MRC and the AI-Crypto Convergence: Seizing the Decade’s Greatest Wealth Migration Opportunity

Good evening to all the future investors at Diamond Ridge Financial Academy!

This is Charles Hanover. Welcome to our advanced investing class at this turning point in history. Right now, the global financial system is shaking hard. Traditional asset values are being re-evaluated, while AI breakthroughs and the rise of institutional crypto are reshaping the capital landscape. U.S. policy shifts have opened the door for AI and digital assets to come together, kicking off a whole new wave of wealth building.

Those who embrace change will lead the future. Those who fight it will be left behind. MRC is right at the heart of this wave. It carries the data-driven logic of the AI era, and it's got the potential to unlock a multi-trillion-dollar smart economy. Tonight, we'll start with the latest market updates and take a deep dive into MRC's strategic value and how to subscribe the right way, helping everyone lock in on this once-in-a-generation shot to level up their wealth.

Today, the UK stock market barely closed higher after a late-day bounce, but overall, it still looks weak and shaky, heavily influenced by outside factors. The FTSE 100 opened lower, dragged down by the U.S. market's big drop overnight. Tech stocks and trusts with big U.S. exposure led the slide, showing just how jumpy the market is. Structurally speaking, capital is pulling out of UK stocks and other traditional assets and moving into gold and crypto, non-sovereign safe havens. Capital is clearly looking for better ways to hedge risk. Even though the UK didn't follow the U.S. in launching tariff retaliation, it still couldn't avoid the structural risks of falling exports and lower growth expectations.

In the U.S. market, there was a strong bounce this morning, the Dow jumped over 700 points, but overall risk appetite still hasn't really come back. Yesterday's deep sell-off shows that investors are still nervous about macro policies. Trump's tariff moves and his open challenge to the Fed's independence are making markets question the safe-haven status of both the dollar and U.S. bonds.

Tech stocks are getting hit hard, the "Big 7" have dropped over 23% on average in the past two months. That means the U.S. stock market's core valuations are getting reworked. The IMF just raised the odds of a U.S. recession in 2025 to 40%, adding to fears about slowing growth in the medium term. Today's rebound looks more like a technical bounce and emotional swing, the downside risk is still building.

