Mastering Market Volatility: The Path to Financial Freedom with Diamond Ridge’s Quantitative Trading & Partnership Program

Hello, Diamond Ridge Financial Academy students! I’m Charles Hanover, and I’m excited to explore the world of quantitative trading with all of you. In today’s highly volatile market, quantitative trading isn’t just an efficient investment tool. It’s a whole new way of thinking that helps us seize opportunities, optimize returns and manage risks more precisely.

Tonight, we’ll start by analyzing market trends, discussing trading strategies and laying the groundwork for our partner profit plan. The goal is to make sure every participant can maximize their returns in the future market environment.

Today, the UK stock market struggled overall. Although a rebound in bank stocks and retail data briefly lifted market sentiment, the gains didn’t hold, and the FTSE 100 closed down 0.03%. Slow economic growth, rising layoffs and persistent inflation pressure were the main factors weighing on the market.

S&P data shows UK companies are cutting jobs at the fastest pace since the pandemic, with February’s job losses hitting the highest level since Nov 2020. This reflects employers’ defensive moves to cope with rising wage costs and weak demand. Meanwhile, the composite PMI fell from 50.6 to 50.5, with manufacturing stuck in contraction for months, adding to concerns about a weakening economy.

Uncertainty over fiscal policy is another drag on the market. Despite a record-high budget surplus in Jan, it fell short of the Office for Budget Responsibility’s expectations. The government may struggle to introduce effective stimulus measures with limited fiscal room. On top of that, the upcoming National Insurance tax hike and minimum wage increase in Apr have already led businesses to raise prices in advance, adding to inflation pressures. This keeps pushing back the Bank of England’s rate cut timeline, increasing investment uncertainty. Additionally, rising housing prices are fueling fears of a potential property bubble, adding more downside risks to UK stocks in the short term.

The US market isn’t looking much better. The Dow Jones dropped as much as 370 points during the session as investors worried about inflation risks from Trump’s tariff policies. Stagflation concerns are becoming a hot topic. Three Fed officials warned that policy uncertainty under Trump could disrupt rate cuts. Business leaders are also concerned about new tariffs, immigration policies, and regulatory changes, driving up risk aversion and accelerating capital outflows from stocks.

Economic data shows the US is slowing down. Feb’s preliminary composite PMI dropped to 50.4, signalling a sharp decline in growth. The service sector index even fell below 50, indicating contraction and weaker momentum. Meanwhile, earnings forecasts aren’t looking good either. UnitedHealth tumbled 8% due to a Justice Department probe, and Walmart’s disappointing results continued to weigh on the market. With major US companies under pressure, market sentiment has worsened.

On the capital flow side, Goldman Sachs warned that institutional and retail investors are losing buying power, and systematic funds may sell $61B worth of US stocks in the next month, pushing the market into a correction phase. JPMorgan also pointed out that US companies have low-profit expectations for 2025, while European and Asian markets seem more attractive, further increasing outflow pressure from US stocks. Overall, US markets are facing multiple challenges, including policy uncertainty, declining earnings forecasts and tightening liquidity, making short-term trends highly unpredictable.

Since Trump took office, global capital markets have become more volatile. Big institutions and financial groups have been adjusting their strategies under the pressure of economic uncertainty, with many even making pessimistic predictions about the global economy and stock market. The main concerns are trade policies, tariff changes and potential shifts in the Fed’s monetary policy. These factors have pushed global markets into a new adjustment phase.

However, despite the overall bearish sentiment, students who followed our Financial Academy’s trades have achieved impressive profits. This isn’t just because we have a professional analysis team. It’s also because we use the world’s most advanced investment tools. These allow us to accurately track market trends and develop highly effective trading strategies.

Last week, we hit 80% of our profit target by combining signals from our quantitative trading system with arbitrage strategies. And in this week’s trades, our trend-following strategy once again delivered significant profits. In fact, market changes aren’t completely random. By analyzing economic policies and predicting price trends, we had already identified a major turning point in the BTC market as early as last Friday. The actual market movement confirmed our analysis. After a dip on Monday, BTC hit a second price pivot on Tuesday, triggering a strong rebound.

From Tuesday to today, BTC’s price has surged by $6K, fueling a major breakout. This means that, for contract trading, a single trade could yield up to 600% returns. If you had invested $500K in this trend and allocated 20% of your position, your single trade profit would be:

$500K × 20% × 600% = $600K, with a total return of 120%. Even those who reacted slightly slower or used smaller positions still made over 80% in profits. This powerful trend has brought us close to fully achieving the “capital doubling” plan, proving the strength and profitability of our trend-trading strategy.

However, these profit opportunities aren’t just luck. They come from a deep understanding of market patterns. Both follow clear market rules, whether it’s arbitrage trading or trend trading. As we saw in our previous technical analysis, when BTC dropped on Tuesday, it precisely bounced off this month’s low, which was the key technical support level we had marked earlier. Looking at the chart, you can clearly see that the lows in Chart ① and Chart ② formed a strong support line, and the pullback in Chart ③ confirmed this level.

