Project Ascension and the Rise of Digital Capital: Why HGS Is This Cycle’s Must-Capture Opportunity

Hello, future investors of Diamond Ridge Financial Academy!

I'm Charles Hanover. I'm very pleased to explore investment wisdom and opportunities with you in this era of change. The current global economic situation is full of uncertainty. Ongoing political and economic turmoil, along with frequent asset price fluctuations, force us to constantly adjust our perspective to find structural opportunities. Accurate trend analysis and sharp market insights are the key to achieving wealth growth.

Today, we will focus on analyzing the impact of tariff policies on the global economy. In addition, we will examine policy changes in the crypto sector and explore how to seize investment opportunities in the HGS token subscription, laying a solid foundation for future financial planning.

The UK stock market was weak today, with the FTSE 100 index dropping 1.7%, mainly due to the dual pressure of economic policies and economic data. In the context of a slowing global economy, the government's fiscal tightening measures have further increased market anxiety. In particular, reductions in public spending have weakened market confidence even more. At the same time, the UK's economic data failed to boost market sentiment. Although the unemployment rate remained stable, production and consumer spending slowed, consumer confidence declined, and investors became more cautious about economic growth.

At the industry level, export-oriented companies are facing significant pressure. The growing uncertainty in the UK economy, combined with a complex global trade environment, has led many export-dependent companies to lower their earnings expectations. Meanwhile, the financial sector is also under pressure due to policy adjustments and the economic slowdown, making its outlook less optimistic.

In the U.S., the stock market plunged at the open, mainly due to Trump's announcement of additional tariffs on nearly all countries. This policy not only escalates global trade tensions but also raises concerns about further weakness in the U.S. economy. The tariff measures are expected to put enormous pressure on multinational companies, especially major corporations like Nike and Apple, whose stock prices suffered heavy losses at the opening. The global supply chain could be deeply disrupted, ultimately backfiring on American consumers and businesses, adding even more uncertainty to the economy.

Therefore, whether in the UK or the U.S., the latest economic data and policy trends indicate that markets are facing significant short-term uncertainty, and a traditional economic recession has become inevitable.

Regarding the latest tariff policies, we need to dive deeper into understanding their far-reaching impact on global financial markets. Before the tariff policies were announced yesterday, market sentiment had warmed up somewhat, mainly due to two factors. First, the global stock market’s continued decline over the past month had largely absorbed the bearish sentiment, and panic spread into the cryptocurrency market, causing a pullback in digital assets like Bitcoin. However, once market sentiment reached a relatively low point, selling pressure eased, and some capital began to attempt bottom fishing.

Second, Trump had previously mentioned several times the possibility of tariff exemptions, leading the market to believe that the U.S. government would not further expand the scope of tariffs and may even allow more countries to qualify for exemptions. Therefore, before the official tariff policy announcement, the overall market expectation was relatively optimistic, and capital flow trends were shifting back toward high-risk assets. The direct manifestation of this sentiment was the rebound in the Crypto market, with Bitcoin rising over 7% at one point, driving up the activity in the entire market.

