Whale Strategy: Mastering Market Trends for Sustainable Wealth Growth

Hello, future investors of Diamond Ridge Financial Academy!

I'm Charles Hanover. It's great to be here with all of you in this challenging yet opportunity-filled market, discussing global economic trends and trading strategies. Right now, the global economy is getting more complex. From tariff policies to shifts in monetary policy, every change greatly impacts market direction. We'll review the latest market trends tonight and analyze today's Whale Plan performance to find solid trading patterns that can help us prepare for the next opportunity.

The UK stock market struggled today. Even though the FTSE 100 made a brief comeback before closing, overall market sentiment remained weak. The index dropped 0.4% in early trading, with Compass Group facing heavy selling pressure, reflecting concerns over corporate profitability. On top of that, the EU's antitrust investigation into Apple and Google has added more uncertainty, which could lead to further adjustments in the tech sector.

Looking at different industries, utilities, chemicals and consumer goods were mostly down. Energy stocks did recover slightly, but not enough to turn the market around. Even with the FTSE 100 bouncing back a bit at the end of the day, overall market sentiment is still cautious, and the UK stock market is likely to face more downside pressure in the short term.

On US stock, markets rebounded during the session, but risks remain high. Trump's tariff policies are adding more uncertainty, holding back corporate investments and raising concerns about a slowing economy. A Bank of America survey showed that 71% of fund managers believe the US is facing stagflation, while 55% think the trade war could trigger a recession, a bigger worry now than inflation.

Tech stocks are still dragging the market down. Even though Tesla and Nvidia saw a brief rebound, their overall trend remains weak. Meanwhile, bond yields are falling, signalling rising risk-off sentiment as investors move their money into safer assets. All in all, uncertainty in US stocks is still high in the short term. This rebound may just be a temporary correction rather than the start of a lasting uptrend.

