The Great Capital Shift: Navigating Market Cycles, Digital Assets, and the Future of Wealth

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's a great honour to embark on this journey with you as we explore the secrets of quantitative trading. The global economy is shifting rapidly, from geopolitical tensions to opportunities driven by technological innovation. In this complex environment, our quantitative trading system has delivered impressive results.

Tonight, we’ll begin by examining market trends, analysing global economic shifts, and identifying the investment opportunities arising from current tariff policies.

Today, the UK stock market struggled overall, facing multiple headwinds. The FTSE 100 Index dropped 0.68%, reflecting a clear shift towards cautious sentiment. A surprise rise in inflation was the main bearish factor—January’s Consumer Price Index (CPI) rose 3.0% year-on-year, significantly higher than December’s 2.5%. This exceeded market expectations, almost eliminating hopes for a Bank of England rate cut in March. The odds of a rate cut next month in the money market fell from 12.5% to below 7%. This suggests the high-rate environment may persist longer, further restricting market liquidity and dampening investor confidence.

In terms of sector performance, mining, aviation, and real estate bore the brunt of the downturn. Mining giant Glencore reported a 16% drop in profits, with rumours emerging about a potential abandonment of its primary London listing, dragging down the entire sector. The airline industry also struggled, with EasyJet and IAG (British Airways' parent company) facing selling pressure. Meanwhile, the real estate sector suffered due to rising inflation and uncertainty surrounding interest rates. Major homebuilders saw stock prices fall across the board, reflecting weak confidence in a sector recovery.

Overall, the UK stock market is grappling with inflation pressures, interest rate uncertainty, and declining sector earnings. With no strong bullish catalysts in the short term, capital outflows may increase, keeping the market under pressure.

The US market also experienced a pullback. After reaching an all-time high on Tuesday, the S&P 500 retreated, while the Dow Jones and Nasdaq also declined. Investor sentiment turned cautious, mainly due to uncertainty over Federal Reserve policy, Trump's latest tariff proposals, and weak economic data. All eyes are now on the upcoming Federal Reserve meeting minutes, as traders seek clues on future rate decisions. The Fed has already signalled that it is in no rush to cut rates, and with inflation remaining stubbornly high, markets now anticipate a delay in policy easing. This has made investors even more cautious.

Adding to the pressure, President Trump has proposed a 25% tariff on imported cars, chips, and pharmaceuticals. While details remain unclear, fears of rising global trade tensions have already weighed on the market.

On the economic front, US housing starts in January fell 9.8% from the previous month, missing expectations. This indicates that the real estate market continues to struggle under high interest rates, with homebuyer demand remaining weak and the industry's recovery looking uncertain. With stock valuations already near record highs, investors are reassessing risks, leading to increased market volatility. If the economic outlook worsens or policy uncertainty increases, US stocks could face a deeper pullback.

In this kind of market, many students are thinking about how to adjust their investment strategies. For those heavily invested in stocks, the big question is whether to hold on or start cutting positions as the market fluctuates at high levels. With the S&P 500 and Nasdaq constantly hitting record highs, optimism is fading, and more investors are starting to worry about stock valuations.

We need more than just a feel for market sentiment to answer these questions. We must take a rational approach, analyzing whether the forces driving this rally are still strong and what risks lie ahead. Only by understanding the core of data and policy changes can we make more precise investment decisions in an uncertain market.

A recent market survey shows that about 89% of respondents believe US stocks are seriously overvalued, the highest level since 2001. Risks are building, and the idea of "American exceptionalism," where global investors favour US stocks over others, is being questioned. For more than a decade, the US stock market has outperformed the world, driven by the tech industry. However, with the macroeconomic environment shifting, more investors are realizing that this kind of rally doesn't come without costs. While the S&P 500 keeps pushing toward record highs, the market itself is becoming more divided.

BTIG's technical analyst Jonathan Krinsky warns that the current trend could be setting up for a major pullback. He points out that while the S&P 500 looks strong on the surface, less than 60% of its stocks are above their 50-day moving average. This means most stocks haven't truly participated in this rally, and the gains are largely driven by a handful of big tech names. That's a fragile setup. If money starts flowing out of these key stocks, the drop could be much sharper than expected. Krinsky believes that if this pattern continues, the market could see a deep correction before Mar, and investors should stay cautious.

