Seizing the Golden Era of Wealth Transition: Navigating Market Turbulence Through Strategic Investments

Hello, everyone at Diamond Ridge Financial Academy!

I’m Charles Hanover. It’s a pleasure to explore investment wisdom with all of you in this era of change. The market is constantly shifting, and only through precise analysis and following the trend can we seize opportunities amid volatility and grow our wealth. Whether it’s personal asset allocation or understanding the broader economy, the essence of investing always comes down to identifying and capitalising on trends.

Tonight, we will analyse current market risks and opportunities by examining market trends from the perspective of technological development and economic cycles. We’ll also explore how to achieve steady profits during economic transitions through the Whale Programme.

Today, the UK stock market delivered a weak overall performance. The FTSE 100 briefly rebounded during the session but eventually fell back near yesterday’s closing price, indicating that market sentiment remains cautious. The Trump administration’s tariff policy is back in focus, as the US plans to impose a 200% tariff on EU wine and other alcoholic beverages in response to the EU’s latest countermeasures. This has heightened concerns over escalating trade tensions.

In terms of sector performance, market uncertainty has directly impacted some stock prices, causing the FTSE 250 to drop by 0.95%. Capital is flowing into safe-haven assets at a faster pace, pushing gold prices above $2,970 per ounce—an all-time high. This reflects growing investor concerns about the economic outlook and rising demand for security.

In the US stock market, the early session extended losses, with tech stocks under pressure and all three major indices dropping by over 1.2% intraday. Even though February’s PPI data was flat, the market widely expects that Trump’s tariff policy will drive up goods prices in the coming months, further fuelling inflation. On top of that, the risk of a US government shutdown has resurfaced, adding to market uncertainty and making investors even more cautious.

The ongoing trade war remains a key concern. After the US officially imposed tariffs on imported steel and aluminium, Canada and the EU swiftly retaliated, raising fears that global economic growth will come under further pressure. The Trump administration has taken a tough stance, vowing to strike back against the EU’s retaliatory tariffs. This has made market sentiment even more cautious, with demand for safe-haven assets rising significantly.

Recently, some students have asked whether now is the right time to buy stocks, as their friends have started jumping in. If you’ve been following my updates closely over the past month, you should already know the answer. A simple analysis shows that the current market decline isn’t just a short-term pullback—it marks the beginning of a deeper economic downturn, with plenty of room for further declines. Buying in now is unlikely to yield the expected returns and could instead expose investors to even greater risks.

We need to be clear about one thing first. The current global stock market decline, led by US stocks, is not merely a normal technical correction but a major recession within the economic cycle. Every significant recession in history has been driven by profound industrial changes. Each stage of the industrial revolution has led to massive industry shifts, eliminating traditional models and shaping a new economic structure. For example, the Third Industrial Revolution brought the wave of digitalisation, which severely impacted traditional manufacturing. The stock market underwent a major adjustment before new tech companies began to rise.

Right now, we are in the midst of the Fourth Industrial Revolution. Emerging industries, represented by artificial intelligence, the digital economy, and blockchain technology, are challenging traditional economic models. This impact is not confined to specific industries but is disrupting the entire market structure. For instance, a task that once required ten workers an entire day can now be completed by one person in an hour using AI. This kind of transformation means not only that many traditional jobs will disappear but also that a large number of conventional companies will fade away. The core of this trend is that technological progress enhances efficiency, and higher efficiency inevitably leads to a reshuffling of the capital markets.

As the market reorganises, many once-stable industries will suffer, and their stock prices will inevitably enter a long-term downtrend. At the same time, companies that can adapt to technological advancements and leverage cutting-edge technology to modernise their industries will likely emerge as winners in this transformation. Therefore, the stock market decline is not just about the fall of traditional industries—it is also a signal that new tech sectors are poised for growth. In this environment, investors should not blindly buy the dip. Instead, they need to understand market changes, adjust their asset allocation, and identify industries and assets with genuine future growth potential.

It is not just the capital markets—our work and daily lives are also undergoing the same transformation. Traditional work models and supply chains are being overturned. In the future, individuals who do not understand AI or the digital economy will gradually be left behind. Just as in the electrical revolution, where those who did not learn how to use electrical devices fell behind mainstream society, the same principle applies today.

This means that, whether at a national level or a personal level, following the trend of technological development is now an unstoppable reality. Those who cling to traditional models and resist adaptation will struggle to survive in this economic shift. This is not merely a trend of technological progress—it is an inevitable consequence of human civilisation advancing forward.

