Capitalizing on Market Volatility: Strategic Investment Amidst Global Economic Transition

Hello, outstanding students of Diamond Ridge Financial Academy!

I am Charles Hanover. It’s great to be here with you in this challenging yet opportunity-filled market, discussing global economic trends and trading strategies. As the global economy becomes more complex, from geopolitical conflicts to changes in tariff policies, every policy shift has a significant impact on market direction.

Tonight, we will focus on the latest market trends and analyse today’s Whale Plan performance. By summarising steady profit trading patterns, we will prepare for the next trading opportunity.

Today, the UK stock market exhibited a choppy trend. Although the FTSE 100 opened higher in the morning, risk-averse sentiment remained strong, causing gains to shrink and most of the rise to be erased.

On the policy front, US-Canada trade tensions escalated further. Canada announced countermeasures against US products, making the market even more cautious. The EU expressed willingness to negotiate on tariffs, but most expect trade tensions will not ease in the short term. These uncertainties are putting additional pressure on the global supply chain, increasing business costs, and pushing investors towards safe-haven assets, thereby limiting market growth.

From an industry perspective, UK airline stocks were hit hard by a profit warning from US airline stocks. IAG, the parent company of British Airways, fell 5%, dragging down the hotel and leisure sector. Consumer stocks also performed weakly, reflecting growing concerns about a slowdown in demand. Homebuilders and retail stocks declined overall, indicating a lack of confidence in economic growth. Overall, the UK market continues to face downward pressure in the short term, with policy uncertainty and weak sentiment increasing volatility.

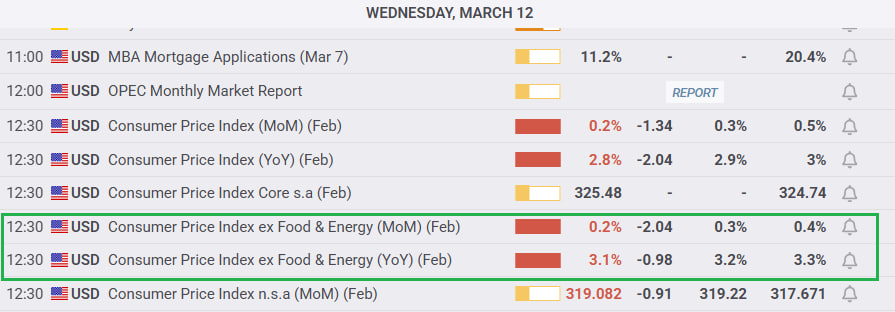

In the US stock market, midday trading was mixed. Tech stocks rebounded, but overall, the market remained under pressure. US February CPI data was lower than expected, raising hopes for a Fed rate cut in June. However, inflation remains above the 2% target, and future tariff policies may further increase business costs, limiting the Fed’s scope to ease monetary policy.

Today, the Trump administration’s steel and aluminium tariffs officially took effect. In response, Canada announced retaliatory tariffs on CAD $30 billion worth of US goods, while the EU is planning tariffs on EUR €26 billion worth of US products. The escalating trade war is fuelling market anxiety. Trade conflicts not only impact corporate profits but also increase global economic uncertainty, making the market more pessimistic about future growth.

Overall, the short-term rebound in US stocks cannot mask the long-term adjustment risks. The trade war, inflationary pressures, and policy uncertainty remain the main downside factors, and the market may face even greater volatility ahead. In this environment, accurately timing the market and following the trend is the key to trading success.

Despite the uncertainties brought by tariff policies, monetary policy shifts, and the spread of market panic, the real risk is not market volatility itself. Rather, it is investors failing to recognise trends, leading them to trade against the market, miss out on profitable opportunities, or even suffer greater losses. However, within this market turmoil lies an opportunity to reshape capital flows. Only by following the trend can we achieve stable profits amid the volatility.