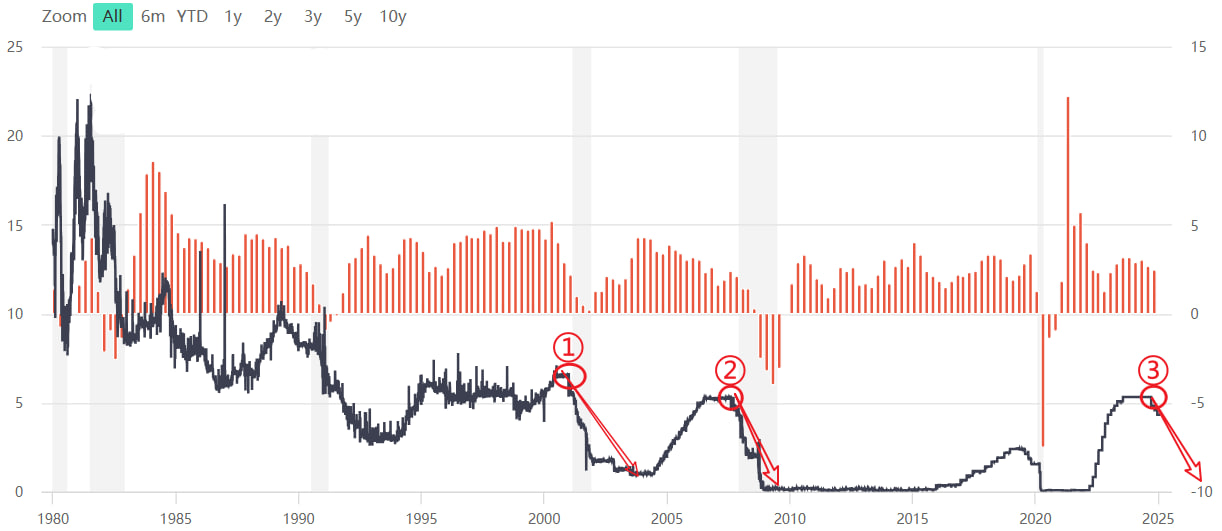

Of course, market trends can't be judged by just technical analysis or short-term sentiment. A deeper understanding of economic cycles and monetary policy is key. In the long run, whether US stocks are fairly valued and if a major pullback is coming will ultimately depend on the strength of the economy. And to understand that, we need to study how economic cycles work and how monetary policy shapes market trends. Looking back at the past 30 years, the US has gone through three major rate hikes and rate cut cycles, each leaving a deep impact on global markets. Right now, we're at the start of the third major rate-cutting cycle.