Besides the long-term impact of technological changes, the market is also directly influenced by economic policies in the short term. Take the US as an example. Since Trump took office, the US government has been pushing economic reforms, using aggressive measures to regain control of the global economy. This trade war and tariff policy are not merely economic adjustments—they are part of the US government’s broader strategic plan. Faced with slowing economic growth, high debt levels, and declining industrial competitiveness, the US government has little choice but to take decisive action to protect its economic position. Policies such as raising tariffs, reducing reliance on imports, encouraging the return of manufacturing, and restricting foreign investment are all designed to safeguard the core interests of the US economy before the technological revolution fully takes hold.

Looking deeper, these moves by the US government are not just short-term trade tactics but part of a long-term strategy for navigating global economic shifts. With AI, blockchain, and the digital economy advancing rapidly, new industries are gradually replacing traditional ones. The US aims to strengthen its economic policies now to gain a competitive edge in this technological revolution. This tariff war is just the beginning—more economic policies will follow to ensure the US maintains control during this global transformation.

This policy shift has a twofold impact on global capital markets. On the one hand, short-term uncertainty is rising—business costs are increasing, corporate profits are shrinking, and the stock market is under greater downward pressure. On the other hand, traditional assets are rapidly losing value, while new industries built around AI, blockchain, and the digital economy are expanding rapidly. This signifies the disruption of the old economic model and the emergence of new wealth opportunities. Investors who can recognise the trend and adjust their strategies early will be the biggest winners in this economic shift.

