Navigating Market Trends: Strategic Investments, AI-Driven Trading, and the Future of Digital Wealth

Hello, students of Diamond Ridge Financial Academy!

I’m Charles Hanover, and I’m excited to explore investment wisdom with all of you in this era of change. The market is constantly shifting, and only with precise analysis and following the trend can we seize opportunities amid volatility and grow our wealth. Whether it’s personal asset allocation or understanding the big picture of the economy, the essence of investing is always about identifying trends.

Tonight, we’ll start with market dynamics, break down recent market trends and trading opportunities and help you build a clearer investment plan. Our goal is to master trend-following strategies for wealth growth.

Today, the UK stock market has been weak overall. The FTSE 100 index saw a brief gain in the morning but quickly turned cautious, ending slightly down by 0.09%. In contrast, major European indexes fell more sharply; Germany’s DAX, France’s CAC 40 and Italy’s FTSE MIB all dropped over 1%, reflecting rising risk aversion. As expected, the Bank of England kept rates unchanged, but the voting results were more hawkish, signalling concerns about inflation risks. While the market still expects rate cuts this year, the Bank of England stressed that wage growth and service sector inflation remain high, which could slow the pace of future cuts. Additionally, the UK Chancellor’s comments showed the government is still leaning toward tight policies without signalling any easing, putting some pressure on market liquidity.

Sector performance data shows that Europe’s restaurant industry struggled. French restaurant giant Sodexo lowered its full-year outlook, causing its stock to plunge 20% and dragging the whole sector down. Meanwhile, the UK real estate sector saw some short-term rebounds due to capital inflows, but overall, it remains in a correction phase. Investors lack confidence in the UK’s economic growth outlook, making it hard for the stock market to sustain an upward trend and a range-bound movement may continue in the short term.

