MRC and the Great Digital Shift: Seizing the Once-in-a-Generation Investment Breakthrough in the Age of AI and Asset Revaluation

Hello to all the future investors at Diamond Ridge Financial Academy!

I'm Charles Hanover. It's a pleasure to dive into real-world strategies for new token subscriptions with you during this time of constant changes and shifting trends. While the market looks shaky on the surface, what's really happening is that global capital is moving away from traditional assets and entering a new cycle driven by tech, supported by policies and focused on revaluing assets.

Today, the UK market is closed, so we're turning our attention to how the risks in the US stock market are speeding up the shift toward digital assets. With policy tailwinds behind us, we'll zoom in on the MRC token and help you catch this once-in-a-lifetime investment window.

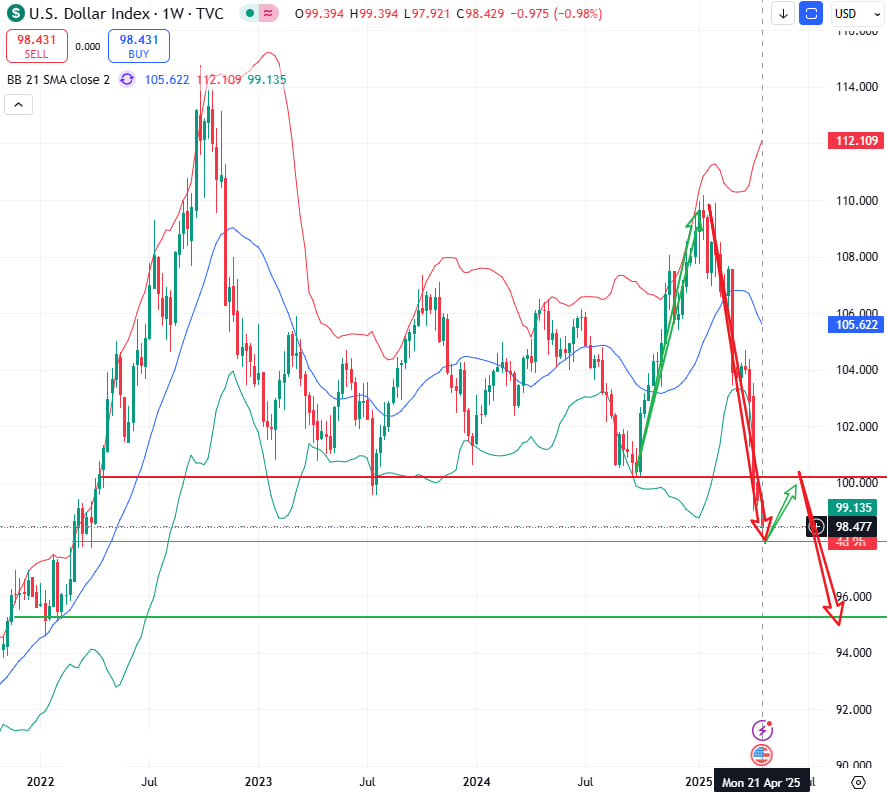

Today, during US trading hours, the pressure kept building. The Dow, S&P, and Nasdaq all opened lower, showing that investors are still on edge regarding the big-picture uncertainties. Trump's attacks on Fed Chair Powell are making people doubt the Fed's independence and are raising deep concerns globally about the US dollar's credibility. The dollar index fell below 98, its lowest since 2022, while gold shot past $3.4K, hitting a new all-time high. That's a clear sign that money is rapidly exiting US financial assets and seeking safer, more robust alternatives.

At the same time, the Fed has started signalling risks on both sides: inflation could rise again due to tariffs, and the economy might weaken. This has left markets confused about what to expect from future monetary policy. With earnings season peaking and tech and manufacturing stocks under pressure, the three major US indexes have already dropped about 8% this month. Systemic risk is now spreading deeper across the market, and a strong rebound isn't likely to happen anytime soon.