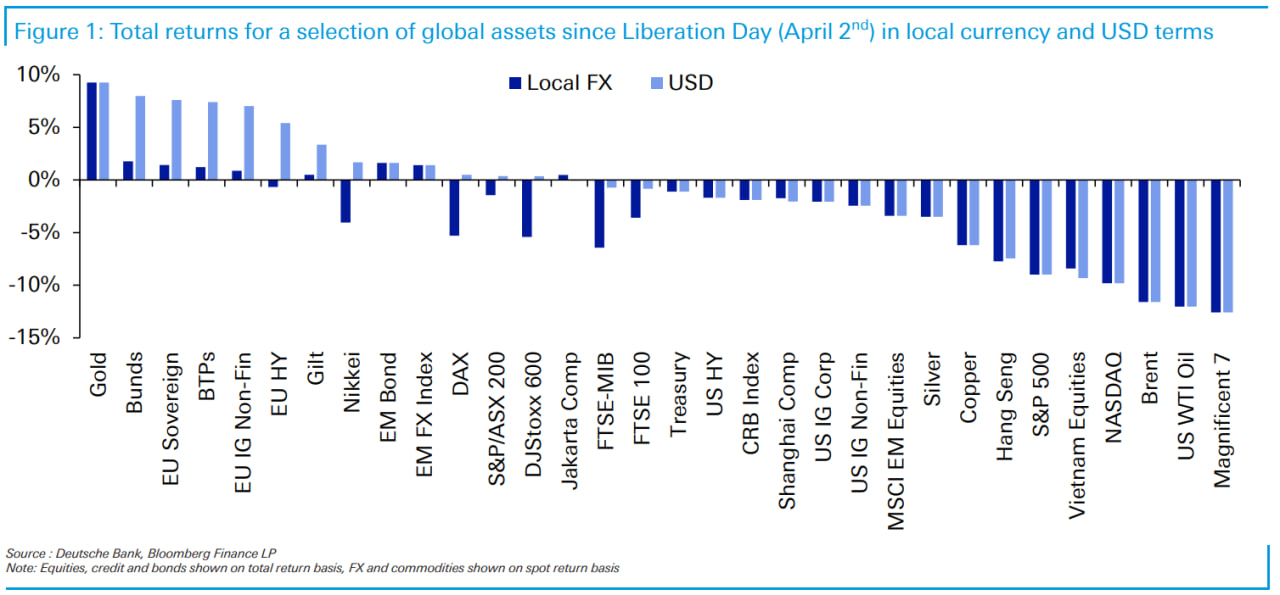

With Trump's ongoing tariff war and increasing political pressure on the Fed's independence, global financial markets have recently fallen into major turbulence. International trade talks are stuck with no real progress, and market fears are rising fast. The 10-year U.S. Treasury yield keeps dropping, while gold prices hit a historic milestone, breaking above $3,500 per ounce for the first time during intraday trading. At the same time, the crypto market is staying strong, and many major tokens have just hit new short-term highs again. Money is quickly flowing out of traditional financial assets and heading into digital assets that offer both safety and growth potential.

It is worth noting that despite ongoing volatility across the broader U.S. stock market, there were notable instances of structural capital inflows today—particularly within technology sectors associated with AI and crypto. Prominent stocks such as MSTR, COIN, and MSLR each recorded gains exceeding 9%. Even WULF, which had experienced several consecutive days of decline, saw a strong rebound of 18%. What these stocks share in common is their connection to digital assets; their upward movement was not fuelled by improved fundamentals but rather by the broader bullish sentiment currently prevailing in the crypto market.

But here's a heads-up: even though these stocks move closely with crypto prices, they're still traditional stock market tools. Their prices are affected not only by how well the companies perform but also by market-wide risks like valuation corrections and changing regulations. In comparison, high-quality crypto assets with real utility, especially those backed by strong tech and policy breakthroughs, offer more clarity, more direct price feedback and more flexible ways to invest. So, in terms of value for money, directly investing in good crypto assets makes a lot more sense than betting on related stocks.

At its core, investing is about picking the best options under limited resources. Any smart investor facing this mix of bond crashes, split stock performance, soaring gold and a booming crypto market should seriously rethink their portfolio. On the macro level, governments around the world are actively pushing for tech-driven upgrades in their industries, especially in AI and blockchain. On the micro level, whether it's the key themes in U.S. stocks or the major flows in crypto, it all points to one clear trend: the deep fusion of AI and the digital economy is becoming the new main theme of this era.

Especially now, with AI tech advancing fast, crypto tokens centred around AI are becoming a key focus in today's asset allocation logic. We need to realize that future industries, social structures and even how we live will all be reshaped by AI and data-powered networks. From self-driving cars to smart healthcare, from smart cities to personalized education, every part of society is being transformed by tech. At the core of all this transformation is computing power, which is growing at an exponential rate.

Industry data shows that global AI computing power is growing at a rate of 63% annually, far surpassing the growth limit set by Moore's Law. This kind of exponential leap is not just improving the efficiency of model operations but also fundamentally restructuring the underlying processing power of the entire information economy system. In other words, future technological progress will no longer rely on single-point breakthroughs but rather on the large-scale parallel collaboration of computing clusters and the high consistency of data-driven mechanisms. This mechanism is best realized through the "AI + blockchain" structure.

In this new wave of technological advancements driven by AI and computing power, crypto is no longer just a "payment tool" or "store of value". It is gradually evolving into the central value hub that connects the entire digital economy system. From data ownership to resource allocation, from system incentives to cross-platform value exchange, digital assets are becoming an indispensable "economic operating system" in all digital production processes. Especially now, as AI fully permeates societal operations, the Token system is not just an "asset" but a universal incentive tool that supports the new economic paradigm.

Imagine a scenario: when an AI system successfully analyzes valuable predictive medical data or efficiently completes a supply chain scheduling task, the computing power, algorithm models and underlying data consumed in the process hold real value. If this value can be confirmed, priced and distributed through blockchain technology, then every output of AI intelligence labour can be tracked, measured and incentivized. This "computing power-based, Token-exchanged" economic loop is the real engine driving digital civilization forward.

