Mastering Market Volatility: Strategic Quantitative Trading and Wealth Expansion in a Global Economic Shift

Hello, outstanding students of Diamond Ridge Financial Academy!

I’m Charles Hanover, and I’m excited to explore the world of quantitative trading with you. In today’s highly volatile market, quantitative trading is not just an efficient investment tool—it’s a whole new way of thinking that helps capture opportunities, optimise returns, and manage risk.

Tonight, we will analyse recent trading strategies based on market trends and discuss how to seize key opportunities in next week’s big data week through the Partner Profit Programme.

Today, the UK stock market experienced fluctuations. Although it rebounded in the afternoon and closed higher, overall uncertainty remains high, and the sustainability of the rebound is questionable. The FTSE 100 Index fell in early trading, impacted by Wall Street weakness, a decline in the mining sector, and a drop in Scottish Mortgage Investment Trust. While strong performances from stocks like IAG, IMI, and Rolls-Royce helped the index recover, the market still lacks strong momentum. This rise mainly came from individual stock news rather than economic fundamentals, highlighting ongoing structural issues. Investors should stay cautious about short-term market swings.

Recent data has been strong in the property market, but this rise is largely driven by expectations of a stamp duty increase, making it more of a short-term boost rather than a lasting trend. The surge in housing prices looks more like a “final rally” before policy adjustments. The real challenge remains inflation, interest rates, and future policy directions. Additionally, global trade uncertainty continues. Trump’s tariff policies are causing market anxiety, with European stocks falling in early trading. Both the German DAX Index and French CAC Index pulled back, reflecting how trade tensions are weighing on market confidence.

The US stock market also showed mixed movements today. The Dow Jones rose at one point, but overall market sentiment remains cautious. The latest PCE data met expectations, showing slight inflation cooling, but it did not change the Fed’s policy stance. Fed officials remain hawkish, emphasising the need for “patience” and not signalling any rate cuts soon, once again dampening market expectations for easing. With ongoing policy uncertainty, investors are becoming more cautious in a high-interest-rate environment, reducing the appeal of risk assets.

Meanwhile, Trump’s tariff policies are a major market concern. He insists on imposing a 25% tariff on Mexican and Canadian goods starting 4 March, plans to add a 10% tariff on Chinese imports, and has even hinted at additional fees on EU goods. These moves are increasing market risk aversion, leading to sell-offs in high-risk assets. Investors are worried that a trade war could slow down the economy.

Overall, US stocks remain in a downward trend. The Nasdaq has dropped 8%, marking its worst monthly decline since last September. The market lacks clear direction, with negative trade war news piling up and economic data instability. Short-term rebounds are limited, and the overall trend remains weak.

The recent extreme market swings have caused a clear divide among investors. This isn't just a short-term market correction; it's an inevitable trend driven by the global economic shift. In such a complex market environment, different investors have made completely different decisions, leading to completely different results.

Many investors still don't realize that this market crisis is far from over. They are holding on to false hope, believing this downturn is just another short-term pullback like before and that the market will eventually bounce back. Because of this, they kept buying more during sharp declines instead of selling, causing their losses to grow even larger. However, that's not the case. This is not a typical technical correction but a systemic crisis triggered by intensifying global economic conflicts and rising trade barriers. In reality, this market turmoil marks the beginning of a massive global wealth shift.

Over the past six trading days, the US stock market has fallen more than it did during the same period in the last two major financial crises of the past 30 years. Individual stocks have dropped even more, spreading fear across the market. Data shows that in the past two weeks, the average loss for global active stock accounts has exceeded 30%, and investors who trade more frequently have suffered even greater losses. This data clearly signals an economic crisis, with the market undergoing a violent adjustment. If fear continues to rise, a full-blown market crash will be unavoidable, potentially triggering a new financial crisis. Based on the history of the 2000 and 2008 financial crises, the market could drop over 45%, and this may just be the beginning.

Market volatility has created winners and losers. Investors who held on to stocks without cutting losses are now facing over 30% in paper losses, with losses still increasing. Meanwhile, those who adjusted their positions early and sold their stocks avoided the market storm and even saw their assets grow during the chaos. In fact, as early as last Monday, we repeatedly advised everyone to sell stocks, clearly stating, "Sell big on big rallies, sell small on small rallies" to reduce risk. Looking back now, those who followed this advice have avoided at least 30% in losses.