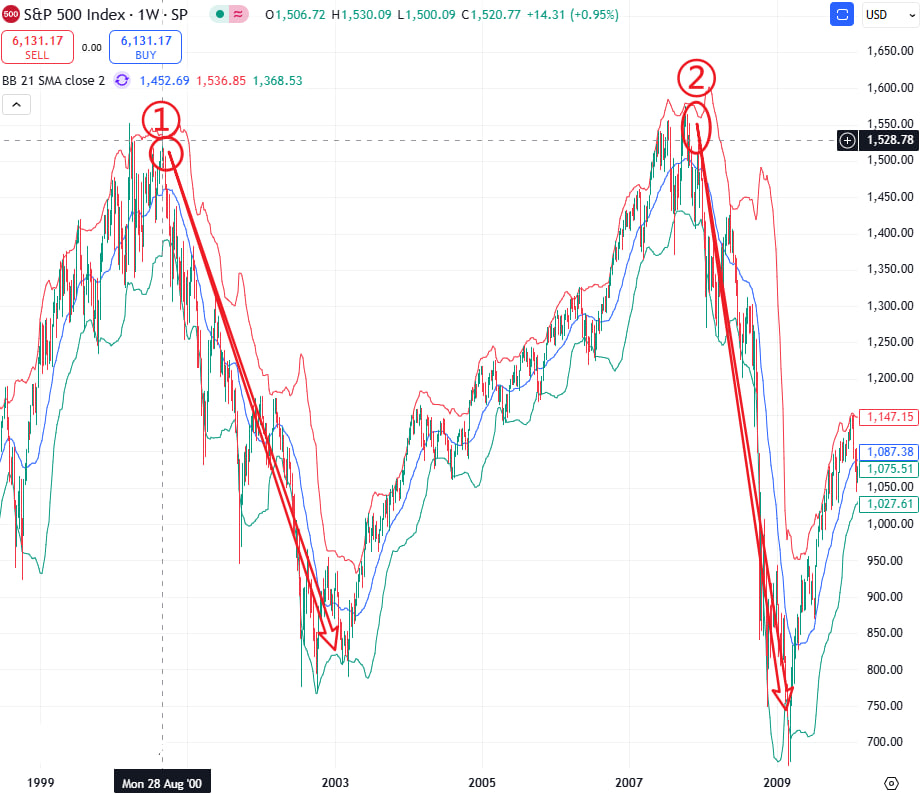

If we look back at the last two Fed rate-cut cycles, we can see a clear pattern: when the Fed starts cutting rates, the market doesn’t immediately enter a new bull run. Instead, stocks usually go through a deep pullback. This happens because of the delayed impact of an economic downturn.

Historical data shows (see Chart ①) that at the end of 2000, the Fed launched an aggressive rate-cut policy to deal with the dot-com bubble burst, lowering the benchmark rate from 6.5% all the way down to 1%. However, this didn’t stop the market from falling. In fact, during this period, the S&P 500 dropped from 1,530 to 780, a nearly 50% decline. The FTSE 100 also fell more than 45%.

The same thing happened from late 2007 to mid-2009 (see Chart ②). The Fed started another rate-cut cycle, slashing rates from 5.25% to 0-0.25%. But instead of stabilizing, the market kept dropping. The S&P 500 plunged from 1,570 to 680, with a max decline of 55%, while the FTSE 100 lost over 45% in the same period. These numbers all point to one thing: US and global stocks enter a deep pullback whenever the Fed kicks off a major rate-cut cycle. And this time, history might just repeat itself.

In Sep 2024, the Fed started a new rate-cut cycle, which the market called the “strongest rate-cut wave in history.” This time, the background is more complicated than the previous two. The Fed’s benchmark rate started dropping from 5.5%, while in the past, the Fed usually cut rates aggressively only after clear signs of recession. But this time, the Fed began cutting rates early, even though inflation was still high, economic growth was slowing, and it was not fully in recession yet. The market has mixed views on this, and some investors think the Fed is trying to avoid a hard landing, while other investors worry that cutting rates too soon could lead to even worse stagflation risks.

What’s even more concerning is that this round of rate cuts is happening in a tougher macro environment than before. Over the past four years, the world went through the pandemic, and central banks flooded the market with liquidity, causing an oversupply of money. At the same time, geopolitical conflicts kept escalating, and global supply chains became less stable. In 2022, the Fed hiked rates above 5% to fight runaway inflation. While this move controlled inflation in the short term, it also slowed US economic growth significantly. Now, the Fed is forced to cut rates again to ease the pressure of high interest rates on the economy. But historically, once the Fed starts cutting rates, it usually signals an upcoming recession. When that happens, corporate earnings drop, investor confidence weakens, and the stock market faces a deep correction.

Overall, US stocks are already at peak valuations. The market’s rally is mostly driven by expectations of easier money. But as the rate-cut cycle moves forward, fears of a recession will grow, and global capital may start pulling out of stocks and shifting to safer assets. Based on past patterns, US and global stock markets could enter a long downturn over the next two years. Right now, the market’s optimism might just be the calm before the storm.

This also explains why the Fed has been slowing down rate cuts lately. The market originally expected the Fed to cut rates quickly in 2024, but recent Fed meeting minutes show that officials are more cautious. The Fed wants to slow the pace of rate cuts to avoid a rapid slide into recession. But that doesn’t mean the market can avoid a correction. On the contrary, once investors realize a recession is inevitable, their risk appetite may shift dramatically, and the stock market’s drop could be even worse than the historical average.

