Seizing the Economic Shift: Unlocking Wealth Through Strategic Investment and Partnership

Hello, students of Diamond Ridge Financial Academy! I’m Charles Hanover, and it’s great to be here with you again. In today’s uncertain market, we not only need to time our investments correctly but also find steady ways to profit amid market fluctuations.

Over the past week, Trump’s policies have once again shaken global markets. However, thanks to our quantitative trading system’s precise signals and trend trading strategies, we successfully achieved our capital-doubling profit goal. That said, some students struggled to keep up with the trading pace and missed key opportunities.

To help everyone stay on track, maximise profits, and build a solid investment system in volatile markets, we’ve introduced a new trading model—the Partner Profit Plan. This plan lowers the entry barrier while providing professional strategy support to ensure investors can generate stable profits even during market turbulence. Tonight, I will provide a full recap of this week’s market trends and break down the key structure and execution strategy of the Partner Profit Plan.

This week, the UK stock market faced pressure, with the FTSE 100 dropping 0.84% overall. Market sentiment was weak, and investor confidence took a hit. A surprise rise in inflation pushed back expectations for a Bank of England rate cut, lowering the odds of a March cut to below 7%. The high-interest-rate environment has increased corporate financing costs, reducing market liquidity and putting pressure on interest-sensitive sectors such as manufacturing and real estate. Additionally, layoffs have accelerated. The unemployment rate remained at 4.4% in February, but the job market contracted overall. Businesses lacked confidence, adding to market stress.

On the industry side, defence stocks briefly rose due to the Ukraine situation but later pulled back, reflecting ongoing uncertainty about military spending. Mining and energy stocks struggled due to commodity price fluctuations, environmental policy constraints, and weaker profits. Financial stocks saw a short-lived rebound but failed to sustain gains due to rising compliance costs and uncertain interest rate prospects.

Fiscal policy also weighed on the market. The UK’s January budget surplus fell short of expectations, limiting the government’s ability to implement stimulus measures. In April, higher national insurance contributions and a minimum wage increase will further raise business costs, adding to inflationary pressure and slowing economic growth. Overall, the UK market remains stuck in a difficult position, with high inflation, high interest rates, and low growth. With no clear upward momentum, further downside risks remain in the short term.

The US market is also under pressure. While the S&P 500 and Nasdaq surged at one point, upward momentum has clearly weakened. The Dow Jones has been pulling back for several days, and market divergence is getting worse.

On the policy side, the Trump administration is pushing for tariffs on imported cars, chips and pharmaceuticals. Though details haven't been fully released, concerns over escalating global trade tensions are growing. This expectation has driven capital into safe-haven assets, putting a cap on tech stock gains. Meanwhile, the latest Fed meeting minutes show that inflation pressure remains, and officials are becoming more cautious. This has cooled expectations for rate cuts this year, increasing the risk of tighter liquidity. Goldman Sachs warned that institutional funds are pulling out of US stocks, with up to $61B in assets potentially being sold off in the next month, adding significant pressure to the market.

On the economic data side, the US Feb PMI flash reading dropped to 50.4, showing a sharp slowdown in economic growth. The services activity index fell below 50, signalling contraction and further weakening economic momentum. Additionally, January's housing started to fall 9.8% month over month, keeping the real estate market under pressure as high rates continue to hurt homebuyer demand. At the same time, initial jobless claims rose last week, and both the manufacturing sector and the job market are losing steam, increasing worries about a US recession.

Corporate earnings expectations don't look great either. Walmart plunged 6.1% due to cautious sales growth guidance, while UnitedHealth Group tumbled 8% over a Justice Department investigation. Tech stock earnings growth is slowing, and funds are shifting into safe-haven assets. Investor confidence in high valuations for tech stocks is fading. Morgan Stanley analysts warned that a large amount of retail money has recently flowed into highly speculative areas, which could mean the market is nearing the end of a bull run, with growing risks of a pullback.