What really stands out is how gold and crypto, these so-called "unconventional defensive assets", are holding firm while traditional assets keep falling. It shows investors are choosing new safe havens in this chaotic environment. BTC, especially, is beating market averages, just like we predicted earlier this month with its structural rebound. As the shock from tariff news fades, the real value of crypto is starting to be accepted again. The focus is shifting back to what it really is: a global store of value that doesn't need government backing, is powered by tech, and has limited supply. When big uncertainties hit, this is where smart money looks for long-term security.

So why are BTC and other cryptos rising while US stocks fall and the dollar weakens? It all comes down to two deep-rooted factors working together. First, crypto is naturally good at fighting inflation. Right now, with the world moving away from globalisation and leaning into high tariffs, most national currencies are seeing their credibility wear down. That's where crypto, being independent of any one country, becomes a great way to hedge against broken systems.

Gold is the classic go-to in times of crisis, and it still matters. But in today's digital age, it's getting harder to use: it's slow to move, expensive to hold and tough to settle quickly. On the flip side, BTC, SOL, and other leading digital assets not only run on secure, decentralised tech but also let you move value instantly and send it where it's needed through smart contracts. That gives them a much faster and more flexible edge when it comes to dodging geopolitical shocks and financial turbulence.

A deeper reason lies in the quiet rise of structural currency substitution happening around the world. In the past, national currencies relied on government backing and financial regulations to stay stable. But now, with post-COVID overspending and money printing becoming the “new normal,” the credibility of fiat currencies is facing a historic trust test. Whether it’s the dollar losing trust due to oversupply, the yen dropping or the yuan swinging, all of it points to significant structural risks. Sovereign currencies are under serious pressure like never before. In contrast, crypto stands out as a new choice for global capital trying to balance safety and growth. It’s based on algorithmic certainty, limited supply and transparent on-chain systems. It’s not just a tech breakthrough; it’s a new way to store value, born out of the global credit system falling apart.

We can already see this trend in today’s market. The three major U.S. indexes dropped nearly 3% during the session, tech, finance and manufacturing all under pressure. Meanwhile, gold and BTC are both climbing, with BTC clearly outpacing gold now. It’s become the “growth leader” in the safe-haven space. This strong move shows that the market is quickly re-evaluating the long-term value of crypto assets, and it might kick off a new round of gains in the short term. As traditional assets keep falling, more money sitting on the sidelines is starting to hedge systemic risks by buying into crypto.

Signs of a real global economic recession are getting stronger. The IMF cut global growth forecasts, U.S. and European manufacturing PMIs keep shrinking, emerging markets are seeing capital outflows and rising fiscal deficits, and pretty much every key structural indicator is flashing red. It looks like we’re heading into a system-wide economic reset that could be worse than 2008. In this macro setting, traditional asset valuation models are being rewritten. Institutions have to rebuild their risk models and asset allocation strategies, and crypto, with its built-in risk-hedging features, will definitely get more attention. Especially BTC, as the world’s first widely accepted “digital gold,” is being re-priced under the new economic logic.

Robert Kiyosaki, author of Rich Dad Poor Dad, made a public statement this week saying BTC could hit $1 million by 2035. He pointed out that the U.S. isn’t just dealing with inflation and interest rate shocks. It’s facing a full-on credit crisis. He mentioned the U.S. is under the biggest debt and job pressure in its history. Credit card defaults are spiking, middle-class pension funds are falling apart, all signs that “this isn’t just a financial crisis, it’s a crisis of civilization.” In times like this, only owning truly scarce assets can protect your purchasing power going forward.

Kiyosaki emphasized that crypto is not just “a nerd thing.” It’s a tool for the next global wealth redistribution. He even said, “If an average person puts a small amount of money into Bitcoin today and holds through the crisis, they might end up in the global top 1% in ten years.” That might sound bold, but with macro trends becoming clearer and crypto slowly being accepted by the system, it’s not far-fetched at all. Right now, we’re in a “valuation switch window,” traditional assets are getting cheaper, while crypto is still undervalued. This is a crucial moment for any smart investor to gain a first-mover advantage in this round of systemic reshuffling.