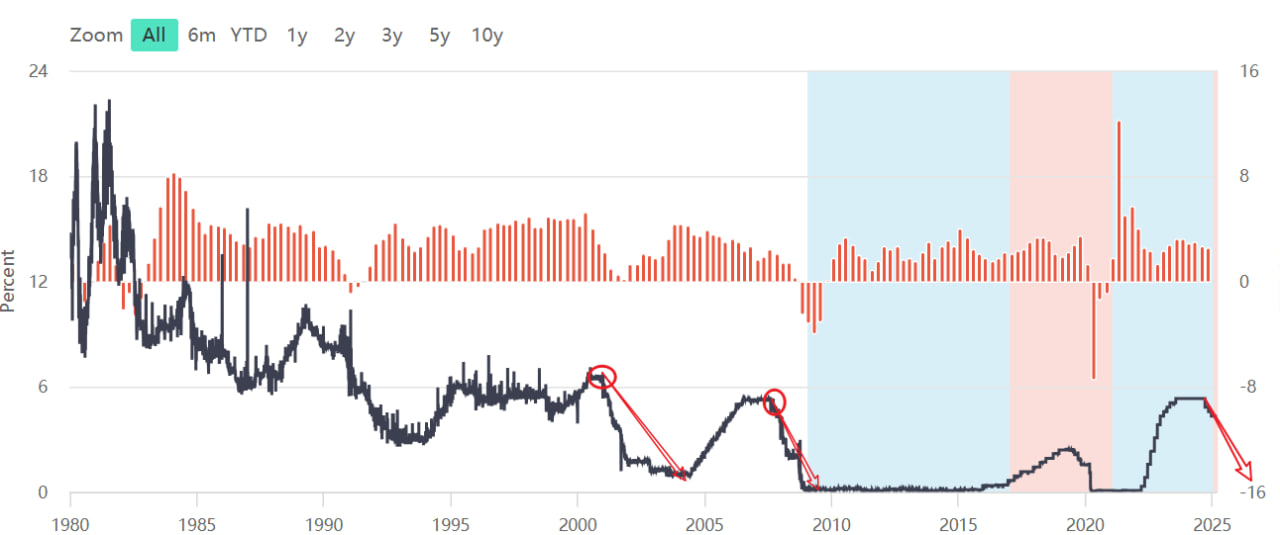

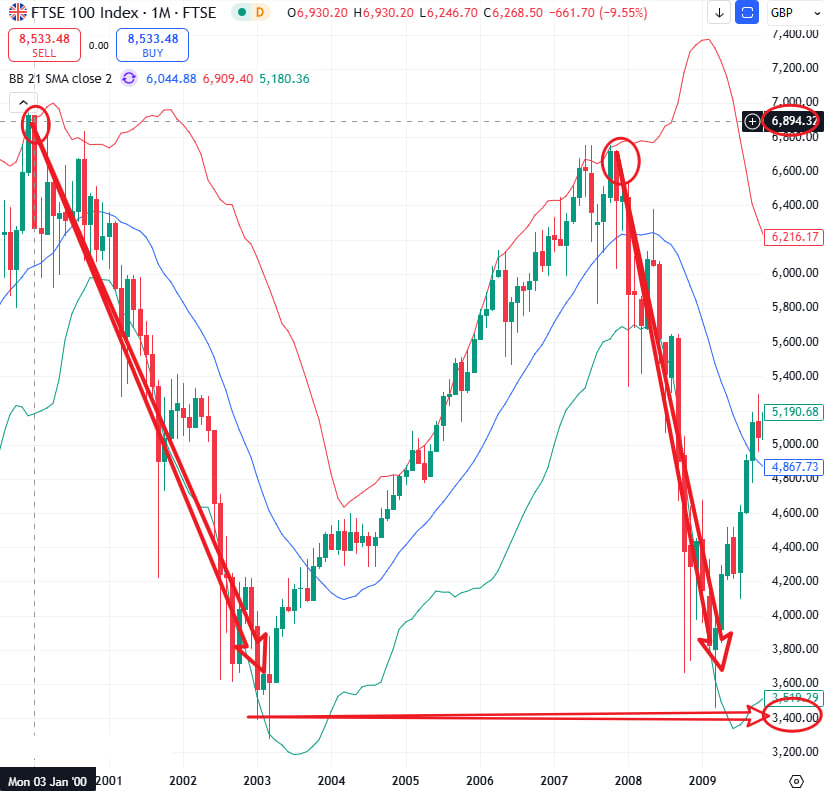

Besides that, we can also observe from the US monetary policy cycle that a significant drop in the US stock market is unavoidable. Looking back at the past 25 years of Federal Reserve rate adjustments, the Fed entered large-scale rate-cut cycles in December 2000 and September 2007. During those periods, the federal funds rate dropped sharply from its peak, with a maximum reduction of 5%. At the same time, the S&P 500, Dow Jones, and the UK’s FTSE 100 all experienced deep pullbacks of over 50%.

Now, both the Bank of England and the Federal Reserve are in a rate-cut cycle again, yet the Dow Jones and other stock indices have only declined by around 10% so far. Based on historical trends, the current market correction is just beginning, and US stocks still have around 40% more downside potential. From a monetary policy perspective, the major market drop has yet to fully materialise, so investors need to remain cautious and avoid blindly buying in at the wrong time.

Recently, the market has moved exactly as we predicted. There was a brief rebound, but in reality, it was merely institutional money driving prices up to sell at a higher level. This is actually the ideal time for regular investors to exit their positions. We saw a slight recovery in the Nasdaq yesterday, but today, it has already fallen sharply again, erasing those gains. This kind of choppy movement is a typical sign of distribution, indicating that the overall market remains in a bearish trend.

While stocks continue to weaken, the crypto market, despite short-term volatility, has demonstrated stronger resilience and even signs of stabilisation. BTC, as an emerging asset, is beginning to decouple from traditional markets, further proving that a new economic structure is taking shape.

This is only the beginning—right now is a golden period for wealth shifts and wealth growth. On one hand, traditional assets are rapidly losing value or even disappearing. On the other, AI, the digital economy, and other emerging industries are becoming the core drivers of economic growth. This economic cycle shift signifies that the market structure is about to be reshaped, and the tech sector will undoubtedly lead the next economic boom.

At this stage, investors need to act decisively—sell traditional assets at high levels and buy emerging digital assets at low levels to position themselves for the future. As traditional assets continue to fade, the market will experience a wave of new tech assets, with more quality investments appearing in digital asset form. Blockchain technology will help maximise their value, unlocking a new round of wealth opportunities.

For investors, now is the best time to adjust asset allocation. Instead of searching for short-term opportunities in a declining traditional market, it is far more strategic to shift investment focus towards high-growth assets for the future. AI, blockchain, renewable energy, and digital finance will all be key engines of the next economic boom. Capital never stays still—it moves with industry trends. Investors must adapt to the times to remain strong in this evolving market.

So, now is not the time to buy stocks at the bottom. This is the key moment to adjust asset structures and transition towards the future. Selling traditional assets at high levels and investing in the digital economy and emerging tech industries at low levels is the best investment strategy right now.

In the next few years, AI, blockchain, and big data will completely reshape the global economy. Those who identify the trend early and adapt quickly will gain a leading edge in this transformation and achieve exponential wealth growth.

Right now, we are in a historic golden window. On one hand, traditional assets are steadily losing value. On the other, digital assets are rising fast. Opportunities like this are extremely rare. From the perspective of industrial revolutions, humanity has experienced three major industrial transformations over the past 200 years, each driving significant shifts in wealth and reshaping industries. From an economic cycle perspective, the world has seen two major financial crises in the past 25 years, and each time, a new wave of industries has surged after the crisis. Today, these two cycles are overlapping, creating an unprecedented wealth transition window. This global tech revolution will not only shape the next 30 years of economic growth but will also mark the beginning of economic transformation and capital migration.

History shows that every tech revolution has created a new group of ultra-wealthy individuals. From Nathan Mayer Rothschild, John D. Rockefeller, Andrew Carnegie, and Bill Gates to Steve Jobs, their success was not random; it was the result of accurately spotting tech trends.