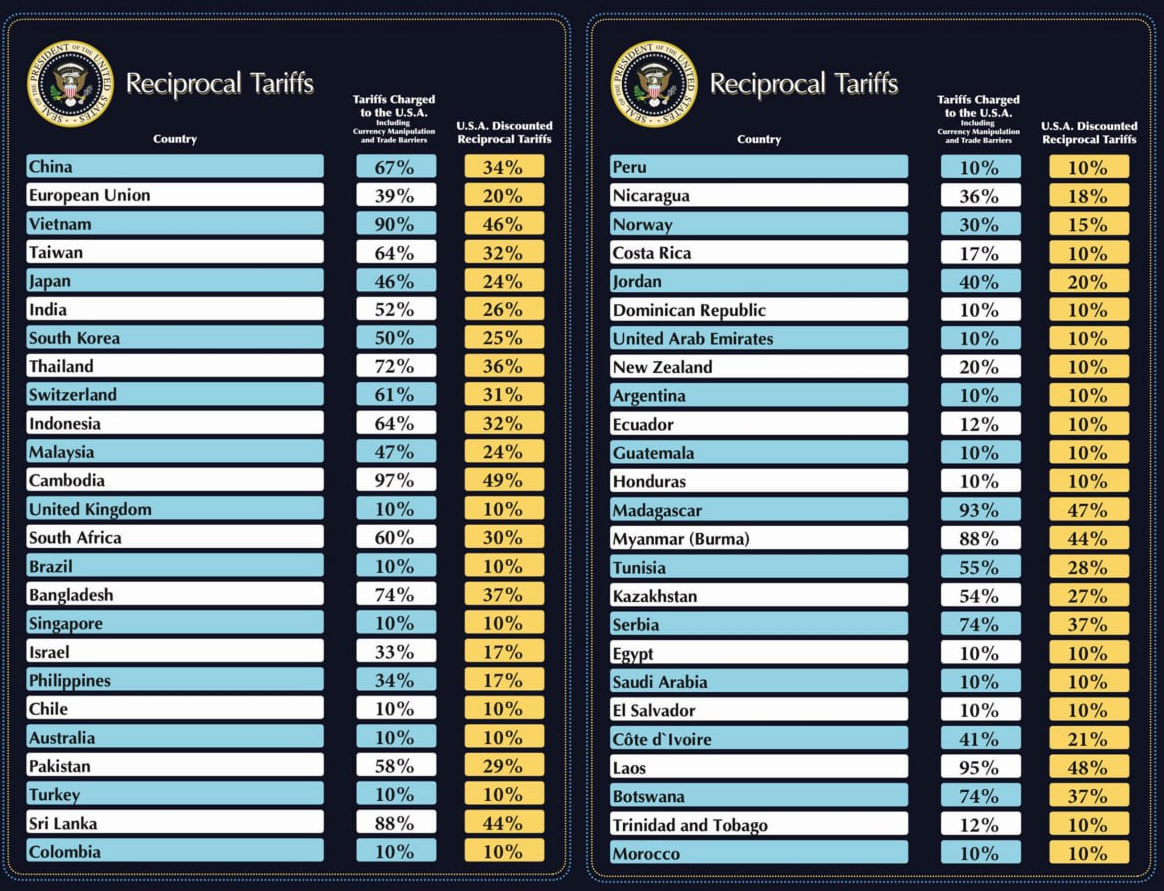

However, the market’s optimism quickly collapsed after the policy details were released. The tariff measures introduced by the Trump administration were much more aggressive than expected and showed clear protectionist tendencies. Specifically, Trump signed a new executive order announcing a reciprocal tariff system for all countries, with a series of specific tariff measures:

① Starting April 2, a 25% import tariff will be imposed on foreign-made cars.

② Starting April 5, a 10% uniform baseline tariff will be applied to all countries.

③ Starting April 9, the reciprocal tariff policy will officially take effect, with U.S. tariffs on other countries set at half the tariff rate those countries impose on the U.S.

This new tariff policy has caused tariff rates on the U.S.’s major trading partners to rise sharply, including 34% on China, 46% on Vietnam, 24% on Japan, 20% on the EU, 32% on Taiwan, 25% on South Korea, 26% on India and 10% on Brazil. The tariff on the UK, set at only 10%, is particularly noteworthy, being much lower than those of other major economies. This suggests that the U.S. may be leaving room for future trade talks with the UK regarding a free trade agreement. In contrast, tariffs on China, the EU, Vietnam and other countries are far higher than expected, with Cambodia’s tariff reaching 49%, showing that the Trump administration is adopting a tougher stance in the global trade landscape.