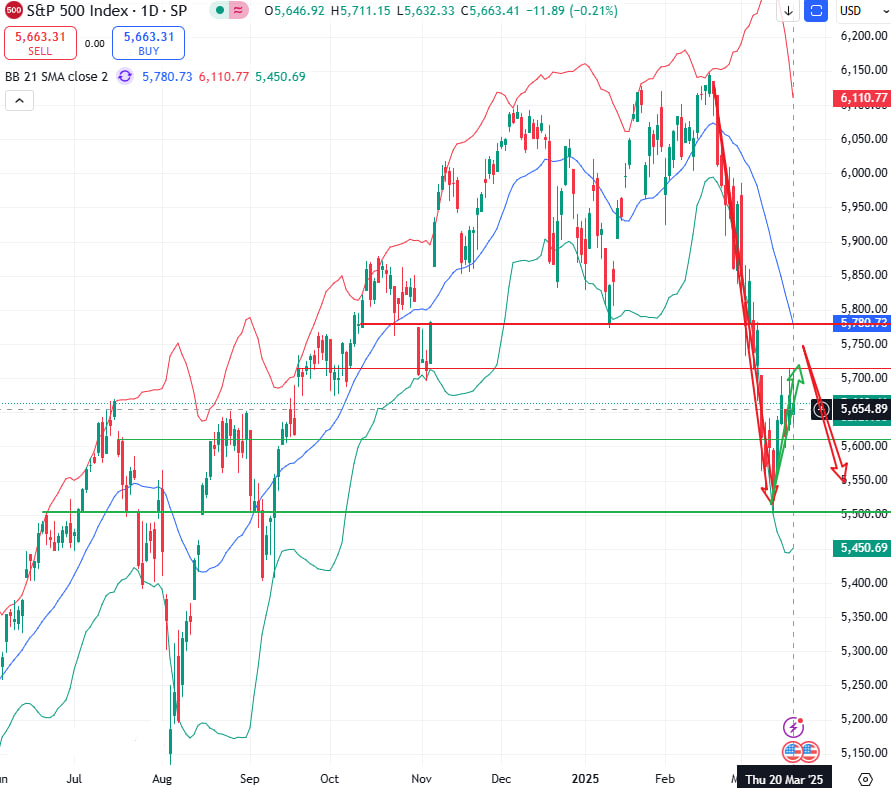

The market saw a slight rebound in early trading on US stock, but downward pressure remained strong. The Fed kept rates unchanged yesterday while cutting its growth forecast and raising its inflation outlook. The dot plot still suggests two rate cuts this year, but investors remain cautious about future trends. Trump’s tariff policies add uncertainty to corporate earnings. Apollo Global Management warned that the market’s optimism lacks a solid basis and hasn’t fully priced in the negative impact of tariffs on profits. At the same time, ECB President Lagarde stated that US tariffs on EU products could lower Eurozone growth by 0.5%, increasing global trade instability and putting more pressure on the market.

Looking at economic data, one can see that US manufacturing data was weak. The Philadelphia Fed Manufacturing Index, New Orders Index and Business Activity Index all declined, showing sluggish growth in the sector. Meanwhile, consumer expectations for the economy worsened, and the Leading Economic Index kept falling, signalling slowing momentum. Moody’s chief economist even warned that the risk of a US recession is “uncomfortably high.” While the Fed is trying to downplay the long-term impact of rising inflation, uncertainty about policy remains, and investors are hesitant to move funds into risk assets.

Many students are likely perplexed by the stock market's morning surge. The market fundamentals are not promising, signs of a recession are becoming more pronounced, and the Fed has not introduced any new easing measures. Yet, stocks experienced a short-term rebound. This is a common occurrence in financial markets. The key is to discern the difference between short-term and long-term trends and understand how various types of money operate in the market.

In the mid to long term, a global recession is unavoidable. Whether it's the US, UK or major European economies, their latest economic data has all missed expectations. The US economy has been weakening for a while, which is why the Fed had to signal rate cuts to ease pressure. However, inflation remains high, and with tariffs being pushed further, the US economy is stuck in a dilemma; on one hand, it needs rate cuts to boost growth, but on the other, inflation limits how much the Fed can cut. This contradiction means that even if the Fed eases policy, it won't stop the US economy from slipping into recession. So, the recent stock market rebound is more like a short-term sentiment adjustment rather than a real trend reversal. From this perspective, every rebound is a good chance for investors to sell high rather than add more positions.

If the stock market is still on a downward trajectory in the long run, why did we witness a rebound over the past two days? There are two primary reasons for this. First, despite the Fed's lack of a clear rate-cut timeline, the market has already begun factoring in an easing cycle. Some short-term and speculative funds seized this opportunity and entered the market, causing a temporary surge in prices. Second, some major stock funds didn't adjust their positions earlier, so they are now attempting to ride the market trend and drive prices up to sell at a better level. These funds leverage their capital advantage to boost prices when market sentiment improves, allowing them to sell at a relatively high level and offset their earlier losses.

This strategy is similar to our Whale Program, except that the Whale Program trades Crypto, which is much more liquid and active than the traditional stock market. That makes short-term trading more sensitive and efficient. Looking at capital flow, stock funds took advantage of the market's reaction to the Fed meeting yesterday, gradually buying in to push prices higher. At the same time, regular investors saw stock prices rising and jumped in, thinking it was a good entry point. This created a "chip battle" in the market; more and more money flowed in, driving prices higher, and investors started believing that an "uptrend is confirmed," which attracted even more capital.

What’s even more interesting is that financial media and analysts often hype up ideas like “market recovery” and “buying opportunity” during times like this. This further strengthens investors’ confidence in buying, pushing the market into a momentum-driven “inertia rally.” However, this rise isn’t based on real fundamental improvement; it’s just a result of short-term market sentiment and capital flow. Once stock funds push prices up, they gradually cash out their profits. When market sentiment fades, stock prices can drop quickly. In short, this is a psychological game between institutional money and regular investors. Retail investors tend to follow market emotions, while institutions control the pace behind the scenes.

