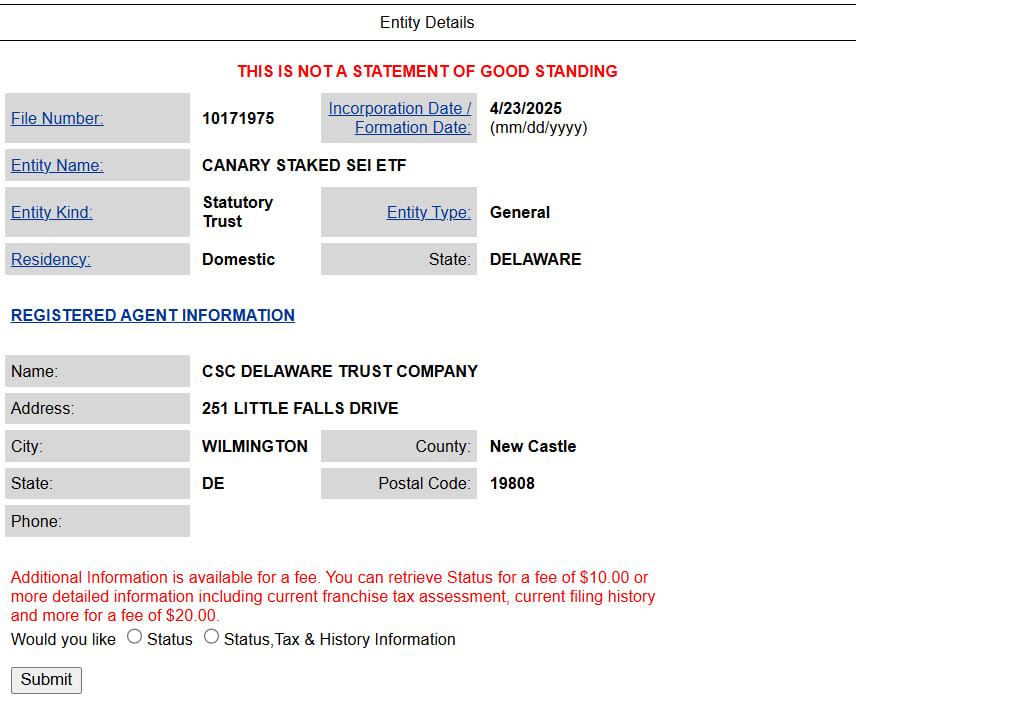

Not long ago, the U.S. Securities and Exchange Commission (SEC) was strongly cracking down on the crypto industry. It often sued exchanges and token issuers, which slowed down the market’s development. However, after BTC, ETH, and other spot ETFs were approved for listing, the whole regulatory direction changed. Now, not only have all lawsuits against major crypto projects been dropped, but the SEC is also actively pushing new rules to improve the market structure. According to Bloomberg, there are now 72 crypto ETFs waiting for SEC approval, covering mainstream tokens like XRP, LTC and SOL, as well as social tokens like Melania and DOGE. The message is clear: the U.S. is moving from cracking down to supporting and from blocking to guiding. Crypto assets are steadily moving into the mainstream financial system.

At the same time, the SEC is starting to try global regulatory cooperation. The SEC’s crypto task force recently had high-level talks with El Salvador’s National Commission of Digital Assets (CNAD), planning to build a “cross-border regulatory sandbox pilot.” This project aims to help tokens become compliant and explore ways to connect U.S. and emerging market rules. It includes letting U.S. brokers get CNAD licenses to run token businesses and using sandbox tests to try out asset tokenization in fields like real estate and equity crowdfunding. As SEC Commissioner Hester Peirce said: “We need a full digital asset regulation system that fits the future economy.”

Outside the U.S., many countries that used to be cautious or even hostile toward crypto are now turning around fast. For example, Russia used to be wary of crypto trading, but now the Ministry of Finance and the central bank are working together to create a national-level crypto exchange open only to “qualified investors.” The goal is to try out compliance without disrupting the current payment system. This shows Russia is trying to create a “safe entry” for its capital to join the digital finance system.

In Asia, a high-level meeting between the Prime Minister of Malaysia and Binance founder Changpeng Zhao drew a lot of attention. They mainly talked about turning Malaysia into a hub for blockchain and digital asset innovation in Southeast Asia. This shows Malaysia’s positive attitude toward decentralized finance and also reflects how many countries in the Global South are using blockchain to break through the limits of traditional finance and compete for leadership in the next digital economy wave.

Of course, if we look at where institutional money is going, we can clearly see that the revaluation of the crypto market is no longer just a concept. It’s turning into a real shift in capital allocation. Over the past year, a lot of money that used to be in stocks, bonds or gold has moved quickly into digital assets, especially top ones like BTC.

For example, Japanese public company Metaplanet now holds 4,855 BTC, making it the biggest holder in Asia and the 10th largest in the world. The company even said it plans to complete a 10,000 BTC allocation by the end of this year. Moves like this aren’t just about adjusting portfolios. They’re changing the whole idea of safe-haven assets. Compared to holding fiat money with high inflation risk or stocks that may drop during a tightening cycle, crypto assets, which are scarce, globally liquid and backed by tech value, have become the new core holding.

