Seizing the Future: Navigating the Global Wealth Shift Towards the Digital Economy

Hello, future investors of Diamond Ridge Financial Academy!

I’m Charles Hanover. It’s great to be here with all of you in this market full of opportunities and challenges, discussing strategies and practices for quantitative trading.

The market has been volatile recently, and global capital flows are undergoing significant changes. Tonight, we’ll dive into the current market trends, analyze the patterns of capital movement and wealth shifts and use the Whale Project to capture over 120% profit from the Fed’s rate decision.

Today, the UK stock market has struggled. The FTSE 100 saw a brief rise in early trading, but there wasn’t enough momentum to sustain it, and the overall trend remained weak. The real estate market is facing increasing challenges. The latest data shows housing supply has hit its highest level in a decade, signalling declining demand. Meanwhile, buyers are rushing to complete transactions before the stamp duty relief deadline, creating even more congestion and worsening liquidity issues. The downturn in real estate isn’t just limiting economic activity; it’s also weighing on consumer and investor sentiment, adding more downward pressure to the market.

Looking at industries, UK food retailers took a hit. Asda’s investment plan announcement intensified competition, causing Tesco and Sainsbury’s stocks to fall. Concerns over industry profitability are growing, and retailers’ profit margins are being squeezed, further weakening market confidence. On top of that, the UK government’s tighter fiscal stance is adding to uncertainty. The Prime Minister’s announcement to abolish NHS England signals a move to cut public spending and ease financial pressure. While this decision aims to improve healthcare system efficiency, it has only deepened worries about the UK’s economic outlook.

Meanwhile, the US stock market is also under pressure. Tech stocks struggled as investors remained cautious about risk assets. The latest economic data shows US retail sales grew just 0.2% in February, far below the expected 0.6%, while January’s figure was revised to a 1.2% decline. Consumer spending is weak, with significant auto, electronics and clothing sales drops. Spending at restaurants and bars also saw the most substantial decline in a year, showing that consumer confidence is rapidly deteriorating. In March, the consumer confidence index fell to its lowest level in two and a half years. Concerns over tariffs, a weakening job market, and rising inflation pressures are further dragging down consumer spending.

Policy uncertainty remains one of the biggest risks. Trump’s tariff policies keep changing, and the reciprocal tariffs set to take effect in Apr could further disrupt global supply chains and push up inflation expectations. The market is closely watching whether the Fed will adjust its stance in response. JPMorgan has raised the probability of a US recession to 40%, and fears about future growth are rising. With weak economic data and ongoing policy uncertainty, US stocks are likely to stay under pressure in the short term. Any rebound may just be a temporary correction rather than a true trend reversal.

Recently, more and more students have started to accept the reality of a recession and realize that the stock market still has room to fall further. This shift in mindset is not a coincidence; it’s a natural reflection of market trends. When the market moves from optimism to caution and investors start feeling economic pressure, capital flows and the structure of wealth go through significant changes. In this environment, why do we keep focusing on the stock market? The reason is simple: stocks are not only a core asset class in the global financial system but also the main carrier of wealth. Their movement is often the clearest indicator of economic health.

Stocks, at their core, are a symbol of a country’s or region’s economic vitality. They represent companies that are key parts of the broader economy. So, when a recession hits, it’s not just the stock market that suffers. Other asset classes are also affected. While different types of assets are impacted to varying degrees, all of them are ultimately influenced by changes in capital markets. To truly understand where capital is flowing, we must first understand the nature of wealth. Only by seeing through the essence of wealth can we predict market shifts and make the best investment decisions.

The main forms of wealth in today’s market include real estate, stocks, crypto, gold, funds, and government bonds. Among them, gold has always been seen as a safe-haven asset. Its fundamental value comes from its scarcity, which gives it monetary properties. Gold, as one of the earliest forms of money, has shown its worth as a safe asset in today’s world of economic uncertainty, rising inflation, and slowing growth. That’s why its price keeps climbing. On the other hand, assets like funds and government bonds have their place in the financial market but are essentially derivatives of other assets. They don’t create true wealth on their own, which limits their long-term value.

