Seizing Market Opportunities: Mastering Next Week’s Strategy to Double Capital Amid Global Trade and Economic Shifts

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's a pleasure to be here with you again. In this market full of opportunities and challenges, we've managed to navigate the volatility and achieve 80% of our profit target using our quantitative trading system and arbitrage strategies. This success paves the way for the launch of our 'Capital Doubling' Weekly Profit Plan tomorrow. Tonight, I'll dissect the impact of Trump's reciprocal tariffs on global capital markets and guide you on how to seize significant profit opportunities in this global economic battle.

Before we analyze the opportunities from the global trade war, let's first review this week's market performance. First, let's look at the UK stock market.

This week, the UK stock market saw a moderate uptrend. In the first half of the week, the market climbed due to the Bank of England's rate cut and better-than-expected GDP data. However, in the latter half, a stronger pound put pressure on export-driven stocks, leading to a slight pullback in the FTSE 100 index. In the end, the FTSE 100 gained 0.37% this week, marking its third straight week of growth.

Last week, the Bank of England cut its benchmark rate by 25 basis points to 4.5%, marking the third rate cut since Aug 2024. The move aims to counter slowing economic growth and inflation pressure. Previously, the Bank of England lowered its 2025 growth forecast from 1.5% to 0.75%, reflecting weak business and consumer confidence as well as sluggish productivity growth.

Data released this week showed that the UK economy grew 0.1% quarter over quarter in Q4 2024, with a 0.4% rise in Dec alone, beating market expectations. However, full-year growth stood at just 0.8%, lower than the previous year's 1.4%. Meanwhile, the Bank of England expects inflation to hit 3.7% in Q3 2025, up from its previous 2.8% forecast, mainly due to rising energy prices and higher public service costs.

At the industry level, concerns over the Labour government's tax policies and global trade uncertainty have led to declining investment and hiring intentions. Additionally, potential risks from US tariff policies have added more uncertainty to the UK economy. In the short term, UK stocks showed cautious optimism this week under the combined influence of policy adjustments, economic data and industry trends. However, in the long run, slowing growth and high inflation may pose downside risks for the stock market.

On the other hand, US stocks had an overall uptrend this week, driven by tariff policies. The S&P 500 rose 1.47%, the Dow Jones Industrial Average gained 0.55%, and the Nasdaq jumped 2.9%. Despite high market volatility, the general trend remained positive, with the S&P 500 nearing its all-time high and the Nasdaq and Dow following closely behind. The tech sector led the way, with the digital economy and AI-related stocks continuing to attract investor interest, serving as key drivers of market gains.

On the policy front, Fed Chair Powell reiterated that there's no rush to adjust interest rates and emphasized the current stance remains appropriate. Meanwhile, President Trump announced new tariff policies, but the market focused more on relatively mild inflation data.

Regarding economic data, the US CPI rose 0.5% month over month in January, marking its largest increase in nearly 18 months, with a 3% year-over-year gain. The PPI also showed strength, rising 0.4% month over month and 3.5% year over year. Despite inflation data coming in higher than expected, Fed officials stated they would assess Trump's policy impact before making any decisions, suggesting no immediate rate changes in the short term.

At the industry level, the tech sector once again led the market, with AI-related firms standing out. Additionally, Berkshire Hathaway’s latest investment disclosure showed continued heavy holdings in Apple, signalling long-term confidence in the tech sector. Although US stocks had a strong week boosted by tech, tariff policies and persistent inflation could pose risks to both the US and global markets.

Despite global economic uncertainties, our profit plan this week was a complete success with the support of our quantitative trading system. Leveraging this week’s economic data and Trump’s policy impact, short-term stock INOD saw a peak gain of over 70% this month, with a minimum gain exceeding 20%. In contract trading, our arbitrage strategy in the Crypto market helped us achieve 80% of our profit target. Specifically, BTC’s range-bound movement under Trump’s tariff policy created excellent trading opportunities for us. Moving forward, we’ll focus on Trump’s tariff policy changes, as they will have a massive short-term impact on the economy. Many students still lack a clear understanding of the global trade war triggered by high inflation, so I will now provide a more detailed explanation.

