Whale Strategy: Seizing Market Shifts and Maximizing Digital Asset Growth in a Transforming Financial Landscape

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and I'm thrilled to join you all in exploring greater profits through the Whale Programme. In today's highly volatile market, quantitative trading is not just an efficient investment tool—it is a whole new way of thinking that enables us to identify market opportunities, optimise returns, and manage risks. The market evolves rapidly, and only by deeply understanding market logic and how institutional funds operate can we gain a competitive edge.

Tonight, we will analyse market trends, explore asset shifts, and utilise the Whale Profit Programme to help every student achieve steady financial growth.

Today, the UK stock market exhibited an unusual reaction despite weak economic data. The FTSE 100 closed up 1.05%, yet hidden risks remain. The UK’s GDP unexpectedly shrank by 0.1% in January, far below the anticipated 0.1% growth. Industrial and manufacturing output declined by 0.9% and 1.1%, respectively, confirming sluggish economic growth.

On the policy side, the British pound weakened due to poor economic data, temporarily boosting mining stocks. However, this rise did not stem from genuine economic improvement but rather from a weaker pound increasing export competitiveness—a short-term effect driven by market sentiment.

Meanwhile, Vanquis Bank’s stock plummeted 5% due to a £191 million loan impairment and a £71.2 million asset write-off, highlighting the fragility of the UK financial system. The banking sector remains under pressure, while uncertainties in the real estate market add to concerns about the UK economy. Although stocks briefly rebounded today, with manufacturing contracting, banking risks rising, and the pound weakening, this rally appears more like a technical correction than a sign of long-term strength. We must continue to monitor policy changes and economic downturn pressures for their future market impact.

In the US stock market, some intraday rebounds occurred, but overall, market pressure remains high. The temporary easing of government shutdown risks helped stabilise market sentiment, leading to a rebound in the three major indices. However, all three have fallen over 4% this week, with the Dow on track for its worst weekly decline since June 2022. The S&P 500 and Nasdaq have also recorded four consecutive weeks of losses, demonstrating how fragile market sentiment remains.

On the economic policy front, the US government continues to adjust tariff plans, placing increased pressure on major trade partners such as China, Canada, and Mexico. It is set to announce new retaliatory tariffs on 2 April. Trump has taken a hard-line approach, pushing for high tariffs on European wine, cars, and other goods, further escalating global trade tensions. These actions could lead to a worsening trade war, higher inflation, and greater market instability.

In yesterday’s session, we reviewed the current pace of global economic development and confirmed that we are now in a transition period. The sharp fluctuations in mainstream assets are completely normal. During this phase, different types of assets are undergoing major transformations, with traditional assets gradually being replaced by emerging digital assets. This is not merely a decline in asset value caused by an economic downturn—it is happening because traditional asset structures are fundamentally flawed. With the technological revolution driving progress, asset structures are bound to evolve, and the rise of digital assets is the clearest example of this trend.

On one hand, traditional assets not only have significant room for further depreciation, but they are also becoming increasingly difficult to store and cash out. Take the UK real estate market as an example—it is facing enormous challenges. In April, a new stamp duty will take effect, substantially increasing transaction costs, reducing market liquidity, and ultimately pushing property prices down. The bigger issue is that even when investors recognise the risks, selling their assets is extremely difficult. Data shows that the average time to sell a property in the UK exceeds three months. Once funds are received, strict bank regulations make cross-border transfers and large transactions complex and restricted, making it even harder for investors to cash out. These inefficient and cumbersome processes are a major reason why traditional assets are struggling to keep pace with the modern economic system.

It is not just real estate—traditional stocks and bonds also have major structural flaws. With complex and non-transparent processes such as asset registration, bookkeeping, and financial reporting, traditional financial markets have long been susceptible to manipulation, leading to serious systemic risks. For instance, after Trump took office, the US Treasury and Department of Defense conducted massive financial audits, exposing long-standing loopholes and a lack of transparency in government financial management. If even the government’s financial system operates in this manner, then corporate finances are likely even worse. The hidden debts and asset bubbles in major corporations far exceed market expectations. These inefficiencies and lack of transparency are key reasons why traditional assets are gradually fading in today’s market.

Thus, the decline of traditional assets is not merely a natural result of the economic cycle—it is driven by structural limitations that hinder economic growth. A lack of transparency, complex processes, low liquidity, and excessive human interference have rendered traditional assets uncompetitive in the modern economy. In contrast, as technology continues to advance, asset structures are also evolving.