However, to truly understand today’s wealth shifts, we need to take a deeper look at the three major global asset classes, which are real estate, stocks, and crypto. Together, they hold over 80% of the world’s wealth and have evolved through different economic cycles.

First, real estate, one of the most traditional forms of wealth, has an irreplaceable role in providing housing, commercial space, and industrial use. However, its liquidity is very poor, which weakens its financial attributes. Real estate prices rely on economic growth and population expansion. However, with the global economy slowing down and job market pressures rising, the real estate market is facing huge challenges. In the UK, for example, the government plans to raise real estate stamp duty starting in Apr. This will further reduce liquidity in the market, causing property prices to drop even faster. As a result, the risk of holding real estate is increasing, and the outlook for this market is not looking good.

Second, the stock market, the main global capital reservoir, has long been the top asset choice for high-net-worth individuals and institutional investors. In the US and UK, stocks typically comprise over 30% of wealthy families’ portfolios. Stocks represent company ownership, meaning investors indirectly own a company’s assets by holding its shares. However, with advances in technology and shifts in market models, the core assets that traditional companies rely on are changing. In the past, a company’s value was mainly tied to physical assets and equipment. But today, more and more tech companies, especially those in AI and the digital economy, derive their value not from physical equipment but from data, technology and algorithms.

This shift means that a company’s core value is now more focused on intangible assets, and traditional stockholding may no longer fully capture this change. The rapid pace of technological innovation has completely transformed how wealth is stored in capital markets. In this trend, crypto is emerging as a new asset class, increasingly becoming a major destination for capital.

Crypto is similar to the stock market in nature; both involve token issuance, much like IPO fundraising in traditional stocks. The key difference is that technology and big data drive most crypto projects today. Take the SCI token, which is currently in the subscription phase. It’s built on the concept of smart city development, using big data, AI and blockchain to optimize urban management and efficiency.

The value of these tokens comes from the technology behind them and their real-world applications. Compared to traditional stocks, they not only have equity-like properties but also function as a medium of exchange. More importantly, since most tokens have a fixed supply, they naturally have anti-inflation properties, helping hedge against Fiat Currency depreciation. This is why more capital, funds and investment groups are gradually shifting into crypto and expanding their presence in this field.

The truth is that every era creates its own asset forms. As technology advances and economic models evolve, the way wealth is stored also changes. During the agricultural age, land, crops and farming tools were the primary assets; wealth was centred around agriculture. Then, with the Industrial Revolution, over 80% of global wealth shifted from agricultural assets to industrial assets, with factories, machinery and energy resources becoming the leading wealth carriers. Today, we are at the start of the Fourth Industrial Revolution, where AI, the digital economy and blockchain technology are shaping the future economy. As a result, the global wealth structure is undergoing a major transformation; over 80% of assets will eventually transition into digital assets, and traditional stock and real estate-based wealth will gradually shift toward the digital economy.

The US government's response has been even more aggressive. From including crypto in national reserve assets to launching a global tariff war and setting up a performance management department, the US is making a series of policy moves to prepare for the upcoming global tech revolution. Crypto, as a new asset in the global capital market, has gradually evolved from a speculative tool into a key part of the global financial system. The US government's incorporation of BTC and other crypto assets into its reserve system is not just a recognition of the digital currency market but also a clear signal of the future direction of the financial system.

At the same time, the US is imposing tariffs on other countries. On the surface, it looks like trade protection, but in reality, it's an attempt to force manufacturing jobs back to the US in response to the employment shifts that AI and the digital economy might bring. These actions may seem like short-term economic measures, but they are actually part of the US government's long-term strategy for the next 20 years of global economic development.