On top of that, Trump's upcoming tariff memorandum is adding to market fears. It's expected to impose retaliatory tariffs against certain countries that tax US tech giants with digital service taxes. This move is seen as Trump's latest strategy to expand the tariff war and reshape global trade. While the memo doesn't yet include specific tax rates or a timeline, the market has already reacted, causing tech stocks and BTC to plunge. Short-term investor sentiment has taken a sharp hit.

Despite the market's wild swings, the overall trend remains within our expectations. As for US stocks, I clearly advised everyone on Monday to sell on rallies. Our strategy is "sell big on big gains, sell small on small gains," especially for traditional industry stocks. Walmart's sharp drop is a perfect example. These traditional stocks climb slowly, but with the global economy weakening and inflation rising, sudden crashes in these stocks are becoming more frequent. That's why I continue to recommend avoiding risky assets like these and selling them decisively to protect your capital. If you followed our trading strategy strictly, you not only avoided losses from this week's US stock drop but also locked in solid profits by selling at high levels.

However, according to my assistant, some members lost over 20% in the stock market this week due to poor execution or failure to keep up with our trading pace. Some even went against our sell signals and bought instead, which only made their losses worse. This once again highlights how critical it is to strictly follow trading strategies and stay in sync with market trends.

It's not just the US stock market. The crypto market also saw huge swings this week. As early as last week, we predicted that BTC was about to rise by $6K in a strong trend. We used our quantitative trading system's precise signals during this move and applied a rolling position strategy. Those who followed the trading pace successfully doubled their capital. This once again proves the power of our quantitative trading system and the importance of adjusting dynamically with market trends.

Even though the trading opportunity was clear, some members still didn't keep up with the trading pace. During market corrections, some even started complaining or blaming us. They felt our analyst team didn't remind them in time to buy or sell, and some even expected assistants to call them one by one with trade signals.

Here, I must admit my failure in management. Previously, our analyst team was small, so we couldn't provide one-on-one guidance for every member's trades. To improve coverage and accuracy in our trading services, we launched an expansion plan for our analyst assistant team this Monday, aiming to offer more detailed investment support to more members. However, as our team grows, our operating costs also rise fast. This means we must balance providing high-quality investment services with ensuring the financial academy's long-term sustainability.

From the members' perspective, they also want more comprehensive and efficient investment support, especially expecting the analyst team to provide more precise trade signals during market swings. At the same time, from the quantitative trading system's project team's perspective, they are preparing for its launch in Apr and are actively promoting it to expand its influence. They also want more real trades to prove the system's accuracy. With all three sides sharing these goals, we've decided to launch the Partner Profit Program to create a true win-win collaboration.

The core goal of the Partner Profit Plan is to ensure that all participants can achieve stable and sustainable profits in the market. The first beneficiaries are our students, making sure they can seize market opportunities accurately and reach their profit targets. The second beneficiary is the project team behind the quantitative trading system. Students must make profits first to have the motivation to promote and use the system and even invest in it long-term after it goes public. The third beneficiary is our analyst team; students are only willing to pay a percentage of their profits for investment services after they earn money. This way, analysts receive stable incentives and can provide higher-quality trading support and strategy analysis.

This plan is not just about short-term profits. It focuses on building a long-term and stable investment ecosystem. As students' profits grow, the market recognition of the quantitative trading system increases, and at the same time, analysts get better incentives. This creates a true win-win situation for all three parties.

Ensuring students achieve stable profits and maximize their returns is the common goal of the financial academy, the quantitative trading system project team and the students themselves. Their interests are closely linked, forming a complete investment cycle. Students' success not only boosts their personal wealth but also directly affects the market influence of the quantitative trading system. Meanwhile, the financial academy's analyst team relies on students' profits to further improve market research and investment services. That's why we aim to deeply integrate the interests of all three parties through the "Partner Profit Plan" and build a long-term, sustainable, win-win model.