The sharp split in today’s market is both a wake-up call and a strong signal. Gold’s upside is ultimately limited, while with its liquidity, trading depth and programmability, crypto is becoming a better base asset for long-term value. As traditional assets keep bleeding and crypto keeps absorbing, the focus of capital allocation is clearly shifting. And that shift is exactly where early movers like us get the biggest reward. Looking back at history, real wealth jumps always happen quietly during chaos.

We believe the emerging crypto market, especially the new tokens driven by AI trends, will gradually replace the traditional stock market and become the biggest “money magnet” in the world over the next ten years. This isn’t just a simple switch; it’s a structural asset shift. Just like newspapers were replaced by online news, brick-and-mortar stores were reshaped by e-commerce, and old factories were pushed out by automation. The financial system will also move from centralized accounts to a decentralized, data-driven model.

We’ve already seen this trend happening. Super AI models like OpenAI are changing the rules across industries, from content creation to chip-making. At the same time, many AI projects no longer rely on traditional funding. Instead, they’re using crypto tokens to capture value and build networks. In other words, AI is not only changing how we work and produce, it’s also rewriting how capital is formed and shared. The clearest sign of this change is the digital wave in asset structure; stocks, bonds, and real estate are losing their “uniqueness,” while digital assets are moving from the edge to the centre.

Data doesn’t lie. According to Pitchbook’s April 17 report, in Q1 of 2025, startups focused on AI and machine learning took in 57.9% of all global VC funding. That means over half of all VC money worldwide is flowing in one direction: AI. And this is just the beginning. The report also said that in North America alone, about 70% of all VC funding in Q1 went to AI projects, reaching $73 billion, already more than half of the total AI funding in all of 2024. What does that tell us? It shows global capital clearly understands that AI isn’t just a tech trend. It’s a massive game-changer that’s reshaping industry structures and social systems and influencing how financial assets are valued.

What’s even more shocking is that this money isn’t spreading out. It’s super concentrated. That means investors are having a serious case of “AI FOMO,” a deep fear of missing out on the structural gains brought by AI. Just like Maria Palma, General Partner at Freestyle Capital, said: “People have never been more worried about someone else taking their market.” That’s not just talk; it’s how capital behaves at its core. In every tech revolution, the smartest money always gets in early, sets up the win and cashes out ten years later. Right now, AI is at the heart of this setup battle. And the key assets behind it? Tokens like MRC are born for AI.

Among all AI-related crypto projects, Metaverse Robotics is undoubtedly one of the most promising and practical ones right now. It doesn’t just throw around “AI” as a marketing trick. It’s actually building a real system that connects on-chain and off-chain worlds, merging the physical and virtual with AI-powered data. The real value of the MRC token doesn’t come from hype. It comes from the core tech it supports: a closed-loop smart economy where robots collect data, edge computing handles processing, blockchain confirms ownership, and AI models continuously optimize the system.

What makes this closed-loop system so powerful is that it’s data-driven. It’s a real, usable, upgradable and measurable production network. MRC, through its PoRS (Proof of Robotic Service) mechanism, turns robot actions in the real world into on-chain data assets. This makes “real-world actions = value contribution” a reality. In the future, any industry needing AI-powered decision-making, whether it’s smart healthcare, smart manufacturing, smart cities, intelligent finance, personalized education or global supply chain optimization, can plug into the MRC network and get rewarded with tokens for generating valuable data. It’s a brand-new model that’s rebuilding how data is valued and distributed.

And MRC’s plan isn’t just talk. According to the team, its global rollout is already in motion. Robot service pilots and on-chain data syncing are starting in Europe, Southeast Asia and Latin America. In Southeast Asia, MRC may launch an AI-based energy dispatch system with local power grid companies. In Europe, several smart cities are adopting MRC for traffic flow prediction and emergency response. In Latin America, MRC is teaming up with large retail chains to build an anonymous user data analysis system. These real-world cases prove that MRC is not just “usable”. It’s already being used and evolving fast into a massive AI data economy.