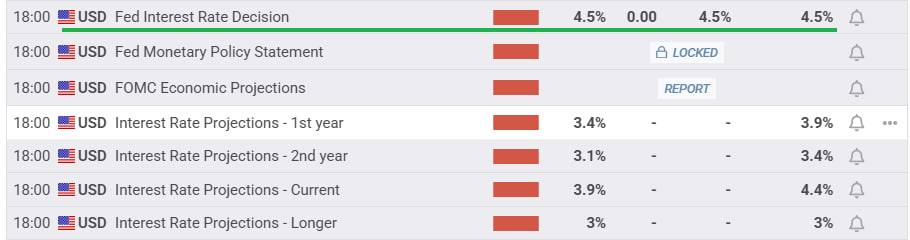

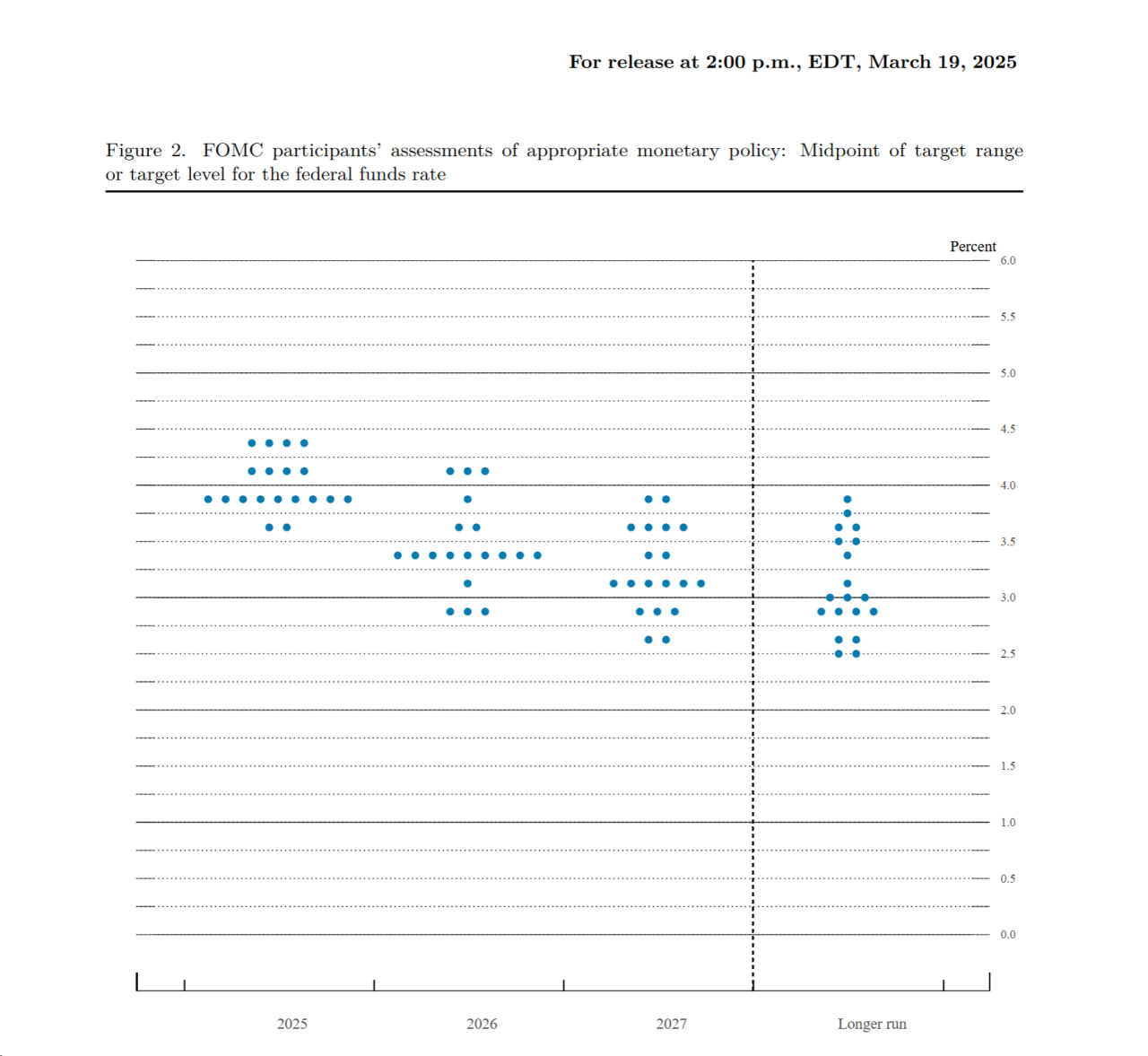

The most significant market focus today is undoubtedly the Fed’s rate decision. Its importance goes beyond just monetary policy’s deep impact on the global financial system; it also comes at a critical time of global tariff policy changes, which will significantly affect capital flows. The meeting outcome was essentially in line with market expectations. The Fed kept its benchmark rate unchanged at 4.25% - 4.50% and noted that economic uncertainty is increasing. According to the latest dot plot, the Fed expects two rate cuts in 2025, the same as its forecast last Dec. Additionally, the Fed announced that it would slow down balance sheet reduction starting Apr 1, signalling a shift toward a more dovish monetary policy.

Although the Fed remains cautious, the latest economic data shows that US economic growth is slowing down. The 2025 GDP growth forecast has been lowered from 2.1% to 1.7%, reflecting declining market confidence in future growth. At the same time, the median core PCE inflation forecast was slightly raised, indicating that inflation pressure still exists, pushing the Fed to stay restrained in its monetary policy adjustments. Looking at the officials' votes, 4 out of 19 believe there should be no rate cuts in 2025, 9 support two cuts and 2 expect three cuts. Overall, the stance remains hawkish. This means the Fed won't adjust its policy easily, and market expectations for rate cuts this year may cool down, but the chances of a cut are still increasing.

The market's focus on Fed policy is also reflected in bets on the timing of future rate cuts. Futures data shows that traders now see a 62.1% chance of a rate cut at the Jun meeting, up from 57% before the Fed's decision was announced. This data suggests that the market widely expects the Fed to start adjusting rates in mid-year, injecting liquidity into the market. And it is this rising rate cut expectation that forms the core logic behind our Whale Plan's long positions.

The Fed meeting not only sets the current rate level but also provides the most direct signal of future rate trends. In our market analysis on Monday, we pointed out that the Fed would keep rates unchanged, and the final data fully confirmed our prediction. This precise forecast allowed us to position our trades in advance and profit steadily from market volatility. However, some of you may wonder: If the Fed decided to hold rates steady, why did the market still see such big swings?

The reason is simple. The core logic of investing is trading expectations, not current facts. The market doesn't wait for policies to take effect before reacting; it positions itself in advance based on future expectations. So, every decision in a Fed meeting, especially any signals about future rate paths, can directly impact market movements. For example, while this meeting didn't change rates, its guidance on future policy strengthened expectations for a Jun rate cut. This is a real positive signal for the market, leading to a short-term stock rebound.

However, despite this brief rally, the market's core challenges remain. The dual pressures of economic recession and high inflation are still limiting further gains in US stocks. Recent volatility in the stock market already reflects this struggle. While rate policy adjustments can boost market sentiment in the short term, weak economic fundamentals make it hard for stocks to sustain a strong upward trend. In contrast, the crypto market reacted more positively, making it the best-performing asset class in this cycle.