From an economic standpoint, these measures are an inevitable choice driven by economic interests. Global inflation remains high, and the US government debt has surpassed $36T. To deal with the deficit crisis, Congress has repeatedly faced the risk of government shutdowns. Meanwhile, traditional economic growth is weak, manufacturing competitiveness is declining, and the debt burden is getting heavier. Faced with these challenges, the US government has no choice but to adopt strong economic policies to maintain its dominant position in the global economy. Tariff policies, fiscal tightening and monetary policies are all part of its strategy to secure its leadership in the global capital market in the new economic era.

All these changes point to one central trend: the global distribution of wealth is undergoing a major shift, and the restructuring of the economic system is unstoppable. In this environment, the value of traditional assets will inevitably be diluted, while digital assets, AI and big data industries will become the new centre of the global capital market. The liquidity of traditional assets like real estate and stocks is declining, and their ability to store value is weakening, while BTC and other crypto assets are gaining wider acceptance. Major financial institutions worldwide are increasing investments in blockchain technology and even launching their own digital currency payment systems. This shift signals that the core form of global wealth will gradually move toward the digital economy.

In this period of economic transformation and wealth redistribution, moving forward presents opportunities, while staying behind could mean a loss of wealth or even its complete disappearance. This is not an exaggeration but a real trend in today's economy. From a government perspective, the debt burden in the US, UK and other Western countries is approaching the breaking point, putting national credit systems under extreme pressure. Governments have no choice but to cut jobs, reduce welfare spending and start shifting traditional assets into digital assets.

For individual investors, this means that relying on traditional asset allocations such as real estate, stocks and bonds not only puts wealth at risk of rapid depreciation but also leads to a lower quality of life as government benefits shrink. The current economic landscape makes it clear that the days of holding onto traditional assets and waiting for an economic recovery are over. The way wealth grows has fundamentally changed.

Wealth itself doesn't just disappear; it simply takes a new form and flows into areas that can hold greater value. Every economic shift brings new asset classes, and only those who follow the trends can seize the opportunity to achieve exponential wealth growth. Everything is pointing in the same direction, from tech development trends to the latest US government policies: digital assets will become the key to storing wealth and the core of the next round of global capital competition.