The next three years are poised to be the golden period for MRC’s ecosystem expansion. The team’s vision extends far beyond building a single commercial use case. They aim to integrate the entire AI industry’s data service layers, upstream and downstream, into a global intelligent data economy. This system will support multiple industries, computing powers, and cross-chain assets. The driving force behind this is the tokenized ecosystem MRC is creating. It connects AI output, robot services, and real-world asset needs, all linked by MRC tokens for ownership, exchange, and rewards.

This isn’t just another crypto model. It’s a real, utility-based, circulation-driven and scalable economy. Once the loop is in place, every data contribution, every AI model call and every cross-border transaction will rely on the MRC token. And once this network reaches every industry that AI touches, the market size it carries could hit trillions. From healthcare to education, logistics to manufacturing, smart cities to edge-powered energy systems, MRC is becoming the key engine that helps turn AI into real-world productivity.

From an investment perspective, MRC’s future upside is backed by logic, structure and perfect timing. With the market heating up and policy expectations rising, the value of investing in MRC is becoming clearer. Take TRUMP, the meme coin that exploded at the start of the year. It jumped from $0.1824 to $80 in just a few weeks, over 400x. That’s a crazy pump, but let’s be real: TRUMP is still a meme coin at its core. Its rise is more about public sentiment, social media traffic and hype rather than genuine tech support or industry connections. Sure, it soared fast, but long-term? It lacks real substance and doesn’t have strong resistance to market cycles.

MRC is a completely different story. This isn’t just another “hyped-up” project. It’s a utility-based token born from AI growth trends, government support and real-world use cases. Technically, it connects metaverse spaces with real-world humanoid robot data networks, using blockchain to secure and exchange that data. That’s not just tech talk; it boosts AI’s real use and offers a global solution for managing data as assets. MRC isn’t just a token. It’s a next-gen engine driving finance and technology forward.

If a meme coin with no industry base can rise by hundreds of times in a short period, why wouldn’t a token like MRC, backed by solid tech, strong policy support, real-world use and high-value data, also see massive growth? That’s exactly why many firms see MRC’s “100x potential” as logical, not just hype. This isn’t speculation. It’s a result of solid structure and clear trends. With the U.S. SEC softening its stance, stablecoin laws moving forward, CBDC bridges being tested, and digital economy laws kicking off in multiple countries, regulatory tailwinds are just beginning. All of this gives MRC a strong policy moat to grow even stronger in the next three years.

Right now, we’re standing at the edge of a huge new cycle. Everyone here in this class has a real shot at changing their future. We missed BTC. We missed SOL. But this time with MRC, we have a chance to catch a project that brings together technology, regulation and a global market push. MRC isn’t just another coin; it’s the spark of the new digital economy and the value hub of AI’s rise in the real world.

So tonight, I want to say this loud and clear: gather all the courage you have. Use every resource you can reach. Make your move, and get into MRC. This isn’t just an investment; it’s a leap across social classes. It’s a chance to change your life. For years, we’ve been stuck, chasing the next big break in the old markets. Now it’s right here. This isn’t some dream. It’s real, running, backed by policy and ready.

That’s all for tonight’s sharing. In this discussion, we’ve looked at how capital is escaping the global economic downturn, seen the ongoing warning signs of a systemic drop in U.S. stocks and confirmed once again that Crypto is going against the trend and rising during this phase. Bitcoin’s resilience, SOL’s breakthrough and the strong rise of AI-based Tokens all point to a clear trend: traditional assets are quietly shifting to a new asset system, and we’re at the beginning of this structural change.

No matter how much capital you have, if you’re willing to make a move, we’ll fully support you in planning your funds, configuring your accounts and setting up your investment paths. We’ll provide the most professional investment strategies to help you take action and seize the opportunity in this “AI + Crypto” boom cycle, claiming the hundredfold rewards that belong to all of us.

If you have any questions about fund collection, strategy layout or the investment process, please contact your assistant right away and we’ll provide one-on-one support throughout. Remember, real opportunities to change your fate won’t wait, once the subscription window closes, you might miss out on the entire growth opportunity of this era.

Now is the golden moment for our collective action. Don’t hesitate, don’t sit back anymore, the time to act decisively has come. MRC is the next peak for you, for all of us. We’re already on the road, just waiting for you to join us.