At the same time, on the lower and middle Bollinger Bands, a classic bullish engulfing pattern appeared, with a green candle swallowing a red one. This signalled a strong rebound, which is why, on Wednesday night, I sent out a signal to add more positions and go long. Since we already had profitable base positions as a safety cushion, increasing our positions at the right time not only lowered risk but also maximized profit potential. This is the beauty of trend trading: it helps control risk while allowing traders to build on strong trends for even greater gains. This strategy not only keeps investors ahead in a volatile market but also ensures the most efficient use of capital for steady growth.

Trend trading isn’t just about reacting to price moves; it requires planning ahead and combining it with arbitrage strategies to optimize capital use. That means traders often need sufficient funds to execute this strategy effectively. Since this approach demands accurate market analysis, analysts or assistant teams typically provide tailored guidance on fund allocation. However, our Financial Academy has limited resources, and some students couldn’t fully keep up with this trade. Some missed the best entry points due to a lack of funds, while others didn’t receive signals in time, limiting their potential profits. Some even let market pullbacks affect their emotions, leading to unnecessary anxiety about their trades.

After reviewing recent trades, I’ve seen many students achieve great returns through our investment plan. But I’ve also noticed some students, limited by their funds, becoming too eager to win, falling into a gambler’s mindset, hoping for overnight success, only to suffer unnecessary losses from market swings. Today, instead of just talking about market analysis or trading strategies, I want to discuss mindset and the right approach to wealth.

I completely understand the desire to improve your financial situation quickly. Everyone wants a better life and hopes to break through their limits to achieve success. This desire isn’t wrong; it’s actually one of the key drivers of success. However, many people admire others’ achievements, wealth and status while overlooking the time, effort and persistence required to get there.

Just yesterday, one of our students shared his journey as a lawyer. He started as an unknown employee, putting in years of effort and facing countless failures and adjustments before finally reaching the top of his field and earning respect. His success didn’t happen overnight. It was built through long-term dedication, continuous learning and unwavering belief in himself.

Speaking of this, I’d like to share my own story. A lot of people envy my success today. Even some of my friends on Wall Street are amazed at what I’ve achieved. But what they don’t know is how deep of a hole I once fell into. I come from the House of Hanover, and I was born into a prestigious family in London. But when I was a child, my family suffered a huge setback and quickly declined. We had to move to New York, and from that moment on, my life completely changed. The day I left London, I made a promise to myself: one day, I would make it back on my own and prove myself. That belief became my biggest motivation, pushing me to learn and grow no matter what.

Maybe it was my father’s influence, but I was fascinated by economics from a young age. In college, I double-majored in economics and engineering, diving deep into the investment world to find my own path. After graduation, I didn’t go straight to Goldman Sachs. Instead, like Warren Buffett, I started my own investment partnership. I put in all my savings, fully believing I could make it big with smart investments. But the reality was much harsher than I expected.

This was the early 2000s, right at the peak of the dot-com bubble. Tech stocks were soaring, and the market was filled with crazy optimism. But within months, it all collapsed. The bubble burst, and many overvalued companies with no real profits went bankrupt. The entire tech sector crashed, and the market suffered a massive downturn. Almost all my investments were wiped out. I lost everything and had to declare bankruptcy.

That period felt like the coldest winter of my life. I wasn’t just broke; I was doubting myself, falling into depression, and even thinking about giving up completely. But my friends and family stood by me, encouraging me to push through. Looking back, that dark time taught me some of the most valuable lessons in both investing and life. I realized that investing is about buying future value, and true value comes from solving real problems. Whether in life, business or investing, you have to stay practical and avoid chasing short-term illusions. Every failure is just another lesson that prepares you for future success.

From then on, I completely changed how I approached investing. I stopped chasing hype and started focusing on market fundamentals, long-term trends and a more balanced investment strategy. Over time, I developed my own pricing trend theory, combining technical analysis with real market demand. I focused on assets with true long-term growth potential. A few years later, this strategy helped me get back on my feet. I made it into Goldman Sachs and eventually managed over $22B in assets.

Looking back, I see that life is just like investing; it’s never a straight lineup. No stock rises forever, and no loss lasts forever. As long as you keep pushing forward and never give up, your time will come. In the investing world, the highest honour is becoming the next “Templeton.” My dream now is to fulfil my goal of building a charity fund. Now that I’m over 60, I hope to spend the rest of my life helping and empowering others through investment, leading more people toward a better future.

I know that some students with limited funds might feel discouraged when they see others with bigger capital making huge profits. But I want to tell you that wealth is never built overnight. The growth of wealth is simply an outward reflection of our inner growth. No matter how insignificant it seems, every small step forward is quietly laying the foundation for future success. As long as you give it your all and stay grounded in the present, wealth will naturally come to you. Step by step, build your own fortune and one day, you'll realize that financial freedom is not some distant dream. Just like high-quality assets often rebound stronger after a pullback, every challenge in life is just preparing you for your next big leap.