It's crucial to understand the far-reaching implications of this tariff policy, which has a staggering impact on 185 countries, marking it as the most extensive tariff adjustment in U.S. history. These nations will now operate under stricter trade conditions, with new tariff rates set at 50% of the rate they impose on the U.S. For the remaining countries, a uniform 10% baseline tariff will be in effect. This policy significantly heightens uncertainty in global supply chains and exacerbates global economic tensions.

In his speech, Trump emphasized that this is a friendly reciprocal tariff policy, urging governments to lower their tariffs on the U.S. and encouraging them to buy more American goods. He claimed that the implementation of this policy would mark the arrival of the golden age for the U.S. economy. However, the market didn't buy it. Once the tariff policy was announced, global financial markets reacted sharply. BTC's price dropped by over 2% instantly, the S&P 500 futures fell 3.7%, and the global market value evaporated by $2 trillion.

By this morning's European trading session, market sentiment had eased somewhat, with BTC rebounding 1.5%. However, this brief rebound didn't last long. As governments around the world expressed their intentions to retaliate against the U.S. tariff policy, the market fell back into panic. In particular, Europe saw countries like France and Germany considering extra tariffs on U.S. products. China's Ministry of Commerce quickly issued a statement emphasizing that countermeasures would be taken if necessary. This series of statements worsened market sentiment again, with the Nasdaq index dropping over 5% shortly after the U.S. stock market opened and the S&P 500 continued its downward trend.

Looking at asset movements, during the sharp drop in U.S. stocks, BTC and other cryptos remained relatively stable and even saw some rebound during the session. This phenomenon is worth noting because it reflects a structural shift in market funds. More and more investors are moving away from traditional financial markets and reallocating funds to digital assets. Especially with the current slowdown in global economic growth and stock market turbulence, cryptos, as a decentralized and global asset class, are gradually gaining favour among more investors. In fact, this trend is not accidental but rather an inevitable result of the gradual digital transformation of global capital in recent years.

At a deeper level, the drop in U.S. stocks is not solely due to the impact of the tariff policy. The underlying reason is the looming threat of a global economic recession. Major economies like the U.S. and Europe are showing signs of weakness in manufacturing and consumption data, even approaching the lowest levels seen during the 2020 pandemic. For instance, the latest U.S. manufacturing PMI dropped to 48.5, below the breakeven level of 50, and the UK's retail sales data has shown three consecutive months of decline. These economic indicators point to a weakening growth momentum in major global economies, and the high inflation and high interest rate policy environment is increasing corporate financing costs, reducing consumer spending, and intensifying downward economic pressure. In this context, the weak stock market performance is hardly surprising.

In the future, market volatility will likely continue. In the short term, after a series of declines, US stocks may see a technical rebound. Some short positions may be covered, and buying funds on dips could push for a brief market correction. However, in the long-term trend, the overall direction of the stock market still leans bearish. Global economic growth is slowing down, and the escalation of trade tensions continues to put pressure on corporate profitability, which in turn hits market confidence. Therefore, the downward trend of US stocks is not over, and this trend fits well with the global economic structural adjustment and the digital transformation of capital.

In fact, the decline in the stock market isn’t only affected by tariff policies. A more important factor behind it is that the global economy has entered a recession cycle. Specifically, data from manufacturing, consumption and other sectors in developed countries like the US and the UK have nearly returned to their lowest levels during the pandemic. This means that even if the market experiences short-term volatility due to technical corrections, in the long run, the main trend of US stocks will remain downward, and the weakness in traditional markets will persist. On the other hand, the digital asset market will see more capital inflow as capital will continue to seek new safe-haven assets and growth opportunities amid global economic restructuring. The decentralized digital economy is the future direction.

