Mastering Market Transitions: Unlocking Wealth Through Quantitative Trading and Strategic Investment

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's a great honour to embark on this journey with you to explore the secrets of quantitative trading. Every shift in today's rapidly changing global economy, from geopolitical conflicts to tech revolutions, deeply impacts the market. This is exactly where our quantitative trading system proves its strong adaptability.

Tonight's session is a crucial step towards gaining a clearer understanding of the market landscape. This knowledge will empower you to seize wealth opportunities through the Partner Profit Plan during this economic transition.

Today, the UK stock market saw a slight rebound, with the FTSE 100 index up 0.7%. However, overall market prospects remain uncertain. The main drivers behind the index's rise were mining and banking stocks, especially as rising copper prices pushed up shares of Antofagasta and Glencore. Lloyds Bank also led the financial sector after analysts upgraded its rating. While market sentiment has improved, this rebound seems more like short-term trading activity rather than a real trend reversal.

In the short term, expectations of additional tariffs on imported goods by the Trump administration have led some investors to bet on short-term gains in the manufacturing sector. However, history tells us that trade protection policies often end up raising production costs, weakening corporate profitability and slowing global economic growth. Meanwhile, oil prices have fallen below $74, reflecting concerns over slowing future demand. After yesterday's sharp drop, BTC has only slightly rebounded, showing that risk-off sentiment is still strong in the market.

Although European markets performed better than the UK, Germany's declining consumer confidence index signals weak demand, keeping the market in a fragile state. With both the UK and US facing similar economic challenges, the risk of a pullback remains high even after this brief rebound.

The US stock market also saw a rebound today. All three major indexes rose in early trading, with the S&P 500 ending a four-day losing streak and the Nasdaq up more than 1% at one point. Market sentiment improved, mainly boosted by Trump’s $4.5T tax cut plan passing the House and the US-Ukraine mineral agreement. Meanwhile, strong investor focus on Nvidia’s earnings fueled short-term speculative demand. However, this rebound looks more like a technical correction rather than a real trend reversal, as overall market uncertainty remains high.

Although short-term positive factors drove the market to rebound, deeper issues remain unresolved. Recent economic data has been weak, with retail sales and consumer confidence both falling short of expectations, heightening concerns about a US economic slowdown. At the same time, stock market overvaluation is becoming more apparent, raising doubts about whether tech giants like Nvidia can maintain their current growth pace.

At the same time, Trump’s trade policies remain a key market driver. New tariffs could push up production costs, causing inflation to rise again and limiting the Fed’s ability to cut rates. High inflation, policy uncertainty and slowing economic growth create a complex market environment, making investors cautious despite the short-term rebound. The market may have bounced back temporarily, but this seems more like a capital rotation rather than a true trend reversal, meaning further adjustments are still likely.

Short-term market swings do not obscure the larger structural economic issues. While the UK stock market rebounded, high inflation, unstable policies, and weak economic growth remain concerns. The US stock market may have recovered briefly, but trade barriers, weak economic data, and the looming risks in the AI sector continue to pose threats, keeping overall market uncertainty high.

In this kind of market, every price movement reflects deeper capital flows. During major market shifts, blindly chasing gains can easily lead to losses. In the current environment, selling stocks is the safest strategy. For short-term investors, any brief rebound should be seen as an exit opportunity rather than a reason to buy back in. Today’s US stock market rebound is a perfect example. On the surface, it looks like a recovery, but in reality, it is just a temporary release of market sentiment, not a real trend reversal.

The market rebound didn't come out of nowhere. Trump's latest tariff policy was the main driver behind today's brief rally in US stocks. News of tariffs on copper triggered a sharp rise in copper futures and related stocks. However, this kind of surge hides significant risks. We've seen similar situations before. When Trump first took office and imposed tariffs on Mexico and Canada, US stocks and futures also saw a short-lived spike, which was followed by a prolonged crash.

These short-term price jumps are often just surface-level reactions. Tariffs can create temporary demand spikes, pushing up raw material prices and giving related stocks a short-term boost. However, rising costs are never good for businesses. Instead, they lead to higher expenses and tighter profit margins. When companies face profit pressure and increasing costs, they are forced to cut back on raw material usage and even reduce production. This, in turn, weakens market demand, creating a downward spiral.

