Seizing the Future: Inflation, Digital Assets, and the Path to Wealth.

Hello, everyone at Diamond Ridge Financial Academy!

I’m Charles Hanover, and I’m excited to be here with all of you in this era full of opportunities. Continuously investing in yourself and learning are the keys to building wealth.

Tonight, we’ll start by analyzing market trends and discussing inflation, what it really means, the challenges it brings and the investment opportunities it creates.

Today, the UK stock market had a weak performance, with the FTSE 100 dipping 0.49%. This was mainly due to disappointing corporate earnings, policy changes and global market movements. British American Tobacco, Unilever and Barclays were the biggest drags on the index. All three companies reported earnings that missed expectations, with British American Tobacco taking the hardest hit. Its stock plunged over 8% as slowing growth in smoke-free products raised concerns about future profits. This shows how inflation and rising costs are squeezing profits in the consumer sector.

Meanwhile, US Treasury yields have climbed to a two-year high, reinforcing expectations that global interest rates will stay high. This has made investors more worried about tightening liquidity, putting pressure on financial stocks. While the UK market struggled, major European indexes surged due to potential progress in Ukraine peace talks. The significant rise in Germany’s DAX and France’s CAC, by 1.7% and 1.4% respectively, is a clear reflection of the impact of geopolitics on market trends. This proves that short-term market moves aren’t just about fundamentals. They’re also shaped by policy, geopolitics, and investor expectations.

Looking at the US stock market, Wall Street had a choppy but positive day. The Dow, S&P 500 and Nasdaq all edged higher. Investors digested inflation data and policy expectations while reacting positively to the news that Trump is delaying new tariffs. The Nasdaq jumped over 1% at one point, showing cautious optimism. Earnings season remains a key focus, with over 77% of S&P 500 companies beating expectations, giving the market some solid support. Tech and financial stocks, in particular, stood out thanks to strong earnings reports.

However, inflation remains the biggest market driver. The US Producer Price Index (PPI) for Jan rose 0.4% month over month, higher than expected. This shows that inflation pressure is still strong, which might keep the Fed from cutting rates anytime soon. Even though PPI was high, Trump’s decision to delay tariffs was a short-term boost for the market. The latest update suggests that the new tariff policy on global imports won’t take effect until Apr 1st, which temporarily eases trade war concerns and improves market sentiment.

From a fundamental perspective, these short-term positives are keeping the dollar strong. However, the dollar could face downward pressure if the tariff policy leads to global retaliation. With inflation still high worldwide, traditional assets are entering a period of greater uncertainty and volatility. Moving forward, the Fed’s next move and Trump’s trade policy decisions will be the biggest market drivers, creating new opportunities for arbitrage and strategic plays.

Today’s trading session highlighted the complexity of the market even further. The combination of PPI data and tariff news led to noticeable market swings. INOD outperformed expectations, surging more than 15% in a single day. At the same time, the crypto market saw significant volatility, creating excellent contract trading opportunities for us.

Take BTC as an example. Over the past week, it has been bouncing between $95K and $98.5K. By using our quantitative trading tools and range-bound strategy, we shorted at resistance and went long at support, locking in steady profits.

Students who followed our arbitrage strategy today saw total returns exceed 25%. Because of the mixed impact of tariff policies and PPI data, BTC, Eth and other cryptos reacted with a delay, creating great arbitrage opportunities. From a price action standpoint, Eth was more responsive today, leading the broader crypto market. This gave us precise entry points for arbitrage trades. Some students with larger capital took full advantage of this and made over 300% returns on single Eth trades.

More importantly, we effectively hedged risk by combining multi-dimensional arbitrage strategies with quantitative tools. Not only did we avoid short-term market volatility, but we also maximized returns. Today’s trades once again proved the strength of our quantitative system in a complex market. It doesn’t just identify opportunities with precision but also executes trades automatically and integrates multiple strategies for stable and efficient profits. With more economic policies and data releases coming up, we’ll continue helping our students navigate market turbulence and generate exceptional returns.