Global economic data continues to weaken—employment markets are struggling, manufacturing is contracting, and trade conflicts are pushing many traditional businesses into difficulty. The sharp adjustments in US stocks have not only intensified global market turbulence but have also forced major financial institutions to lower their economic growth forecasts, warning of a deeper recession. However, the nature of the market is fluctuation, not a one-way collapse. The real cause of investment failure is misjudging the trend. Many investors panic-sell and miss real opportunities, whereas students at our financial academy have used precise strategies and sound money management to secure stable profits during market swings.

As early as mid-last month, our analyst team conducted in-depth research on the current market environment and accurately predicted the upcoming market adjustment. I repeatedly emphasised that market risks were rising, so I advised everyone to gradually reduce stock holdings and shift towards more growth-oriented asset allocations. During this process, our Partner Investment Plan played a crucial role. Through well-planned strategy adjustments, our students ensured steady profits despite sharp market fluctuations. Now, even though market uncertainty persists, our students have already secured significant returns by following the Partner Investment Plan’s steady strategy.

To further enhance profitability, we have adopted a more active market participation strategy—the Whale Plan. By pooling capital together, we not only follow market trends to drive price movements but also use collective funds to amplify short-term market swings, ensuring all participants secure more stable and substantial profits. This is the true power of the Whale Plan—using precise strategies and capital advantages to control market timing, creating predictable profit opportunities within market volatility.

The US Labour Department report shows that, after seasonal adjustment, the February CPI rose by 2.8% year on year, lower than the market expectation of 2.9%, with the previous figure at 3.0%. Core CPI increased by 3.1% year on year, also below the market forecast of 3.2%, with the previous figure at 3.3%. This data indicates that US inflation is slowing further, suggesting that the Fed’s monetary policy may become more accommodative, which could positively impact the market. Specifically, for BTC and the crypto market, lower inflation expectations mean the dollar’s purchasing power is relatively increasing, and stronger expectations of Fed rate cuts this year make capital more likely to flow into BTC and other inflation-resistant assets.

In fact, as early as yesterday, our analyst team accurately predicted that the CPI data would be bullish through data analysis. Combined with short-term bullish signals from our quantitative trading system, we planned trades in advance. To reduce risk, we guided students with larger capital to position themselves early and gradually build positions before market sentiment was fully released. When the CPI data was announced and market sentiment peaked, BTC’s price surged. We then increased our trading volume and used our capital advantage to push the price even higher, doubling overall profit potential.

According to the assistant’s afternoon trade report, students participating in this Whale Plan achieved returns ranging from 25% to 137%. This success not only validates the profitability of the Partner Investment Plan but also proves the effectiveness of our trading strategy and quantitative trading tools. With precise market predictions, an advanced quantitative trading system, and capital advantages, we ensure that our students can consistently profit even in volatile markets. Market fluctuations are inevitable, but the key is how to turn them into the best profit opportunities. With strategic investment planning, we can not only manage risks but also turn market uncertainty into a predictable profit model, creating steady wealth growth for all participants.

Some students may ask, if we already have these advantages, why do we still rely on major economic data events? The answer is simple—momentum. The market is driven by capital, and when key data is released, market sentiment is amplified, and trading volume surges. This is the perfect time for us to use volatility to maximise profits. Take AQS as an example. Our mid-term Whale Plan aims to push this token’s price above $5, while it is currently around $1.7. The final target is clear, so the question is: at what price should we buy in to maximise profits? The answer is obvious—the lower, the better, ideally below $1.7. However, for the price to rise from $1.7 to $3, then to above $5, it requires continuous buying pressure from large capital inflows. Clearly, no one wants to chase high prices after a big surge. So, who drives this price movement in between?

The answer is market sentiment and external funds. This is why momentum matters. We need to use major economic events to attract more market participants and boost their trading interest, pushing prices higher. For example, bullish CPI data, Fed policy shifts, and the launch of our quantitative trading system are all positive factors we can foresee through data analysis. CPI is a key economic indicator that global capital markets closely watch, attracting significant investor attention and capital inflows. By positioning ourselves early at market lows, we not only secure cheaper entries but also leverage our capital advantage to take control when market sentiment starts pushing prices up.