From a global standpoint, the United States, as the world's largest economy, exerts the greatest control over its tariff policies, largely due to its substantial internal demand. Consequently, it experiences a relatively smaller negative impact compared to other nations. In contrast, other economies often bear the brunt of a trade war, as they must contend not only with rising costs for domestic businesses but also with increasing competitive pressures in the global market. This heightens uncertainty in the global economy, compelling investors to reassess the evolving economic landscape.

Another key driver behind the rebound is short-term investors trying to buy at low prices. After days of market declines, many traders who don't fully understand market trends tried to catch the bottom, only to get trapped. As the market keeps falling, some investors hope to "average down" their positions instead of cutting losses in time. The result? Every small rebound attracts new buyers, but in the end, these dip-buyers get squeezed even more. The constant battle of short-term money flow makes stock prices appear to have support, but in reality, these gains are unsustainable, leading to another round of declines once funds run dry.

The biggest red flag, however, is institutional money at work. The recent wild market swings have been largely driven by big players. Over the past six trading days, we've seen the same pattern repeat: stocks open higher, climb briefly, and then drop sharply within a short time. Last Friday's and this Monday's early gains were perfect examples. The real reason behind this? Institutions are using market sentiment to push up stock prices so they can unload their shares. During every rebound, institutions quietly sell, while retail investors, caught in the volatility, keep buying. Eventually, retail traders become the ones left holding the bag. Once this trend fully takes shape, selling pressure will keep growing until the market finds a true bottom.

The changes in market structure are not only reflected in stock trends but also in the broader adjustment of the economic system. As the global economy enters a new phase of transition, the value of traditional assets is undergoing a significant reshaping. During past industrial revolutions, global markets shifted from agricultural assets to industrial assets, and with the rise of the Internet, industrial assets evolved into Internet assets. Now, breakthroughs in AI technology and the rapid expansion of the digital economy are propelling the market into a new stage—the era of digital assets. This signifies that digital assets are gradually replacing traditional Internet assets. It is not merely a natural evolution of market structure but an irreversible trend in economic development.

Against this backdrop, the global economy is facing major challenges. Inflation remains high, government debt crises are escalating, and trade wars are further disrupting economic stability. The restructuring of supply chains and adjustments in payment systems are placing unprecedented pressure on the value of traditional assets. Meanwhile, the increasing demand for safe-haven assets is driving greater interest in gold and BTC. Over the past year, gold prices have surged by more than 50%, clearly demonstrating that investors are reallocating assets to hedge against global economic uncertainty.

Gold is regarded as a safe-haven asset because it has historically served as a monetary substitute during economic crises. BTC, however, goes even further; it is not merely a safe-haven asset but also a future digital asset. Over the past year, BTC’s price has risen from $40K to a peak of $109K. Despite recent market fluctuations pushing it below $90K, its overall gain still exceeds 100%. This demonstrates the market’s growing recognition of digital assets.

BTC’s value is not solely about price growth; it represents an economic transformation. Historically, gold was the global standard before World War II, and during this economic transition, it has once again emerged as a key asset. However, BTC holds an even more distinctive position. Its value far surpasses that of gold because it is not merely a currency; it is a new asset class that represents the future of the global digital economy. BTC’s gains have outpaced those of gold, reflecting the market’s confidence in the potential of digital assets.

More importantly, the rise of BTC didn’t rely on government support. Instead, it grew strong despite resistance from governments and banks worldwide and eventually earned market recognition. This alone proves that its credibility has surpassed the limits of the traditional financial system, making it the true digital gold. Over the past five years, BTC and other digital assets have gone from being suppressed and questioned to gradually gaining legal status. In the US alone, 23 states have already included BTC in their national strategic reserves, while countries like El Salvador and the Central African Republic have directly made it legal tender. Meanwhile, financial powerhouses like Switzerland and Germany not only recognize BTC’s monetary status but are also accelerating the push for asset digitization. As the global financial system undergoes a deep transformation, digital assets are steadily moving into the mainstream market, and their impact and value can no longer be ignored.

Right now, as global economic conflicts intensify and market structures shift dramatically, the escalation of global trade wars has become a catalyst for economic transformation. This doesn’t just mean assets are being repriced. It signals a complete reshaping of future market dynamics. Those who cling to traditional investment thinking are being left behind, while those who can spot trends and position themselves early in emerging assets will be the real winners of this financial revolution.