Looking at history, every technological revolution has reshaped asset structures. The Industrial Revolution shifted value from agriculture to industry, and now, the rise of the digital economy is driving traditional financial assets towards digital forms. This shift mirrors how cars replaced horse-drawn carriages or how AI is gradually replacing traditional business models—it is an inevitable consequence of technological progress.

Compared to traditional assets, digital assets have entirely different characteristics. Take crypto as an example—it runs on blockchain technology, which not only records every transaction transparently but also ensures security, efficiency, and immutability. In the traditional financial system, cross-border transfers typically go through banks, clearing institutions, and other intermediaries, making the process slow and costly. However, with crypto, transactions can be completed within minutes without complicated procedures. This high level of efficiency is why an increasing number of countries and businesses are adopting crypto for trade settlements.

For example, the Swiss government has already tokenised part of its national debt, making it tradable on the market. This not only lowers issuance costs but also improves bond security and liquidity, creating a more efficient financial system. This demonstrates that traditional financial assets are gradually shifting towards digital assets, and this trend is accelerating.

Beyond that, more high-quality tech assets are choosing to raise funds and go public through tokenisation. Compared to traditional IPOs, issuing digital assets is cheaper, offers better liquidity, and significantly lowers entry barriers for investors. This allows tech companies to raise capital more efficiently. More importantly, digital assets provide far greater transparency than traditional finance, reducing market information gaps and limiting the risk of manipulation, leading to fairer and more efficient financial markets.

Another key factor driving this trend is the evolving regulatory environment for crypto. In recent years, governments have shifted from a wait-and-see approach to active regulation to ensure market stability and legitimacy. For example, the US Senate Banking Committee recently voted to pass the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act. This legislation aims to create a proper regulatory framework for stablecoin payments, ensuring their safe circulation within the financial system. The bill was approved by 18 votes to 6 and is expected to be presented to the Senate for a full vote within the first 100 days of Trump’s presidency. If officially passed and signed into law, it will become the first stablecoin regulation in the US.

On this, Senate Banking Committee Chairman Tim Scott stated that passing the GENIUS Act is a key step in making stablecoins a safe and reliable payment tool within the financial system. This policy move signifies that crypto’s legitimacy and recognition will continue to increase, potentially making it a key component of the future global payment system.

This shift is highly significant for investors. The lengthy and complex processes of the traditional financial system have severely restricted the movement of funds. However, with stablecoin regulations in place, barriers to using crypto for payments and settlements will be completely removed. Investors will be able to bypass traditional banks and use crypto directly for transactions, enabling faster and more flexible financial operations. This will greatly enhance market acceptance of crypto and accelerate the global transition towards digital assets.

Given this trend, a large number of stocks will gradually transition into digital assets in the future. This is one of the key reasons why the stock market has been in a long-term decline. While short-term rebounds do occur, in the long run, economic transformation and current tariff policies are accelerating the decline of the traditional economy. As a result, these rebounds are often temporary, and the market still faces significant downside risks ahead.

In comparison, the crypto market, led by BTC, has demonstrated much stronger resilience. While the crypto market also experienced some short-term sell-offs due to shifting capital flows during this economic transition, its overall performance has been significantly better than the stock market.

Take BTC as an example—after briefly dropping below $78K on 10 and 11 March, its price quickly rebounded, forming a stable support level. Meanwhile, the three major US stock indices continued to hit new lows. This clearly indicates that capital is rapidly moving from stocks to digital assets, with institutional investors gradually accumulating BTC and other high-quality crypto assets at lower prices.

Today’s market performance further confirms this trend. BTC surged over 5% during the session, triggering a broader rebound in the crypto market. At the same time, this also influenced tech stocks, leading to a slight recovery in some sectors and briefly lifting the overall US stock market. However, even though US stocks rebounded due to BTC’s rise, their momentum and gains remained far weaker than those of the crypto market. This proves that now is still the best time to sell stocks and start buying crypto at lower prices.

It is worth noting that when it comes to digital assets, governments and institutions tend to be more forward-thinking than retail investors. Recently, reports have emerged that the US government is planning to sell 15% of its gold reserves to acquire over 1 million BTC. According to the latest estimates from Singapore-based blockchain firm Matrixport, selling 15% of gold reserves would enable the US government to accumulate approximately 1.05 million BTC over the next five years. This suggests that the US is accelerating the restructuring of its reserve assets by increasing its crypto holdings.

