Exploring Global Economic Shifts and Investment Strategies: Navigating the Digital Asset Revolution with Project Ascension

Hello to all future investors of Diamond Ridge Financial Academy,

I’m Charles Hanover, and I’m very pleased to be with you today to discuss global economic trends and trading strategies in this market filled with both challenges and opportunities. At present, the global economic landscape is becoming increasingly complex. As countries roll out new tariff policies and crypto regulations, each shift in policy has a profound impact on market direction.

Tonight, we will begin with recent market movements, focusing on investment opportunities in new tokens, and explore how to take advantage of the global trend towards asset digitalisation through the dual-engine strategy of Project Ascension.

In today’s market environment, the UK stock market remains under pressure, largely affected by both the global economic situation and weak domestic data. The performance of the manufacturing and services sectors in the UK has fallen short of expectations, suggesting that domestic economic momentum remains weak. High inflation and sluggish consumer spending are further dampening confidence in the country’s recovery.

Looking at sectors, technology and consumer goods have been hit hardest. Tech firms are facing gloomy profit outlooks due to rising financing costs, while consumer goods are being dragged down by low consumer confidence and falling spending. Given these conditions, short-term market pressure remains significant.

Meanwhile, the US stock market is also under downward pressure. With Donald Trump expected to announce broad reciprocal tariff policies, market sentiment has become tense. Key indices like the Dow Jones, Nasdaq, and S&P 500 have all seen declines. Investors are turning to short-term hedging strategies, fearing that Trump’s tariff actions could cause sharp fluctuations in the FX, equity, and bond markets.

Although there are discussions within Trump’s team about possible tax cuts, the lack of clarity around the policy details is adding to market uncertainty, further fuelling a sense of panic. In particular, US data for March on manufacturing and employment has been disappointing, with hiring demand from businesses slowing down noticeably. Many investors worry that such policies might worsen the risk of an economic slowdown.

Overall, in this period of global economic transition, traditional economic systems will likely remain under pressure. And as tonight’s tariff measures officially begin to roll out, the news has caused a strong market reaction, adding notable downward pressure to stock markets in the near term.

There is growing concern among investors that this policy may further destabilise global supply chains and reduce corporate profitability. These worries are already reflected in the movements of the US markets over the past few days.

Take the Nasdaq Index as an example — on Monday, its intraday decline reached as much as 2.5%, and today, it also dropped over 1.4% during trading. The US stock market is showing signs of weakness, with market sentiment turning cautious. Many investors are choosing to reduce their stock holdings to avoid potential risks as new policies are implemented.

However, in contrast to the downtrend in US equities, the crypto market, led by Bitcoin, has shown strong resilience, recording three consecutive days of gains. This reflects a clear shift in capital flow. Looking at recent price movements, it’s clear that crypto often rises before US stocks rebound — a trend we saw again in today’s trading session.

Take Bitcoin’s performance as an example. As shown in the technical chart I shared with some team members earlier today, Bitcoin rose from $84,000 to above $86,000 in the morning, showing a clear improvement in market sentiment. Later, when the US market opened, the Nasdaq Index dropped sharply, but all three major indices then rebounded, seemingly lifted by strength in the crypto market.

This kind of correlation is not a coincidence — it’s a reflection of a changing market trend. As cryptos continue to rise, their influence on overall market sentiment is growing. Based on the current rhythm of the market, Bitcoin has held above the middle line of the Bollinger Bands, and as tariff and crypto regulations become clearer, Bitcoin could see a stronger upward move in the near future.

From the view of capital flow and market trend, even if tariff policies bring some short-term negativity, the crypto market is showing a strong upward trend against the overall direction. This strength is mainly driven by two key factors: First, the market is actively digesting the uncertainty caused by tariff policies. After early panic and adjustment, investors are forming more stable expectations, and emotional reactions are starting to fade. Second, with the recent SEC crypto roundtable events, market attention has started to shift from the bearish trend in equities towards the digital asset market. As regulation becomes clearer, confidence in investing in crypto is also improving.

