From Collapse to Creation: Seizing the Wealth Transfer in the Age of AI and Crypto

Hi, future investors of Diamond Ridge Financial Academy,

This is Charles Hanover. I’m really excited to explore the wisdom and opportunities of investing with all of you during these times of significant changes. Right now, the global economy is full of uncertainty, constant policy moves, and sharp asset price swings that are testing every investor’s judgment and decision-making. It's crucial that we all have a forward-thinking mindset and a deep understanding of trends to navigate this wave of structural changes and seize real future opportunities.

Tonight, we’ll start with a look at market movements and then dive into future trends in the tech industry. We’ll also break down the key logic behind evolving crypto policies and talk about how investing in new coins can help ride this wave of wealth transfer, giving us a chance to reshape our asset paths and maybe even reach true financial freedom.

Today, the UK stock market bounced back strong after Trump announced a “90-day tariff pause.” The FTSE 100 shot up more than 6% at one point and still closed nearly 3% higher. But honestly, this looks more like a mood swing than a real trend reversal. People are still worried about Trump’s back-and-forth policies. The 10% base tariff hasn’t been removed, and there’s no real sign of easing the 125% tariff fight between China and the US.

Energy prices dropped, Tesco gave a profit warning, and bond yields are still high, all signs that weak consumer demand and system-wide stress are still hanging around. Even though European stocks went up across the board, the sharp pullback in the US market shows that global risk appetite won’t hold up for long. With outside pressure and weak spots inside the economy, it’s going to be tough for the UK stock market to keep this short-term rebound going.

As for the US stock market, things took another hard hit today. The Nasdaq dropped more than 900 points during the day, and both the S&P 500 and Dow fell over 6%. Sure, there was a quick bounce earlier when Trump said tariffs would be delayed for 90 days, but the market quickly realized that wasn’t a real turning point. Goldman Sachs gave a clear warning that what we’re seeing now, this “event-driven bear market,” could easily turn into a full-on cycle bear market. They said the rebound was just a technical fix driven by panic. Former Treasury Secretary Summers even said these tariff policies are “the most self-harming economic move since WWII.” All the flip-flopping in policy is killing market confidence. Even though inflation dropped more than expected, it didn’t boost the stock market. Instead, it showed real pressure from a slowing economy. That risk is now hitting consumer spending and the credit market. US stocks are already stuck in a serious downward trend.

After a strong rebound in global assets yesterday, the market quickly regained its rationality today, and traditional assets have fallen sharply again. The traditional energy sector, especially oil, dropped by 5% today. In the past 24 hours, nearly all of the gains have been wiped out, and the market has returned to a state dominated by uncertainty. Investor risk appetite has cooled rapidly, showing that this so-called “rebound” is nothing more than a typical short-covering rally, not a real reversal signal.

At the same time, driven by the broad pullback in global traditional assets, the crypto market also saw a drop. But for us, none of this is surprising. In fact, it was entirely within our expectations. We’ve been repeatedly stressing for the past month that the global economy has already shifted into a recessionary trend. Even without Trump’s high tariffs, the global stock market would have continued to fall due to high valuations and weakening economic fundamentals. Now, the introduction of tariff policies has just accelerated this process, causing a market that was already on the edge to lose its last psychological support.

What’s even more important is that, from a deeper logical perspective, the global economy has quietly entered a long and complex period of major recession since the pandemic. This recession doesn’t necessarily show up in a sharp GDP drop, but it’s hidden in structural data like the continuous shrinkage of manufacturing, the inability to recover jobs and low consumer confidence. Yet, at the same time, the market gives an illusion of “surface prosperity,” real estate, stocks and service industry data keep hitting new highs, and some investors even mistakenly think the economy has fully recovered, but in reality, it’s just a typical monetary illusion.

After the pandemic, major central banks around the world launched the largest-scale monetary easing in human history to “stabilize the economy.” Whether it’s the Fed’s unlimited QE or negative interest rate policies from the ECB and the BOJ, all of these have been injecting liquidity into the market without restraint. The overproduction of fiat money has flooded the market, but this money hasn’t really entered the real economy. Instead, it’s pouring into the asset markets, pushing up stock prices, real estate and other surface-level data, creating one asset bubble after another. The supply of goods and services hasn’t expanded at the same pace, which has caused a disconnection between real economic activity and asset prices. The “increase” we’re seeing is more about paper wealth stacking up, not real growth.

