Seizing the Future: Navigating the Economic Transformation with AI, Digital Assets, and Strategic Investments

Hello, everyone at Diamond Ridge Financial Academy!

I’m Charles Hanover, and I’m excited to be here with you again. In today’s uncertain market, it’s not just about timing our investments right—we also need solid strategies to stay profitable despite the volatility. Over the past week, Trump’s policies have once again shaken global markets, but thanks to our quantitative trading system and trend-based strategies, we successfully avoided risks and made great returns.

To help all our members stay ahead and maximise profits while building a strong investment system, we’re officially launching a brand-new trading model—the Partner Profit Programme. This programme is backed by the academy, ensuring capital security while also offering personalised trading guidance to help you maximise your returns. As of tonight, every participant in the programme has already earned at least 63% returns, even at the lowest rate. Later this evening, I’ll review this past week’s market trends and break down the major trading opportunities coming up as we enter a super data week alongside a global economic shift. Our goal? To help every partner achieve 100% to 350% steady profits in the coming week.

The UK stock market gained 1.74% this week but overall, it’s still under pressure. The short-term rebound was mostly driven by individual stock news rather than real economic improvement. Looking at the bigger picture, the UK’s economy is slowing down, companies are cutting jobs at the fastest pace since the pandemic, hiring demand is at record lows, manufacturing has been shrinking for months, business confidence is weak and consumer spending keeps declining. On top of that, the upcoming Apr hike in national insurance and minimum wage is pushing businesses to raise prices ahead of time, further fueling inflation. This is delaying rate-cut expectations from the Bank of England and increasing market uncertainty.

While defence spending boosted military stocks and rising commodity prices gave mining and banking stocks a short-lived lift, these gains were mostly driven by market sentiment and aren’t likely to last. On top of that, global trade tensions are worsening—Trump has announced a 25% tariff hike on goods from Mexico, Canada, and China, starting 4th March, increasing risk aversion in the market. Investors are rushing towards safe-haven assets, the British pound is under pressure, and overall market confidence has taken a hit.

Looking ahead, the UK stock market still faces weak fundamentals, growing policy uncertainty, and high inflation. The recent rebound could just be a technical correction, and there’s a real chance the market could dip again.

The US stock market remained under pressure this week. The Dow Jones edged up 0.95%, but the S&P 500 dropped 0.97%, and the Nasdaq plunged 3.38% as tech stocks faced heavy sell-offs. Market risks are clearly rising due to slowing global growth, Trump’s tariff policies, and uncertainty surrounding the Fed’s monetary policy. This has pushed the market into a highly volatile phase, with money flowing out of risk assets at a faster pace.

Economic data was weak. The February PMI dropped to 50.4, with the services index falling below the expansion line, signalling a clear slowdown in economic growth. Housing starts in January plunged 9.8%, and both retail sales and consumer confidence came in below expectations, adding to fears of an economic slowdown. At the same time, the Trump administration is set to impose a 25% tariff on imported cars starting 2nd April, further fuelling risk-off sentiment. Investors are becoming increasingly cautious about corporate earnings and economic growth prospects.

Tech stocks took the hardest hit this week, wiping out nearly all of the Nasdaq’s gains from earlier this year. Nvidia spiked intraday but pulled back, Tesla continued to slide after a major shareholder warned it could drop another 50%, and Microsoft scaled back AI-related investments, causing the market to reassess the growth potential of high-valuation tech stocks. Meanwhile, a Bank of America report showed that money is rapidly moving from high-risk assets to defensive sectors, reflecting rising risk aversion.

One major red flag came from Jeremy Grantham, a well-known value investor, who issued a serious market bubble warning. He believes that US stocks are in a “super bubble,” with valuations even higher than in 1929 and 2021, and second only to Japan’s 1989 stock market bubble. His model suggests that the market still has a 50% downside before returning to normal valuation levels. He also warned that inflation, trade wars, and liquidity concerns will make the correction even worse, urging investors to prepare for a major market pullback.

This week’s market performance once again confirmed our judgement—the short-term rebound in US stocks was just a capital reflow, not a trend reversal. As global economic uncertainty intensifies, market fragility is becoming more evident. Institutional investors’ risk appetite has dropped significantly, and bearish sentiment among retail investors has hit its highest level since 2023. In this situation, we remain cautious, focusing on selling stocks and making precise moves at key moments of market volatility.