However, in reality, the chance of a soft landing is almost zero based on the current situation. On one hand, the Fed wants to avoid cutting rates too soon to keep market confidence high, but other major economies like the EU, UK and Australia have already started their rate-cut cycles. This has created a serious divide in global liquidity policies. As the world’s largest economy, the US is still trying to hold rates high for now, but eventually, it will be forced into a rate-cut cycle due to global economic pressures. When that happens, the dollar’s appeal will drop fast, and money may start flowing out of US stocks in search of a safer place.

On the other hand, ongoing geopolitical conflicts are making the global economy even more uncertain. Although there have been reports of US-Russia talks about a ceasefire in the Russia-Ukraine war, the reality doesn’t look promising. Ukraine is still bombing Russia’s energy infrastructure, and conflicts in the Middle East, such as the Israel-Palestine war and the Syria conflict, are still ongoing.

Besides that, regional wars in Africa and rising military tensions across continents are also heating up. Over the past two years, so many wars have broken out suddenly across the world. Besides causing humanitarian crises, they have also made the economic environment more unstable. At the root of these wars is the global money oversupply, uncontrolled inflation and rising debt, which have all intensified economic tensions.

Against this backdrop, global capital is looking for new directions, and the market’s investment logic is shifting. From a trading strategy perspective, the current stock market should be approached with a selling mindset, especially for high-valuation industries that are heavily affected by macro conditions. If there’s enough cash on hand, it might be worth picking up some long-term growth tech stocks at lower prices. But what’s even more worth watching is the rising digital asset market. Historically, whenever traditional markets enter a recession, new emerging markets tend to rise and attract capital. In this economic adjustment period, the biggest opportunity could very well be in digital assets.

The economy runs mainly on two driving forces. One is the market economy or free economy, where supply and demand adjust freely to drive market growth. The other is the policy economy, where governments control the market through various policies to protect their own economic interests. The global economy will grow rapidly if these two forces move in the same direction. But if they go against each other, it can cause economic turmoil or even a crisis. The global economy is currently caught in a battle between these two forces.

On one hand, the free economy, driven by the tech revolution, is pushing the world into the Fourth Industrial Revolution. Advancements in AI, big data and blockchain are reshaping business models and capital markets, fueling a new wave of wealth growth. On the other hand, governments are turning to trade protectionism to deal with the slowing global economy and trade imbalances, using tariffs, exchange rates and fiscal stimulus to stabilize their economies. The clash between these two trends will inevitably lead to a major redistribution of global capital.

If we look at the long run, tech development is the only real path to economic growth. History has proven this through three previous industrial revolutions. The shift from an agricultural to an industrial economy moved wealth from land and farm products to industrial assets and machinery. As we have moved into the information age, wealth has shifted again from traditional industries to tech giants like Microsoft, Apple, Amazon, and Google. Now, we are transitioning from the information age to the digital age. AI, digital assets and blockchain are driving the digitization of global assets. This means traditional asset forms like stocks and real estate could eventually be replaced by digital assets, creating a whole new economic system. This is the natural course of history and the future direction of capital markets.

It’s worth noting that every tech revolution has come with an economic crisis, and economic adjustments often act as a catalyst for the rise of new technologies. In the 18th century, the Industrial Revolution disrupted traditional farming economies, but at the same time, new industrial companies emerged and boosted productivity. In the 20th century, the internet revolution challenged old business models but also created unprecedented economic growth, giving global capital new places to flow.