The most important thing is that, even during this monetary frenzy, the stock market’s gains have been far lower than the speed of fiat currency expansion. This itself is a warning sign; the shadow of stagflation is spreading, and the decline of traditional economies is almost certain. It’s like a critically ill patient who’s been moved into the ICU. Although IVs, injections, and medications have temporarily stabilized the condition, it doesn’t mean the body is recovering. It’s just delaying the outbreak of the illness. Now, with the Trump administration suddenly rolling out a series of high-intensity tariff policies, it’s like pressing down on a patient who hasn’t fully recovered yet. In the short term, it might stimulate some domestic industries, but from a macro perspective, this will only further shrink global trade and economic vitality, accelerating the spread of systemic risks.

Until now, some people still mistakenly view the financial storm triggered by these tariffs as a sudden policy shock. However, as time passes, more and more signs show that this is not a random event but rather a deep, systemic reshaping of the global economic structure. The U.S. is increasingly strengthening its support for industries like AI, blockchain, robotics and biomedicine, which shows they are using a tech-driven global economic restructuring to compete for dominance in the future. Behind all this, there's a more fundamental reality: the logic of traditional industries is breaking down, and the new framework of the digital age is being rapidly built.

Without the rapid involvement of technology and timely reshaping of industrial structures, this crisis would only continue to worsen. However, the real issue is that traditional industrial chains, financial structures, and global divisions of labour can no longer support the operating logic of the future economy. This is exactly why, since Trump took office, he has continued pushing for tariff reform while also frequently voicing support for cryptos and blockchain technology. What he's trying to drive isn't just a short-term strategy for votes; it's a push for a "new digital economy order" to secure the U.S.'s next leadership position in the global competition.

From this perspective, cryptos aren't "speculative tools" opposed to sovereign nations but are becoming the underlying infrastructure of the next-generation financial system. We can see that more and more countries are integrating digital currencies into their national strategies, and more and more financial institutions are shifting to blockchain. A large amount of capital is moving away from traditional financial systems and is being deployed in the digital economy. This is not just a migration of capital but a deep restructuring of value systems.

Of course, some students may still have difficulty fully understanding the complex situation of the current global economic transformation. To help everyone better understand the systemic opportunities brought by the tech explosion over the next ten years, I'd like to share the research perspective of a friend. He's a professor at Oxford University who specializes in AI ethics and future tech paths. We met at a closed-door seminar on solar energy and AI collaboration. Recently, he raised a highly forward-looking point: Over the next ten years, driven by the rapid evolution of AI, human society will complete, in a compressed timeline, the technological breakthroughs that took the past 100 years to accumulate. This isn't just a trend judgment but something that is being increasingly validated by empirical data in the tech world.

This friend recently published a research paper, "Preparing for the Explosion of Intelligence," in which he clearly argued this viewpoint. He pointed out that from 1925 to 2025, humanity's technological progress has covered almost everything that modern society relies on. From the foundation of quantum physics and the rise of cosmology to the decoding of DNA sequences and the development of modern psychology, from aeroplanes, radar, stealth technology, smartphones, solar energy systems, and drones to humans landing on the moon, these technological achievements have deeply reshaped the entire structure of civilization. What's surprising is that MacAskill believes that in the next 10 years, AI will help humanity achieve scientific breakthroughs equivalent to the past 100 years. Its speed of transformation will be more intense and thorough than any industrial revolution.

This judgment is highly consistent with the prediction of Dario, the founder of the AI company Anthropic. Dario once proposed that we are about to enter a "compressed 21st century," meaning that the next ten years might condense the technological evolution of the past century. The support for this view comes not only from the evolution of AI algorithms themselves but also from their exponential growth in research efficiency, computational power and logical reasoning speed.

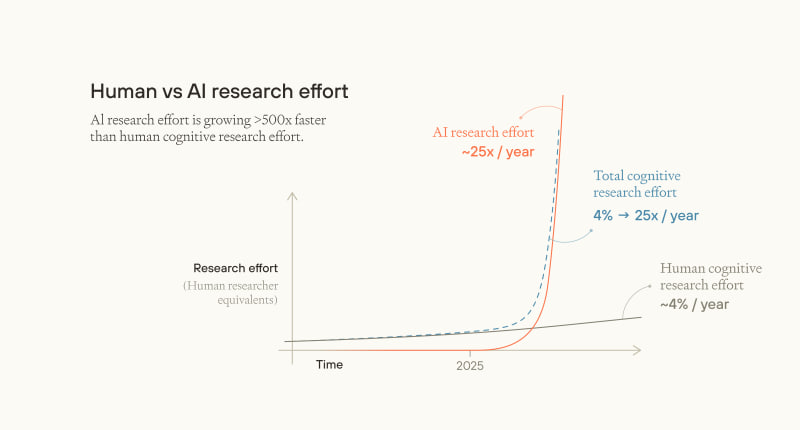

From human history, technological progress usually increases at a linear rate of 4%-5% per year. However, according to MacAskill's team model, AI's research capabilities will grow at a compounded rate of 20-25 times yearly. This means we are about to cross a "singularity moment" of technological acceleration. Once AI's research capabilities surpass human capabilities, its "acceleration" will proceed exponentially.