While the global economy is adjusting, US politics is entering a new cycle. Looking back at this US presidential election, Trump’s re-election didn’t come as a surprise. Logically, the economic miracle of the US over the past 100 years has relied mainly on its open system, which has attracted the world’s best innovators and companies, making the US the core of the technological revolution. As a businessman, Trump’s governance style leans more towards maximizing economic interests. Compared to his predecessor, he focuses more on using market methods to drive economic growth. In the current context of slowing global economic growth and tightening market liquidity, Trump’s policy direction will likely be more geared towards supporting high-tech industries, especially those representing the Fourth Technological Revolution, such as AI, blockchain and new energy.

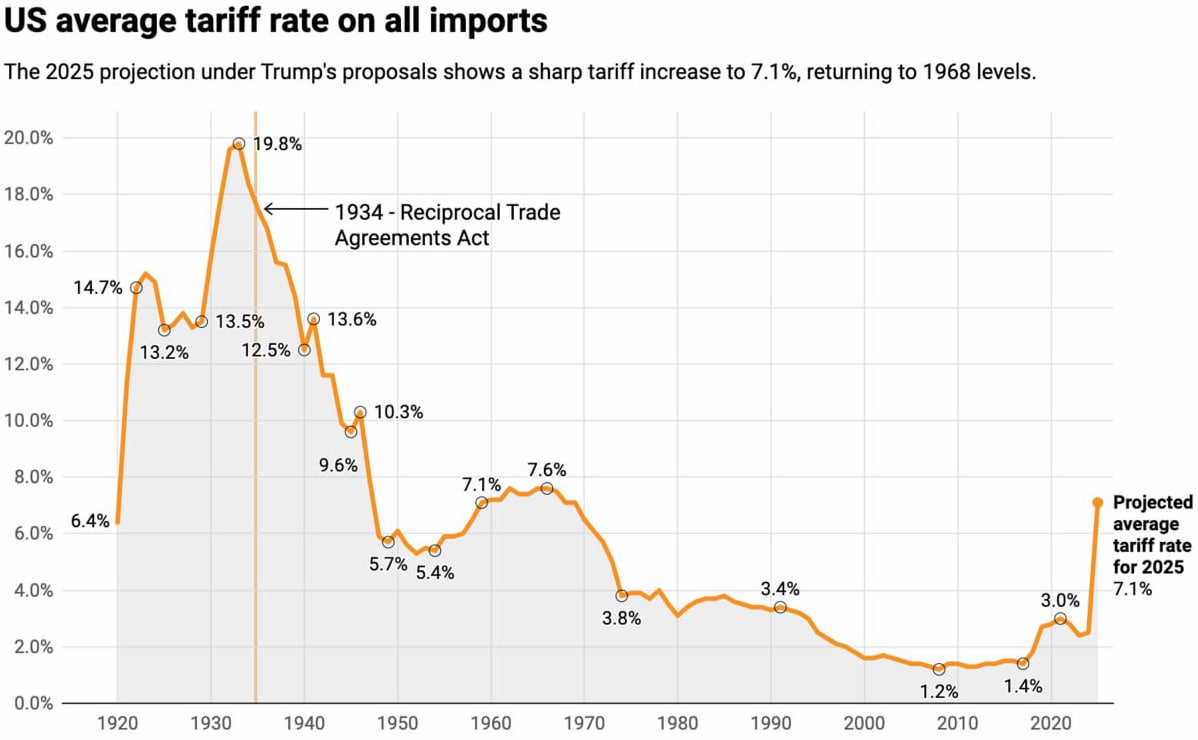

Looking at the policy direction during the election period, Trump’s successful victory largely depended on two key factors: first, a tough tariff policy and second, a strong support for cryptos. From the current market cycle, the impact of the tariff policy is nearing its peak, and market bearish sentiment has gradually been released. While high tariffs will continue to affect global supply chains, their short-term impact on the market has already been absorbed. Moving forward, its impact will shift from a short-term emotional shock to long-term economic friction in the next one or two years. Meanwhile, the US government is gradually pushing forward policies that are more favourable to the development of cryptos, aiming to fill the gap caused by the transformation of the global financial system.