Lately, inflation has been the centre of attention. Whether it’s economic data tied to inflation or key policymakers’ statements, the market has been reacting with extreme volatility. Some even argue that the past three years of the Russia-Ukraine war and the ongoing military conflicts worldwide are, at their core, driven by persistent global inflation pressure. For investors, understanding what inflation really is and what’s causing it is the key to handling future economic uncertainty.

What is inflation, and why does it happen? Simply put, inflation is the decline in the purchasing power of money, shown by a general rise in the prices of goods and services. Inflation occurs when the supply of money in the market grows much faster than the actual growth of goods and services. This is usually caused by a mix of factors, such as excessive money printing by central banks, rising fiscal deficits, supply chain disruptions or geopolitical tensions. For example, after the pandemic, the US and European countries adopted quantitative easing policies, injecting massive liquidity into the market, which led to a rapid surge in global prices. Inflation may be seen as a sign of economic recovery in the short term, but if it gets out of control, the consequences can be disastrous.

High inflation not only erodes people’s wealth but can also trigger deeper economic crises. The first is a financial crisis. Central banks are forced to raise interest rates aggressively when inflation is too high. Rapid rate hikes often cause huge market turmoil, leading to sharp declines in stocks, bonds and commodities. The second is a national credit crisis. When inflation soars to a certain level, fiat currency loses much of its purchasing power. Investors start losing confidence in both the currency and the government, turning to safe-haven assets instead. This directly threatens the stability of the economy. History shows that many countries have suffered severe economic collapses due to runaway inflation. Nations like Zimbabwe and Venezuela are prime examples of how hyperinflation can destroy an economy.

To truly understand inflation, we should start with the history of money. The concept of money can be traced back to the early days of bartering. In those times, there was no such thing as money, and people exchanged goods and services directly to meet their needs. If someone who picked wild fruit wanted to eat fish, they had to find a fisherman willing to trade. And that fisherman had to happen to need wild fruit at the same time for the deal to work. This “double coincidence of wants” made trade extremely inefficient, limiting the market size and economic growth.

As societies became more complex and productive, people began looking for easier ways to trade, leading to the birth of money. Early forms of money varied widely, including livestock, shells, blocks of salt and even stones. Later, precious metals like gold and silver became the main form of money due to their rarity, durability and ease of division. Governments and empires around the world started minting metal coins, marking a major step in the development of monetary systems.

However, as commerce and long-distance trade expanded, carrying large amounts of metal coins became impractical. This led to the rise of banking systems. Banks not only helped manage and store metal money but also provided credit and loans for merchants. Paper money was initially just a substitute for metal currency, with banks guaranteeing that holders could exchange it for gold or silver at any time. However, as banking systems became more advanced, paper money gradually broke away from its metal backing and became independent fiat currency.

In the 19th and 20th centuries, the financial system kept evolving, transitioning from the gold standard to the widespread use of credit money. Central banks in different countries started managing money supply and interest rates, becoming key tools for economic regulation. By the late 20th century, rapid advances in information technology, a key driver of this evolution, brought major changes to money. Currency became digital, with bank cards, electronic checks and online banking becoming the main payment methods. This shift greatly improved transaction efficiency, driving the rise of global cross-border payments and e-commerce. Money is fully transformed from a physical form into a digital flow.

However, this was just the beginning of the transformation. In the digital economy era of the 21st century, the rise of crypto brought a whole new revolution to the monetary system. In 2009, BTC was created, marking the start of decentralized digital currency. BTC is a decentralized currency based on blockchain technology. It does not rely on any central bank or government but instead uses a distributed network for transaction verification. The core of blockchain technology lies in its decentralization and immutability, ensuring transparency and security in transactions. BTC’s success quickly led to the creation of many other crypto such as Eth and Ripple. These digital currencies are not only changing the nature of money but are also reshaping global financial markets.