Visualizing this trend: AI's research progress is like a high-speed train. At first, you might only hear its roar from a distance, but once it's in sight, it will rush by at a speed beyond comprehension. As shown in the picture above, after 2025, the "orange index curve" will quickly cross the "grey line" of traditional human research growth, entering uncharted territory. Adding to this is the compound effect of human-AI collaboration, like bringing AI into research decision-making, technological simulations and interdisciplinary integration, which could speed up technological progress by up to 25 times a year, as shown by the "blue dotted line" in the image.

What's more interesting is that MacAskill breaks down AI's growth into two core dimensions: one is the ability to expand computing power, meaning the scale of complex reasoning AI can handle; the other is the improvement in reasoning efficiency, meaning the ability to solve problems in less time. He believes that in the next few years, AI's computing power could grow by 2.5 times per year, and reasoning efficiency could grow by 10 times yearly, with overall growth hitting 25 times annually. Even if this prediction is a bit high, its trend still holds a strong reference value. This acceleration in research will directly change the innovation paths in fundamental sciences, engineering technology and social systems.

Over the next ten years, we can expect unprecedented breakthroughs in the following areas. First, a leap in scientific theory, covering cutting-edge fields like medicine, biology, physics and materials science. AI can help us decode life laws and natural principles we couldn't understand before, greatly improving research-to-application efficiency.

Second, a huge shift in industrial structure. Traditional industries that rely on human labour for repetitive, dangerous or judgment-based tasks will be fully replaced by AI and robotics. Tasks humans currently perform in industrial systems, either hands-on work or process supervision, are quickly being taken over by AI systems and automated machines. As humanoid robots spread throughout industrial systems, the traditional industrial model based on "population dividend" will be completely overturned. Manufacturing capability will no longer depend on the number of workers but on the efficiency of intelligent collaboration and energy systems.

Third, massive energy release. Right now, humans have only tapped into 0.01% of the total solar energy available. In the future, if we fully convert just 2% of solar energy from oceans and deserts, humanity's energy supply could increase by more than 100 times. This logic is supported by Elon Musk in many of his speeches. He points out that solar energy is the biggest energy source in the entire solar system. The future energy revolution will focus on the three core stages of "harvesting, storing and distributing." This is exactly what Tesla is focusing on with its two main business areas: solar energy and energy storage systems. With AI applied to energy scheduling, storage balancing and flow prediction, the global energy structure will shift towards a smarter, more distributed system.

Fourth, material shortages will be proven to be a false problem. For a long time, humans have lived with anxiety over the idea that "resources will run out." Decades ago, some predicted that oil would run out in the early 21st century. Others worried that Earth's water resources wouldn't support future population growth, and many even believed that "population control" was the only way to avoid resource wars. However, these fears are gradually being broken down with the rapid development of AI technology. The resources we currently use on Earth are just a tiny fraction of what could potentially be developed. With breakthroughs in materials science, bioengineering, synthetic technology and AI's ability to efficiently simulate and reorganize natural laws, more and more materials that were once hard to develop will be refined, restructured and even replicated.

In the future, we'll be able to use AI to synthesize food, simulate complex chemical reactions to make clean fuel, collect resources from space and even build logistics networks between planets. What once may have seemed like science fiction is now becoming a central focus of scientific research and industry investment. AI will no longer just be a tool; it will become the engine driving the restructuring of resources, turning what seemed like a limited world into an infinite universe.

Of course, technological changes bring both risks and challenges. As AI becomes stronger in reasoning, execution and self-learning, ensuring it is not abused or loses control becomes a major issue. This is why we emphasize the need for "cryptographic technology" in the age of AI. With the rise of AI, robotics and smart hardware, all computing, data storage and device control must be done within a "trusted network." Blockchain, in fact, is currently the only technology architecture that can provide "trust and order" in large-scale decentralized systems. It not only records information and prevents tampering but also automates preset logic through smart contracts, forming the infrastructure for regulating AI systems.

From this perspective, future "crypto assets" will no longer be speculative tokens but the storage of technological information. Every AI command, data transmission, and robot action will be tied to a piece of blockchain rights. It could be an authorization code, a computing power certificate, or permission to run a smart service. It is these pieces of information and control rights flowing through the blockchain that will form the core of the "currency" in future societies.