I hope all of you seize this opportunity, especially now that the tech revolution and economic policies are creating a double advantage for smart investors. And to those with limited funds, don't lose heart. The power of compounding is incredible. Even the smallest progress each day will, over time, bring results beyond your imagination. Don't envy someone else's wealth today. Take action to change your own future. Building wealth takes time, wisdom and patience. The only thing you need to do is take that first bold step and make the most of every opportunity for growth and profit.

As for the challenges we're currently facing, we choose to tackle them head-on and work towards the best solutions to create a better future. For example, we've been actively addressing concerns about trading conflicts. As early as last week, we started gathering feedback and thinking deeply about how to take advantage of the current market trends so that every student can maximize their returns. That's our shared goal. So, at the beginning of this week, we expanded our team, adding more analysts, assistants and other support staff to provide you with more accurate and efficient investment services. This way, everyone can get personalized trading strategies tailored to their needs.

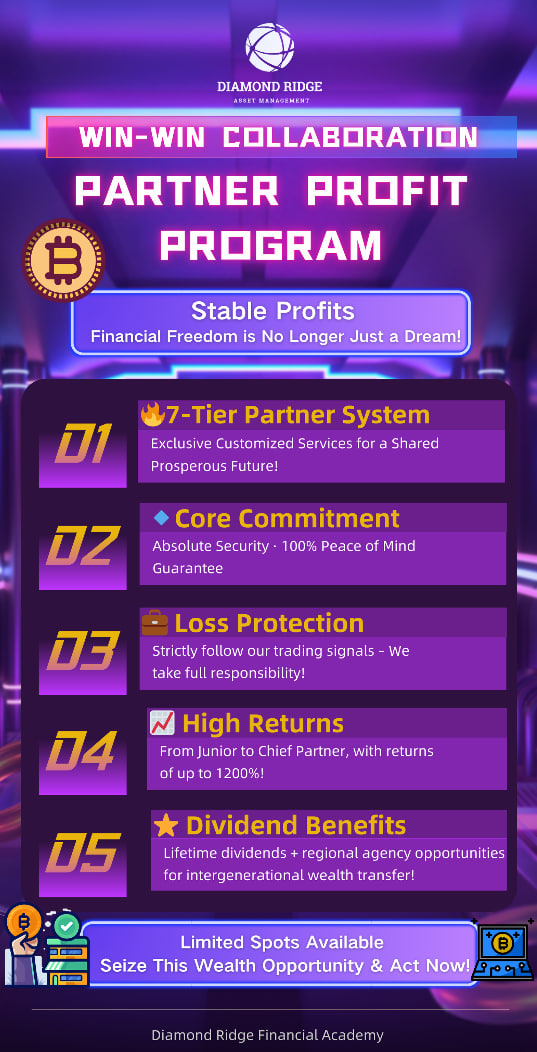

At the same time, while we're increasing our team size, we also have to balance overall operational costs, service quality and profit distribution. From a student's perspective, there's still concern about future investments, especially for those unfamiliar with the market or who have experienced losses before. They fear risks and losses, so they need a safer and more reasonable investment plan, one that allows them to benefit from market trends while keeping their funds secure. On the project side, our quantitative trading system is set to officially launch this Apr. Expanding market influence and optimizing system performance before launch to make it even more precise and efficient are top priorities. To meet the needs of all three parties, we held an in-depth discussion this Wednesday. After multiple rounds of talks, we finally reached an agreement on the "Partner Investment Cooperation Plan."

This isn’t just another investment opportunity. It’s a true win-win partnership. Whether you’re new to the market or a seasoned investor who’s faced setbacks, this Partner Profit Plan is your key to wealth growth. More importantly, this plan includes a safety net. As long as you follow our academy’s trading strategies, we will provide a guarantee for your investment. This ensures that every student can enjoy stable and secure returns throughout the trading process, allowing you to participate fully in this wave of financial growth with confidence.

While taking the first step might not be easy, every bold beginning can lead to unexpected success. Seizing every profit opportunity now won’t just help you ease financial pressure. It will also bring you closer to financial freedom. This isn’t some fairy tale; it’s a real path that every hardworking person can take. Wealth growth is simply the result of your skills improving. When you keep pushing forward and making the most of every growth opportunity, wealth will naturally follow faster and more steadily than you might imagine.

The Partner Profit Plan officially launches next Wednesday! Whether your goal is to build your initial capital or grow your existing wealth, this plan is the perfect choice. Contact our assistant now to book your spot! We will customize an investment plan for you based on your capital, risk tolerance, and trading needs. Let’s move forward together, seize this once-in-a-lifetime market opportunity, and reach new financial heights!