This is exactly the same as our trading pace in the Whale Program yesterday. Many students asked after the trade why prices kept going up after we sold. Did we take profit too early? Here’s what we need to clarify: First, in any trade, it’s impossible to buy at the absolute bottom or sell at the absolute top. The market is always moving. What we do is follow our strategy and quantitative signals to trade at the best positions, making sure risk is low and profits are maximized. Second, our trade setups are planned in advance. Every entry and exit is carefully calculated to ensure smooth capital flow and minimize market impact.

More importantly, all our capital deployment in the Whale Program is based on a win-win model. The bigger the capital size, the greater its influence in the market. So, those who contribute more capital naturally get higher returns. At the same time, since the Whale Program enters and exits in batches, it’s impossible for every single trade to sell at the highest point. Market price movements often lag behind real capital flow. When part of the funds exit, market sentiment may still push prices up for a while. This doesn’t mean selling too early; it’s just the natural rhythm of capital flow.

Of course, compared to the stock market, Crypto trading is much simpler, more active and more profitable. There are two main reasons for this. First, from a long-term investment perspective, Crypto is at the core of the digital economy and is growing at a high speed. With continuous breakthroughs in AI, blockchain, and other cutting-edge technologies, the use cases of Crypto and its market acceptance are rising. Its long-term uptrend is already established. In other words, the Crypto market not only has strong short-term momentum but also much greater long-term growth potential, making overall trade success rates higher.

Second, crypto markets have much better liquidity than stocks. Essentially, Crypto has the growth potential of tech stocks while also functioning like currency. Compared to traditional stock markets, crypto is more globalized, has lower entry barriers and isn’t restricted by a single market’s regulations or trading hours. More importantly, crypto fundraising makes it much easier for many new projects to get global investor attention than traditional stock financing. That’s because crypto naturally combines “asset” and “money,” carrying both investment and currency properties. This makes it far more accepted than similar stock assets. Value + liquidity ultimately leads to high premiums.

This is just like how some students recently asked about the listing valuation of a new token (SCI). I wasn't paying much attention to the project at first since we've been focusing on the Whale Program to maximize everyone's profits. But yesterday, I suddenly noticed that SCI's subscription premium had already exceeded 350%. This means that SCI's valuation could be over $10 or even higher by the time it goes live. Of course, all new stocks or tokens tend to have some level of premium at launch. But in today's global economic transition period, digital assets often have even higher market premiums, giving investors more profit potential.

The essence of a premium is actually just capital inflow. Take SCI as an example. Its subscription progress bar has already passed 366%, meaning investor demand is far greater than the total number of tokens originally planned for issuance. This drives up the overall market valuation. In other words, SCI's high premium isn't because its fundamentals changed drastically in a short time. It's because the level of capital participation is high enough to push the asset price up. Similarly, the core strategy of the Whale Program is to leverage capital advantages to drive the market in our favour, creating higher-than-expected premiums. This expands our profit potential and maximizes returns.

With yesterday's Fed rate decision creating a perfect trading opportunity, everyone in the Whale Program made significant profits. However, some students still missed out due to being busy with work, lack of time, or trading mistakes. My take on this is that everyone has their own field of expertise. Maybe you're a doctor, and your speciality is treating patients and helping people recover, so most of your time and energy goes into the medical field. Maybe you're a lawyer, designer or engineer, but your core strength is in your professional skills, not trading. Because of this mismatch in time and expertise, some students struggle to trade efficiently.

In the investment market, it's crucial to delegate professional tasks to professionals. If you have limited time, you can rely on an expert analyst team to manage your funds. Alternatively, you can use a quantitative trading AI system, which ensures every trade is executed with precision, guiding you towards the best profit opportunities.

