From Regulation to Revolution: Why MRC Is the Nexus of AI, Crypto, and Global Economic Realignment

Good evening, future investors of Diamond Ridge Financial Academy!

I’m Charles Hanover. I’m honoured to walk side by side with all of you again in this era full of challenges and opportunities. With the global economy growing more unstable, constant policy shifts, and wild asset price swings, investors with real foresight must look at trends from a bigger-picture view. Only by focusing on both technology and policy changes can we find clear paths to wealth because going with the trend is the only way to ride through the cycles and rise to the top of this era.

In tonight’s class, we’ll review the key market moves around the world this week, examine the tech changes and policy fit behind the MRC project, and determine its big role in the future AI economy. More importantly, I’ll walk you through this historic coin investment opportunity powered by both “tech + policy,” helping every prepared member grab an early lead in this wealth shift and aim for that 100x asset starting point.

This week, even though the UK stock market had a solid rebound on the charts, the FTSE 100 went up 3.9%, the overall market is still weak and lacks real support from the fundamentals. The bounce mainly came from the gold and energy sectors getting stronger again. As gold prices keep hitting new highs, safe-haven assets have become the top choice for short-term capital inflow. But this jump looks more like a break caused by better liquidity, not a full-on trend reversal. The US-Europe trade tensions are still heating up, and Trump’s unpredictable tariffs are putting pressure on exports, manufacturing, and defence stocks. As a result, the outlook for UK manufacturing demand from overseas is getting worse.

At the same time, the European Central Bank cut rates for the third time this year, and the IMF warned about rising financial risks and gold prices hitting all-time highs, all adding to fears that the global economy is slowing down. The UK’s own data isn’t great either; job and wage numbers both missed forecasts, and even a possible rate cut from the Bank of England couldn’t bring real confidence back to the market. So overall, even though the UK market looked a bit steadier this week, the heavy macro pressure and policy uncertainty could easily pull it back into a deeper drop.

Over in the US, the stock market did even worse. The three major indexes had small rebounds early in the week, but all ended up down about 2%, continuing their mid-term slide. Trump’s bigger tariff plans raised major concerns about global supply chains; everything from chips and medicine to key minerals got hit. Fed Chair Powell warned that tariffs could push inflation up, making it harder to cut rates, and then Trump told him to step down, which made the market even more nervous by turning monetary policy into politics. Tech and healthcare stocks both took big hits, earnings forecasts are being cut, and financial risks are starting to spread downward. In the short term, US stocks are under huge pressure, and there’s not much fuel left for a real bounce.