Starting in March, the Trump administration has begun frequently releasing positive signals for cryptos. From the White House meetings led by Trump to the series of cryptocurrency roundtable discussions hosted by the SEC (Securities and Exchange Commission), these policy movements indicate that the US government is actively promoting the compliance and institutionalization of the cryptocurrency industry. The ultimate goal of the Trump administration is to turn the US into the global cryptocurrency capital by supporting policies that enable closer integration between the dollar and the cryptocurrency asset system.

Based on the pace of tariff policy implementation and market reactions, the current round of tariff adjustments started around February. It will be fully implemented by April 2, with the overall duration lasting about two months. The crypto policy rollout began in late March and is expected to last until early May, which means the next month will be a key period for the crypto market's growth. In fact, looking at market capital flows, both state governments in the U.S. and major Wall Street groups are accelerating their investments in the crypto market.

Currently, funds are entering the crypto market in three main ways:

First, large institutions and governments are speeding up their purchase of mainstream digital assets like BTC as strategic reserve assets. Recently, several U.S. state governments have announced they will shift part of their fiscal reserves into cryptos, while some Wall Street institutions are actively adjusting their portfolios, gradually adding BTC to hedge against U.S. dollar inflation risks. Additionally, some think tanks in the U.S. Treasury have proposed enhancing the U.S. dollar's anchor system with BTC, though this proposal hasn't been officially implemented yet. Still, it shows that mainstream institutions have fundamentally changed their stance on cryptos.

Second, big Wall Street players like BlackRock and Fidelity are accelerating the launch and liquidity development of crypto-related ETFs. In the past two years, several crypto ETFs have been approved, with the launch of the BTC spot ETF marking a clear compliance path for institutional investors to enter the crypto market. This trend is strengthening, pushing institutional funds into the market and accelerating the large-scale allocation of crypto assets.

Third, the tokenisation of traditional financial assets is rapidly advancing, with more stocks, real estate and other assets moving onto the blockchain. Several U.S. state governments and financial institutions have recently started pilot programs for real estate tokenisation, allowing certain commercial real estate projects to be digitally traded through blockchain. This trend means that crypto assets will gradually integrate into the traditional financial system, providing new growth potential for the digital asset market.

Among all the developments in the crypto market, the most noteworthy field is the integration of artificial intelligence and blockchain in new projects. For example, the HGS (Human Genome Sequencing) project, which is currently gaining significant attention, combines blockchain technology with whole genome sequencing (WGS). Its goal is to build the world's first decentralised precision medicine ecosystem based on sovereign data principles. The core technologies of HGS include quantum-resistant blockchain architecture, edge federated learning mechanisms, improved DAG consensus and PoH health proof mechanisms. These technologies allow HGS to process massive amounts of genetic data efficiently while ensuring privacy and security. HGS's potential impact is vast, including but not limited to personalised diagnostics, drug development and public health management. If successful, this project could revolutionise the global healthcare industry's data management model and significantly accelerate the development of precision medicine.

To help everyone better grasp this opportunity, let's dive into the profit logic behind investing in new coins. According to market rules, the profit model for new coins can be split into two stages. Take SCI as an example. Its subscription price was $3.75, the subscription progress reached 366%, and the final listing price was $11.9, more than 3 times the subscription price. After listing, SCI saw another surge as market excitement grew, rising more than 4 times. This shows that investing in new coins not only offers premium profits in the subscription stage but also benefits from the market sentiment, driving price increases in the secondary market after listing.

For some students who still have doubts about the risks and rewards of new coin subscriptions, we can further analyze the security of new coin investments. The first part of new coin investment profits comes from the subscription stage, and the key here is the completion of the subscription progress bar. If the progress bar exceeds 100%, the success rate for listing is very high, which also means a supply-demand imbalance, ensuring basic profits for subscribers. More importantly, even if the subscription fails, funds will be returned, meaning there is no risk to the principal. The second part of the profit comes from market premiums after listing. Once listed, the token typically attracts a wave of capital, driving up the price in a short period. This phenomenon has been confirmed in many new coin projects, such as SCI and TRUMP, which saw multiple-fold gains after listing.