In the short term, the current tariff policies have already ignited the fuse of global economic transition, and this presents us with the best trading opportunity. To meet the needs of our students and take full advantage of this rare market window, we have launched the Partner Investment Plan. This is more than just an investment move; it’s a chance to seize the wealth explosion ahead. The market trend is already clear. Our goal is to ride this wave of accelerated growth and achieve financial breakthroughs in the most stable way possible.

The Partner Profit Plan is our “aircraft carrier” in this global economic shift, providing every student with the chance to navigate economic cycles and reach new heights of wealth. But remember, this is not just a trading strategy; it’s a real upgrade in financial power.

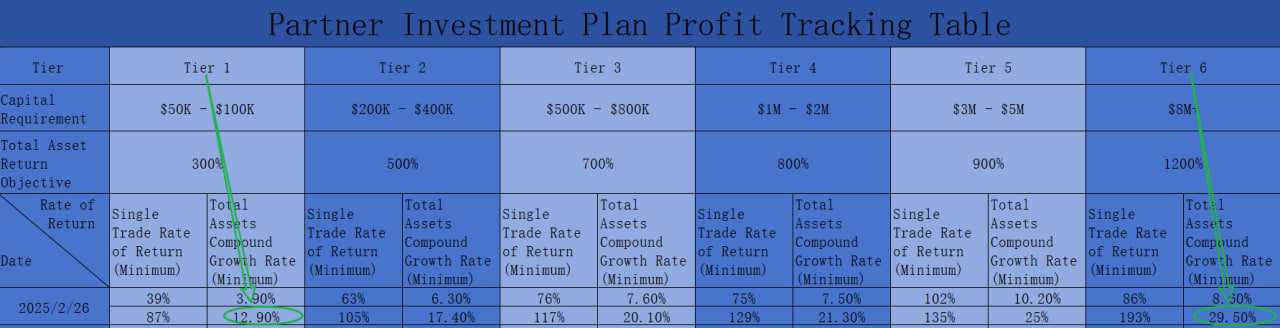

And the Partner Profit Plan is just the beginning. The ultimate goal is to build a millionaire incubator. I want you to not only earn 300%-1200% in profits from trading but also become a regional agent for our quantitative trading system (brand ambassador), enjoying lifetime dividends and making your wealth grow effortlessly, even across generations! This is not just a trading plan; it’s a once-in-a-lifetime chance for ordinary people to change their fate and break through financial barriers.

How to join? It's super simple: DM the assistant now, join the Partner Plan and follow the trading signals strictly. Every step will bring you closer to financial freedom. More importantly, we guarantee your profits with a contract. We fully back returns of 300%-1200%. At the same time, we offer long-term growth bonuses through AQS tokens, ensuring your assets keep increasing in value. Plus, the AI Quantitative Trading System pre-sale launching in Apr will give participants access to cutting-edge trading technology, helping you stay ahead in the next market boom.

The success of the quantitative trading system is not just a technical innovation. It's a major breakthrough in digital finance. It makes trading more precise and efficient while giving us the ability to upgrade wealth-building models to a whole new level. In the past, investing relied on human decisions and market experience. But now, AI and quantitative algorithms have ushered in a new era, allowing every participant to leverage top-tier technology to boost efficiency, reduce risk and maximize market gains. Today, we are standing at a historic turning point, and it's not only witnessing market change but also holding the tools to reshape the future of wealth. We are no longer just spectators but active participants shaping the future.

Over the past few days, some students have been asking me: How far is financial freedom for the average person? The truth is, it all comes down to your choices and actions right now. As long as you follow the trend and seize the opportunity, it's achievable. Looking back at the past three years, Crypto has outperformed traditional assets, with an annual growth rate of over 150%. The total Crypto market cap has already surpassed $4T. Let's look at the growth trajectory of digital assets over the past few years:

In 2022, the total Crypto market cap was about $800B.

In 2023, the market started recovering, reaching $1.09T by Aug.

In 2024, the Crypto market skyrocketed from $1T at the end of 2023 to $4T.

This data clearly shows that digital assets are growing exponentially, and they will expand even faster moving forward. Right now, we are in a key window of global economic transition. The current market pullback is actually a once-in-a-lifetime trading opportunity. With short-term policy shifts, the implementation of global tariff policies in the next month will drive market volatility, creating an incredible profit opportunity for our Partner Profit Plan.

