The Rise of Digital Capital: Positioning for the Next Global Wealth Wave

Hello, future investors of Diamond Ridge Financial Academy!

I'm Charles Hanover. It's great to explore investment wisdom and opportunities with you in this era of rapid change. Markets are unpredictable, global politics and economies are shaking, and asset prices keep swinging. The key to success? Spotting trends and seizing structural opportunities. That's how we find certainty in uncertainty and truly build wealth.

Our journey tonight will take us into the realm of global market trends and the latest U.S. government-led crypto roundtable discussions. Our shared goal is to equip you with the knowledge to navigate the digital asset landscape and lay a solid foundation for your long-term wealth planning.

Today, the UK stock market took a hit from tariff concerns, with the FTSE 100 down 0.27%. President Trump announced a 25% tariff on all foreign cars and auto parts, sparking global risk-off sentiment. European auto stocks led the decline, dragging the DAX down over 1% and putting pressure on European markets.

On top of that, the UK Institute for Fiscal Studies warned about possible tax hikes this fall, while the British Chamber of Commerce raised concerns over the impact of tariffs on exports to the U.S. Businesses are losing confidence, and economic data shows weaker consumer spending and rising energy costs, fueling market sell-offs.

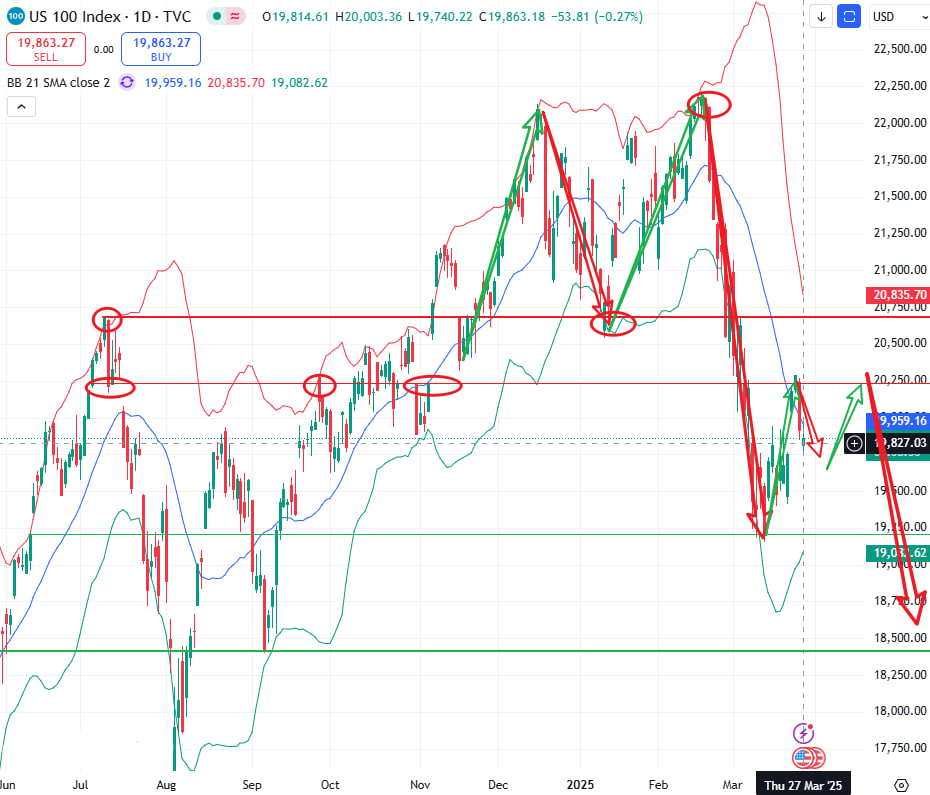

U.S. markets also struggled at the open, with the Dow, S&P and Nasdaq all slipping further. Investors are closely watching Trump's latest trade policy; starting April 2, a new tariff will hit all non-U.S.-made cars and parts. He claims the tariffs will be "very flexible", but markets aren't buying it. Worries of retaliation from the EU, Canada and Japan are rising, adding to fears of a deeper trade war and a global slowdown.

Meanwhile, consumer confidence just hit a 12-year low and jobless claims keep climbing. These signals point to a shaky economic recovery. With policy battles and mixed economic data, both the U.S. and UK stock markets are likely in for a long bearish trend.

