Strategic Wealth Shift: Mastering Market Cycles and Capitalising on Global Economic Transformation

Hello, future investors of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's great to be here with you again. In this uncertain market, we need to not only time our investments accurately but also find stable ways to make profits during market swings. Over the past week, tariff policies and economic data from different countries have shaken global investors. However, thanks to the stability of the Partner Investment Plan and our quantitative trading system's precise strategies, we not only avoided risks but also secured solid gains.

Tonight, we'll review the past week's market trends, dive into the opportunities brought by current economic policies and work together through the Partner Cooperation Agreement to set up the "Whale" Profit Plan, making sure we stay ahead during this economic shift.

Over the past week, global markets have generally declined due to trade policies, economic data and overall market sentiment. The UK stock market stayed under pressure, with the FTSE 100 dropping 1.47% in total, showing that concerns over slowing global economic growth are rising. After US President Trump announced new tariffs on imports from Mexico and Canada, global risk-aversion spiked, and investors rushed to government bonds and other safe-haven assets.

At the same time, OPEC+ announced production increases, worsening the outlook for the energy sector. This pushed oil prices lower, weighing on UK oil and gas stocks, with Shell's share price dropping. On top of that, leadership changes in major companies added more uncertainty, making investors more cautious about the future earnings of UK businesses.

Although the market briefly rebounded midweek after the US Commerce Secretary hinted that some tariffs might be lifted, sparking hopes for new trade talks, investor sentiment remained cautious. Ukraine's willingness to talk with Russia briefly eased geopolitical tensions, helping the FTSE 100 rise by 0.5%.

However, this rebound didn't last. The UK's economic data kept getting worse, with the construction PMI plunging, signalling growing risks of a downturn in the sector. Bank of England Governor Andrew Bailey warned that global trade conflicts pose a "major" threat to the UK economy. Meanwhile, the British Chambers of Commerce cut its 2025 growth forecast to 0.9%, highlighting rising business costs. With all these factors in play, market optimism faded quickly, and stocks weakened again.

In Europe, the European Central Bank cut interest rates by 25 basis points this week, lowering the benchmark deposit rate to 2.5% to counter economic slowdown and trade uncertainties. But the market wasn't too confident about the policy's effectiveness. The euro briefly strengthened against the dollar but soon dropped again, showing that investors aren't fully convinced by the ECB's easing measures. Global markets are still under the shadow of trade wars, while Europe struggles to find a balance between inflation pressures and loose monetary policy, keeping market volatility high.

The US stock market saw a choppy downtrend this week. The S&P 500 and Nasdaq fell for the third straight week, both losing over 3%, while the Dow dropped 2.37%. The Trump administration expanded its tariff policy further, announcing a 25% tariff on imports from Canada and Mexico and planning to raise tariffs on Chinese goods from 10% to 20%, sparking market fears. Concerns over a bigger hit to global supply chains grew, and investors adjusted their positions to prepare for potential market turmoil.

The market's focus shifted to upcoming economic data to assess the real state of the US economy. Fed Chair Jerome Powell's speech was a key event, and the nonfarm payroll data released on Mar 7 became a major driver of market sentiment. The report showed 151K new jobs in Feb, falling short of the 170K estimate, while the unemployment rate rose to 4.1%, signalling a cooling labour market. Though Powell said the economy still has some resilience and doesn't need a rate adjustment for now, concerns over slowing growth kept rising, adding to market uncertainty.

In terms of sector performance, energy stocks held up relatively well, supported by a small rebound in oil prices, slightly outperforming the broader market. However, tech stocks took another hit. Even though Broadcom posted strong Q2 guidance, lifting its stock and briefly boosting the chip sector, overall market sentiment remained weak. Financials were also under pressure, with Citigroup and JPMorgan falling as concerns grew over banks' future earnings potential.

Overall, the market remained in a correction phase this week, weighed down by policy uncertainty, weak economic data and volatile sentiment. Both the UK and US stock markets pulled back due to the trade war escalation and lower growth expectations, while European markets remained choppy, balancing between rate cuts and inflation pressures.

In the crypto market, volatility was just as intense this week. Last Sunday, BTC led an 8% rally across the crypto market after rumours spread that Trump would attend a White House crypto summit. However, this brief surge quickly faded, with BTC pulling back nearly 10% this week as global trade tensions worsened and Trump's tariff policy took effect. Some investors were puzzled, wondering why the market reacted so sharply when the Trump administration had reportedly included Bitcoin in the national strategic reserves. Some even speculated that BTC's drop was due to the market losing confidence in Trump's crypto reserve policy.