Eth surged more than 5% intraday, several times higher than the gains of major US stock indexes. The reason behind this is that crypto is a non-dollar asset. When the market expects rate cuts, it means more US dollar liquidity, which pushes up crypto prices. Additionally, crypto not only has long-term growth potential similar to stocks but also attracts strong attention from those betting on future financial system changes. As more mainstream institutions and countries start accepting crypto as part of their asset allocations, the market size and trading depth continue to expand, giving crypto stronger momentum during market swings.

Market Response to the Latest Fed Meeting: Capital Shifting Towards Crypto. The market reaction to this Federal Reserve meeting shows that capital is gradually shifting from traditional markets to the crypto market. This trend indicates that investors seek higher returns and assets with stronger inflation resistance, and cryptocurrencies meet this demand perfectly. With global economic instability and challenges to the traditional financial system, the market value of digital assets is being redefined.

U.S. stocks may see a temporary rebound in the short term, but economic fundamentals remain weak, and uncertainty is still high. In contrast, crypto markets, which are highly sensitive to loose monetary policies, have shown stronger upward momentum. Funds are increasingly flowing into digital assets, and this trend is expected to intensify over the coming months.

Driven by today’s Federal Reserve rate decision, our Whale Plan has once again delivered substantial profits, bringing better-than-expected returns to our members. Everyone who followed today’s trading plan secured steady gains of 27% to 181%. Even the latest entrants in the pre-team achieved over 27% profit. This success was not a coincidence. It resulted from precise analysis, strategic planning, and disciplined execution.

Three Key Factors Behind Today’s High Profits

1️⃣ In-depth Market Analysis & Smart Execution

Before trading, we conducted a comprehensive economic data analysis. We used quantitative trading tools to accurately capture buy and sell signals, ensuring that every trade was executed at the best possible moment.

2️⃣ Fed Meeting-Driven Market Liquidity

The Fed meeting brought in a surge of market capital, fueling market sentiment and creating ideal conditions for our strategy to capitalize on.

3️⃣ Leveraging Capital Advantages for Strategic Market Moves

With the Financial Academy and team funds, we gradually accumulated positions at lower price levels, controlled price movements, and boosted prices when sentiment was at its peak. This not only secured stable profits but also amplified overall returns.

Challenges Faced During Today’s Trade Execution

Despite today’s strong success, we encountered some resistance while pushing prices higher. Certain sell-off activities disrupted the execution flow.

Based on capital flow analysis, we observed that a rapid price surge occurred at a low-price level, which did not align with our planned capital deployment rhythm. Later, when prices reached a higher level, a wave of mass sell-offs followed.

Two Possible Reasons for This Market Disruption

1️⃣ Unplanned Buying Pressure from Some Members

Motivated by last week’s high profits, some members increased their buy orders without reporting to their assistant. This caused excessive capital inflows in a short period, pushing prices up faster than expected.

2️⃣ Unintended External Influence

Some members may have shared our trading plans with non-team participants or friends who are not part of the Partner Investment Plan. This led to outside funds rushing in to buy, only to sell collectively after the price surged, disrupting our overall trading rhythm and limiting our maximum profits.

Despite this, our team members demonstrated strong execution skills and significant capital advantages. Combined with the additional market inflows from the Federal Reserve’s rate decision, we quickly adjusted our strategy, regained control of price movements and not only completed the trade successfully but also achieved higher-than-expected profits. This clearly proves the importance of strong capital backing and efficient execution in a volatile market. Even when the market briefly went out of control, we were able to adapt quickly and secure solid profits.

However, even though this trade was successful, we must continue to review and refine our approach to ensure that future trades are even more precise. The investment market is highly competitive, and our Whale Plan has grown into a powerful force. But we are not the only whale in the market—other capital groups are also competing with us, and some even try to take advantage of our movements.

Today’s successful trade was largely due to strong market sentiment, which weakened the impact of competing capital. However, price movements could have been more unpredictable if market sentiment had not been so strong. This is especially important for members with smaller capital, as higher volatility increases their trading costs and risk exposure. Smaller investors could face greater trading risks if other whales disrupt the market.

Of course, the Financial Academy provides a safety net for members who have joined the Partner Investment Plan, eliminating concerns about smaller individual capital risks.

Key Takeaways from Today’s Trading Session

From today’s trade, it is clear that global capital is focused on this exceptional profit opportunity. The global financial landscape is undergoing massive changes due to tariff policies and monetary policy shifts.