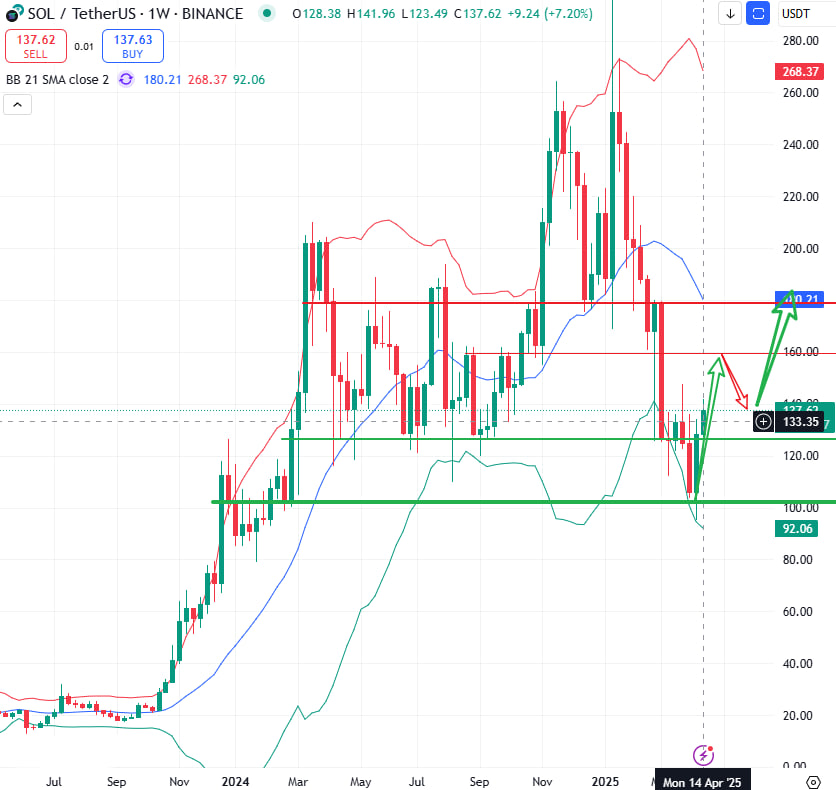

However, in sharp contrast, the crypto market saw a surprising rally this week. BTC jumped over 3% at one point, while major tokens like SOL and Dogecoin went up nearly 7%. This shows that as traditional financial markets come under pressure, crypto assets are becoming a new place for money to both stay safe and grow. Solana especially stood out; its smart contract ecosystem, powered by AI, offers faster execution and stronger decentralization, drawing in tons of DeFi and AI-linked apps. These auto-executing, data-driven contracts helped SOL shine from a tech point of view and made its token outperform the rest in this round of gains.

Looking at the bigger picture, this shift in capital isn’t random; it’s a smart move in response to the reshaped global economy. Tariff policies are causing short-term shocks, but markets are now doubting their long-term impact. Money is starting to chase more solid, long-term trends. At the same time, crypto is getting quiet but steady policy tailwinds: clearer rules in many countries, ETF channels slowly opening up, and stablecoin laws speeding up. The whole industry is moving from a “regulation grey zone” to being officially accepted, and that’s the real reason why prices are being re-rated.

What’s worth noting is that even Fed Chair Powell, who used to be cautious about crypto, has clearly shifted his stance in recent months. He used to raise red flags about BTC, ETH and other decentralized assets, worrying they could hurt the dollar’s dominance and shake up the current financial system. But times have changed. With the crypto market growing and capital flowing in, even the most conservative regulators are starting to take a second look. For the first time, Powell recently said that stablecoins have a role to play and that “crypto tech will be a key part of the future financial system, and its place should be defined by smart rules, not just pushed aside.” That line alone signals a major shift in how crypto is being regulated.

Meanwhile, the US SEC, which used to be super tough on the industry and hit it hard, has softened its stance after losing in court to Coinbase, Ripple and others. This change in tone is boosting market confidence and giving big investors a clear path to join in. So, the crypto market is now stepping out of the shadows and into a new phase of legal clarity and policy support. In fact, this shift isn’t just about one country; it’s part of a global change in how finance works. Right now, we’re at a turning point where trust in old-school money systems is fading, and new digital finance is rising fast. And at this point, where the money flows isn’t just about short-term ups and downs, it’s about a deep shift in how people understand the future of value.

If, in the past ten years, crypto assets were mostly seen as "speculative assets," then now, they're becoming part of key discussions in global economic governance. The SEC kicked off a series of crypto roundtable meetings at the end of last month, marking the US's official move to take part in building rules for the crypto world through institutional efforts. This week, Powell once again made it clear he supports stablecoins and CBDCs working together and called for opening up regulation for the crypto payment system. This sends a strong signal that not only breaks a long-standing policy deadlock but also marks a shift for crypto payments from "wild growth" to a new stage of "orderly expansion."

In Apr 2025, the US Stablecoin Act officially took effect. For the first time, it requires all stablecoin issuers to get a federal financial license and publicly prove 1:1 dollar reserves. This puts an end to long-time "black box" issues with reserves for coins like USDT and gives stablecoins a legal status on par with traditional money market funds. This is a turning point where stablecoins move from being "alternative payment tools" to "formal financial components."