So, how is this series of changes related to inflation? In fact, high inflation is one of the main drivers behind the rise of new forms of money. Whenever traditional fiat currency loses purchasing power significantly, people start looking for more reliable ways to store wealth. For centuries, gold was the most popular safe-haven asset. Today, crypto is taking on that role. Digital currencies like BTC, due to their decentralized nature and limited supply, are seen as “digital gold” and are becoming an effective tool to hedge against inflation.

Looking at the nature of money, the root cause of today’s inflation is the excessive issuance of fiat currency. To handle economic crises and financial turmoil, governments worldwide frequently use quantitative easing policies to inject massive liquidity into the market as the money supply keeps increasing while actual economic growth lags behind and prices surge, leading to severe inflation. However, returning to a gold-based monetary system is no longer practical. While gold serves as a store of value, it has many limitations in modern transactions. First, gold is not easy to carry and does not meet the needs of today’s digital economy. Second, large-scale transactions involving gold require significant manpower and transportation costs, making it inefficient for global markets.

With technological advancements and the arrival of the Fourth Industrial Revolution, crypto has rapidly risen, becoming a key force in driving global integration. Unlike gold, crypto overcomes these limitations while offering unique advantages. It is fully decentralized, not issued by any country or institution, and its market price is determined purely by supply and demand. Additionally, crypto transactions can be completed instantly on a global scale, greatly improving money flow efficiency while reducing the complexity and cost of cross-border payments. Leading digital currencies like BTC and Eth, with these advantages, are gradually becoming essential pillars of the future global digital economy.

More importantly, crypto is not just about being a medium of exchange. Many tokens are backed by high-tech projects, similar to a company’s stock, with huge growth potential. We can imagine a future where almost all technologies, services and products can be tokenized. Projects issue tokens to represent their market value. When demand for a technology or product rises, its token price naturally increases. The token price falls if a project loses competitiveness or market demand declines.

This supply and demand-based system largely eliminates the inflation problem caused by “middlemen” in fiat currency and may even remove the root cause of traditional financial crises.

SOL is a perfect example. It is not just crypto but also the foundation for decentralized applications (DApps). With its high-performance blockchain technology, SOL allows developers to build fast and efficient decentralized apps across multiple industries, from financial services to gaming, NFT marketplaces and supply chain tracking. Thanks to its unique consensus mechanism and ultra-fast transaction speeds, the SOL network has become a key infrastructure in the emerging decentralized ecosystem, as well as a valuable investment asset and financial tool.

The biggest innovation of crypto is that it completely breaks free from the traditional money issuance and regulation system. No single entity can control its supply; market demand fully determines its price. At the same time, blockchain technology, closely tied to crypto, is being widely applied in finance, supply chains, healthcare, and many other fields, making it a powerful force that drives the digital economy. Around the world, more and more tech companies, government agencies and even banks are embracing this new form of money and exploring ways to integrate it into the existing financial system.