The advantage of Quantitative Trading AI is that it combines big data analysis, deep learning algorithms and real-time market monitoring technology. It can scan market trends 24/7 and automatically execute trades at the best moments. By analyzing market sentiment, capital flow and technical indicators, it develops high-probability trading strategies and strictly enforces take-profit and stop-loss rules to control trading risks. Compared to manual trading, Quantitative Trading AI has the following key advantages:

① Efficient Execution: Manual trading requires analyzing the market, determining entry points and placing orders manually. In contrast, Quantitative Trading AI can monitor the market in real-time and make trading decisions within milliseconds, ensuring trades are executed at the best price.

② Emotion-Free Trading: Emotional reactions during market fluctuations often affect human traders, leading to irrational decisions. AI trading systems rely entirely on data analysis and are not influenced by market sentiment, allowing them to strictly follow preset strategies.

③ 24/7 Trading: Unlike manual traders who can only trade during specific hours, Quantitative Trading AI monitors the market around the clock, capturing every short-term opportunity. This is especially useful when global markets move simultaneously, enabling more precise arbitrage trades.

④ Accurate Take-Profit & Stop-Loss: The AI system can automatically adjust take-profit and stop-loss levels based on market conditions, ensuring profits while keeping risks under control and minimizing losses from sudden market swings.

⑤ Suitable for Different Investors: Whether you don’t have time to trade or are a professional trader looking to optimize your strategy, Quantitative Trading AI offers the best trading solutions.

To sum up, in today’s market, using intelligent trading systems for investments has become the choice of more and more professional investors. The future of investing will rely heavily on data-driven quantitative trading, and traditional manual trading will gradually be eliminated in market competition. For students who want to earn stable profits in the crypto market but don’t have enough time to trade, using Quantitative Trading AI for fully automated trading is undoubtedly a smart choice.

Of course, automated trading is still in its early stages. While its returns are nowhere near the high profits of the Whale Program, it offers stable earnings without requiring manual operations. This makes it a highly efficient way for time-constrained students to grow their wealth. However, our goal is not just to create a basic automated trading system but to build a comprehensive, efficient and intelligent quantitative trading ecosystem. Because of this, the project team has decided to delay the official launch of the Quantitative Trading AI system until May. This ensures that the system will include a complete set of automated trading functions, providing investors with a better trading experience. This decision is a major boost for the entire quantitative trading ecosystem. Not only will it attract more institutional investors, but it will also significantly increase the value of its core token, AQS.

This trend shows that AQS’s rise has already become a market consensus. So, I strongly recommend that all students participating in the Partner Investment Plan fully allocate AQS in their mid-term Whale Program strategy. Especially for those who made high profits from the Whale Program yesterday, now is the perfect time to reinvest those earnings. I suggest investing 50% of yesterday’s profits in AQS to ensure your assets continue to grow during this market uptrend. If you already bought AQS yesterday, your account is now showing nearly 10% in floating profits. This is the power of mid-term investing. Compared to high-frequency short-term trades, mid-term positioning allows you to buy and hold for growth. You just need to wait for market sentiment to build up and enjoy the significant returns from price appreciation.

Looking back at our recent market strategies, you'll see that whether it's the short-term Whale Program, the mid-term AQS trading strategy or the choice of automated trading, every step we take follows market trends to secure stable and high profits. For example, yesterday's Whale Program aligned with the global economic downturn and expectations of a looser US monetary policy. We positioned ourselves precisely before the Fed's rate decision and took profits successfully. The mid-term AQS investment follows the market logic of the upcoming launch of the quantitative trading system, providing investors with steady long-term growth. Meanwhile, the introduction of the automated trading system aligns with the deep integration of AI and fintech, making investments smarter, more data-driven and fully automated. Every investment decision is based on macroeconomic trends and technological advancements, which is the key to consistently achieving excess returns.