Looking back at this month's trading, students who followed the trading plan closely have made significant profits. In the first week, our trading strategy helped students achieve a 50% profit. In the second week, profits increased to 80%. This week, by combining trend trading with arbitrage strategies, we successfully doubled our initial capital while avoiding the stock market crash. If we calculate based on a $50K starting capital, the account balance reached $75K after the first week, grew to $135K in the second week and by the third week, the total amount had risen to $270K. With weekly compounding, the total return has exceeded 400%. These results prove the importance of precise strategy execution, strict investment discipline and the powerful support of the quantitative trading system.

However, not all students achieved the same results. Some students, with sufficient capital and strict strategy execution, earned even higher profits. Meanwhile, others with smaller funds tried to grow their capital too quickly by going all-in or blindly following the market. This led to losses or missing the best entry points. Once again, this highlights the critical role of discipline and execution in trading. The market gives everyone the same opportunities, but the final profits depend on students' starting capital and their ability to strictly follow strategies and market signals.

The market's performance this month has been incredible. On the one hand, Trump's presidency has brought major changes to global economic policies, causing huge market swings and creating great opportunities for short-term trading and arbitrage. On the other hand, the outstanding performance of the quantitative trading system has played a key role. It not only accurately captures market fluctuations but also uses smart algorithms to optimize trading timing, helping investors find the best trading opportunities during market swings.

Although market fluctuations and adjustments are unavoidable during trading, we have successfully secured consistent profits by effectively using arbitrage strategies, trend trading, and rolling position increases. This has helped students steadily grow their assets even in a volatile market.

Because of this, we have decided to launch a more stable investment plan for students based on this month's trading results, the "Partner Profit Plan." This plan not only provides comprehensive investment guidance but also guarantees returns for all partners. This means that in the upcoming trading cycle, as long as students strictly follow the financial academy's trading strategies, they will not only enjoy steady investment returns but also receive a capital safety guarantee. This is not only a testament to our confidence in our analyst team and the accuracy of the quantitative trading system but also a response to the huge market opportunities created by shifts in the global economic landscape.

Right now, the global economy is at a major turning point, with two key factors speeding up changes in the capital markets. First, breakthroughs in artificial intelligence are driving a transformation in the tech industry and accelerating the growth of the digital economy. The AI industry chain and related tech sectors are becoming the most promising investment targets for the future. Second, since Trump took office, a series of economic policy adjustments have been deeply impacting global markets. The most disruptive one, the tariff policy, is set to take effect in early Apr. At the same time, the UK's real estate tax adjustments will roll out in April. These policy changes are not isolated events, but part of a natural shift as major economies go through economic cycles. Such adjustments will trigger massive market swings in the short term, creating unprecedented investment opportunities for us.

From an investment perspective, this means that the market will present a series of short-term trading opportunities in the next month or so. Shifts in market sentiment will cause sharp price swings, especially before and after the tariff policy takes effect, creating great chances for arbitrage and trend trading. So, to help our students seize these upcoming opportunities, we are launching the Partner Profit Plan. Every participant can earn between 300% and 1200% in this market shift.

The core idea of the Partner Profit Plan is “shared risk, shared rewards.” In simple terms, students only need to follow the trading strategies provided by the Financial Academy, and we will fully back their investments. If any participant experiences losses or lower-than-expected returns during the program, the Financial Academy will cover the losses or make up the difference. This not only reduces investment risks but also greatly improves trading stability, ensuring that every partner can stay ahead in market turbulence.

At the same time, we aim to build a more complete investment ecosystem through this plan. To ensure sustainability, we will take a small percentage of students’ profits as an investment service fee. This means the more students earn, the stronger the market recognition of the quantitative trading system and the better the incentives for our analyst team. In the end, this creates a true win-win-win model. Under this partnership framework, all sides benefit from market movements, driving the development of quantitative trading technology and making the entire investment system more efficient, stable and sustainable.