Institutional layouts go beyond passive BTC allocation and actively enter the "functional token" track, focusing on AI, data rights and application ecosystems, looking for new investment engines. For example, global tech giant SoftBank recently reached a strategic partnership with stablecoin giant Tether, investing heavily in AI, brain-machine interfaces and cutting-edge technologies while deeply collaborating with the Metaverse Robotics project. Through strategic integration with the MRC ecosystem, SoftBank not only injects its tech and data processing capabilities into the blockchain world but also pushes a data rights mechanism for global scientific achievements, offering a clear model for "data assetization."

MRC's significance has long exceeded that of a simple crypto token. It represents the underlying path of AI and blockchain integration and creates a new value network that spans technology, industry and finance. MRC is not a solution for one specific scenario but a decentralized information flow and value interaction protocol, playing a central and irreplaceable role in the global restructuring of the digital economy.

More importantly, in the global shift from technology to financial transformation, crypto plays a crucial role in upgrading financial infrastructure. It is no longer a speculative product but a "high-dimensional medium" linking technology and financial systems. Crypto assets serve as a global value expression system for technology and information, ensuring traceability, verification and traceability of global research processes and outcomes through blockchain. Each link records research data, industrial models and algorithmic logic, and once data is on-chain, it guarantees security and anti-tampering, as well as global sharing and automated circulation through cross-chain mechanisms.

With the support of AI, this on-chain data can be processed and applied more efficiently. For example, in healthcare, blockchain can encrypt and store all global pathology cases, genetic developments, and drug trials, with AI systems training and simulation to establish more accurate treatment paths and prediction models. This data+AI collaboration improves research efficiency, reduces trial costs and accelerates the process from research to commercial application. In this cycle, blockchain not only plays the role of "storage and rights verification" but also uses crypto assets to achieve "value incentives and circulation," forming a complete tech-finance system.

Among the cutting-edge crypto projects, MRC is undoubtedly one of the most outstanding and well-structured. It builds an underlying system based on the metaverse space, creating a virtual world capable of supporting global tech circulation. It digitizes all technology and information from the real world, using AI and humanoid robots to manage and execute, achieving "virtual modelling + physical mapping" in the metaverse. For example, a manufacturing company can first complete 3D modelling, performance testing and data optimization in the metaverse, then use 3D printing to produce it in the real world. This greatly shortens R&D cycles and reduces trial-and-error costs.

In the context of global data sharing, every piece of data in the MRC system holds growth potential and sustainable value. As AI continues to iterate, it absorbs on-chain data and optimizes model performance. This "data as fuel" operational model not only grants value to data assets but also makes the platform storing these data highly valuable in financial terms. MRC is such a system, a super-platform that can support global AI computing power, data rights distribution, smart task execution, and token value mapping.

That’s exactly why the current capital market’s view on MRC has gone far beyond the early-stage speculation. Now, it’s being listed as a core asset for mid-to-long-term strategic allocation. Less than two days after MRC’s Subscription started, the progress bar quickly broke through 1800%, drawing huge attention and discussions in the market. This is not a coincidence. It shows that capital clearly recognises MRC’s strong logic in technology, real-world use and policy support.

We must understand that the boom in the crypto market has never come from speculation alone; it’s because the global asset structure is going through deep changes. In the past few decades, assets were mainly “physical capital,” such as real estate, gold and equity. However, in the next 20 or 30 years, “data capital” will become the main value driver. For data to become an asset, it must have ownership rights, ways to move it and a system to measure its value. These three things are exactly what blockchain and AI together can solve. MRC is a native example of this new system.

Because of all this, we have reason to believe the real “main bull run” of the crypto market is just starting. As the global economy is being rebuilt, the basic logic of assets is also changing. In the future, wealth won’t come from real estate, gold or old industrial chains but from a new type of asset-based on digital ownership, algorithm power and smart governance. Imagine this: from intellectual property to medical data, from energy quotas to carbon credits, even people’s time and skills will all be mapped into Tokens on the blockchain. They will flow, settle, be priced and confirmed through the system, building a new digital economy.

And in this wave of tech revolution and financial system upgrade, the first tokens to be revalued will be “functional tokens,” those with real use, full ecosystems and strong policy support. MRC is clearly one of the best in this new lineup. As one of the strongest projects in the AI sector, with deep industry ties and full real-world use, MRC’s hot Subscription shows how confident the market is in its long-term future. This is more than just a “consensus upgrade” in digital assets; it’s a race to grab the future of tech gains. For any investor still watching from the side, this is not a time to take lightly. It’s a key moment that will decide your future cost, profit and position advantage.