The improvement in computing power is reshaping the entire industrial structure of human society. From manufacturing to financial services, from content generation to smart cities, no field is immune to its influence. In the past, AI applications were limited by slow training speeds, long model deployment times and low real-time response efficiency. But now, with computing power growing at 63% per year, these limitations are starting to change. The unmanned collaborative systems in smart factories have become a reality; edge devices can locally deploy algorithms and execute tasks, quantitative models in finance can react in milliseconds, advertising, personalized recommendations, and even city traffic scheduling systems have entered an era of "real-time computing + dynamic iteration."

For example, in smart cities, traditional city management relied more on manpower and static model judgments. With AI and high computing power, massive video, traffic flow, and energy consumption data can now be analyzed in seconds to optimize signal light scheduling, emergency alerts and energy distribution for city governance. This efficiency improvement not only saves resources but also directly changes the rhythm and energy-saving levels of city operations.

Furthermore, the surge in computing power is sparking a game-changing transformation: experiments and simulations are no longer confined to labs but are shifting to virtual spaces. This trend is especially noticeable in the biomedical field. We know that most diseases are evolving, and the complexity of the human genome system goes far beyond any single-variable model predictions. How can we simulate the process of gene mutations? How can we map out the paths of pathogen variations? Traditional methods require huge research funding and long cycles, and it sometimes takes hundreds of years to create useful data models.

But now, thanks to powerful AI systems and the growing global computing power, humans can do precise modelling and high-speed simulations in virtual spaces. By integrating global genetic data and disease databases, AI can run billions of potential combinations and constantly improve its predictive ability at a very low cost. This means that gene evolution simulations, which used to take decades or even centuries, can now be compressed to just a few years or even months with AI and computing power. This greatly boosts the efficiency of scientific research and opens the door to possibilities, from “passive treatment” to “active prevention” and even “genetic reconstruction.”

To make all of this possible, the two most important factors are “research data” and “AI systems.” AI’s power lies in algorithms, and the soul of algorithms is data. Only by enabling the global flow, connection and sharing of vast and scattered data resources can AI systems truly develop the learning and evolution abilities of a “brain.” In this process, a “platform” is needed, one that can receive, verify, store, process and fairly allocate the value of these data. This is the core mission that MRC is undertaking.

Metaverse Robotics is not just a single AI project or a vague blockchain application. It’s a data asset network that spans the AI industry’s entire supply chain. It’s a super system connecting data, algorithms, hardware and token incentives. It combines the openness of the metaverse with the iteration of AI, using blockchain to secure data rights, transactions and value exchange. In the MRC ecosystem, all AI-generated data will be packaged as on-chain assets. Every model call will be completed via smart contracts, with tasks and value exchanged, and every contribution will earn rewards, truly creating a decentralized, data-driven, intelligent economy.

MRC’s metaverse isn’t fictional; it’s a “digital lab” and “universal operating system” built for AI systems. All future AI-driven industries, whether it’s gene simulation, distributed manufacturing, AI education, virtual offices, smart cities or even financial clearing, tech investments and intellectual crowdsourcing, will be able to create their own data spaces within MRC’s system and use MRC tokens to exchange value. This system is open, programmable, and dynamically evolving, and because of this, it has long-term growth potential.

Especially in the future, as most work moves online and data and intelligence become real “means of production,” the universal data flow system MRC provides will be the infrastructure relied upon by AI professionals, application companies and individual users. Imagine that in the future, when a research institution needs to access global medical data for AI training, it won’t have to deal with international coordination, approvals or complicated compliance processes. Instead, it will simply use MRC tokens to call the data and pay for it. Once the data is used, it will be returned to the nodes, completing the cycle. Building this kind of system is like creating a “network of energy for the digital age,” and its strategic importance is almost equal to the role electricity played in the industrial revolution.

The reason MRC has long-term investment value is that it has created a complete closed loop in terms of technical logic, data architecture, real-world application and economic models. What we're witnessing today is not just the unlocking of a single project's value but the dawn of a revolutionary change that spans AI, the digital economy, research platforms and intelligent societies. MRC is not just a bridge between AI and blockchain; it's the catalyst for a new era of data civilization. Its value is not just the rise in tokens but the industry logic and future tech order it represents.

What's even more important is that MRC's supply mechanism further strengthens its long-term investment value. Unlike traditional inflationary currencies, MRC's total supply is strictly limited, which gives it natural anti-inflation properties. From a financial logic standpoint, scarcity is the first principle that supports long-term value growth. The reason BTC has been one of the best-performing assets globally over the past decade is because of the combined effect of "scarcity + consensus + safe haven." Now, following similar logic, MRC, with its limited supply, tech-driven growth and global institutional trends, is taking a development path similar to BTC but with more industry depth.