Looking deeper, this change in market dynamics is a natural result of global economic cycles. Historically, whenever traditional economic models enter a decline phase, new industries rise to take the lead. Today, we are at a major turning point — the rapid development of technology is driving explosive growth in areas like artificial intelligence, blockchain, and the digital economy. The capital market’s attention is shifting to these emerging sectors, leading to a change in global asset allocation.

Especially as trust in the US dollar system faces new challenges, investors are looking for alternative ways to protect and grow their wealth. Crypto is becoming a key vehicle in this round of global capital redistribution.

It’s worth noting that the implementation of the tariff policy has been ongoing for two months, while positive policies for the cryptocurrency market have only started to emerge in late March. From a market sentiment perspective, the impact of the tariff policy is gradually waning, and even if new tariff measures are introduced later, their marginal impact on the market is no longer as severe as it was initially.

On the other hand, positive policies for the cryptocurrency market are in their fermentation period, which means investor attention is shifting. For example, over the past two months, the US stock market has generally been in a volatile downtrend, while Bitcoin has begun to rise steadily after completing its bottoming process — indicating a clear increase in market appetite for digital assets. This also means that as the tariff policy gradually fades from public view, the positive factors for cryptocurrencies will increasingly become the market’s focus.

Against this backdrop, both governments — such as the US and the UK — and major financial institutions on Wall Street are actively working to accelerate the digitalisation of assets. The Trump administration has repeatedly stressed the need for the US to maintain a leading position in AI and digital assets.

In today’s “Liberation Day” speech, Trump reaffirmed this strategy, stating that the US Treasury will complete a Bitcoin audit by 5 April. The purpose is to clarify the government’s Bitcoin holdings and confirm whether XRP, Solana, or Cardano will be included in strategic reserves. These actions show growing official recognition of digital assets and may help lay the foundation for a clearer regulatory framework in future.

At the state level, US state governments are also supporting Bitcoin legalisation and institutional investment. Lawmakers in states like Alabama have recently proposed a bill that would allow the state to invest up to 10% of public funds in digital assets, limited to assets with a market cap over $750 billion. This reflects rising recognition at the local level, and similar legislation may follow in other states.

In the UK, several digital economy trade associations have jointly submitted a proposal to the Prime Minister’s office, calling for the appointment of a special envoy for crypto policy and the creation of a national plan for digital assets and blockchain technology. This reflects the UK government’s growing awareness of crypto’s future economic role and its interest in building a strong regulatory environment to attract investment. Notably, the proposal mentioned recent policy changes in the US and stressed that the UK risks falling behind in the digital asset space if it does not act soon.

Beyond government initiatives, traditional Wall Street institutions are also embracing crypto. Bitcoin mining firm MARA Holdings has announced plans to raise $2 billion through a stock offering to buy Bitcoin, following a similar approach to MicroStrategy.

At the same time, US video game retailer GameStop updated its investment policy, adding Bitcoin to its treasury reserves and successfully raising $1.5 billion. Similar moves are happening globally. BlackRock, Fidelity, and Grayscale are all increasing their exposure to digital assets and are also promoting the tokenisation of traditional assets such as securities and real estate.

These signs show that the digitisation of global assets is speeding up. Whether it’s government policy shifts or capital market movements, everything is pushing this transformation forward. Especially in the crypto market, more and more individual investors are turning to digital assets — it’s no longer just for institutions.

Today, Eric Trump, son of former U.S. President Donald Trump, revealed on social media that after banks like JPMorgan and Bank of America shut down his family’s accounts, he moved his assets into crypto. This proves once again that crypto isn’t just a speculative market anymore — it’s becoming a key wealth storage tool for more investors.

At the same time, the rollout of global tariff policies marks a new phase in global trade and signals a major shift in the world’s economic structure. The global economy is going through unprecedented changes, and capital market trends are evolving fast. Stock market volatility is rising, and more money is flowing into digital assets. Bitcoin, Ethereum, and other major cryptos are becoming an important part of the financial system. Meanwhile, emerging technologies like AI, blockchain, and Web3.0 are reshaping the entire economy. The rise of digital assets isn’t just about market sentiment — it’s a fundamental shift in the global economy.