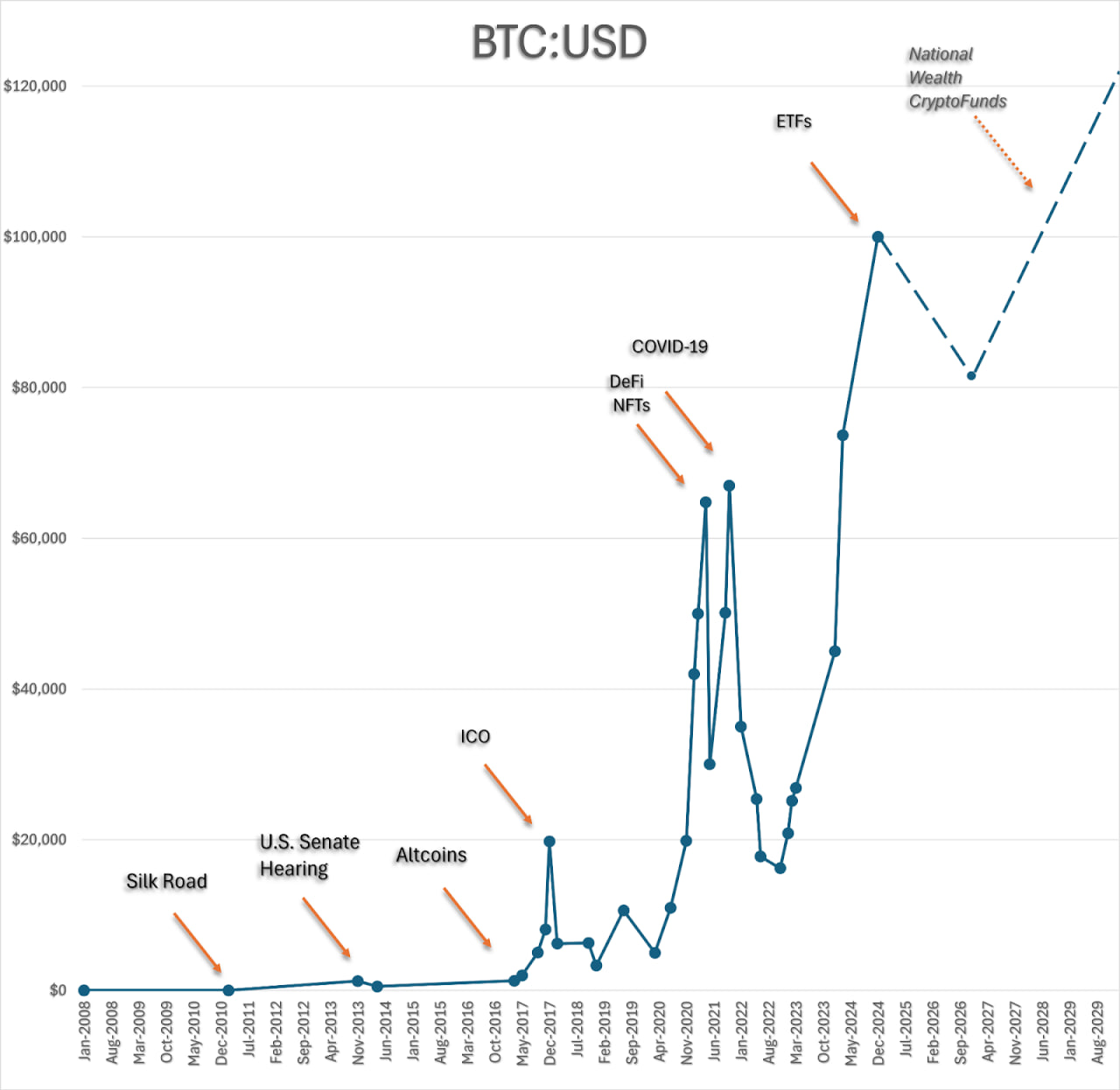

Today, the global economy is undergoing structural changes. Traditional economic models are fading, while breakthroughs in AI, digital assets and blockchain are reshaping how capital markets operate. Just like after the 2008 financial crisis, when doubts about the stability of the Fiat Currency system grew, BTC was born. Over the past decade, it has gone from being unknown to becoming a major global digital store of value.

BTC's price started from zero and climbed to a record high of $110K. Its path wasn't linear; it went through multiple cycles of surges and pullbacks. In 2010, a pizza cost 5,000 BTC and in 2011, the rise of Silk Road triggered an early price spike. Even though the US government shut down the marketplace, a public hearing in the US Senate unexpectedly pushed BTC past $1.2K.

From then on, BTC started gaining attention as a new asset. In 2016, the launch of ETH and smart contracts opened a new chapter in the crypto market. The 2017 ICO boom pushed prices even higher, with BTC reaching $20K. However, after the overheated market, 2018 saw the first crypto winter, with prices dropping sharply. However, the rise of decentralized finance (DeFi) and the explosive growth of NFTs brought new momentum, further solidifying BTC's position.