At this critical moment of market change, the Partner Profit Plan is not just a great way to capitalize on economic shifts. It is also the best strategy for achieving risk-free returns. For those interested in joining, now is the best time to sign up. Please contact our assistant as soon as possible to secure a spot in the partner trading system. At the same time, to maximize profits, we also suggest that all students plan their funds in advance. This will ensure they can respond calmly when key market trends appear and take advantage of every profit opportunity.

Many students have already joined, but some still lack a clear investment plan and have little understanding of how to use their capital effectively. In a quantitative trading system, funds are not just a weapon for conquering the market. They are also a shield against risk. Through sufficient capital reserves, compound interest and scientific trading strategies, we have successfully balanced low risk with high returns, laying a solid foundation for long-term stable profits. Proper capital management turns trading from a stressful gamble into a steady wealth-building process.

Let’s say your goal is to make $1K per day. If your capital is only $1K to $5K, you may have to use high leverage and go all-in, which significantly raises the risk. Any small market movement could make you panic and lead to major losses. But if you have $100K to $1M in capital, you only need to invest $10K to $50K to achieve the same returns. This makes trading much more stable and stress-free instead of a high-pressure bet.

More capital not only brings more stable profits but also helps absorb short-term market fluctuations and reduces systemic risks. With sufficient funds, you can stay calm and hold your position instead of panic-selling even if the market swings sharply in the short term. This is the true purpose of capital management. Having a larger capital reserve not only ensures a smoother trading experience but also gives investors stronger adaptability in the market.

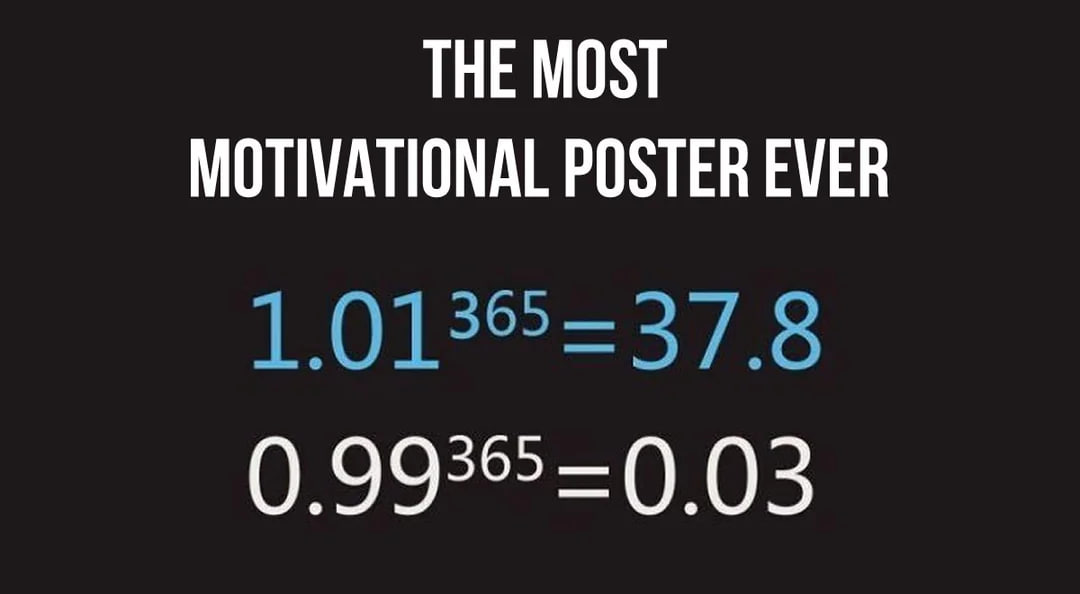

Some may think this approach is "too slow," but let's look at the numbers. Since the public test of our quantitative trading system, if each trade earned just 8%, executing it precisely 30 times in a row would generate a total return of 1006.27%. Not to mention, our actual returns have far exceeded this assumption. We have repeatedly achieved over 50% compound weekly returns in the past month.