Now, looking at today's point in time, let's rethink: what assets are worth investing in? A barrel of oil, an ounce of gold, or a tech chain that can be called AI, drive robots, coordinate energy systems, and even evolve on its own? The answer is already clear. The core assets of the future will no longer be tangible materials but rather collaborative systems of information, algorithms, computing power, networks, and intelligence. And this is exactly what crypto assets are building.

We can imagine that, at some point in the future, both fiat currencies and energy assets will gradually exit the main stage of history. In their place will be a new era driven by technology chains. This new system will not only manage electricity, produce food, reshape transportation and manage health but also control humanoid robots to serve human society through smart contracts. These crypto assets, formed by these informational chains, will become the true "currency standard" of the AI era.

This fundamentally explains why, on the one hand, the U.S. is loudly calling for the return of manufacturing and claiming to rebuild domestic industrial capabilities, while on the other hand, it is strongly supporting future tech industries like AI, quantum computing, crypto assets and Web3 infrastructure through national policy. Their real strategy is not to "go back to the past" but to "move forward by leveraging the shell," using manufacturing to protect the middle class's stable expectations while using technology to lock in the next global wealth hotspot. Especially in the past year, U.S. states have been rolling out crypto legislation and encouraging AI companies to deploy their core business on the blockchain, with one underlying goal: to use digital assets as the "institutional engine" for technological development and make this new system the U.S.'s strategic moat.

So, when we look at cryptos, we should no longer equate them with "virtual assets" or "speculative tools" but rather understand them at a higher level for the era they represent. They are an asset expression of technological development, the credit foundation of the AI ecosystem, the information settlement platform for smart societies and a sovereign tool for reshaping global value. In other words, they are not a short-term wealth opportunity but a technological and cognitive revolution.

Take the HGS project, which is currently in the subscription phase, as an example. HGS is a concrete embodiment of this logic. As an innovative platform combining AI, whole genome sequencing (WGS) and blockchain technology, HGS is building a global, decentralized, precision healthcare ecosystem based on sovereign data principles. The project's underlying architecture uses quantum-resistant blockchain and edge-federated learning mechanisms. It integrates an improved DAG mechanism and PoH (Proof of Health) algorithm at the consensus layer, providing secure and efficient support for the encryption, storage, management and transaction of high-frequency genetic data.

Its applications cover personalized healthcare, drug research, epidemic prediction, public health management and several other important areas, with vast industrial scalability and policy adaptability. More importantly, HGS is still in its early development stage, and its token price is extremely low, making it a highly cost-effective option for investors with a medium-to-long-term perspective. If we project the current pace of AI and biomedicine industry development, it's not unrealistic for HGS to break $50 by the end of the year.

Looking at the long-term development prospects and market size, the true driver of the "Fourth Industrial Revolution" will be robotics-related infrastructure projects. Especially as humanoid robots gradually move from the lab to the market, from manufacturing floors into homes for services and from factories to urban operations, their core value is no longer just "hardware shells." Instead, it's all about real-time data calculations, identity recognition, behaviour control and encrypted transmission. For this reason, the data and information asset network built around robots will become the "digital engine" of this new industrial system.

According to sources in the crypto world, a robot public blockchain project driven by consortiums like Nvidia and Vanguard has entered the testing stage. It's expected to launch ahead of schedule after the SEC's roundtable meeting releases policy windows. Based on this prediction, we've been emphasizing the importance of new coin subscriptions since April and advising investors to gradually shift their focus from short-term market speculation to these new industries' foundational projects that offer structural dividends.

That's all for tonight's talk. In this round of discussions, we not only analyzed the strategic logic behind U.S. tariffs, starting from global policy changes but also clarified how the tech industry will reshape the global economic order in the next decade based on Professor William MacAskill's scientific projections on the speed of AI development. In this context, digital assets are not just a new investment product but also a fundamental force that transcends economic cycles.

Looking at the present, even if the market faces short-term fluctuations, the certain advantages shown by new coin investments remain irreplaceable. The subscription progress of the HGS project has surpassed 500%, which reflects mainstream capital's strong consensus on its value logic. As premium expectations continue to rise, the performance of HGS after its launch is highly anticipated. For forward-thinking investors, now is not the time to wait; it is the key window to invest early, increase the subscription amount, and grab more shares.

In this golden window of global economic transformation and asset structure reshaping, we not only need to understand the trends but also ride the wave, seizing every strategic opportunity that can be executed. Let's join forces with Project Ascension, and in this era of deep integration between technology and finance, grasp the wealth-changing path brought by the digital asset wave. The opportunity has arrived, and determination will shape the future.