Of course, markets always reach a turning point. As we've seen, stocks are adjusting, and after a sharp sell-off, traditional assets are now showing clear divergence. This shift highlights a deeper restructuring in today's capital markets.

Since the big drop in U.S. stocks on February 19, major global assets have been hit hard. Stocks, bonds, commodities and real estate all took a hit. But at the same time, the crypto market quietly went through its own correction and was the first to bounce back. This whole cycle of decline and recovery shows us one clear trend: global capital is steadily moving away from traditional assets and flowing into digital assets, ones that are more liquid, future-oriented and better at handling policy uncertainty.

BTC, for example, has rebounded over 14% from its low of $77K, proving itself as a market “anchor” and a safe haven in this asset rotation.

Meanwhile, we’re also seeing clear structural shifts within the U.S. stock market. Some traditional industries continue to struggle, while tech giants like TSLA and META, linked to AI and the digital economy, are leading the Nasdaq’s recovery. TSLA’s rebound is particularly interesting. Yes, it was oversold due to a technical bounce, but the bigger reason is its exposure to BTC and its rumoured involvement in a crypto-AI metaverse startup. This makes it more than just an EV company; it’s a hidden digital asset player that naturally attracts investor interest.

The real driving force behind all this? A major policy shift. Since Trump hosted a crypto summit at the White House on March 7, the U.S. government’s stance on digital assets has changed dramatically. High-level meetings on crypto compliance, institutional adoption and mainstream integration have been held across the White House, SEC and state finance departments. This “Crypto Roundtable Series” signals that crypto is no longer a fringe asset; it’s being pulled into the core of the global financial system. With the April 2 tariff changes coming up, crypto is looking more and more like a key tool for the U.S. to reshape capital flows and adapt to shifting global trade dynamics.

But this isn’t just theory; it’s happening in real time. At the SEC’s March 21 Crypto Roundtable in D.C., we saw the U.S. actively lay the groundwork for crypto regulation, adoption, and growth. While no new rules were announced that day, the level of discussion made it clear: this wasn’t just an industry meetup but a strategic move toward reshaping the financial system. It set the stage for upcoming developments in compliance, custody, asset tokenization and DeFi integration.

I was invited to this event to discuss how digital assets can merge with traditional finance. Key US regulators and tech leaders proposed that discussions will focus over the next two months on defining the regulatory boundaries of crypto trading, establishing compliance frameworks for custody solutions, exploring the tokenisation of real-world assets (RWA), and aligning DeFi principles with US constitutional values. These topics show that the US is thinking long-term about digital finance and is serious about bringing crypto into mainstream markets through structured policies. This isn’t just a test run; it’s the beginning of a major financial shift.

What's even more interesting is that multiple U.S. states and major financial institutions are already responding to this shift with real action. The most significant move comes from Wyoming. At the Washington Blockchain Summit, Wyoming Governor Mark Gordon officially announced that the state would launch a fully compliant, multi-chain stablecoin backed by the U.S. dollar, WYST, this July. This stablecoin will be backed by high-quality assets like U.S. Treasuries, cash and repurchase agreements with a minimum capitalization requirement of 102%. In other words, every WYST will be backed by over $1.02 in assets. This setup not only increases the token's creditworthiness but also makes stablecoins more practical for payments, settlements and cross-border transactions.

WYST will first go live on seven major blockchains, including Ethereum, Solana, Avalanche and Polygon, making it the first legally compliant stablecoin backed by a state government to operate across multiple chains. More importantly, Wyoming isn't treating WYST just as a payment tool; it wants it to be a highly efficient vehicle for global dollar circulation with lower transaction costs than traditional ACH transfers or wire payments. This vision shows that local U.S. governments are preparing for the future of "global digital dollar sovereignty," where crypto stablecoins gradually replace traditional settlement systems and become an extension of the national currency framework.

Beyond state governments, major financial institutions are also speeding up their digital transformation. Asset management giant Fidelity Investments recently announced plans to launch a dollar-backed stablecoin and integrate Ethereum-based OnChain stock classes into its money market funds. This move not only gives customers more transparency and traceability in asset management but also signals that blockchain technology is officially becoming part of the $11 trillion traditional asset management system. Fidelity's approach aligns with the U.S. push for regulatory clarity while leveraging its expertise in custody, clearing and asset issuance to take the lead in tokenized finance.