Since last Monday, I’ve repeatedly emphasised that the market’s rise is just a temporary correction, not a trend shift. Stock valuations have already strayed far from economic fundamentals. The global market is at a key transition period, and structural adjustments have only just begun. In particular, with rapid advancements in tech, emerging fields like AI, blockchain, and the digital economy are rising fast, while lagging companies in traditional industries are gradually being eliminated.

We need to understand that technological progress always brings industry transformation. At its core, this transformation is about capital redistribution. Companies that can’t keep up with the times will eventually be ruthlessly wiped out by the market. Capital will leave these sectors and flow into areas with greater growth potential. So, under the current market conditions, any stock market rebound should be seen as a selling opportunity, not a signal to buy more.

The rise of the tech industry isn’t just about sector growth—it’s a fundamental shift in how society operates. The combination of AI and big data is accelerating the adoption of autonomous driving, IoT, and smart homes. With blockchain in the mix, data security and privacy protection have reached new heights. As self-driving technology matures, the transportation industry will be directly impacted, and driver jobs will be replaced by automation. The spread of IoT will make life smarter, completely disrupting the business models of traditional home appliances, communications, and security industries. These trends not only represent human progress but also mean that many traditional business models will lose their competitive edge. Companies relying on outdated models may disappear in the coming years, making their assets and stocks worthless.

Many people still don’t fully grasp these market changes. Some even hope that traditional industries can maintain stable growth. But if we look at history, we’ll see that technological shifts happen much faster than most people expect. Take Nokia, for example. In 2000, it was the king of the mobile phone market, holding over 30% of global market share. But with the rise of smartphones and mobile internet, its dominance was quickly overtaken by Apple and Samsung.