To understand the market logic, we first need to analyze what happened at the White House Crypto Summit. This was the first-ever official national-level meeting in US history to discuss crypto, marking a significant shift in the government's stance on digital assets. At the summit, Trump stressed that the federal government would support BTC and the entire crypto industry, saying the crackdown during Biden's administration was over. He also urged Congress to speed up legislation to provide a clearer regulatory framework for crypto and digital assets, ensuring the industry's compliance and growth.

The summit brought together about 30 senior government officials, members of Congress and business executives, including the Treasury Secretary, White House AI & Crypto Affairs Chief David Sacks and several well-known crypto founders, CEOs and investors. In the State Dining Room, they had deep discussions with the President and his team about the future of crypto and its role in the global financial system.

Notably, the day before the summit, Trump signed an executive order officially announcing the establishment of a strategic BTC reserve and promised that the federal government would not sell the 200K BTC it currently holds. This news was initially seen as a major boost for crypto. However, since the summit failed to release any concrete policy documents or provide clear assurances on whether and when the government would continue buying BTC, market expectations for a short-term rally quickly cooled. As the summit ended, BTC dropped about 3%, and other altcoins like XRP, ADA and SOL also faced selling pressure. Market sentiment shifted from optimism to a wait-and-see approach.

On a deeper level, while the summit didn't bring immediate bullish news, it did signal a complete shift in the US government's attitude toward crypto. For years, Trump was sceptical of crypto and even called BTC a "scam" that threatened the value of the US dollar. However, since last year's election campaign, Trump and his family members have become more involved in the crypto space, even launching a crypto lending platform called World Liberty Financial (WLF). This shift isn't random; it's driven by deeper economic and political considerations.

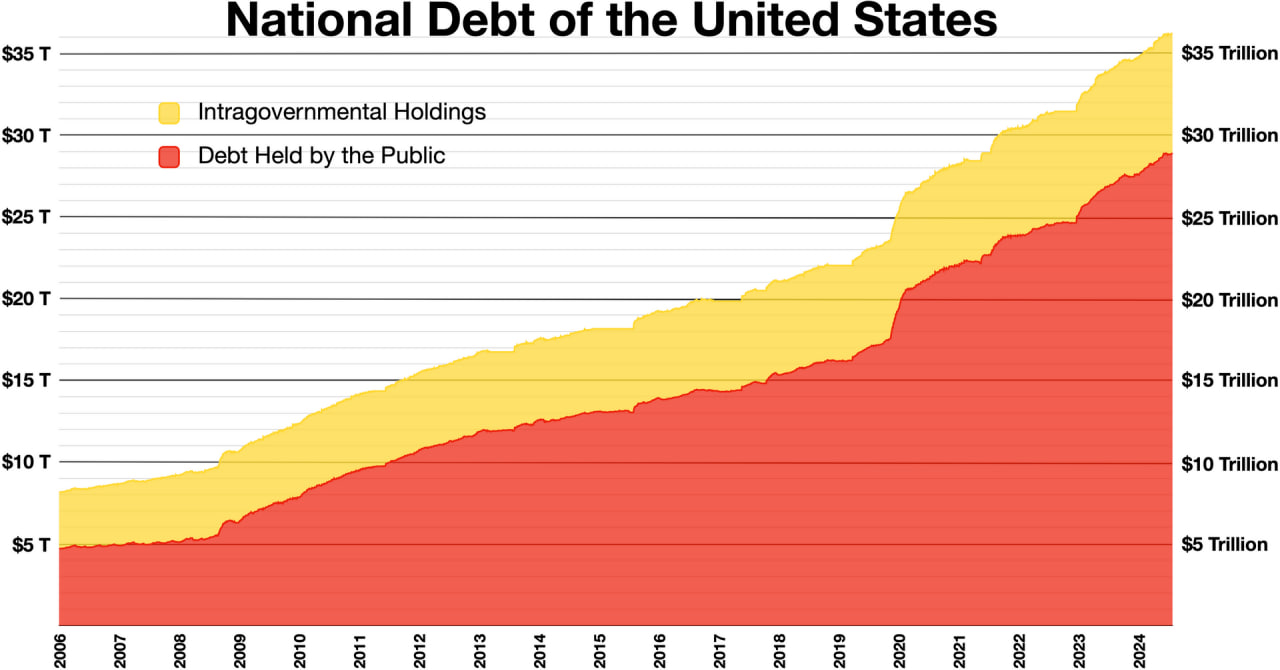

In fact, from a global financial perspective, adding BTC to the US strategic reserves isn't just about supporting crypto innovation. It's also a potential solution to the country's fiscal crisis. In recent years, the US government debt has skyrocketed. By 2024, the total US debt had reached $36T, with $29T held by the public and $7.4T held internally by the government. According to the Bureau of Economic Analysis, the US GDP in 2024 was about $29.5T, meaning public debt now exceeds a full year of GDP, making repayment nearly impossible.