Meanwhile, BlackRock, the world's largest asset manager, is rapidly deepening its involvement in digital assets. Public records show that BlackRock spent over $100 million this week to buy spot Bitcoin and plans to keep expanding its crypto exposure. This sends a clear message: Traditional financial giants have regained full confidence in crypto markets and are now positioning themselves to dominate the next wave of financial digitization. What they see in crypto is a powerful combination of financial functionality, tech innovation and global liquidity, all in one asset class.

On the legislative side, the U.S. Congress is also steadily advancing its regulatory framework. This week, the House formally introduced the "Stablecoin Transparency and Accountability Act" (STABLE), which aims to set compliance standards, increase transparency, and ensure risk control for future stablecoin developments. Meanwhile, the Senate passed the GENIUS Act on March 13. Together, these two bills lay the groundwork for U.S. stablecoin regulation. These legislative efforts will provide a legal foundation for stablecoins to be integrated into banking systems, financial markets, and international payments, marking a major step in bringing crypto assets into the core of the national financial framework. This shift is a fundamental sign of how the global financial system is being restructured.

The market has already responded, while top-level policies continue to send positive signals. Over the past few days, the crypto market has seen a broad rally. BTC has been steadily rebounding, while altcoins and newly launched tokens have shown even stronger moves, with both significant gains and increased liquidity. The logic behind this isn't complicated: Major coins still represent market confidence, but their growth potential is relatively limited. Meanwhile, new tokens and altcoins combine tech innovation, market expectations, and capital speculation, making them more attractive to investors and making it easier to gain premium valuations. That's why major coins serve as the foundation for asset stability in our real trading strategy, while new and concept tokens take on a more aggressive, high-growth role.

One key point worth mentioning is the rapid acceleration of high-quality token issuances, driven by events like White House meetings and SEC-led roundtable discussions. As policy signals become clearer, we can expect more traditional financial assets to be converted into tokens through RWA mechanisms. This doesn't just mean a massive expansion in crypto's total market cap; it also marks the start of a large-scale migration of assets across industries and borders. What we once called the "rise of the digital economy" is now evolving into a wave of "global asset tokenization." This shift is not only changing investment strategies but also reshaping the fundamental structure of global wealth flows.

From a market microstructure perspective, this transformation is already taking shape. Recently, AI-related tokens and RWA sector coins have seen continuous gains, with capital flowing into high-growth assets. The market is clearly rotating between sectors, and bullish sentiment is picking up. At the same time, we're seeing a positive shift in investor behaviour, moving from blindly chasing pumps to building strategic positions, from focusing on short-term price swings to analyzing project fundamentals and from speculative trading to mid-term positioning. This shift in mindset is one of the clearest signals of a new market cycle approaching.

So, when we reassess our investment strategy, one conclusion becomes obvious: The only way to truly navigate this structural bull market is by combining mid-term positioning with early-stage token subscriptions. Buying into new token launches is one of the best ways to enter quality projects early. It offers low entry barriers, high certainty and controllable risk while also allowing assets to scale quickly through post-launch liquidity premiums.

Take the recently launched token SCI as an example. This project is a smart city data service platform that combines AI, IoT and Blockchain, aiming to improve city operations across key areas like smart transportation, energy management and security monitoring. During its subscription phase, demand surged to 366%. Its initial listing price jumped to $11.9, and now, just two weeks later, it has already skyrocketed past $40, more than a 10x increase.

In other words, if a student got a $100k allocation of SCI, their portfolio would now be worth $1M. This kind of rapid wealth growth isn’t a dream; it’s the real result of catching the early wave of new tokens. SCI represents a type of high-quality token driven by strong project fundamentals, market hype and policy tailwinds. Its smart city applications, AI-IoT integration and decentralized data architecture, are all cutting-edge trends in today’s tech world. This explosive potential is exactly why we focus on new tokens. With the combined forces of project value, market enthusiasm and policy trends, new token subscriptions have become the most effective way for everyday investors to enter early-stage core assets. Beyond that, high-quality altcoin projects related to AI, Web3 and blockchain infrastructure form the backbone of our mid-term spot investment strategy.

Looking at global policy shifts and market changes, it’s becoming increasingly clear that the U.S. is pushing forward digital asset development at every level, from top-down planning to real-world implementation. Whether it’s Wyoming’s stablecoin pilot program, investment giants like BlackRock and Fidelity doubling down on digital assets or the advancement of key legislation like the STABLE Act and GENIUS Act, the message is loud and clear: Crypto is no longer just a tech concept, it’s becoming a core pillar of the global financial system.