Recently, Trump has once again pushed for a reciprocal tariff policy, causing major turbulence in the global economy. The core idea of this policy is to make US tariffs on other countries match what those countries impose on the US. In other words, both sides must apply the same tariff rates to each other. However, to secure an advantage for the US, Trump is not just demanding equality; he’s even willing to raise tariffs beyond that. This means previous trade imbalances will be eliminated, reshaping the global trade landscape. Take US-EU auto tariffs as an example. The EU currently imposes a 10% tariff on American cars, while the US only charges 2.5% on European cars. Trump sees this gap as unfair and has proposed raising US auto tariffs to 10% or even higher, matching the EU’s rate and correcting this trade imbalance.

On the surface, Trump’s reciprocal tariff policy seems like an effort to balance trade rules, but there’s much more behind it. As a businessman turned president, Trump is a master negotiator. His real goal with this policy is to gain leverage in trade talks with other countries. For example, after Trump announced the policy, Indian Prime Minister Modi quickly visited the US to negotiate tariff exemptions for Indian goods. India has long imposed high tariffs on American products, such as 28% on US cars and up to 150% on alcohol. Under Trump’s pressure, India had to reconsider its strategy. Similarly, Brazil rushed to arrange talks with Trump’s team, hoping to secure exemptions for its steel and aluminium exports. This shows that Trump has successfully taken the upper hand in negotiations, setting the pace and forcing major economies into trade talks with the US.

More importantly, the reciprocal tariff policy has long-term strategic significance, as it is driving a global supply chain shift. The new tariffs cover key industries like automobiles, electronics, agriculture, steel and aluminium. This expands the impact of the previous Section 301 tariffs and disrupts global manufacturing. Many multinational companies are now reassessing their supply chain strategies, with some moving production from China to Vietnam, India and other emerging markets to avoid tariff risks and supply chain uncertainties. This shift not only affects US-China trade but also brings profound changes to Asia’s and the world’s economic structure.

As a key US trade partner, the EU is one of the biggest targets of the reciprocal tariff policy. On average, EU tariffs on American goods are higher than US tariffs on European products, with the auto and agriculture sectors hit the hardest. German and French carmakers, along with the steel industries in Italy and Spain, now face higher export costs. In response, the EU has moved quickly to counteract, planning to impose tariffs on US agricultural products, Boeing aircraft and tech goods. This tit-for-tat strategy has further escalated trade tensions, increasing global economic uncertainty.

China is also facing significant challenges. The potential expansion of Section 301 tariffs by Trump to more categories, including semiconductors, solar energy and rare earth materials, poses a grave threat to China's high-tech and new energy industries. This compels Chinese companies to reconsider their supply chain strategies and export plans. The potential shift of some production lines to Southeast Asian countries to reduce reliance on US-China trade not only impacts this trade but also has the potential to disrupt the global manufacturing system, leading to broader economic instability.

India, Japan, and South Korea are also deeply affected. India's long-standing high tariffs on American products, particularly cars and alcohol, are being challenged by Trump's reciprocal tariff policy, prompting India to rethink its trade strategy to avoid US retaliation. Despite their close ties with the US, Japan and South Korea's high tariffs on American products in sectors like agriculture and autos make them susceptible to reciprocal tariffs, which could have a significant impact on their economies. Given the importance of agriculture as a key economic pillar in these countries, any blow to the sector could trigger widespread social and economic consequences.

Additionally, countries across the Americas, including Canada, Mexico and Brazil, are closely watching this policy. Canada and Mexico have strong trade ties with the US under NAFTA, but they still face tariff risks in certain industries. These countries are currently actively negotiating with the US to delay policy implementation. Meanwhile, ASEAN countries, with their lower production costs and strong trade leverage, actually have an advantage in this situation. Some may even secure exemptions, making them the new winners in global trade.

While the reciprocal tariff policy may boost US manufacturing and make domestic products more competitive in the short term, its long-term impact on both the US and the global economy cannot be ignored. First, other countries will inevitably impose retaliatory tariffs, raising production costs for American businesses. Large multinational corporations that rely on global supply chains, like Boeing, Tesla and Apple, will face higher expenses and tougher international competition. Second, this policy could worsen inflation in the US. Rising import prices will directly increase living costs for American consumers, squeezing household spending and putting pressure on economic growth.

At the same time, the Federal Reserve's monetary policy will be heavily affected. With inflation climbing, the Fed will face greater pressure on interest rates and overall market liquidity. The latest data from the New York Fed shows that US consumer debt has hit a record $18T, with default rates continuing to rise. Long-term tariff policies will only make this burden heavier, especially for small businesses and everyday families, leading to even greater financial strain.