The upcoming market trend is becoming clearer; global assets are gradually shifting, and the nature of traditional assets is changing. More and more wealth is moving from the traditional financial system to the digital economy. In response, we must fully recognize the massive potential of digital assets and position ourselves early to stay ahead of the wealth wave. For every investor, this is not just an opportunity to build wealth but also a chance to move up the financial ladder. Whether it's BTC, AQS or high-tech investments like quantitative trading and AI, these will be the biggest growth areas in the capital markets.

At the same time, the Financial Academy has built a deep, win-win partnership with all squad members in this process. On one hand, the academy helps students seize market trends, securing stable profits while generating service revenue for the academy. On the other hand, all squad members who enter the partnership not only enjoy risk-free returns from the Partner Investment Plan but also gain exclusive squad-level benefits, including regional agency rights for the quantitative trading system, dividend rights, senior club retirement benefits and more. In other words, we're not just helping you earn market profits; we're also building a long-term, stable wealth ecosystem where every participant can achieve lasting gains in this digital economy wave.

Our next major focus will be expanding the "Millionaire Incubation Base" by leveraging ongoing tech trends. This will help more students achieve stable asset growth under the guidance of the Partner Investment Plan. After the quantitative trading system launches in May, we will also establish a Global Senior Investment Club. This club will bring together elite investors from various industries, allowing all students to use their expertise, connect with high-quality capital and drive emerging tech developments, achieving both financial growth and personal fulfilment.

This Global Senior Investment Club will not only be a platform for wealth exchange but also a high-end investment network connecting top global investment institutions, entrepreneurs and fund managers. Club members will gain exclusive investment opportunities, including early-stage tech project incubation, global real estate allocation and top-tier AI and blockchain investments. In addition, senior members will receive global business networking support, invitations to top-tier investment and financing forums and access to the latest investment ideas and strategies. Future investment opportunities will no longer be limited to a single market but will integrate capital and technology resources to create broader wealth resonance. This is not just about wealth growth; it's an unprecedented capital integration wave that allows all partners to stand at the forefront of the global capital market and seize the next big wealth opportunity.

More importantly, as the club continues to grow, we will establish a dedicated charity fund that focuses on education, healthcare, and social welfare. True wealth is not just about personal asset growth. It should also have social value and help more people live better lives. The Financial Academy will use the Global Senior Investment Club as a foundation to promote social impact investing, making wealth not only a symbol of personal success but also a powerful force for social progress.

That’s all for tonight’s session. In today’s discussion, I provided an in-depth analysis of long-term market trends and how short-term capital flows create trading opportunities. I also emphasized that only by following market trends can we seize the golden opportunity for wealth growth. For members with limited time who cannot trade all day, you can join automated trading or simply invest in AQS. This approach simplifies the trading process, reduces pressure and ensures stable profits, allowing you to benefit from long-term market growth.

For those seeking higher returns and who have time to participate in active trading, please get ready for next week’s Whale Profit Plan, driven by the EU tariff policy update. Based on the success of our last two Whale Plans, we are about to launch an even more discreet and highly profitable short-term trading strategy.

This is a golden opportunity, especially for members with smaller starting capital who are still in the early accumulation stage. It offers a fast way to double your capital, helping you move up to advanced investor levels and catch up with our financial freedom roadmap. Opportunities always favour those who are prepared. Every market fluctuation presents a chance for strategic positioning, and the Whale Plan is designed to help members profit from market volatility.

There is no absolute certainty in investing—only those who follow the trend can stay ahead.

The future is clear: global assets are rapidly shifting toward the digital economy, and capital flows are undergoing fundamental changes. Only those who see the trend and act decisively in this historic wealth transformation will gain the advantage and achieve financial breakthroughs. I hope that every member can find their own profitable strategy within our trading system, establish their foothold in the market and continuously expand their asset portfolio.

If you have any questions about the upcoming trades, the Partner Investment Plan, or the automated trading system, please contact your assistant immediately to receive the latest trading strategies and allocation plans. A new market opportunity is emerging. I hope all partners will seize this trend and continue progressing on the path to wealth!