In this critical period of wealth transition, protecting and growing assets is the core challenge for all investors. In such a market environment, successfully building wealth requires not only precise trading strategies and advanced tools but also capital collaboration to continuously strengthen our market position and secure premium opportunities in the investment space.

Financial Markets Are Not a Solo Game

Throughout history, those who have thrived and accumulated immense wealth were not lone traders but those who understood capital collaboration and market trends. Today’s trade once again proved this. With precise data analysis and strong capital coordination, we were able to maintain control during market fluctuations and achieve exceptional returns. This was not just a short-term profit but a valuable market lesson, showing all participants the importance of capital integration and trend-following strategies.

Next Steps: Strengthening Secrecy in the Whale Plan

We will implement tighter security measures in upcoming Whale Plan operations to prevent market interference from competing capital.

1️⃣ Strict Trade Execution:

All members must follow trading instructions exactly and must not disclose trade details to outsiders. This will prevent unplanned capital inflows, which could disrupt our strategy and create unnecessary price volatility.

2️⃣ Expanding Managed Trading Services:

We will promote delegated trading, allowing more members to have their trades executed by our professional team.

This ensures the strict execution of strategies while also reducing the risks of manual trading mistakes. More importantly, this allows members to focus on their personal lives while still enjoying stable profits, achieving both financial success and a high-quality lifestyle.

Of course, our trading strategy is always trend-driven—only by following the major market trends can we truly capture the wealth opportunities of this era. Over the past two Whale Plans, we have successfully tested our strategy, which is based on macroeconomic policy analysis, market sentiment management and capital coordination.

The upcoming Secret Whale Plan will further optimise our strategy to make trading more stable and efficient. Right now, with global trade barriers intensifying, Europe preparing to announce counter-tariffs against the U.S., and the U.S. set to release the PCE Price Index next week, these key macroeconomic events will provide new opportunities for our next Whale Plan. For details on the short-term trading strategy and how to apply for delegated trading, please contact your assistant as soon as possible to ensure your participation in the next trade.

Expanding the Whale Plan: From Profits to a Global Investment Club

As profits continue to accumulate, our Whale Team is growing rapidly, both in members and capital size. Some members have already reached the millionaire level, proving the success of our strategy and teamwork. Based on this momentum, we will expand our "Millionaire Incubation Hub" and further increase the Whale Team's capital power. Our goal is to establish a global elite investment club, not just a profit-making platform but a high-end financial ecosystem that integrates:

✔️ Premium investment opportunities

✔️ Resource sharing

✔️ Networking among top industry professionals

Within this exclusive club, we will connect with top-tier investment institutions, entrepreneurs, and fund managers from around the world. We aim to build a diversified, high-yield investment portfolio by bringing together leading experts across industries.

This is not just about financial growth but also about social status and quality of life. Through this transformation, all participants will move to the next level, securing long-term financial success and a higher standard of living.

Giving Back: Establishing a Charity Fund

At the same time, we recognise that true wealth is not just about personal gain—it's about creating a positive impact. As the Whale Plan continues to grow, we will establish a dedicated charity fund under the Partner Investment Plan, focusing on:

✔️ Education support

✔️ Medical aid

✔️ Social welfare programs

Real success is not just about accumulating wealth but using that wealth to help others and contribute to a better society.

Key Takeaways from Today's Trade

Looking back at today's trade, we not only achieved exceptional profits but also gained clearer insights into future wealth trends. The global capital market is undergoing a major shift—traditional assets are facing unprecedented challenges while emerging asset classes are rising. Key sectors such as:

✔️ Cryptocurrency

✔️ Artificial Intelligence

✔️ Big Data

✔️ Blockchain

Are quickly becoming the core focus of global capital flows. Our investment strategy is built around these trends, ensuring that every member can stay ahead in this global wealth migration and steadily grow their assets.

The future market will continue to be challenging, but as long as we follow the trend and move forward together, we can secure our path to wealth in this vast investment ocean. The core of the Whale Plan is not just about short-term profits. It is about building a long-term, sustainable wealth growth system.

We have already started positioning for the Mid-Term Whale Plan, where at least 50% of profits from each short-term trade are allocated to AQS. When the quantitative trading system officially launches in May, we expect it to generate over 4x returns. Every trade is a step toward greater wealth, and our vision extends far beyond this.

That's all for tonight's session. Please contact your assistant immediately for details on the next Whale Plan's trading strategy. A new market opportunity is emerging, and we hope all partners will seize this trend and continue advancing on the path to wealth!