HGS not only aligns with the development trends in AI and the digital economy but also catches the favourable policy window in the U.S. According to official announcements, the token will open for subscription on April 8 and end on the evening of April 11, with a subscription price of 0.55 USDT. It's worth noting that this price is much lower than market expectations, indicating there is significant arbitrage potential. Based on the current market enthusiasm, the market premium for this token is expected to exceed $6, meaning just participating in the subscription could result in more than ten times the profit. Once HGS successfully lists, considering its unique concept combining AI and genome sequencing along with deep blockchain integration, market capital might surge even more than expected, further driving up the price.

So, how can you increase your return on investment in HGS's new coin? In fact, making money is almost certain; the key is how much to earn. The profit potential in new coin investments depends on the subscription success rate, which directly affects the share and final profit an investor gets. The rule for new coin investments follows the principles of priority of funds and timing. That means the more capital you invest and the earlier you participate, the higher the chance and share of success. For HGS's subscription, if the expected premium is 10 times, participants who have a higher success rate closer to 100% will see bigger profits. If you can participate in more subscription shares, your potential profit will be even greater. Therefore, the key to grabbing new coin subscription opportunities is boosting your capital strength and increasing your chances of success, which will maximize your return.

Right now, the liquidity of global assets is accelerating, especially the volatility and opportunities in the cryptocurrency market. Without quantitative trading tools and capital advantages, it's hard to make consistent profits in short-term trading. However, new coin subscriptions offer relatively certain investment opportunities. Unlike other types of short-term trades, the success rate and market premium stability of new coin subscriptions have gradually been proven. Recently, even with BTC pulling back, tokens representing emerging projects like EOS have risen sharply, which shows that emerging crypto projects still have strong growth potential.

With the global crypto roundtable series taking place, more and more funds and institutions are flowing into the crypto market, and this trend is very clear. Whether for new investors or experienced market players, the current new coin investment opportunities are an excellent chance for profit. Especially with the double boost of market trends and favourable policies, new coin subscriptions are becoming a solid and high-return investment strategy.

That's all for tonight's share. In this round of discussion, I mainly explained how tariff policies impact capital flow and analyzed the transition from tariff policies to the crypto market. We identified certain opportunities from uncertain changes: On one hand, the positive trend of global crypto policies has become inevitable. On the other hand, the trend of global asset digitization is gradually emerging. With these factors working together, new coin investment has become a certain profit opportunity. Therefore, now is the best time to invest in new coins.

Next Tuesday, the subscription for the HGS token will start. For those who want to seize this 10x profit opportunity, I recommend starting to raise funds now to ensure you can maximize your participation in the subscription. Especially for those with smaller funds, tomorrow's non-farm payroll data market is also a good opportunity to accumulate funds. Our Project Ascension strategy focuses mainly on mid-term investments in quality tokens, with short-term trading as a supplement, to help everyone achieve the best returns in the current market. If you have any questions about strategy, feel free to contact the assistant for consultation. We will provide one-on-one guidance based on your specific situation to ensure every student seizes this new coin investment opportunity and meets their financial goals.

New coin subscriptions, especially projects like HGS, are no longer a risky gamble but a certain investment opportunity. As long as we manage the three key factors, capital, time and strategy, the future profits will be worth looking forward to. With the changes in the global economy and policy environment, investment opportunities in the crypto field will only continue to grow.

If you're ready to take action with us, don't hesitate to join Project Ascension and work with us towards the ultimate goal of achieving financial freedom in this wave of asset digitization. We believe that in this age full of opportunities, every student has the chance to reap the rewards they deserve through scientific investment strategies and decisive actions.