Looking at history, every major tech revolution has reshaped asset structures. This digital wave is no exception — it’s driving a massive restructuring of global wealth. From government policies and market capital flows to individual investors’ asset strategies, everything points to the digital economy entering a golden era. This trend brings huge opportunities for all investors.

That’s why this game-changing investment opportunity is open to everyone. It’s not just a shift for governments and institutions — it’s also a rare chance for individual investors to build real wealth. At this key moment, as one of our students, you can benefit not only from traditional asset allocation but also from advanced investment strategies that can help you grow your portfolio faster.

To help every student seize this trend, we’re launching Project Ascension. This programme isn’t just about helping you earn big in the digital asset boom — it’s also designed to create a Millionaire Incubator. More importantly, Project Ascension will serve as the gateway to an exclusive global investment club, bringing together bold and visionary investors. By joining, you’ll gain access to unique insights, strategies, and resources — giving you a real edge in this new era of digital asset investing.

Project Ascension comes at a key moment in the global economic shift, perfectly timed with the April Cryptocurrency Roundtable series. Taking advantage of this, we’ll fully focus on seizing cryptocurrency investment opportunities. The plan will mainly revolve around short-term and mid-term investments, adapting to the current market changes and the rise of cutting-edge technologies to develop flexible and efficient investment strategies.

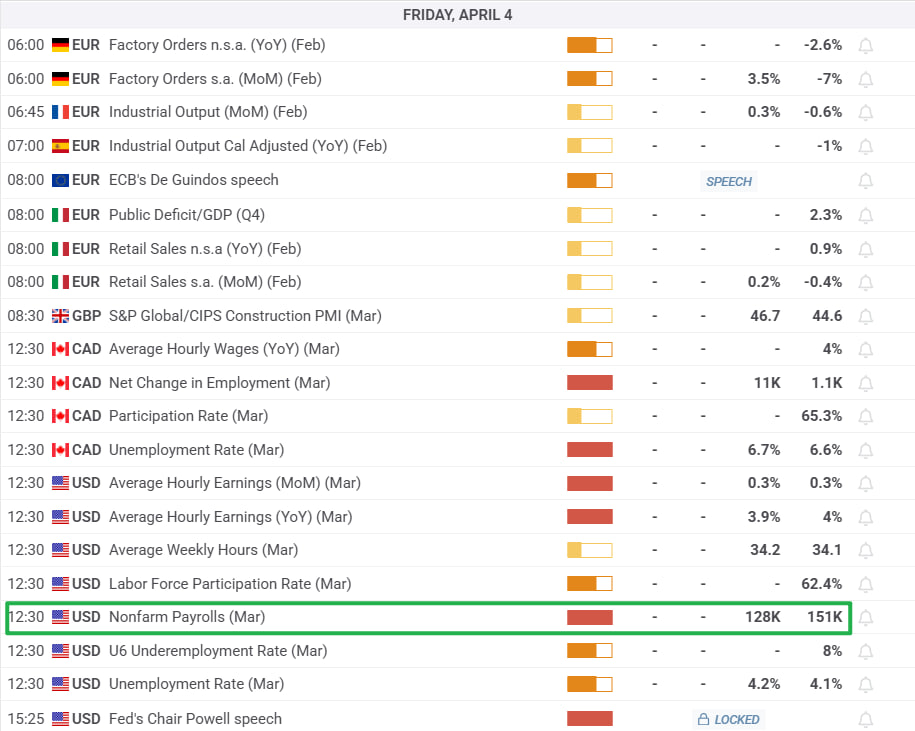

In short-term trading, we’ll primarily base our actions on market data. By leveraging the advantage of concentrated funds through team collaboration, we aim to maximize profits. For example, this Friday’s U.S. non-farm payroll data is the first major data release since the tariff policies that reflect the real state of the U.S. economy. We expect that this data release could cause major market volatility, which could bring us over 120% short-term returns. With precise market judgment and efficient capital management, we plan to capture significant opportunities at this key moment and achieve the ideal returns.