Not only that, some members sold their stocks and immediately joined this week's Partner Investment Plan, quickly earning significant profits. As of today, the lowest return for those in the Partner Profit Plan has reached 47%, while some have even doubled their gains. This means that the wealth gap between investors still holding losing stocks and those who adjusted their positions early and seized new opportunities has widened by at least 80%, with some seeing wealth growth of over 170%. This is the huge difference that comes from making the right choices. Market opportunities are never equally distributed. Only those who can see the trend and act decisively can truly benefit from market swings.

Investing is just like life; direction matters more than effort. If you go in the wrong direction, not only will your hard work be wasted, but you could also suffer even greater losses. It's like someone leaving Manchester, wanting to get to London as fast as possible. If they head north instead, no matter how hard they try, they'll only get farther away from their goal. However, once the direction is right, the key is to improve efficiency and reach the destination in the shortest time. The fastest way to get there is to choose the best way to travel, like driving to catch a flight instead of taking a muddy mountain road. For those with enough resources, taking a private jet would be an even quicker option.

Consider today's PCE data trading as an example. Many members might not even know exactly what the PCE Price Index is, but that didn't stop them from making a profit. The core of the market lies in understanding trends and sentiment, and it's the professional trading strategies that provide the reassurance for members to make the best decisions at key moments. All they need to do is prepare in advance and follow the analyst's strategy.

For example, before today's PCE data release, our analyst team had already developed a precise trading strategy based on market sentiment and technical signals. Tier 3 and above members, with relatively more capital, positioned themselves early. When the market volatility surged after the PCE data came out, their profits easily exceeded 250%. This wasn't luck; it was the result of scientific market analysis and precise trade execution.

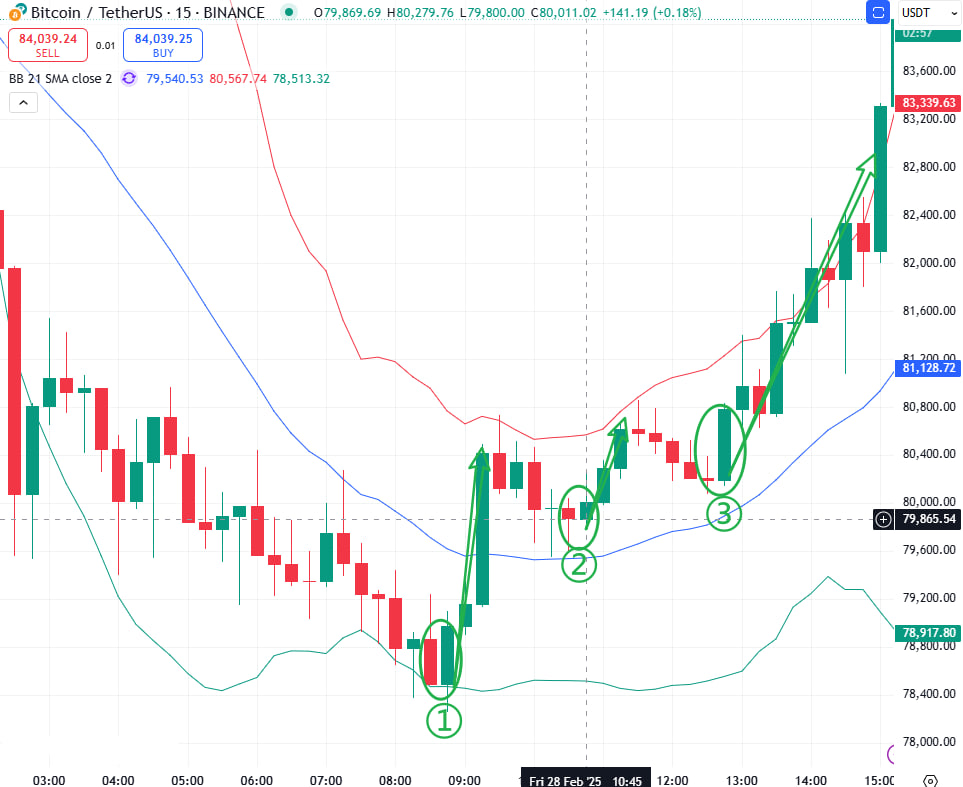

We use a multi-currency portfolio trading model. Take BTC as an example; we accurately captured the market’s turning point. Looking back at the technical trends, we used the BOLL technical indicator before the PCE data was released to spot a clear buy signal. When BTC formed a green candle engulfing a red candle near the lower BOLL band (see Image ①), its downtrend pattern had already ended. Then, when the market pulled back to the middle BOLL band, another green candle engulfed a red candle (see Image ②), further confirming the rebound trend.