This proves that when stable capital management is combined with smart trading strategies, investing becomes a sustainable way to build wealth; it's not just a short-term, high-risk gamble. A solid capital reserve means sharp offence and strong defence, allowing investors to truly control market rhythms and achieve long-term, steady profits.

With the ongoing tech revolution and global economic policy shifts, the next month will be a key transition period for the global economy. Traditional assets are expected to see significant declines while emerging sectors like artificial intelligence and digital assets will present historic investment opportunities. Given this market environment, I urge all students to carefully review their investment portfolios. By combining the upcoming Partner Profit Plan with a well-thought-out asset allocation strategy, you can position yourself for success. We are at a major turning point in the global economic cycle, and this is the best time to reposition personal assets and grow wealth. For students who are still unsure about their investment direction, please contact the assistant or reach out to me directly. Our analyst team will create a personalized investment plan based on your risk preference, return expectations and available funds, ensuring that each participant in the Partner Profit Plan maximizes their earnings.

Students with smaller capital should take action now. The next month or so presents a rare opportunity to build initial wealth during this global economic shift. Many may think their funds are too limited to make a meaningful impact in the market, but history has shown that every economic cycle shift creates massive wealth opportunities. The key is whether we can seize the moment.

More importantly, are we willing to put in the effort? On one hand, we must expand our capital base to build a stronger foundation for future investments. On the other hand, we must dedicate enough time and focus to stay in sync with the upcoming trading cycles. Only through continuous effort today can we take full advantage of the coming market changes, break through wealth barriers, and ultimately step through the door to financial freedom.

Investing is like life, and success always comes from careful planning and continuous effort. Instead of regretting missing BTC's 35x surge, NVIDIA's 50x growth or the past three weeks' profit opportunities, take action now and create new possibilities for the future. If you hesitate today, you will only find yourself stuck in regret and missed chances tomorrow. The market always rewards those who are prepared, and only those who act decisively at key moments can truly seize the window for wealth growth.

Next Wednesday, we will officially launch the Partner Profit Program. This is not just an investment opportunity but also a crucial step in adapting to the global economic shift. All students should plan their funds and get ready to trade, preparing for the massive opportunities this transformation will bring. For those not yet ready, we will provide a two-day buffer to ensure everyone has enough time to adjust their capital allocation and investment strategy. Those who are fully prepared can contact the assistant in advance to start planning their trading strategies and secure the first-mover advantage.

As we look at the tariff policy timeline, it's clear that next week marks the official start of the global economic shift. The recent shockwaves sent by Trump's tariff policy are just the beginning, and we can expect even more volatility in the days to come. The retaliatory tariffs on digital services tax will have a direct impact on capital flows in the global tech sector, setting off another round of market fluctuations. This not only means an explosion of short-term trading opportunities but also the potential to reshape long-term market trends. The upcoming volatility is expected to expand further, creating over 150% profit opportunities for investors. Especially on Friday, the release of the US Core PCE Price Index will directly affect global monetary policy expectations, inevitably causing sharp market swings and opening up more profit space for arbitrage and trend trading.

That's all for tonight's session. Hopefully, this lesson has helped you understand the importance of seizing market opportunities. Only when high-quality market opportunities are combined with efficient trading tools can we maximize profits in a volatile market. The current global economic shift is an unprecedented opportunity. With the precise investment strategies provided by our analyst team, every student has the chance to earn 300%-1200% in this market transformation. This is the inevitable result of our win-win cooperation.

All students should take action immediately and seize this once-in-a-lifetime opportunity for wealth growth. In this wave of economic transformation, only those who actively engage and execute strategies precisely can truly ride the trend and achieve exponential asset growth. Market opportunities disappear quickly. Only those who take the first step boldly will become the ultimate winners. The Partner Profit Program is not just about investment; it is a crucial turning point that will shape your financial future. Now is the time to take action, lay a solid foundation for your asset growth and embrace your peak wealth!