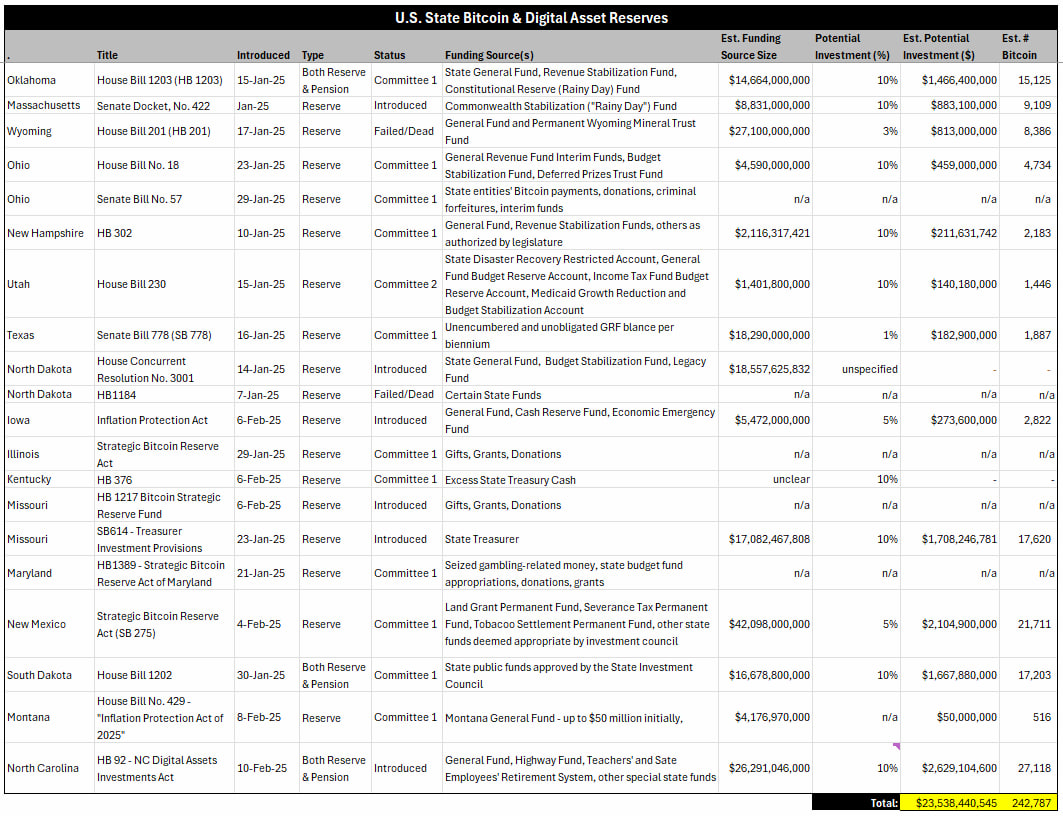

On top of that, many countries and institutions are already increasing their holdings of BTC, ETH and other digital assets, even considering them part of their national strategic reserves. Last year, the US proposed adding BTC to its national reserves and actively pushed legislation to make it a reserve asset for individual states. In early 2025, Utah became the first state to pass a BTC reserve bill, with Missouri, Arizona and Kentucky following closely behind, working on similar legislation. These policies will no doubt provide strong upward momentum for BTC and other leading crypto. According to the latest forecasts, if pension funds and other government-managed investment funds also start allocating BTC, the market could see an additional $2.3B in buying demand, creating solid price support.

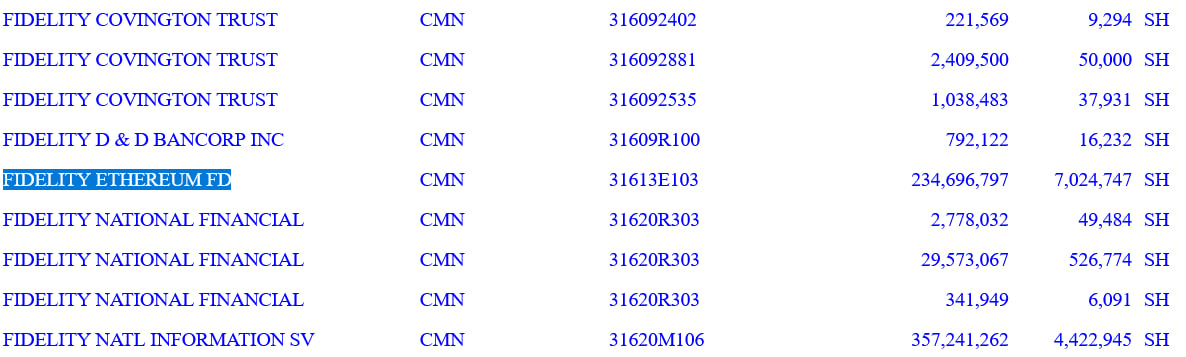

Not just US state governments but big players in finance are also increasing their digital asset holdings. Asset management giant BlackRock recently raised its stake in MicroStrategy to 5%. Since MicroStrategy is the world's largest corporate BTC holder, BlackRock now indirectly holds a massive amount of BTC. In addition, BlackRock's latest filing with the SEC reveals that its investments in BTC ETFs and Ethereum ETFs continue to expand, with over $1B in digital assets under management.