In the mid-term investment area, we will align with global economic and market trends, focusing on quality token trades, especially those related to AI concepts. As AI technology continues to evolve, the potential of related tokens will become more evident, creating continuous investment opportunities. In Project Ascension, we will carefully select tokens with long-term growth potential to help our students steadily grow their capital.

However, the most exciting investment opportunities are undoubtedly new token subscriptions. As a lower-risk investment approach, the advantages of new token subscriptions are clear. First, there’s no risk to the principal. You simply pre-order tokens before they hit the market. Also, as market enthusiasm for new tokens rises, these tokens often see significant price increases after their listing, creating great arbitrage opportunities. Just like with an IPO, the initial trading activity tends to push the market price of tokens higher.

For instance, the TRUMP token, launched in February, was priced at $0.1824 at launch but peaked at $77.35, a 424x increase. Similarly, the SCI token quadrupled in price shortly after launch, bringing investors substantial returns. These early-stage performances of new tokens vividly prove the market’s enthusiasm for digital assets and show the massive potential and returns of new token subscriptions. That’s why, in Project Ascension, we’ll pool all funds to participate in new token subscriptions. This is not just a guaranteed profit opportunity driven by both technological development and favourable policies but also a window for every investor to grow their wealth.

Looking ahead, as the global asset digitization process continues to accelerate, digital currencies will gradually become a key part of global investment portfolios. Project Ascension is designed with this forward-looking trend in mind, aiming to generate long-term stable returns for every student and provide broader cooperation opportunities for members of the global investment club. In our upcoming investment strategy, we’ll combine short-term contracts and quality tokens to fully tap into the massive wealth opportunities brought by global capital tokenization in April, helping each student stand firm in the digital asset era and stay ahead in wealth growth.

Tonight's sharing ends here. In this round of communication, we have developed the dual-driver investment strategy of Project Ascension. This strategy, which is based on global economic and policy development trends, involves two key components: flexible operations of short-term contracts and deep positioning of high-quality tokens. The goal is to fully seize the tremendous wealth opportunities brought by global capital tokenization in April. Especially in the new token subscription field, this will become an important entry point for all ordinary investors and is worth everyone's full participation.

Among them, the most eye-catching new token recently is undoubtedly HGS (Human Genome Sequencing). According to the investment skills for new token subscriptions, the rules of fund priority and time priority are very important. Whoever participates first will take the lead and gain greater returns. Therefore, I recommend everyone to fully participate in the HGS subscription to seize this clear profit opportunity driven by both the technological revolution and policy benefits. This is not only a major technological innovation project but also in line with the current trend of global asset digitization, and it is expected to become the next explosive asset.

The core of new token subscriptions lies in grasping the price fluctuations in the early listing period and using the market's high enthusiasm and the initial high premium space for investment arbitrage. HGS, as the most attention-grabbing new token, has great potential due to its technological background and policy support, especially as the combination of biotechnology and artificial intelligence becomes increasingly close. HGS is expected to become another major breakthrough in the digital asset field.

Therefore, in the coming days, I hope every student will fully participate in the HGS subscription. By pooling our funds and resources, we will maximize this opportunity and ensure that all students can obtain substantial returns in this opportunity-filled market. Whether you are a newcomer to new token investments or an experienced investor, Project Ascension will provide you with full support and guidance to help you stand out in this promising market.

Regarding new token subscriptions and the detailed layout of Project Ascension, I suggest everyone contact me now. Together, we will dig into the new wealth opportunities brought by the digital age. At this time of change, every action we take will leave a profound mark on future asset appreciation. As long as you follow our steps, the future wealth will be right in front of you.

The future investment opportunities are already clear. The rise of digital assets will reshape the entire financial market. In this global asset digitization wave, Project Ascension not only helps students seize current short-term opportunities but also provides everyone with a long-term, sustainable growth investment platform. Whether participating in new token subscriptions or following our short-term and mid-term investment strategies, your wealth accumulation will no longer stagnate. Let's welcome the investment opportunities of this era and reach the peak of wealth together.