If the US government chooses to default, it will directly shake the global trust in the dollar, which could trigger a systemic financial crisis. However, adding crypto to national reserves might offer a brand-new solution for the US government. More and more institutions and "whale" investors believe the US might use BTC as a financial adjustment tool to hedge against dollar credit risk and release liquidity through the crypto market when needed. In other words, the US government's strategic move is actually bringing BTC and other digital assets into the dollar system, making them part of the dollar's credit system rather than just independent investments.

On the surface, the Trump administration's push for crypto industry growth and its call for other countries to join in seem to promote the globalization of crypto. However, from a broader perspective, this move looks more like a strategic setup for the US financial system. By adding BTC to national reserves, crypto officially enters the sovereign financial system, putting it alongside fiat currency and gold in the future global financial landscape. This not only gives BTC higher legitimacy but also allows the US government to have stronger control over the market's liquidity, using it for its own financial strategies and even gaining an upper hand in global financial competition.

However, economic policies are always about battles for interest. At the end of the day, every policy decision is about redistributing wealth and reshaping interest structures. For example, the UK, the EU, and some other countries haven't publicly supported crypto like the US, and some traditional banks are even strongly against it. The main reason is that these governments don't hold a large amount of BTC. If the UK government held over 10% of its reserves in BTC, things could be completely different. Imagine if the UK had a massive BTC stash; they would likely use it to handle debt problems and push supportive policies to stay competitive in the next financial shift. That's the essence of interest-driven decisions, and every market move comes from the capital behind it, not just market demand or policy direction.

At present, the US government publicly acknowledges holding approximately 200,000 BTC, which accounts for roughly 1% of the total BTC supply. Given the scale of their holdings, this amount is insufficient to drive BTC prices upward significantly at this stage, which explains why BTC has not experienced a sustained short-term rally.

Of course, this reported figure does not represent the entirety of the US government's reserves, and we cannot overlook undisclosed holdings distributed across various institutions and private funds. However, regardless of the specifics, blockchain data indicates that the US government's current holdings remain below 10%, suggesting they have yet to reach their actual target.

Meanwhile, the global economy is going through a deep structural shift, and the US economy is showing signs of weakness. Over the past five years, global growth has slowed, US manufacturing has declined sharply, the fiscal deficit has continued expanding, and government debt has exceeded $36T, with $29T held by the public. If the US government doesn't take action, it will struggle to maintain the dollar's international credit system. More importantly, over 40 of the 50 US states have already started stockpiling gold and other hard assets to strengthen their economic stability. In this era of rapid digital economy and AI growth, as of Mar 2025, at least 20 states have officially proposed legislation to add BTC to their reserves, with some planning to invest 10% of public funds in BTC and other digital assets.

Take Arizona as an example. Its Public Safety Personnel Retirement System (PSPRS) manages over $20B in assets. If the state's legislative proposal gets approved, it could invest up to $2B in BTC, which is about 20K BTC. If all proposals go through, US state governments could invest over $23B in BTC, making up 5.9% of BTC's circulating supply. This move would profoundly impact the entire crypto market and signal that the US government's BTC strategy is becoming more systematic.

In this context, the US government is no longer just a passive market player. It has become a core "whale" in the crypto market. What does a $23B potential buy order mean? Without a doubt, the US government is taking control of this market. However, market prices don't move based on simple supply and demand. When capital power is strong enough, national and institutional strategies become much more complex. Adding BTC to national reserves doesn't mean its price will skyrocket in the short term. On the contrary, as governments and major financial groups get more involved, BTC's strategic role keeps rising, and its price movements are becoming more complicated.

But no matter how complex the market gets, we only need to understand major interest groups' short-term and long-term motives to predict where things are heading accurately. Capital always chases profit. Whether it's long-term strategic holdings or short-term policy adjustments, everything comes down to one core logic: how to maximize returns. In other words, the US government wants to accumulate as much BTC as possible at the lowest cost so it can have greater control over the future financial system.