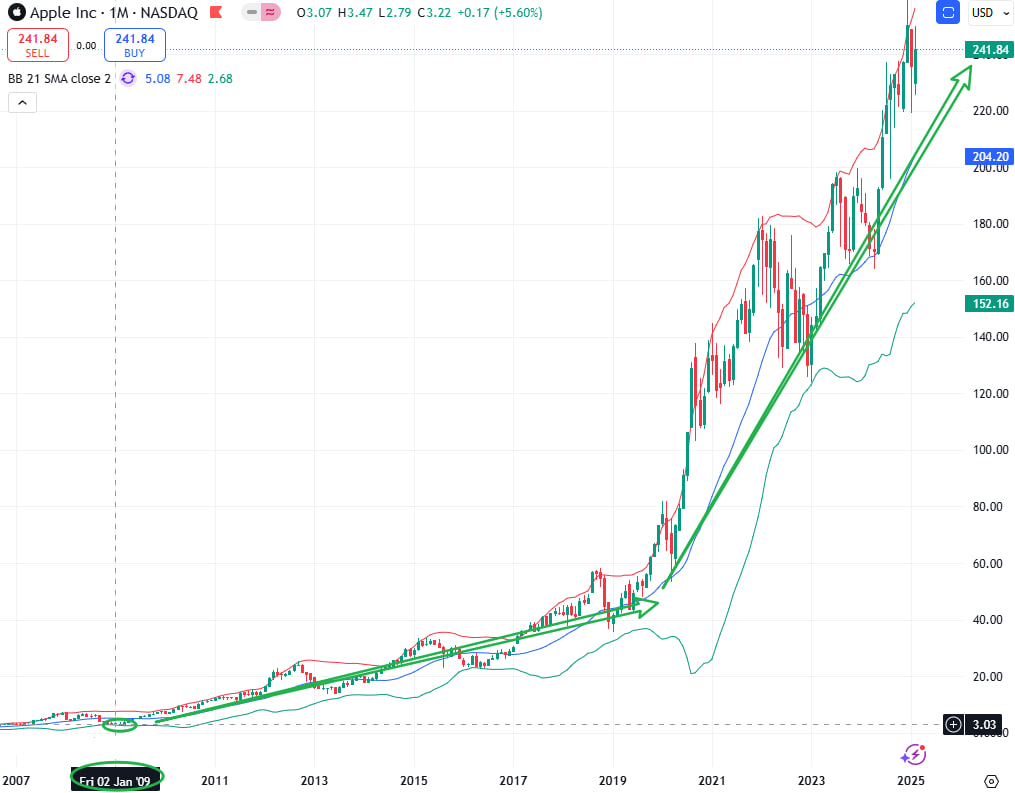

By 2020, Nokia’s market share had shrunk to less than 3%, while Apple and Samsung together accounted for over 30% of global sales. The key difference was that Apple didn’t just make money from selling phones—it upgraded its business model through internet services, data, and an ecosystem that increased user stickiness. As a result, Apple’s stock price grew tenfold over the past decade.

Looking back at Nokia, it wasn’t eliminated because the market suddenly collapsed. It failed because it missed the internet revolution and didn’t adjust its strategy in time. In contrast, Apple seized the tech revolution, combining mobile internet, big data, and smart hardware to create a brand-new business model. This led to massive success in the market.

Reviewing Apple’s growth journey, we can see that even during financial crises, its stock price experienced short-term drops. But every pullback eventually became the best buying opportunity (as shown in the chart above). This case clearly demonstrates that when an industry is undergoing a transformation, it’s often the best time to invest. As long as we plan ahead, we can reap huge returns in the next wave of technological innovation.

The market is all about redistributing resources, and technological progress is the driving force behind this shift. Today, emerging fields like AI, cloud computing, blockchain, and biotech are attracting global capital, while traditional industries are being pushed to the sidelines. This means the biggest gainers in the future may not be today’s market giants, but rather small companies that are just starting out yet hold key technologies.

Take NVIDIA, for example. Back in 2000, it was just a little-known company that few people paid attention to. But with breakthroughs in chip technology and the rise of AI and big data, NVIDIA’s GPUs became widely used in AI computing, self-driving cars, and high-performance computing. Its market value grew from under $1 billion back then to $3 trillion today, making it the dominant player in the global semiconductor industry.

From this perspective, today’s market correction isn’t just short-term volatility—it’s a major reshuffling of global capital. Every big market adjustment reflects shifts in capital flow. Overinflated traditional industries are being replaced by emerging sectors, and capital is constantly seeking new growth opportunities. This means our investment strategy must shift from passively reacting to market swings to actively positioning for the future. Holding on to traditional industry assets blindly will only make investors miss real wealth opportunities in this economic transition.

So, instead of guessing short-term market moves, we need to accurately identify which industries and companies will take the lead in this transformation. We must position ourselves in these emerging assets ahead of time, rather than clinging to traditional assets that are on their way out.

The essence of the tech revolution is that new technology keeps advancing, replacing old models. For investors, it’s not just about product upgrades—it’s even more about the asset shifts behind these products. A company's core value lies in integrating resources to produce what society needs, creating value growth. And the essence of investing is to position in assets that can keep generating greater market demand and profit from their value appreciation. These assets can be traditional publicly traded stocks or emerging crypto projects. Whether it’s the stock market or the digital economy, the core investment logic is the same: find high-growth industries and assets, and invest before the market fully prices them in.

Looking back at history, every tech revolution has brought massive investment opportunities. The last industrial revolution led to the rise of traditional manufacturing, while the internet revolution triggered explosive growth in IT. In this revolution, Apple is a classic example. It successfully transformed from a traditional electronics manufacturer into an internet tech company, skyrocketing its market value tenfold in a short time. Similarly, NVIDIA started as just another chipmaker, but with the rise of the internet and AI, its market value surged 100x in just a decade.

That’s why in today’s investment strategy, we should focus not only on tech stocks that have dropped sharply during this economic transition but also on emerging tech firms and newly listed token projects.

AQS is a prime example. It’s not just a key AI industry project—it also keeps evolving with the digital economy, staying at the forefront of the industry. In the long run, AQS has strong growth potential. And in the short term, its quantitative trading system is about to be upgraded, which will not only drive a short-term price surge but also open the door for long-term growth. This is exactly why we included AQS in our portfolio investment strategy under the Partner Profit Programme. It aligns with the direction of the tech revolution and follows market capital flow trends, providing investors with long-term, steady value growth opportunities.