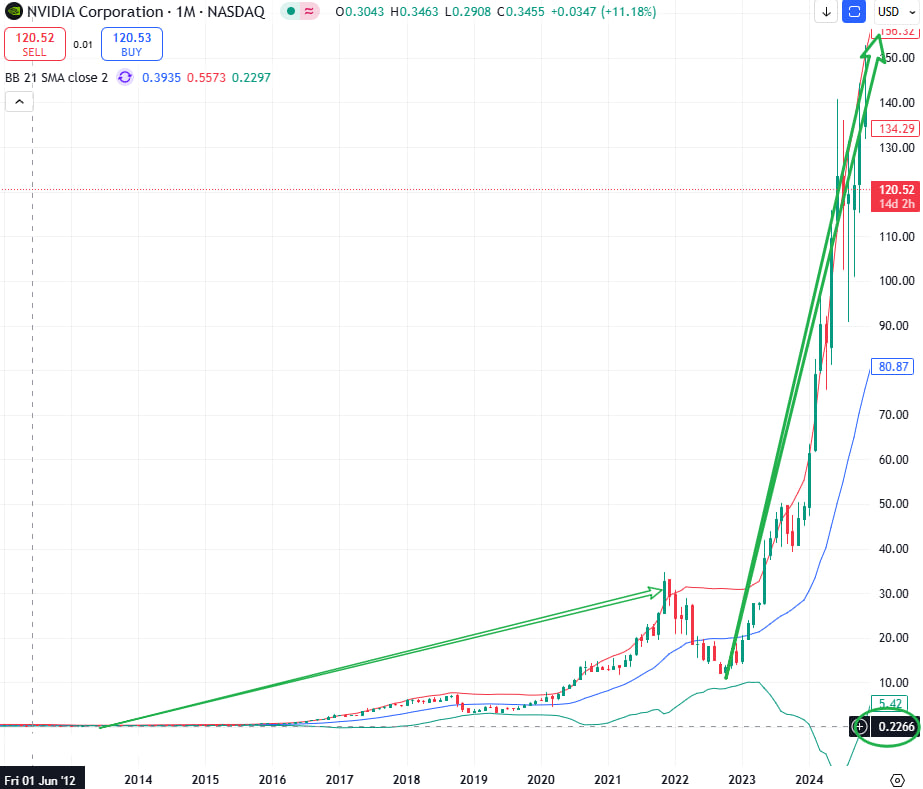

During this wealth redistribution window, the right investment decisions could bring 100x or even 1,000x returns. History has proven this over and over again. For example, Nvidia's stock price has surged 600x in the past decade because it caught the AI wave at the right time. Now, in this global economic transition, the potential of digital assets is even more obvious than the rise of tech stocks. Global capital is rapidly pouring into the crypto market, and more and more startups are choosing to raise funds and go public through crypto, pushing digital assets into a golden breakout phase. In the next few years, missing this wealth transition could mean losing at least 60% of existing assets. On the other hand, those who follow the trend and seize this digital asset boom could see their wealth grow by 100x.

We are standing at a historic turning point; this week marks a critical moment in this economic shift. Global tariff policies, the Federal Reserve's interest rate decision and other key economic events are coming together, driving market volatility into a new acceleration phase. Against this backdrop, our Financial Academy's elite team is not only capitalizing on the market opportunities created by economic and monetary policy adjustments but also using capital leverage to maximize profits, ensuring that every participant secures extraordinary returns. We expect the average profit for Whale Program members this week to exceed 120%, but more importantly, this isn't just a short-term trading opportunity; it's the start of our long-term partnership for mutual success.

The Whale Program has never been the final goal; it's just the beginning of something much bigger. What we are building is not just a profit-making strategy but an entire wealth system designed for long-term success. We are creating a "Millionaire Incubator" centred around digital assets, driven by quantitative trading and smart investing, bringing together the world's top investors and traders to build the future's digital asset consortium. This isn't just a chance for personal wealth growth; it's a strategic move to take the lead in the global capital market revolution. By seizing this transformation, we won't just secure our own wealth; we will become key players in the new economic model.

That’s all for tonight’s session. In today’s discussion, we reviewed the evolution of wealth throughout history, the changing structure of assets in different eras and how the global economy is now shifting towards the digital economy. The progress of time never stops, and the way assets are held is never fixed. Right now, we are at a critical turning point in the global economy, where traditional financial models are transitioning towards digital economic structures. This shift is accelerating at an unprecedented pace due to global tariff policies.

At the same time, Wednesday’s Federal Reserve interest rate decision will introduce new market volatility, creating a prime profit opportunity for the Whale Plan. All members should contact their assistant as soon as possible to confirm their trading capital and schedule. We will create personalised trading strategies based on each member’s situation, ensuring that everyone maximises their profits and accurately captures market movements.

With the rapid rise of AI and digital finance, the core of the capital market is shifting from traditional economic models to digital asset structures, and we are at the centre of this transformation. Today’s decisions will directly impact your future wealth trajectory. Our goal at the Financial Academy is to ensure that every partner becomes a direct beneficiary of this shift. The train of this new era has already left the station. We have two choices: stand still and hesitate or read the trend correctly and confidently move forward. In this global wealth restructuring, opportunities belong only to those who see the trend and take action.

This is not just an investment decision. It is a historic financial opportunity. Every market transformation creates new financial powerhouses, and we want every member of the Whale Plan to be part of this revolution. Markets do not wait for those who hesitate. They always reward the early movers. Especially in today’s challenging environment, the sooner you take action, the more control you will have over your financial future. Despite the uncertainties in the market, this moment offers some of the greatest opportunities we’ve ever seen. We are fully prepared for this wealth transition.

Let’s move forward together, win together and create our own era of digital finance!