When market sentiment turns extremely bullish, we only need a relatively small amount of capital to push the price higher with ease. Then, as the market enters the greed phase and investors rush in, we gradually take profits, exiting in an orderly manner at the most optimistic stage. This ensures capital safety and maximises returns. This approach not only reduces market risks but also fully leverages our capital advantage, making trading more stable and controllable.

This process demonstrates that making profits is not complicated. The key is to follow the trend and use capital to amplify market sentiment and price movement. When the market swings wildly, investors are most likely to make mistakes. However, with smart strategies and precise execution, we can lock in profits ahead of time as market sentiment drives the trend. How do we expand price movement? The answer lies in major economic events and data releases, as they trigger significant market swings and create opportunities for us to trade with the trend.

Today’s Whale Plan results exceeded many students’ expectations. Not only did everyone make solid profits, but the investment process was also more stable than anticipated. Some students may feel this opportunity came too quickly and, since they had limited capital, their returns were not ideal despite making money. Others missed today’s trade due to personal matters and were unable to take advantage of this “sure-win” market move. To these students, I want to emphasise that this type of high-confidence trade will not be the last—it is part of our long-term investment strategy.

Of course, top-tier profit opportunities do not arise all the time. The best investments always ride the trend—following momentum is the key to achieving greater returns. Right now, we are in a global economic transition period, and the market is already volatile. However, Trump’s tariff policies do not have fixed release times, and his stance is unpredictable, making it harder for large financial institutions to plan ahead.

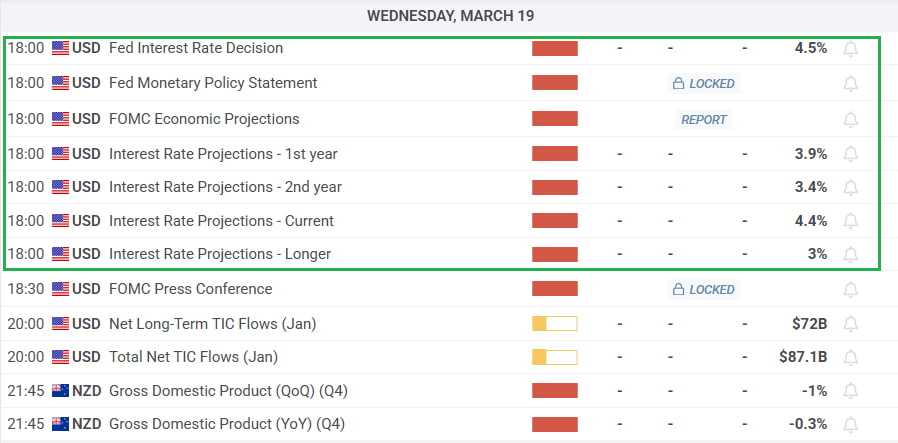

Economic data-driven trades, on the other hand, are different. Take today’s CPI data—it was a scheduled event, allowing us to prepare in advance for stable profits. But even more significant than CPI is next Wednesday’s Fed rate decision. This economic event will directly shape future monetary policy, and the market’s expected volatility is far greater than that of CPI. This means that, from a major event perspective, this week and next week mark the peak of this economic transition. During this period, the market is already prone to large swings. With the Fed’s rate decision added on top of that, market sentiment will be amplified even further, creating massive profit opportunities.

For opportunities like this, our partner team’s “whale group” will position itself ahead of next Wednesday’s super profit opportunity. For students who missed today’s Whale Plan, you can sign up in advance to get priority for next Wednesday’s setup. However, keep in mind that major trades like this are becoming increasingly rare. The economic transition window is closing, and only significant events like monetary policy decisions can create the kind of market swings required for the Whale Plan. In other words, this might be the last highly certain “hunt” in this phase. If you miss it, the next opportunity could be a long wait. So, if you want to join, ensure you are prepared with both capital and time to avoid missing out on another sure-win trade.