Goldman Sachs also made a significant move in Q4 2024, substantially increasing its investment in crypto ETFs. Its holdings in ETH and BTC spot ETFs surged by 114%, bringing the total value to over $1.5B, further solidifying its leading position in the digital asset market. This trend indicates that Wall Street is fully embracing digital currencies, and it's foreseeable that digital assets will become a crucial part of mainstream investment portfolios.

At the same time, Europe's acceptance of crypto is also rising. Sweden has tokenized part of its national debt assets. The Czech Republic has removed capital gains tax for BTC and other digital assets held for over three years. The UK was one of the earliest countries to open up to the crypto market. As early as 2014, the UK government recognized the legal status of crypto and introduced the FCA's "regulatory sandbox" to give crypto companies room to innovate. This move has not only attracted massive international capital but also strengthened London's position as a global financial hub.

That said, some countries remain cautious about crypto and are instead pushing forward with central bank digital currencies (CBDCs). Unlike decentralized crypto, CBDCs are issued and fully controlled by central banks to improve monetary efficiency and security. The Bank of England, the European Central Bank and other institutions have already launched CBDC pilot projects, aiming to take the lead in the future digital economy. However, this centralized form of digital money contradicts the core idea of crypto, setting up a likely short-term clash between governments and decentralized currencies.

In countries like the UK, the real goal is not to completely ban crypto but to develop a controlled, government-backed version of "non-decentralized" digital money. CBDCs, issued by central banks, go against the philosophy of decentralized crypto like BTC and Eth. This growing trend is creating more friction between governments, banks, and decentralized crypto, and in the short term, we may see intense "currency competition."

Recently, many students have faced banking restrictions when trying to buy crypto, a widespread issue across Europe. The main reason is that governments worry crypto could destabilize the traditional financial system. As a result, many banks are imposing limits on accounts involved in crypto transactions or even shutting down related payment channels. But there's still a way around this. If banking channels don't work, especially for VIP students, you can opt for C2C (Customer-to-Customer) cash transactions. This is a more flexible and efficient method that bypasses banking restrictions entirely, allowing you to buy crypto directly from a C2C merchant.

How does it work? You can book an appointment with a C2C merchant for an in-person cash transaction. Some platforms and merchants even offer doorstep cash pickup services, ensuring both convenience and security. This is currently the fastest way to overcome banking restrictions and take advantage of market opportunities.

Of course, no matter which method you choose, it's crucial to ensure the legality and safety of the transaction. Selecting a reputable merchant is key. Also, regulated C2C platforms should be used for bookings and transactions to minimize potential risks.

As the digital currency market continues to grow rapidly, the battle between governments, banks and decentralized crypto will only become more frequent. But history has shown us time and again that technological change and market demand are far stronger forces than any policy. Those who dare to position themselves early and explore alternative solutions often seize real opportunities for wealth.

Given today’s high inflation and the rise of the digital economy, it’s more important than ever to invest in the crypto market, which offers both defensive value and tech-driven growth. On the one hand, we can buy spot assets during dips, prioritizing long-term potential coins like BTC, SOL and especially AQS. AQS’s quantitative trading system is about to launch, which will be a major catalyst, driving its price higher and creating huge upside potential. On the other hand, we should take advantage of short-term market swings by using quantitative trading strategies for contract trading, rapidly expanding our assets.