At the same time, the three BOLL lines turned upward, and BTC’s price found support near the middle band before making a strong rebound (see Image ③). This was the perfect time to add to our positions and keep them in line with the trend. Considering the market impact of the PCE data, we further increased our positions, ultimately achieving over 250% in profits.

This trading strategy perfectly combines quantitative trading systems with market trend analysis. It not only helped us reduce trading risks but also maximized our profits. In a highly volatile market, trend-following trading is always the safest and most stable way to make money. By using precise trading signals, scientific position management, and trend-following strategies, we successfully took advantage of market swings and achieved exponential profit growth.

Investing is not just a subject to study; it’s something you need to practice. The goal of teaching members about investing is not to turn everyone into independent traders but to give them a basic understanding of the market so they can make the right decisions at critical moments. If you lack experience, working with a professional team is the smartest choice.

Past market cases have already proven that our analyst team has the ability to make accurate market predictions. From recommending Tesla, Rolls-Royce, and INOD stocks earlier, leading to huge profits, to recently advising members to sell stocks and avoid market risks, our strategies have repeatedly been validated by the market.

Now, with the support of quantitative trading tools, our investment strategies have been further optimized and improved. The market is brutal; it doesn’t care about anyone’s emotions and strictly follows capital flows and trend patterns. For regular investors, following a professional team and using a proven investment system is the key to staying undefeated in the market. With expert market analysis and solid real-world experience, our financial academy accurately identified this economic shift last week and used quantitative trading strategies to achieve returns far beyond the market average.

Investing is not just a numbers game; it’s a journey of wisdom, knowledge and strategy. Every market fluctuation is a new adventure, and choosing the right path and the right people to travel with often determines whether you reach your destination. Just like planning a trip, you can explore on your own, take detours and waste time, or you can follow a proven route with an experienced guide, reaching your goal in the shortest time with the least risk. Our Partner Investment Plan is the optimal route. With professional market analysis, personalized trading guidance, and a powerful quantitative trading system, we create a safe and stable path to profits, helping members achieve real wealth growth on their market journey.

The current economic transition is like a breathtaking view you can’t afford to miss. The dramatic shifts in the market mean traditional investment methods are becoming riskier but also open up new wealth opportunities. Over the past year, we’ve seen soaring inflation, central banks constantly adjusting policies and ongoing global trade tensions, each change reshaping the logic of the capital markets. Every market movement is a chance to reshuffle capital, and those who can truly seize these opportunities are the ones who adapt and follow the trends. For regular investors, the biggest challenge is not predicting the market but finding a strategy that works for them in changing conditions, ensuring they’re always on the right side.

Leave the professional work to the professionals. Whether it’s persistent global inflation or wealth shifts caused by tariff policies, one thing is clear: the market doesn’t move randomly. It follows patterns. Every major market adjustment eliminates those without a strategy while creating rare opportunities for those who are prepared. The key is not just having a strategy, but having a strategy that adapts to the market, stays grounded amid volatility and is not swayed by short-term emotions. Only by sticking to such strategies and staying flexible can we remain undefeated in uncertain times.

This is the core of our Partner Investment Strategy—winning with stability. The market is never short of opportunities, but what’s often missing is the ability to take advantage of them. And that ability comes from sound money management and disciplined trade execution. Precise capital management is the foundation of all our trading strategies. Only by establishing a strict risk control system can we ensure steady profits in any market environment. By capturing long-term trends and combining them with small-position operations, our strategy maximizes returns while keeping risk to a minimum. Many investors try to make quick profits through short-term trading, but they overlook the uncertainty that market volatility brings. The real key to long-term wealth growth is mastering trends and optimizing capital management, not frequent buying and selling.