This is exactly the core of our trading strategy: following market trends and finding certainty in an uncertain environment. Through contract trading, spot holdings and other portfolio investment strategies, we can achieve exponential wealth growth. And the power of compound interest can take asset growth to unimaginable heights. The size of your capital directly determines the ceiling of your future profits. This time, we are looking at a once-in-a-lifetime opportunity for wealth. The more capital you have, the bigger market space you can leverage and the greater the returns you can generate.

So, here’s the question: are you in the best position? Are you ready for this wealth explosion? The market won’t wait for anyone, and opportunities only belong to those who take action and seize the moment.

Everyone has dreams, but what truly matters is whether there’s a clear path to turn them into reality. Right now, that path is right in front of us. The global economic shift, the rise of digital assets, and breakthroughs in quantitative trading technology are coming together to create a once-in-a-lifetime opportunity. The market trend has changed, wealth is being redistributed, and this time, we have the chance to be at the forefront of this transformation.

The opportunity is here, but only action can truly capture it. Today, our Partner Profit Plan has been officially launched, and the first group of students has already joined and achieved results beyond expectations. In today’s first Partner Team Trading session, we recorded an incredible 126%-279% profit. More importantly, these numbers are based on the lowest returns, meaning that by simply following the Partner Team’s trading strategy, every student’s total capital gains today reached at least 12.9%. This isn’t just theory; it’s real results. Imagine what kind of wealth growth this rate of return could bring when compounded over time. Those who have taken the first step are already experiencing the real rewards from the market, and this is just the beginning.

In real trading, some students may have already noticed that the profit gap between different teams became obvious on the very first day. This isn’t just a difference in numbers; it’s a gap in wealth growth speed. As trading strategies continue to improve and compounding kicks in, this gap will only get bigger. The students who are already making steady profits didn’t just get lucky. They made one key, correct choice. They chose to believe, take action, and follow the right strategy. Today, their profits have already far exceeded their initial investment. Whether it’s financial products or the accumulation of AQS tokens, their total assets have already surpassed their principal. And from now on, every dollar of profit is pure gain. This is the reward of early positioning. The market won’t wait forever, but those who got in early are already enjoying the massive returns from this wealth shift.

What’s even more important is that, in the current market environment, the compounding effect of data will create even bigger profit opportunities. For example, tomorrow’s US Initial Jobless Claims data and Friday’s Core PCE Price Index. Especially the PCE Price Index is the key data that affects Fed rate cut expectations and is the most crucial moment for market trading opportunities. Right now, we’re in the window of global economic transformation. The combination of tariff policies and monetary policies will cause extreme market volatility. Our goal is to position ourselves precisely in this kind of market and seize profit opportunities.

Historical data shows that this PCE release is expected to bring over 500% profit in a single trade. This isn’t a coincidence; it’s a reflection of market patterns. Every time similar economic data is released, it triggers massive price swings, and those who position themselves early tend to earn outsized returns. With such an opportunity ahead, the top priority is to expand your capital as soon as possible so you can maximize your profits in the coming market moves. Right now, we are using the most professional quantitative trading strategies to turn every price swing into actual profits. The key to maximizing gains is to capitalize on Friday’s big PCE event and let compounding do its magic.

That’s it for tonight’s session. I hope every student can truly understand today’s content, recognize the essence of the current market environment, and see the once-in-a-lifetime opportunity brought by global economic transformation. The market shift has already begun, wealth is being redistributed, and the choices you make today will determine your future. Those who hesitate and wait for a so-called “better time” will ultimately be swallowed by the market. Opportunities never wait until you’re fully ready; they come and go in an instant. Only those who take decisive action will secure their future.

Are you ready? With a major market shake-up ahead, the biggest risk isn’t volatility but hesitation. Those still sitting on the sidelines will be left behind, while those who have positioned early and acted decisively have already found new paths to wealth in the storm. Life doesn’t give you many chances to “wait a little longer.” What you miss isn’t just one trade. It could be the turning point of your destiny. Don’t let your future self be the one saying, “If only I had…”

Right now, whether you’re worried about a stock market crash or unsure how to invest, message us immediately. We will create a personalized investment strategy just for you, helping you capture new market opportunities and grow your capital even in turbulent times. Wealth isn’t something you wait for; it’s created by bold decisions. Take that step now and embrace your financial breakthrough!