The true essence of investing lies in understanding how technological revolutions and advancements shape future wealth trends. Right now, Trump’s global tariff policies are accelerating the shift between old and new assets. The global supply chain is undergoing a major restructuring, and the redistribution of industrial profits is putting traditional businesses and financial systems under significant pressure. Market trends are irreversible, which means that traditional stocks are assets we must gradually reduce or even sell off. In contrast, we should actively invest in future-focused tech assets, especially those at the intersection of artificial intelligence, digital economies, and blockchain technology.

The market has already sent clear signals. While tech assets, including crypto, have also experienced pullbacks in this economic transition, they have shown far greater resilience than traditional stocks. Whether in terms of correction depth or rebound strength, digital assets are proving increasingly robust. More importantly, institutional investors are recognising future industrial trends and taking advantage of this transition period to buy digital assets at lower prices. This shift indicates that capital is actively realigning investment strategies in preparation for the next technological revolution—something we must focus on when making investment decisions.

Over the past two weeks, our trading strategies have fully demonstrated this investment logic. Through in-depth analysis of economic cycles and market data, we not only avoided the sharp downturn in the stock market in advance but also launched the Partner Investment Plan during this period of economic turbulence. The core purpose of this plan is to help investors manage risk more effectively while maximising returns. Amidst global market volatility, the Partner Plan has not only helped participants avoid significant losses but has also enabled them to enter the right markets at the right time, achieving steady and sustainable profits through a well-structured investment strategy.

Through the past two weeks of learning, we have gained a clearer understanding of how global economic cycles operate. At present, inflation remains high worldwide, and the five-year post-pandemic economic recovery period has just ended. The market has now entered a new phase of economic and monetary flow. Trump’s global trade tariff policies are further accelerating the transformation of the global economy.

Looking at the current US economic policies, the full implementation of this policy cycle is expected around early April. This means that the window for global economic transition remains open for about another month. Tariffs are only the beginning—we anticipate further key policies to be introduced, such as tax adjustments, changes in monetary policy, and government support for emerging industries. These policies will drive a new wave of global wealth redistribution, and we are positioned right at the heart of this transformation.

Capital naturally flows—it does not create or disappear out of thin air but instead redistributes itself in alignment with industrial revolutions. In the long run, capital always prioritises industries that align with technological advancements, while in the short term, government policies influence where money moves. By accurately identifying the key trends in the tech revolution and analysing economic policies from the US, the EU, and the UK, we can pinpoint the best investment opportunities and achieve steady compound growth.

Based on this understanding, our Partner Investment Plan offers participants a safety net for investment returns. This is not an empty promise but a scientific investment strategy tailored to the current market environment. Against the backdrop of global economic transition, we have positioned ourselves ahead of the curve, acquiring cryptocurrency spot assets at low prices while using our quantitative trading system to hedge risks through contract trading. This strategy maximises capital efficiency while controlling risk, ensuring that we capitalise on market volatility to generate the highest possible returns. Market corrections always present significant opportunities, and those who strategically position themselves during this phase will earn returns far exceeding the market average.

Next week marks a golden period for trading, as we enter a super data week. This means not only a surge in global policy changes but also the release of major economic data that will have a direct impact on the markets. First, the first week of March will see an intense wave of tariff and economic policy adjustments, where even the smallest policy shift could create major market movements. Additionally, a series of critical economic reports will be released, influencing growth forecasts, monetary policy shifts, and market liquidity. With both policy changes and economic data overlapping, next week’s market volatility will significantly increase, providing us with a profit potential ranging from 100% to 350%.