As the market matured, institutional investors started getting in. BTC gradually shifted from a speculative tool to an important part of global investment portfolios. In 2022, traditional financial institutions officially launched BTC exchange-traded funds (ETFs), and by 2024–2025, the market reached its peak. BTC established itself as "digital gold," becoming a key asset for hedging against Fiat Currency depreciation and global economic uncertainty.

Now, there are even rumours that the US government might invest directly in crypto assets through a newly established sovereign wealth fund. If this happens, it won't just inject more liquidity into the BTC market, but it could also influence global policies and trigger a chain reaction. As the world's financial hub, the US government's gradual recognition of BTC's value would force other countries to adjust their stance on digital assets. This trend could lead to another major price surge for BTC within the next two to five years.

Although Bitcoin's speculative value remains a topic of debate in the market, there is no denying that it has become an important asset in the global financial system. Since its creation, Bitcoin has not fully followed the "electronic cash" system envisioned in Satoshi Nakamoto's white paper, but this does not mean its potential is limited. On the contrary, its evolution has shown that Bitcoin is more than just a payment tool—it is a key foundation of the next-generation digital financial system.

In regulated markets, Bitcoin has moved beyond pure speculation and is gradually establishing itself as a form of money. Its decentralised, censorship-resistant and programmable nature makes it one of the best hedging tools against global inflation, excessive money printing and economic uncertainty.

Many people question BTC's reliability, but in reality, it has been running as the world's first fully decentralized ledger system for 17 years without any major security incidents, an unmatched achievement in financial markets. Compared to traditional banking systems and Fiat Currency frameworks, BTC is even more secure. Its resistance to censorship and decentralized nature make it a new option for global capital flows.

Now, financial authorities worldwide are recognizing BTC's resilience and security. In the future, it will play a bigger role in various applications. BTC's blockchain isn't just a financial tool. It could be used for national land registries, decentralized alternatives to DNS systems and even electronic voting in democratic countries. While BTC's high transaction costs limit its use in small payments, its security makes it irreplaceable for storing critical, tamper-proof data and financial settlements. Following today's economic trends, we will focus on tech investments, prioritizing digital assets while using tech stocks as a secondary strategy to capture the wealth-shift opportunities ahead.

In this environment where crisis and opportunity coexist, many investors hope to preserve their assets while achieving financial freedom. From an investment logic perspective, the market operates along two main paths: one driven by the free market economy powered by technological revolutions and the other driven by government-led policy economics. Right now, we are in the acceleration phase of the Fourth Industrial Revolution, while global tariff policies are increasing market volatility. With these two factors combined, we expect major investment opportunities in the next month due to both technology-driven and policy-driven forces.

From today’s discussion, I believe everyone now understands that investing isn’t complicated. As long as you follow the trend and seize every profit opportunity, you can achieve steady wealth growth. The global capital market is undergoing structural adjustments. This is not just a time for risk management. It’s also a key turning point for capital flow. For investors, now is the best time to adjust asset allocation. Especially for those with limited capital, my advice is to focus on building up your initial funds first. Get out of financial difficulties, increase your cash flow and then gradually move toward financial freedom.

For investors with more capital, we are also actively looking for better ways to help you seize the current market opportunities and achieve more stable wealth growth. The Business Academy, project partners and student representatives have reached a basic consensus. Soon, we will launch a win-win partnership investment plan to provide customized investment strategies and precise market guidance for investors of different capital levels. Through this plan, we aim to help more investors allocate assets efficiently and achieve long-term stable growth in the current market. Stay tuned.

At the same time, I suggest everyone get ready for trading and actively participate in the market to take advantage of the “double-your-capital” profit plan. The market is at a critical point, and after tonight’s Federal Reserve meeting minutes are released, the trend will become even clearer. This will be a prime profit window for short-term traders.

So, make sure you are well-prepared in terms of both capital and strategy. For those looking to double their capital, now is the best time to take action. The market has already sent clear signals, and wealth always belongs to those who dare to act decisively at the right moment. Let’s move forward together and seize the wealth opportunities in front of us!