Take Bill Gates, for example. In his early days, he had very little capital, but he quickly saw the potential of the Internet revolution. He started a business with Paul Allen, raised funds in every way possible, with a strong belief in the trend, and built Microsoft into the world’s largest software company, changing the world forever. Today, a similar opportunity is right in front of us: AI, blockchain and digital finance are redefining market rules and opening up new paths for wealth growth.

Of course, the majority rarely understands real opportunities. When Bill Gates first started, most of his friends didn’t understand, support or even take his ideas as a joke. But he knew that technological progress was unstoppable, so before success, he didn’t need anyone’s approval. He just stayed focused on his goal. Investing works the same way. Real opportunities don’t wait for everyone to understand them before they appear. Those who only act after the market fully accepts a trend will always be followers, not creators.

This is exactly the same logic as when I advised everyone to sell stocks in mid-last month. Back then, many didn’t understand and even questioned why we should sell when the market still seemed stable. But as the market kept falling, more investors started panic-selling; by then, they had already missed the best exit point. The market always rewards those who position themselves early, not those who wait until everything is obvious before taking action.

Today, we find ourselves at another significant juncture, on the brink of the most crucial wealth shift of the next 30 years.

Right now is not just a turning point for the global economy; it’s also the beginning of the next 30 years of economic growth. For everyday investors, this is also a key moment for wealth transition. If you can seize this opportunity, you have the potential to build your own wealth legend, just like Bill Gates or the Rothschild family, by leveraging the power of the times. Wealth is not just about accumulating money. It’s a reflection of knowledge and action. At this crucial stage of global economic transformation, only those who truly understand the trends and are willing to take action will gain the upper hand and achieve wealth breakthroughs.

Not everyone can become Bill Gates or Steve Jobs, but as long as we recognize the direction of the times, follow the trend, adjust our investment structure and actively pool funds, we can take advantage of this capital shift, achieve financial freedom ahead of time, and enjoy a higher quality of life. This is not just a market opportunity; it’s a major shift in wealth distribution.

With this vision in mind, we launched the Partner Investment Program to create a “Millionaire Incubator” by working together with our students. This platform not only allows us to fully integrate resources and form a strong capital force but also helps us accurately capture wealth opportunities during market volatility through the Whale Plan. As our quantitative trading system continues improving and the Whale Plan alliance grows stronger, our investment model has now entered a stable growth phase. Moving forward, we will continue to follow market trends, expand our investment team and explore more wealth opportunities. In this process, we will not only accelerate the development of the quantitative trading system but also help every student achieve rapid wealth growth and gain real market influence.

At the same time, students in high-level investment teams will not only enjoy more trading opportunities and higher profits due to their capital advantage but also receive additional benefits based on their financial contributions to the Whale Plan. These benefits include regional agency rights for the quantitative trading system, dividend rights and long-term retirement security. This means the Partner Investment Program is not just a short-term wealth-building platform. It is a long-term system for accumulating and distributing wealth, providing a secure and steady financial foundation for every student through co-investment. We are not just seizing the current market opportunity. We are also creating a high-level investment club during this global economic shift. By leveraging the power of pooled capital, we aim to drive technological advancements and achieve higher-level wealth management and investment returns.

That’s all for tonight’s session. In this discussion, we covered everything from the trends of the tech revolution to economic policies and monetary cycles, giving a systematic analysis of the current market landscape. We made it clear that the global economy is in a recession. In this context, it’s not the right time to buy stocks. Instead, investors should take advantage of the market correction and sell off their holdings to avoid even bigger losses in the future. By reviewing historical market patterns, we once again confirmed the current wealth transition opportunity and further established that the digital economy will dominate the future economic landscape.

Right now, there is a golden window for wealth transition. This is not only a process of eliminating traditional assets but also a stage where new assets are rising. The growth of the digital economy is giving investors an unprecedented opportunity, and the concentration of capital will further amplify profit potential. All students should actively prepare funds and take advantage of the wealth opportunities brought by the digital economy to avoid missing out on this historic wealth accumulation cycle.

One key point to watch is that the recent tariff policy changes have triggered new market turbulence, and next week’s Federal Reserve meeting will be a critical turning point in this economic shift. The market expects the Fed to make further policy adjustments, which will increase volatility and create another great opportunity for the Whale Plan to capture market swings. We will take advantage of this perfect investment opportunity by officially launching the Whale Profit Plan, which is expected to bring over 100% returns for every participating student. In the coming market turbulence, we will once again validate the core profit logic of the Whale Plan and use our capital advantage to make precise investments at key market moments.

We are standing at a historic crossroads, and this is not just another investment opportunity; it is a key moment that will shape the future wealth landscape. The market is about to experience the last major wave under the current tariff policy, and this will be the best time for the Whale Plan to maximize profits. All students must plan their funds and trades in advance to ensure they can take full advantage of the coming market moves and achieve wealth transition. Let’s move forward together, take control of this economic transformation and create our own new chapter of wealth!