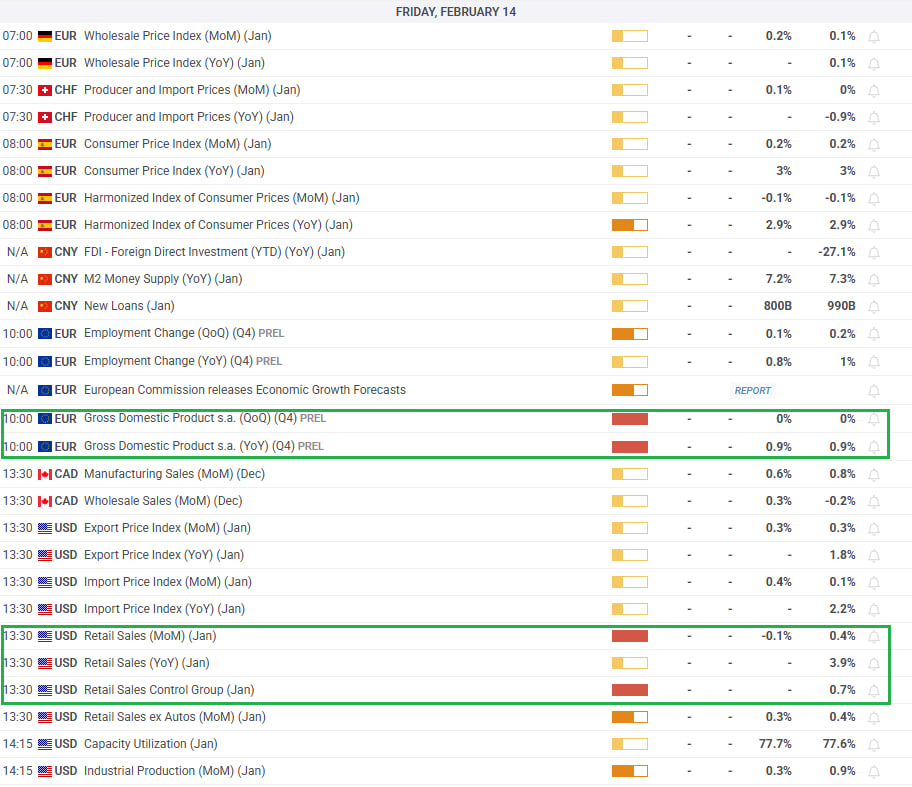

In this high-inflation environment with rising systemic risks, students with limited funds must not wait for opportunities but actively seize them amid the crisis to build their initial wealth. Every market movement presents a chance, especially during key economic data releases. Short-term arbitrage strategies can help us maximize returns. For example, tomorrow’s release of the US Jan retail sales month-over-month data is a prime trading opportunity. We estimate that the overall profit potential could exceed 20%.

Looking ahead to the next week, several major economic reports will be released, including the UK’s Dec three-month ILO unemployment rate, the UK’s Jan CPI month over month, the UK’s Feb manufacturing PMI flash and the US Feb S&P Global manufacturing PMI flash. Meanwhile, global tariff policy changes could also create new trading opportunities. These key events won’t just trigger market volatility. They’ll also provide multiple chances for short-term arbitrage.

Success in anything starts with taking the first step. For students who haven’t yet built enough trading experience, following the guidance of the quantitative trading system will help you develop your own strategies and market mindset. Gaining experience from recent trades before scaling up is the best way to steadily grow your profits. For those with larger capital, using arbitrage and multi-strategy trading to hedge risks is the best path to stable growth.

Great opportunities always come to those who wait. In this shifting economic landscape, let’s leverage the quantitative trading system and digital asset market to create more wealth together. For students who have yet to accumulate their initial capital, take action now and take that first bold step toward your future. Believe in the power of compounding, trust in the trends of tech and economic transformation and move forward with confidence. A brighter tomorrow belongs to those who have the courage to seize the opportunity.