To fund this reserve adjustment plan, US Senator Cynthia Lummis has already proposed selling part of the gold reserves. While this move may trigger market volatility, the real intention behind it is clearly a long-term strategy for the crypto market. Recent market trends closely align with this strategy—the US government publicly maintains a tough stance on crypto while simultaneously implementing policies and financial manoeuvres to increase its holdings at lower prices. This suggests that even at the national level, there is full recognition of digital assets’ future potential, with preparations being made for a shift in the global financial system.

Meanwhile, Geoff Kendrick, Head of Digital Asset Research at Standard Chartered Bank, also highlighted that BTC’s recent price movements closely mirror those of risk assets such as the "Magnificent Seven" stocks, rather than indicating an issue with the crypto market itself. He explained that BTC’s short-term corrections are primarily driven by rising risk-averse sentiment in the market, rather than a decline in its fundamentals. In fact, institutional investors are capitalising on market fluctuations to continue accumulating BTC, and this trend is expected to accelerate in the coming years.

Kendrick remains highly bullish on BTC’s long-term outlook, predicting that its price will reach $200K by the end of 2025. Over the long run, growing expectations of Fed rate cuts will further boost BTC’s value, and the crypto market is now entering a new phase of capital accumulation.

The trend and opportunities are clear. In this environment, how can regular investors seize the moment and achieve steady growth in digital assets? The Partner Investment Programme has been designed as a solution.

This partnership model is a fair and transparent win-win strategy, where all participants gain access to professional investment strategies and precise quantitative trading signals provided by the financial academy. Once an agreement is reached, the academy not only offers comprehensive trading guidance but also guarantees both the principal and returns, ensuring a secure investment process. In return, the academy takes a percentage of the profits instead of charging fixed fees. This means that the academy only earns if participants make money, aligning the interests of both the academy and investors, thereby creating a genuine win-win collaboration.

At the same time, we are leveraging this market trend to build a millionaire incubator, bringing together top investors for deeper capital partnerships. The recently launched Whale Profit Programme is a key part of this strategy.

The core concept behind the Whale Programme is to utilise collective capital power, precise quantitative trading strategies, and a strong analysis team to secure stable profits during market fluctuations. Unlike traditional retail trading, the Whale Programme relies on massive capital cooperation, allowing us not only to follow market trends but also to influence key movements, leading to higher returns.

Some participants have asked why we always choose to make our moves when major economic data is released. The key reason lies in capital-driven logic. Both large institutions and individual investors closely follow data-driven markets, as they offer clear trading patterns and more predictable profit opportunities.

The advantages of data-driven trading mainly include:

1. Data events typically trigger strong market swings, creating greater profit potential.

2. The release schedule is fixed, allowing investors to plan ahead without the need for constant market monitoring.

3. Once the data is published, the market usually follows its direction, forming a predictable trend.

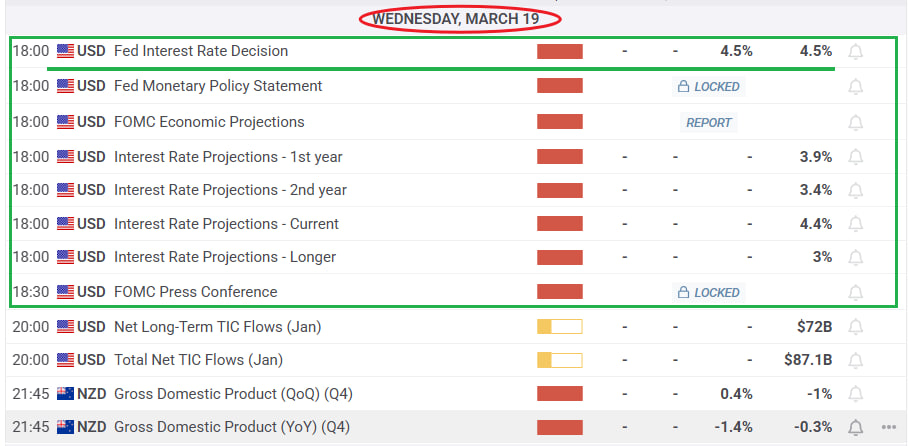

A precise trade is ultimately about determining the right time, price, and direction. The timing of data-driven trades is fixed. For instance, next Wednesday’s Fed rate decision will be announced at 6 PM ET. The trade price can be adjusted based on market reactions, while the trade direction depends on the data outcome:If the data is bullish, we go long on crypto.If the data is bearish, we short the relevant assets.