On a global scale, the reciprocal tariff policy could potentially trigger a new financial crisis. The International Monetary Fund and the World Bank have already revised their global GDP growth forecasts, cautioning that if trade tensions continue to escalate, the world economy could face a severe recession or even systemic risks. Multinational companies would be forced to cut investments, lay off workers, or shut down operations, creating a ripple effect that would drag down the global economy.

In this growing global economic uncertainty environment, more and more countries and businesses are stockpiling gold and crypto as safe-haven assets. As a traditional hedge, gold has seen its price steadily rise in recent years. However, compared to gold, the rise of crypto is offering a brand-new solution for the global economy. Since 2018, an increasing number of multinational companies have started using crypto for trade settlements, not only cutting cross-border payment costs but also avoiding risks caused by exchange rate fluctuations.

The decentralized and inflation-resistant nature of crypto makes it a key tool for dealing with global economic turbulence. As Trump’s tariff policies move forward, the crypto market is expected to see another wave of growth. More businesses will choose to accumulate BTC, ETH, and other digital assets, and they may even use tokenized financing to drive business innovation and expansion. In the future, digital assets will not only serve as a hedge but also become a crucial part of global capital flow, pushing financial markets toward greater decentralization and digitalization.

This tariff battle is full of risks, but it also brings huge opportunities. History has repeatedly shown us that every major shift in the global economic landscape creates a chance for new industries and assets to rise. This time, crypto and digital assets will undoubtedly play an even bigger role in shaping the future of the global economy, driving the world into a new digital era.

In such a complex and fast-changing economic environment, combined with the massive impact of the tech revolution, we must focus more on asset allocation and investment strategies. On the one hand, we need to think about how to avoid asset devaluation caused by global inflation, especially for assets priced in Fiat Currency. This is precisely why gold and other safe-haven assets have been rising recently. More and more countries, businesses, and even individual investors have recognized this risk and are buying gold to hedge against it. On the other hand, the key is how to achieve long-term and stable asset growth in an uncertain market. A trinary investment portfolio is a highly recommended choice. It not only effectively preserves wealth, but it also takes advantage of the tech revolution and digital economy trends, empowering investors with a well-rounded approach to gain long-term growth opportunities in a volatile market.

Short-term contract trading is a highly attractive option for students who haven't yet built up their initial capital or want to achieve higher returns. Contract trading isn't actually complicated; it's all about making a profit from the price difference between buying and selling, especially when digital assets like BTC experience predictable market trends due to specific events.