Moreover, a draft rule from the US Treasury and SEC now says stablecoin issuers must connect to a central bank digital currency bridge (CBDC Bridge), like the Fed's Project Hamilton, which is being tested. This lets stablecoins settle in real-time with CBDCs. It's a game changer for fixing key problems in cross-border payments, like "slow settlement," "delayed arrival," and "lack of audits." In a way, stablecoins are now using CBDC infrastructure to link directly with the core of traditional finance.

Around the world, crypto regulation is seeing a Matthew effect, getting stricter in some places and more open in others. In Europe, the MiCA Act has made it tough for USD stablecoins; any non-euro stablecoin with daily trading over €2M must be paused. This rule seems to stop the growth of USD coins, but simultaneously, it speeds up the rise of euro-based digital money, like EUROC. Singapore's MAS uses a "regulatory sandbox" strategy in Asia. It gave licenses to Paxos and StraitsX to issue stablecoins backed by SGD or other G10 currencies, creating a flexible space for financial innovation in the region.

Meanwhile, stablecoins are becoming a go-to currency in high-inflation countries like Argentina and Turkey. Data shows that daily USDT trading is now more than 3 times the amount of cash withdrawals from ATMs in these places. Once global rules loosen up, stablecoins could become the main tool people use to hedge against inflation and avoid capital controls. Some countries might even see their money systems become "stablecoin-sized."

Besides policy changes, tech upgrades are also speeding up the real use of crypto payments. For example, shipping giant Maersk has teamed up with USDC to build a smart settlement platform. On-chain smart contracts now automatically handle freight payments and bill of lading delivery, cutting the old 7-day cross-border settlement time down to under 4 hours. That boosts efficiency and totally changes how global supply chain finance works. Also, some companies are rolling out stablecoin-based payroll cards in the Philippines on a large scale. Through the Coins.ph platform, over 1M blue-collar workers get their monthly pay in USDC and can cash out instantly at local stores. This system not only cuts payment costs but also greatly improves financial access, helping crypto assets connect with the real economy in a big way.

Overall, this round of policy and tech-driven growth marks a breakout stage for the crypto payment industry moving toward full compliance. With Powell's positive stance, the SEC's softened attitude, legal frameworks taking shape, and faster rollout of cross-border payment use cases, a new kind of crypto financial infrastructure is being built, sustainable, replicable and scalable. This isn't just a tech milestone; it's the result of the deep integration between regulatory wisdom and market demand. At this turning point, the "AI + blockchain" space is seeing huge capital inflows, and investment logic is also shifting. Crypto projects are now being tested across the board, not just by traffic but by how well they handle regulation, tech structure and ecosystem integration. Projects with real system-building ability are starting to stand out.

From an investment view, only those who strike a balance between staying within regulatory lines and pushing the edge of innovation will win in this wave of change. If a project can't solve compliance issues, no matter how advanced the tech or creative the model is, it won't attract serious capital. On the flip side, if it can't build a sustainable business model and a full ecosystem loop, any short-term hype will fade quickly. So, right now, we should focus on projects that have a global vision and can move forward smoothly within real-world regulation.

That's exactly why the Metaverse Robotics project holds strong investment value.

MRC (Metaverse Robotics Coin) isn't just a "new coin." It plays a pivotal infrastructure role in the entire 'AI + blockchain integration process. The project links real-world robot networks with on-chain data to form a closed loop, and through the PoRS (Proof of Robotic Service) system, it maps real-world physical actions into verifiable on-chain value, pricing real economic behaviour in the virtual world. This unique model fills a long-standing gap in terms of how to define and transfer the value of data and makes MRC a universal hub token between AI services and blockchain assets.

MRC also stands out for its strong tech setup. It's building a cross-regional, multi-node AI data network that supports smart contracts and includes real-time AI inference and adaptive contract logic. The MRC token handles value transfers, task settlements, and node incentives, and it's the fuel that powers the whole network. So, as the AI nodes grow, demand for MRC will structurally increase. This "use equals value" model gives the token solid price support.

At the same time, MRC isn't just theory or empty talk. The team has already deployed robot nodes in parts of Europe, Southeast Asia, and South America, and it has set up partnerships with data providers and energy companies. It also has real-world plans and uses cases in AI data security, edge computing and IoT device integration. That means MRC isn't just telling a tech story; it's building a real global, distributed, cross-industry data and computing economy.