Many students in our past sessions were doubtful when they heard “100x profit.” That’s because they didn’t truly understand the basic logic of new token investing. Let’s take the HGS project as an example, which many people joined. The Subscription price was just $0.55, and the progress bar was only around 500%, which was a moderate heat level. But even so, its listing price jumped to $2.96, rising more than 5x in a short time. Then, shortly after listing, its price surged again by 3x. This means if you got a share in the Subscription and held it until the top after listing, your theoretical max return could be over 15x, and all of this came with zero risk and no losses on your starting funds. This is the special charm of a new token Subscription: low entry, high certainty, no drawdown and big returns.

Right now, MRC is far ahead of HGS in many aspects, including industry outlook, technical strength, and policy support. Its Subscription heat has also reached a record-breaking 1800%. What does this mean? This means that the current subscription price of MRC is at least 18 times lower than what the market truly expects. On top of that, new tokens usually get an extra 3 to 8 times markup when they list. So, if you’re able to get MRC at the current price of $5.12, your future return could very likely reach 50 to 80 times or even more. This is not just a theory; it’s a proven fact based on many past new token cases.

That’s exactly why, the moment the subscription opened, I didn’t hesitate to put all my available funds into MRC. More importantly, I also suggested that nearly all of my friends who have a good understanding of crypto join this subscription actively. For them, there’s no need to wait around for the next BTC and no need to keep guessing between bull and bear markets. Right now, there’s a nearly guaranteed opportunity right in front of them. Especially those who’ve joined projects like TRUMP or SOL in the past, they clearly know how powerful and explosive early-stage token Subscriptions can be. For example, TRUMP started at only $0.18 and reached a high of $80 in less than two months, an increase of over 400 times. These aren’t distant stories but real examples we’ve lived through.

Of course, to get more MRC shares during the subscription, you need to understand how the “time priority + fund priority” rule works. In the current system, time priority decides whether you get selected, while fund priority decides how much you get. That means the earlier you subscribe, the higher your chance of getting selected, the more money you put in, and the more tokens you’re likely to get. This is a race of fast decisions, and how well you use your resources decides how big your share of this new wave of gains will be.

Let’s look at a clear example: Suppose Mr. A and Mr. B both subscribed $50,000 the moment the MRC subscription opened. But Mr. B added another $50,000 today to the same account, making his total Subscription amount $100,000. In the system, if Mr. A gets a $5,000 share of tokens, then based on the “fund priority” rule, Mr. B may get $20,000 or even more. Notice that Mr. B only doubled his funds, but because the Subscription heat is rising fast, he may receive over 4 times the value of tokens compared to Mr. A. That’s why we keep saying, during MRC Subscription, adding funds and continuing to subscribe are key ways to raise your return.

A special reminder to those students who already joined the subscription but didn’t put in enough, if you subscribed early and now add more to the same account, you’ll have a stronger system advantage than those joining later with large amounts. Remember, this is the only time that regular investors can compete for tokens at the same price as institutions. Once you miss this, the cost gap can’t be made up.

Of course, the more valuable an opportunity is, the more it needs good planning and strong action working together. We’ve always said that building wealth never depends on luck. It depends on planning. Even the best trend, if you don’t match it with the right strategy, timing and execution, will only become a success story that belongs to someone else. That’s why we strongly suggest every student take this Subscription chance to rethink and redesign their path to wealth, like how to use MRC to cross the $10 million asset level, or how to choose the best liquid tokens based on your current asset structure.

If you face any problems in real practice, whether it’s about Subscription timing, fund planning, tax optimization, estimating your chance of getting selected or building your market strategy, please contact your personal assistant right away. Our support team is fully ready to provide one-on-one help to each participant. We’ll make sure you don’t hit any obstacles and don’t miss any chance to grow your return in this MRC Subscription round. We want every step you take to not just “join” but to “take the lead” and grab the spot and shares that belong to you.

Please remember this clearly: this kind of window only appears once. The ticket to enter a new era is never handed out when everyone is fully ready. When you’re still hesitating, many others are already at the starting line. The choice you make today will become the base logic of your wealth structure tomorrow. Use every resource you can to raise your weight in this MRC Subscription to the highest level because this could very well be your true starting point toward financial freedom, the turning point for your big life breakthrough. And right now is the best moment to act.

That’s all for tonight’s talk. In this session, I walked you through why, under today’s global economic slowdown and the rising pressure on traditional assets, capital is quickly shifting to the crypto market. We not only looked at how policies and capital flows are shaping the trend but also went deeper into the true value of crypto assets. Crypto is no longer just a product of blockchain; it has become a financial core built on data, algorithms, computing power and shared belief. MRC, as the sole token within the AI sector that integrates technological application, data ownership, and complete value circulation, unquestionably merits thorough consideration and strategic planning from every student. This is not just about a project’s potential; it’s about whether you have the courage to ride through the cycles and ca

Always remember that real era-changing opportunities never wait for people who hesitate. Especially now, when the world’s industries are going through a deep transformation, only those who believe firmly, act fast and follow the trend boldly can truly catch the huge wealth gains brought by this tech wave. Let’s grab this rare window given by the times, act with full confidence and precision, and fully join the MRC investment plan. With our shared beliefs and actions, we’ll witness the wealth miracle of the smart age together. Now is the best beginning.