Key Economic Data for Next Week:

Monday: UK February Manufacturing PMI (final), US February ISM Manufacturing PMI

Wednesday: US February ADP Employment Change, US February S&P Global Services PMI (final)

Thursday: Eurozone ECB Deposit Facility Rate (March 6), US Weekly Initial Jobless Claims (March 1)

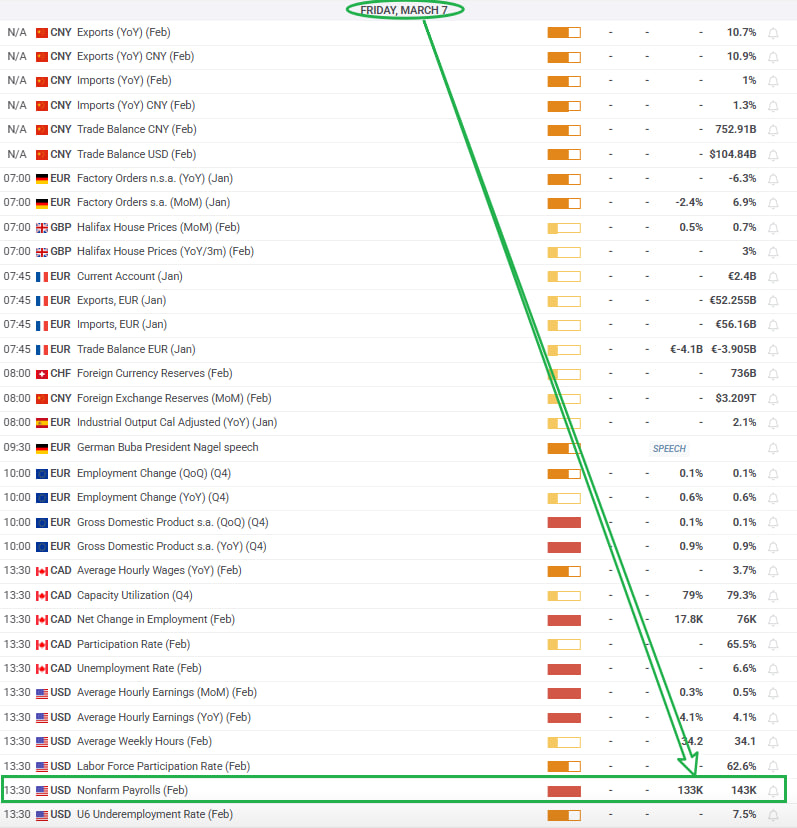

Friday: US February Unemployment Rate, US February Non-Farm Payrolls (NFP)

The Non-Farm Payroll (NFP) report on Friday is of utmost significance, as it is a key indicator of the US economy’s health and will influence the Federal Reserve’s future monetary policy decisions. Historically, when NFP data deviates significantly from market expectations, we see strong market volatility—a prime opportunity for profitable trades within our strategy.

Given the current market trends, we anticipate that the upcoming NFP release could yield over 800% returns on a single trade. This presents a unique wealth-building opportunity, particularly for those with smaller capital. Next week’s market conditions could allow participants to quickly generate substantial profits, leveraging market fluctuations for compounding effects that boost capital growth and enhance future trading potential.

Final Thoughts for Tonight’s Session:

In this discussion, I have focused on the global shift in asset allocation and why making the right investment decisions during economic transitions is crucial. The market never stops evolving, and technological advancements are rapidly replacing traditional industries. If investors fail to let go of outdated assets, their wealth—just like Nokia’s once-dominant mobile phones- will gradually disappear in market competition.

However, those who embrace technological change and position themselves in digital assets will not only protect their wealth from inflation and market downturns but will also seize this global transformation to achieve exponential financial growth.

I hope tonight’s discussion encourages you to reassess your investment strategies—not just to preserve your current lifestyle but to ensure you enjoy an even higher quality of life in the future.

The Global Economy is at a Turning Point—Next Week is a Golden Opportunity for Wealth Redistribution! With global policy shifts and key economic data releases driving major market movements, next week presents a prime moment for wealth migration. These combined forces will not only set new trends in the spot market but also create unprecedented volatility, offering exceptional profit opportunities in contract trading.

The opportunity is right in front of you—the key question is: are you ready to act decisively and seize this moment of financial growth? Backed by our analyst team’s expert strategies and a world-class quantitative trading system, our Partner Investment Plan is fully prepared to capitalise on this market cycle. Every participant will have the chance to secure profits and confidently ride the trend.

Markets Wait for No One—Wealth Belongs to Those Who Take Action!

This week could be a pivotal moment for your future wealth. The best time to act is now to join our Partner Investment Plan, trade alongside us, and leverage this economic shift to accelerate your financial success.