Looking at the numbers, BTC has risen by over 900% in the past two years, and its annual growth has far outpaced traditional stocks and gold over the past decade, consistently being one of the world's most growing assets. Today, MRC is completing a similar leap to Bitcoin's "from consensus to application, from ideas to reality." The difference is that MRC is not just a form of asset; it is becoming the mainstream payment medium and value standard in key areas like AI tech services, data trading, contract execution and resource allocation.

This logic is also being verified by top global investment institutions. Whether it's Fidelity or Grayscale, both have recently added MRC to their key observation lists and predict that it could break the $500 mark by the end of this year. This judgment isn't just speculation but the result of MRC's role in the AI industry chain, its global expansion, and its supportive policy environment. If we calculate based on its current original subscription price, the potential growth is more than a hundred times, which is why we are so confident in MRC and continue to increase our investments.

Looking at the broader industry development, we can also see that AI and blockchain will fully integrate in the next three years, with AI moving from model training to vertical industry applications, from research breakthroughs to commercial service implementation. Whether it's smart healthcare, smart education, financial risk control, global research data modelling and AI algorithm cloud deployment, almost all high-value AI services will enter the market delivery and settlement stage. MRC is highly likely to become the mainstream payment token across the entire tech service chain, taking on new digital transaction demands worth trillions of dollars.

At this key point in the global economic restructuring, as the digital industry system gradually takes shape, we no longer need to bet on vague concepts and hype. Instead, we have the opportunity to clearly see a "rare asset driven by both technology and policy, with an ecosystem expansion logic, scarce assets and urgent demand for real-world application." And this is the real opportunity that MRC offers us today.

That’s it for tonight’s sharing. Starting with the global economic backdrop and the logic behind technological evolution, we’ve deeply analyzed the integration trend of AI and the digital economy. From multiple dimensions like data, policy, technology and valuation, we’ve gradually revealed the long-term growth path behind MRC. It’s clear that in the next three years, the main economic development trend will become more and more apparent. It’s the new wave of technologies represented by AI that will completely reshape traditional asset allocation logic, and MRC happens to be right in the middle of this key turning point. It won’t just become the infrastructure for technology implementation but also the era-defining asset bridge that helps investors achieve wealth leaps.

Of course, such an era-defining opportunity isn’t for everyone. The so-called “hundred times profit” has never been for those who hesitate and delay. History repeatedly tells us that the ones who truly capture structural dividends are always those who dare to break through cognitive boundaries at key moments and who aren’t afraid to go against conventional thinking. In a seemingly chaotic situation, staying on course and sticking to one’s judgment when the world is sceptical is the most essential trait for anyone who’s made a wealth leap.

Most people will exit early during this global AI wave because they lack a clear understanding of the trend. The remaining ones will be eliminated through fear, hesitation and uncertainty during practical execution. Even more, people won’t even make it to the starting line and will already be left behind by the times. Think about the early days of the new energy vehicle industry, how many people couldn’t see Tesla’s future, how much capital was withdrawn because of short-term setbacks, and how only Musk truly made it through the cycles, winning in the end. It’s this certainty that allowed him to weather the industry reshuffle, completing the leap from a fringe entrepreneur to the world’s richest person in just a few years.

Now, we’re standing at the same turning point. MRC is the gateway to the future, a real asset project with technical depth, policy alignment, industrial demand and a scarcity mechanism. You don’t need to search for the right moment anymore. It’s right in front of you, ready to take off. What you need to do is not sit back and wait but act with the courage and decisiveness of those who change their fate. Mobilize all the resources you can, and lock in this once-in-a-lifetime opportunity.

This decision could be the most crucial turning point in your life. If you miss it, maybe you’ll have to wait another ten years for a similar opportunity. But if you seize it, you’ll be among the first to benefit from the new cycle. For MRC’s subscription strategy, capital allocation methods and implementation path, please contact your dedicated assistant as soon as possible. We’ll provide full process support to help you complete every step smoothly and efficiently. Let’s take this opportunity in the AI era, a wealth channel that truly belongs to us, and start this journey together, winning the future.