Now, imagine you're the US government with $23B to spend; your goal is to buy as much BTC as possible. Would you enter at $100K per BTC or wait for a pullback to $80K or lower? The answer is obvious. Government capital always aims to push prices down first to secure more at better prices. That's why BTC saw a strong rally before Trump officially took office, with heavy buying between $55K and $75K. This recent pullback is likely the result of the US government's initial accumulation phase. Now, with Trump speeding up the push to make the US a crypto financial hub and officially bringing BTC into national reserves, the second round of government accumulation has already begun.

To acquire more BTC at lower prices, the US government could employ various tactics to induce short-term market panic and drive prices down. One method involves leveraging tariff policies to generate global economic uncertainty, prompting investors to offload BTC out of fear. Another approach is market manipulation through its own BTC reserves, creating artificial selling pressure. By transferring BTC between its own entities—essentially staging a sell-off—the government could give the impression of significant selling activity, leading to a price decline. This strategy would not only allow it to accumulate BTC at lower prices but also grant it a degree of market influence by shaping investor sentiment.

Some students might wonder: if we follow this logic, wouldn’t a bigger drop in BTC prices actually benefit the US government even more? Could we even see a major crash? At its core, every currency system relies on trust. Market stability depends on how much people believe in its value. Take gold, for example; it has held its status as a safe-haven asset for a long time because governments and institutions worldwide recognize its reserve value. If the world dumped gold all at once, its value would crash.

The same goes for the US dollar. As a fiat currency, its value depends on the US government’s credibility. The market’s trust in the dollar is what keeps it circulating. BTC, on the other hand, is not only scarce but also decentralized, giving it unique technological advantages over traditional fiat money. Since the US government has already publicly backed BTC and added it to its strategic reserves, there’s no way they’d let its credibility collapse. Instead, they’ll use market corrections as a chance to transform BTC into a key part of their financial strategy.

Also, even if the US government controls the market, it won’t let BTC prices drop below its own entry cost. This is just how power shifts between old and new financial groups. A state government might want to buy BTC at lower prices, but that doesn’t mean they want other states already holding BTC to take losses. In other words, even in a major market dip, the US government won’t let BTC fall below their first large-scale accumulation price. So, even if there’s short-term pressure, this range remains the best entry point for long-term investors. That’s exactly why we pointed out last year that $75K is the ideal price for long-term positioning.

From a big-picture strategy, the US government’s goal isn’t to pump BTC in the short term; it’s to gain control in the future global financial system reset. Short-term volatility is just part of their plan. More importantly, as technology advances and AI and digital economies rise rapidly, the process of digitizing global assets is speeding up. Changes in tariff policies and the US government’s official recognition of BTC as a strategic reserve asset are key factors driving global economic transformation and wealth redistribution.

Over the past 70 years, the US has linked gold and oil to the dollar, building its global financial dominance and using the dollar’s control to strengthen its economic power. Now, as the US government starts adding Crypto to its national reserves, it signals a major shift in global asset allocation. With the rise of the digital economy, digital assets will take up a growing share of the global financial system. This isn’t just a natural market evolution; it’s a sign of a strategic shift at the national level.

In the future, more and more assets will be converted into digital assets. This is not only a global economic trend but also an inevitable result of technological progress. For example, stock market assets are moving into digital assets, and many tech companies are now holding BTC as part of their reserves. Some multinational corporations have even started using Crypto for trade settlements and employee salaries. Additionally, an increasing number of tech firms and startups are moving away from traditional stock market IPOs and opting for token offerings (ICOs) or other forms of digital asset financing. In the US, both methods are already legally recognized, but compared to stock financing, digital asset financing offers greater liquidity and supports a more decentralized market.

In the short term, the Crypto market may face regulation and intervention from institutions and governments, leading to price swings. However, in the long run, the White House Summit has laid a solid foundation for Crypto’s future. This is not only a historic moment where BTC is officially recognized by national-level capital but also the best buying opportunity for investors. Missing this market correction could mean losing out on the golden window of this financial transformation.

At this key turning point in history, we must recognise that technology is reshaping traditional economic models, and capital flows will determine the future market leaders. Our Financial Academy is committed to helping students navigate complex market environments and find the best investment strategies. That’s why we’ve launched the Partner Investment Plan to help more students seize this market shift and achieve financial growth.

We don’t just aim to help students make stable profits in the market. We want to build deep partnerships with them to create the next generation of financial groups in the digital economy era. The reshaping of the economic landscape is changing how wealth is distributed, and only those who position themselves at the top of the trend will gain an edge in the wealth cycle. This is not only the core goal of every student but also the ultimate vision of the Partner Investment Plan. We hope all students take this plan as a starting point to grasp this global economic shift and embark on a new journey toward financial freedom.