Beyond precise capital management, increasing capital size is also a key factor in boosting returns. The market operates on a simple rule: the bigger the capital, the stronger the control over trades. Our Partner Investment Plan applies different strategy levels based on capital size. Members with larger funds not only gain access to more trading opportunities but also reduce transaction costs and improve profit stability. More importantly, when it comes to profit distribution, the larger the capital, the smaller the share of profits that needs to be allocated, which means a higher return rate. For investors aiming for greater profits, learning how to scale up capital in the market is the key to achieving long-term compound growth.

Balancing offence and defence determines the trading outcome of the market, which is a dynamic battlefield. Many investors focus too much on short-term gains while overlooking the true essence of the market: balance. The unique advantage of the Partner Investment Plan is that we don’t just focus on offence but also emphasize strong defence. Market fluctuations are inevitable, but with a scientific risk control system and precise trading strategies, we can maximize profits in any market environment while minimizing potential losses. This is not just about trading skills; it’s an investment philosophy that requires knowing how to take advantage of every market movement.

Within the Partner Investment team, every member shares similar goals and capital levels, creating a sense of unity that allows continuous learning and growth throughout the trading process. Market fluctuations are not the real threat; the real threat is fear and uncertainty. But when you’re part of a professional trading system, you’ll realize that even in extreme market swings, there’s always a way to adapt and find opportunities. Investing is a long-term game, and those who can survive and keep profiting in the market are the ones who master the balance between offence and defence.

Today is the last day of the month, which means next month marks a key window for global economic transformation. Market changes are accelerating, and the core goal of the Partner Investment Plan is to help every member achieve a 300%-1200% profit target during this golden period of wealth migration. In the current market landscape, following the global economic shift is crucial. At the same time, taking advantage of specific economic data-driven trends allows us to further amplify profits. For example, today’s PCE market movement was a short-term opportunity for excess returns. Looking ahead, next week marks the first trading week of March and is recognized as a “Super Data Week,” making it one of the most crucial trading opportunities of the month.

Next week, the market will release a series of key economic data that influence global capital flows, including Manufacturing PMI, the European Central Bank’s interest rate decision and US ADP employment data. However, Friday’s US Non-Farm Payroll (NFP) report will be the most impactful event. The NFP data directly reflects the real state of the US economy and has a decisive influence on the Federal Reserve’s monetary policy and government fiscal policy. History has shown that whenever the NFP data sees a significant change, the market experiences intense volatility, and this volatility is precisely our best opportunity to capture profits. Based on current market trends, we anticipate that next week’s NFP movement could generate over 800% in returns, making it an excellent chance for all members to grow their capital and maximize compound profits.

With the upcoming economic transformation window coinciding with Super Data Week, next week is a crucial point for rapid profit expansion. For all members, this is not just a trading opportunity; it is also a key moment to optimize asset allocation and improve long-term profitability. The larger the capital, the greater the effect of compound growth, leading to much stronger investment stability. Therefore, all members should seize this window of opportunity, make early preparations and ensure they fully benefit from the market’s upcoming movements. Whether you are a beginner or an advanced partner, the earlier you enter the market, the more trading opportunities you will have, and each additional trade means another chance for compound growth.

That’s it for tonight’s session. I hope today’s discussion has helped you gain a deeper understanding of the current global economic landscape and the potential opportunities brought by this wealth migration. At the same time, I encourage you to think about navigating the financial risks of this global economic transformation and finding the best strategy for maximizing your asset growth during this period of change. Members who have joined the Partner Profit Plan should adjust their trading schedules and closely follow our strategies for Super Data Week to ensure they capture the most valuable market opportunities.

In the face of global economic transformation and market volatility, only scientific investment strategies and advanced trading tools can help us move forward steadily and achieve consistent profits. The Partner Profit Plan is built on this principle, combining professional market analysis, quantitative trading technology and precise risk control systems to help every member capture trends in market fluctuations and achieve exponential wealth growth. This is not just an investment method; it is a strategic choice to adapt to change and take control of the future. In this critical period filled with both challenges and opportunities, let’s move forward together, ride the wave of global capital flow and reach new heights in wealth growth, creating our own investment legend!