The size of your capital directly determines your trading strategy. Students with larger funds can position themselves early, combining spot and contract trades to capture major trends. Those with smaller funds can only take advantage of short-term moves on the 5-minute or 10-minute charts. While the profits are steady, they are nowhere near the returns from 1-hour or 4-hour trades, which can be several times higher. The greater the capital, the more trade opportunities, the higher the profits, and the faster compounding accelerates wealth growth.

Take this Whale Plan as an example—Tier 6 teams made four times the profit of Tier 1 teams. This profit gap is not just a one-time occurrence. Over the long run, compounding continuously multiplies these gains. Each time a higher-tier team earns slightly more, those extra profits accumulate over time, leading to exponential growth.

More importantly, the larger the capital, the more it contributes to the Whale Plan, which also means better entry positions. In trading, large capital does not just move prices; it allows for entry at key levels, ensuring more stable profits. In the future, as our “Millionaire Base” continues to grow, we will expand the Whale Plan into a global quantitative fund elite investment club. This will attract more high-quality capital, unlocking even greater market opportunities amid the ongoing economic shift and wealth transformation.

At the same time, high-level partner teams will enjoy exclusive benefits, including regional agency rights for the quantitative trading system, profit-sharing, and even pension funds. This will not only help every student elevate their wealth and lifestyle but will also drive economic and technological progress, creating an even greater social impact.

Of course, besides actively preparing funds, small market trades can also help build capital. This is particularly important for students with smaller funds or those still in the reserve team. Every market movement presents an opportunity to gain trading experience and accumulate wealth. Progressing step by step and improving with every trade is the key to laying a solid foundation for future wealth growth. For example, tomorrow’s PPI data and Friday’s Consumer Sentiment Index release will cause short-term market fluctuations—these are trading opportunities that can be utilised.

However, no matter how promising an opportunity is, it must be acted upon. Even the best trading strategy requires capital to be effective. For students who want to participate in next week’s Super Whale Profit Plan, ensure you are fully prepared in advance. Gather sufficient capital so you can enter at the optimal time and maximise returns. The greater your funds, the higher your profits, and growing capital will generate even greater wealth effects in the future. For students with limited trading time, besides joining the Whale Plan, a steadier mid-term strategy is also an option.

For instance, buying and holding AQS tokens until the target price of $5 can generate asset growth over a longer period without the need for constant monitoring. Additionally, the automated trading function of the quantitative trading system will be launching soon. Once live, students will be able to use this system to earn stable profits, freeing up their time while allowing their money to grow automatically.

That concludes tonight’s session. In this discussion, I provided an in-depth analysis of the risks and opportunities presented by the global economic transition. By reviewing the success of the Whale Plan, we have once again validated the core concept of the Partner Investment Plan: strong capital advantages, precise trading strategies, and cutting-edge quantitative trading tools, all working together to create a “sure-win” profit model. By trading around major economic events, we can further expand profit potential from market fluctuations, ensuring highly efficient capital growth.

The market will not wait, and top-tier wealth opportunities will not last forever. Every economic transition creates a new wealth class, and only those who follow the trend will emerge as the ultimate winners. Right now, we are standing at a historic moment of wealth transformation. This is not just another investment opportunity—it is a pivotal turning point that will shape the future financial landscape. Within the Whale Plan framework, capital pooling remains the most stable and profitable strategy in today’s market. Moreover, the upcoming Fed interest rate decision represents the last major opportunity in this round of market volatility.

Make sure you plan your funds and trades in advance to seize this super profit opportunity. This is the ideal moment for exponential capital growth and a crucial step towards reshaping your financial future. Let us work together to capture the benefits of this economic transition and reach new heights of wealth!