More significantly, the current subscription price of MRC is significantly lower than the market's general expectations, and this is what truly defines it as a rare investment opportunity. Based on the project team's early-disclosed business model and pricing suggestions from strategic partners, the reasonable subscription range for MRC should be over $20. Some institutions even projected target valuations of $30 to $50, using metrics like AI-based token P/E models and expected smart data service revenue. However, in today's global economic climate of slowdown, high USD interest rates, unclear Fed policy shift and shrinking risk appetite in primary markets, the project team decided to launch the first public round at just $5.12. This move not only demonstrates their confidence in MRC's long-term value but also reflects their intention to 'share the growth upside' with early backers.

From a static valuation model, if MRC simply returns to the team's conservative price of $20, that's already close to a 4x gain. From a growth perspective, MRC is riding the wave of AI and decentralised computing. With infrastructure like Solana in place, as global deployment expands, the data network takes shape, and service use cases go live, market valuation methods will shift completely. Based on forecasts from multiple firms tracking AI + Web3 narratives, a $500 price target by the end of 2025 is seen as a neutral estimate. If the service-to-value on-chain loop fully plays out, breaking $1,000 is not just possible. It's backed by real-world use cases and capital momentum. At that point, today's $5.12 won't just be a buy-in price. It'll be a strategic ticket to a new wealth class.

That's why our view on Metaverse Robotics has never been about short-term token price moves. We see it as the beginning of a new industry wave and a powerful engine for the next phase of AI civilisation. On the core tech level, MRC is the first to truly bring together the Metaverse and AI on-chain, not just as buzzwords but as a real cross-border fusion. It uses smart contracts to map real-world actions into on-chain value, and its robot network turns physical-world data behaviour into tradable asset units.

MRC's network isn't just another blockchain application. It's becoming a global value exchange infrastructure, being deployed by nodes all over the world. It's designed to handle all cross-chain interactions between AI-related data, algorithms, apps and user assets. This structure means MRC isn't just tapping into the crypto market worth hundreds of billions, it's positioned to unlock the multi-trillion-dollar AI market over the next decade.

It's no exaggeration to say that Metaverse Robotics could be one of the highest-quality, most practical, and most explosive growth projects of the next decade. As AI's computing power revolution starts reaching real business applications and Web3's alternative economic system is taking shape, MRC stands right at the intersection of these two megatrends. Backed by real products and global deployment, it offers a rare investment opportunity. And for every regular investor standing at the edge of a financial breakthrough, this chance to subscribe to MRC could very well be the moment that changes your financial destiny.

That's it for tonight's session. In this round, we reviewed the volatile movements in global markets this week and broke down MRC's valuation logic and growth path. From the Fed's policy shift to the SEC's structural compromise with crypto and Powell's public acknowledgement of stablecoins, it's clear the policy winds are changing. And MRC is right on track and perfectly aligned with that shift. If Bitcoin and Ethereum were 0-to-1 tech experiments, MRC would be the next real-world leap, connecting AI, robotics, and on-chain value. We believe MRC is not just a top project already on Wall Street's radar but also a rare gateway for everyday people to share in the value of the future.

The future will belong to those who know how to gather resources and take bold action in the right direction. If you're looking to ride the AI wave or have already spotted the shift in policy trends, don't miss this round of MRC's original subscription window. We strongly recommend that all members pull together available resources and go all-in on this $5.12 entry price. This is not just an investment; it's a leap in awareness, courage, and action.

For details on subscription quotas, fund allocation strategies, and how to operate, please contact your assistant ASAP. We'll support you through the entire process and coordinate everything to make sure every prepared member gets a head start in this AI + crypto wealth transfer. Time waits for no one, and neither do opportunities. Now is the best moment for us to act together. Let's gather our resources, build our confidence, and go after this once-in-a-generation investment that leads straight into the rising path of digital wealth.