As the Partner Investment Plan continues to grow, members of the trading teams are seeing steady profit increases, and the foundation of the “Millionaire Incubation Base” is taking shape. High-level team members, in particular, have not only expanded their capital significantly, but the overall capital concentration advantage of our teams has made our trading strategies far superior to those of regular market groups. More importantly, with the support of the quantitative trading system, our trading accuracy and win rate have greatly improved, allowing us to execute scientific strategies and achieve steady profits. Now, the core competitiveness of the Partner Investment Plan has surpassed most market-driven institutions. We are not just market participants; we are market creators.

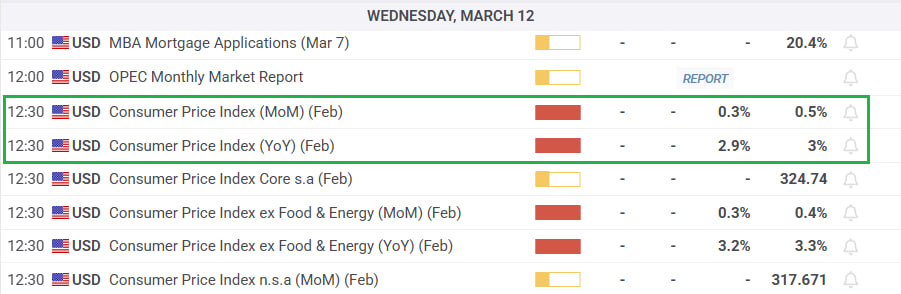

The next two weeks will mark the peak of this economic shift. On the one hand, US tariff policies will take full effect in early Apr, and we are now just half a month away from their official implementation. This week, the US has already launched a new round of tariffs on Canada, Mexico, and China, and next week, an even denser wave of policy actions is expected. Market sentiment will further react during this period, driving larger price movements. On the other hand, next week is also a critical moment for US monetary policy. The Federal Reserve will release the CPI data next Wednesday, which not only reflects the state of the US economy but is also the key factor in shaping interest rate decisions. Over the past few months, US inflation data has been highly volatile, and this report will directly impact market pricing for a potential Fed rate cut in Jun. No matter the outcome, the release will trigger major short-term market fluctuations, and we aim to seize these trading opportunities to maximize profits.

This week’s Non-Farm Payrolls (NFP) market moves have already generated significant profits for Tier 5 and above team members, proving the profitability of the “Whale” Plan. To further expand our success and allow more students to enjoy stable profits, next week’s strategy will focus entirely on the “Whale” Profit Plan. We will leverage our capital concentration advantage, combine it with economic data volatility and precisely track market sentiment shifts to ensure our funds enter the market at the most optimal moments for maximum returns.

The key target of the “Whale” Plan is next Wednesday’s US CPI data release. Economic data releases often cause extreme market swings, and our capital concentration advantage allows us to navigate these moves easily, executing precise trades to capture easy profits.

That’s all for tonight’s session. Today, we focused on analysing the current economic transition period and the wealth shift driven by the U.S. government. It is now clear that the U.S. government has passed legislation to include cryptocurrency in its national strategic reserves. In the short term, they are pushing market adjustments to acquire assets at lower prices. However, this presents a prime investment opportunity for regular investors in the long run. As we have emphasised many times, every market fluctuation is a process of wealth redistribution. The key to profit is not how the market moves but whether we position ourselves on the right trend.

To fully take advantage of this golden window created by the U.S. wealth transition, we will officially launch the “Whale” Profit Plan next week. With capital concentration advantages, precise quantitative trading, and global economic policy support, our goal is not just short-term gains but identifying long-term growth opportunities in market fluctuations. No matter how the market moves, our strategies are designed to find predictable profit opportunities and ensure steady capital growth.

All members, whether in the advanced trading team or the preparation phase, can take part in this major opportunity. Large capital members can be positioned early to secure the best profits at the start of market moves. Smaller capital members can use the momentum created by the “Whale” plan to enter at key moments and maximise returns. Most importantly, our strategies are not based on short-term speculation but on global economic cycles and institutional fund flows, allowing every participant to build a strong market foundation and achieve real financial growth.

Opportunities belong to those who are prepared and take action. The market waits for no one—especially in times of major transformation. Every trade could be a key step towards reshaping your financial future. Next week’s CPI market event will be one of the biggest trading opportunities of the year and an excellent chance to double capital. Our funds are ready to deploy, waiting for the perfect moment to strike. I hope all members seize this wealth-building opportunity and create their own success stories in this market shift!