Data-driven markets attract high levels of attention, making it easy to trigger market sentiment and cause large capital flows in or out. However, most investors trade based on emotions—they are too fearful to buy at low prices and too greedy to resist chasing high prices. As a result, regular investors often continue adding positions when prices rise and panic-sell when prices drop. This trading pattern gives institutions and large capital groups more room to manoeuvre.

The Whale Programme takes advantage of this market behaviour by positioning ahead of data releases, waiting for market sentiment to unfold, and ensuring more stable profits.

Take this Wednesday’s CPI data event as an example. We conducted an in-depth analysis in advance and predicted that the data would strengthen market expectations for Fed rate cuts, which would boost the prices of non-USD currencies and crypto. Based on this, the financial academy organised Tier 5 and higher-ranked participants to build positions in a planned manner before the data release.

To avoid pushing up prices too early, we began buying in gradually five hours ahead, securing the lowest possible entry points. Then, once the data was released, market sentiment took hold, and investors flooded in. We used this momentum to push prices even higher. In the end, this strategy ensured stable profits for all participants and created additional contract trading opportunities for those with larger capital, achieving double-layered gains.

The success of this strategy has enabled the Whale Programme to rapidly accumulate more capital power and gain greater market recognition for our trading system. As we approach the upcoming Fed rate decision, we will replicate this approach to capture another round of profits from market volatility.

Interest rate decisions impact the market even more than CPI data, as Fed rate adjustments directly influence liquidity conditions and global capital flows. Right now, the market widely expects the Fed to begin a rate-cut cycle. If the decision signals further easing, the crypto market could experience an even stronger rally. That is why, ahead of the decision, we will once again organise Whale Programme capital to buy in at low levels, maximising profit potential during market swings.

Market opportunities do not last forever. Successful trades rely on precise strategies and solid execution. The core logic behind the Whale Programme has already been proven, and the coming market volatility presents our best opportunity to capitalise once again.

Investing is not about predicting—it is about following the trend. The market has already sent clear signals—traditional assets are rapidly losing value, while digital assets are becoming the new safe haven for capital. Nations, institutions, and high-net-worth investors are all adjusting their asset structures to prepare for the shift in the financial system.

For regular investors, the most important step right now is to follow the trend, join this asset transition wave, and take advantage of the low-risk, high-reward opportunities offered by the Whale Programme to achieve steady wealth growth.

That’s all for tonight’s session. In this discussion, we explored the changes in the global economic landscape, analyzed the trend of traditional assets losing value and digital assets rising and used the success of the Whale Program to show how to take advantage of market swings for stable and efficient profits. We also looked into the potential market opportunities from the upcoming Fed rate decision and developed targeted trading strategies to ensure all participants can secure a strong position in the coming market moves.

It’s important to note that the Fed rate decision will be a major turning point in this round of market volatility. It will not only affect global capital flows but also directly determine the market’s overall direction. This is another golden opportunity for a low-risk, high-reward setup for the Whale Program. Especially with the market widely expecting rate cuts, digital assets are likely to see capital inflows. That’s why we will position ourselves in advance to secure the best entry points when market sentiment explodes, making full use of irrational price swings to maximize profits.

Every major economic shift in history has led to massive wealth transfers. Only those who can accurately spot trends and act decisively will truly stand at the forefront and reap huge rewards from market changes. Right now, the Whale Program is at a critical growth stage. Our capital size, trading strategies and market influence are expanding rapidly. This not only ensures stable returns for every participant but also gives the program stronger market leadership. In this environment, the earlier you join, the bigger your profit potential. But if you miss this opportunity, you’ll only end up chasing the market at higher levels later.

In the next few days, we will finalize a more detailed trading plan for the Fed rate decision while aligning it with the overall strategy of the Whale Program to ensure that every participant can fully capture this market opportunity. Please make sure your capital and trading plans are ready so you can ride the momentum when the key moment arrives and keep growing your wealth. We are standing at the edge of a global financial transformation, and the Whale Program will be the driving force behind this new wave of wealth creation. Let’s seize this chance together and reach new financial heights!