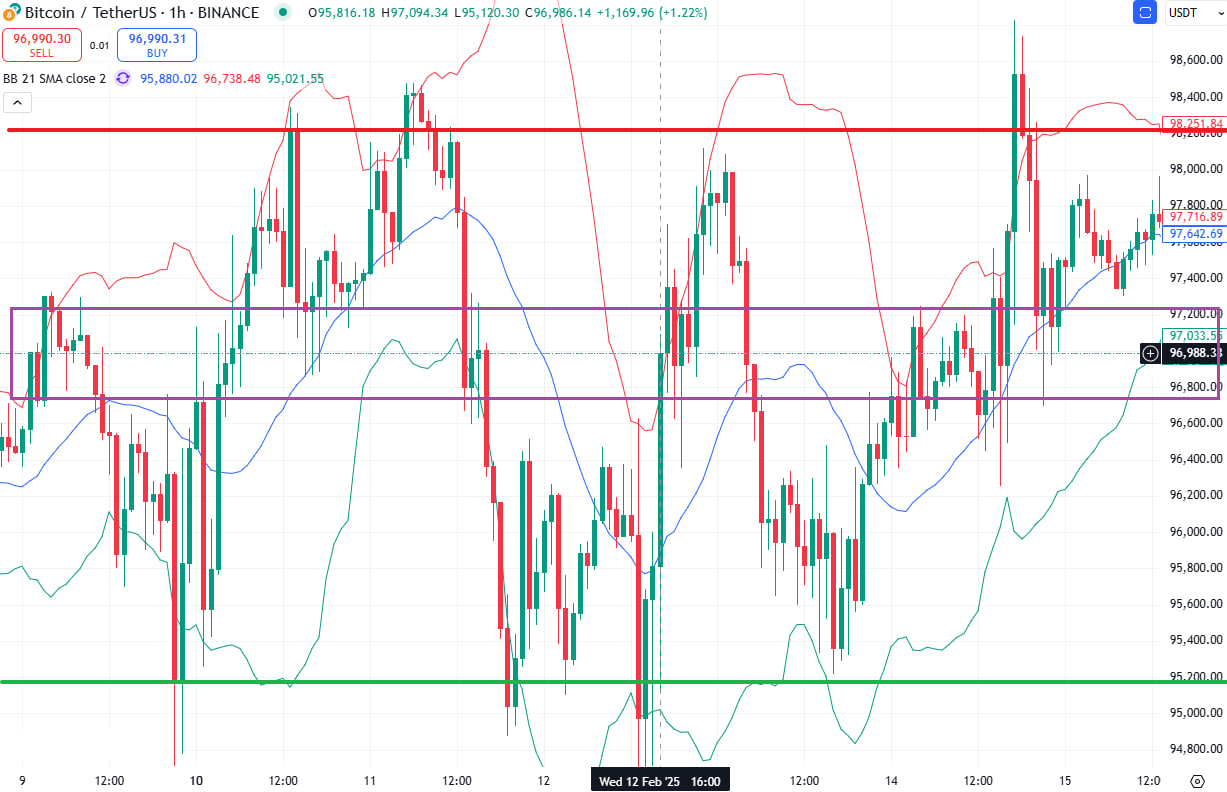

As shown in the chart, BTC has been moving within a range-bound market between $95K and $98.5K this week. If you've been paying attention, you'll notice that this kind of price fluctuation is perfect for arbitrage trading. By opening long or short positions near the midpoint of the range, around $97K, you have a high chance of making a profit. This is the core advantage of arbitrage trading: by continuously capturing opportunities within the range, you can not only reduce risk but also take advantage of market volatility caused by data or policy changes. Repeatedly trading within the range allows for stable and efficient returns.

This week’s short-term profits have been absolutely crazy, with some trades delivering returns far beyond our initial expectations. However, this fast profit-making has also led to some negative behaviour. Some students have less than $10K in capital but keep using heavy positions or even going all-in. While some made their initial investment two to three times this week, many others suffered losses due to excessive risk-taking. Chasing high returns while ignoring risk control can easily turn into pure gambling, leading to unpredictable results. Some students even mentioned that extreme trading cases shared in the group affected their mindset, disrupted their strategies and eventually led them to leave the group.

For those who went all-in, I must give a serious warning. Investing is not gambling. It’s a professional skill based on scientific methods, rational analysis and strict risk management. Chasing high returns blindly while ignoring risk control can easily lead to losses, cause psychological stress and disrupt long-term investment plans.

At the same time, we immediately reached out to the affected students and gathered their feedback and suggestions. Based on their input, we are preparing a more comprehensive investment service plan and actively expanding our academy’s team of analysts and assistants. Our goal is to help everyone maximize their profits while meeting the needs of each student. Thank you for your understanding and support; this motivates us to keep improving our teaching and services.

Next week’s trading presents an exciting opportunity, and we will closely monitor market changes driven by global tariff policies. With the impact of US reciprocal tariffs, major economies like the EU, the UK, and China will surely respond with their own policies. This could break the current market price trends and trigger a new wave of movement in the crypto market. That’s why our main focus for next week is the “Capital Doubling” profit plan. Based on past trend movements, we expect BTC to fluctuate by around $15K this time. Following a relatively conservative strategy, we only need to capture a $7.5K price range. Even if we use just 20% of our capital for contract trading, we can easily achieve 1.5x returns.

For students with larger capital, we can continue adding positions as the trend becomes clearer, based on market conditions and profit levels, to maximize gains. For example, we can start building long positions when BTC is at $96K. Once the price rises to $98K and confirms a bullish trend, we can increase our position after securing some initial profits. This way, we use existing profits as a safety cushion while gaining higher returns as the trend continues. This strategy not only lowers investment risk but also maximizes profits. Therefore, for students with smaller capital or those who haven’t built up their initial funds yet, now is the time to prepare. Make sure to seize this major opportunity brought by the “tariff market” next week.

Through tonight’s discussion, I believe everyone has gained a deeper understanding of the current economic situation and investment opportunities. Stagflation and high inflation are the core issues in today’s economy. In response, various countries are implementing tariff and monetary policies, causing significant shifts in the capital markets. As I’ve always emphasized, in a market where crisis and opportunity coexist, the most dangerous thing isn’t risk; it’s missing out on great opportunities.

Next week’s market is a rare opportunity for us. By combining quantitative trading and arbitrage strategies, every student has the chance to achieve rapid capital growth. Let’s stay confident, take action, and seize this golden profit window created by economic shifts. Together, we will reach our weekly goal of “Capital Doubling.”