The next two months will be a “strategic window” of explosive liquidity, major token launches, and clearer regulations. This isn’t the time to sit on the sidelines; it’s time to act, realign portfolios and optimize strategies. With both opportunities and risks ahead, well-prepared investors will have a golden chance to capitalize on this “wealth explosion” phase.

Right now, with technological revolutions and policy momentum reshaping global asset structures, we stand at a major turning point. This is the most certain wealth opportunity of the past 20 years, an exclusive advantage for our generation of investors. To help every student seize this moment, we’re launching a collective initiative called Project Ascension, with financial freedom as the ultimate goal. This initiative will combine new token subscriptions, whale trading strategies and mid-term spot allocation to create a structured, scalable and repeatable path to wealth, helping students achieve financial breakthroughs and long-term freedom.

At its core, investing has never been about complex technology; it's about insight and courage. Back in the 2000s, when the internet revolution took off, those who recognized the trend and boldly invested in Amazon, Google and other tech stocks saw 100x or more in returns. Today, the rise of AI, blockchain and digital assets is creating a whole new financial world. Insight is seeing reality as it is. Courage is the starting point of embracing change. If you can position yourself early while others hesitate, you will be the beneficiary and new winner of this wave when the digital economy fully takes off.

For the next investment execution, we will adopt a "spot-focused, contract-assisted" dual-driven model, focusing on capturing high-growth tokens with strong short-term momentum and clear growth logic, especially in AI, robotics and on-chain data infrastructure. For example, SCI, which has been continuously rising, has surged from $3.75 at subscription to $40, a typical case of a new token benefiting from policy support.

On the mid-term side, we still have strong confidence in AQS’s growth potential. As an AI concept token that we have been closely tracking, its upcoming launch of the quantitative trading system will further strengthen market consensus. Recently, some students took early profits during the push, causing some price fluctuations. We have made adjustments to address this: AQS will now be managed under a dedicated “Whale Plan” path, with the target price raised to $7. No early profit-taking is allowed, ensuring every student captures at least 4x returns by following the full trend. For detailed execution rules, contact an assistant.

Meanwhile, on the short-term side, we will continue to utilize the "contract + spot" strategy combination to actively participate in key volatility trades. For example, tomorrow's U.S. PCE inflation report, one of the Fed's core indicators for measuring consumer inflation, could trigger sharp market fluctuations if it exceeds expectations, especially under the current highly uncertain tariff policy environment. We will fully leverage capital advantages, relying on the whale strategy to execute precise positioning and capture maximum short-term profit opportunities amid volatility.

It can be said that AQS's mid-term positioning, new token subscriptions to seize dividends, and short-term whale trading to amplify cash flow are the three modules that have formed our core investment strategy for the next stage. This strategy not only captures long-term value release but also provides the ability to flexibly adapt to high volatility in the short term, offering investors a clear, executable and actionable path to wealth growth. As long as we continue to follow the rhythm and execute firmly, we have every reason to believe that Project Ascension will truly become our milestone for wealth leap and cognitive upgrade.

Tonight’s session ends here. In this discussion, I covered three major trends, the tech revolution, policy shifts and asset digitization, to explain how global wealth structures are being reshaped. With the U.S. government pushing for digital asset regulation from top-level policies to legislative execution, Crypto is no longer just an “investment”. It’s becoming a new bridge connecting global capital, technology and sovereignty. We’ll follow this historic trend and lead every student toward the ultimate goal of financial freedom.

We’ll stick to a spot + contract dual strategy for future moves, using short-term trades to build a solid base for high-quality tokens. We'll go all-in to secure early-stage gains when new token subscription windows open, especially during policy-driven listing waves. In other words, when there are no new tokens, we’ll focus on AQS positioning and short-term whale profit strategies.

Tomorrow’s whale plan is a great chance for students with smaller capital to build profits quickly. With big funds driving trends and tactical plays around high-volatility points, even small accounts can see solid returns in just a day or two. If you’re ready to join, reach out to an assistant now for tomorrow’s strategy and execution plan.

The coming market won’t be about waiting for opportunities; it’s about creating them. Let’s stay confident, act together and execute precisely. In this digital era of wealth cycles, we’ll ride every growth wave and seize every opportunity the times offer. The turning point is already here. Now is the best time to move forward together.