Mastering Market Volatility: The Power of the Triple Investment Strategy in a Changing Economic Landscape

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's a great honour to start this journey with you as we explore the secrets of quantitative trading. The global economy is shifting rapidly from geopolitical tensions to opportunities brought by technological advancements. In this complex environment, our quantitative trading system has delivered impressive results.

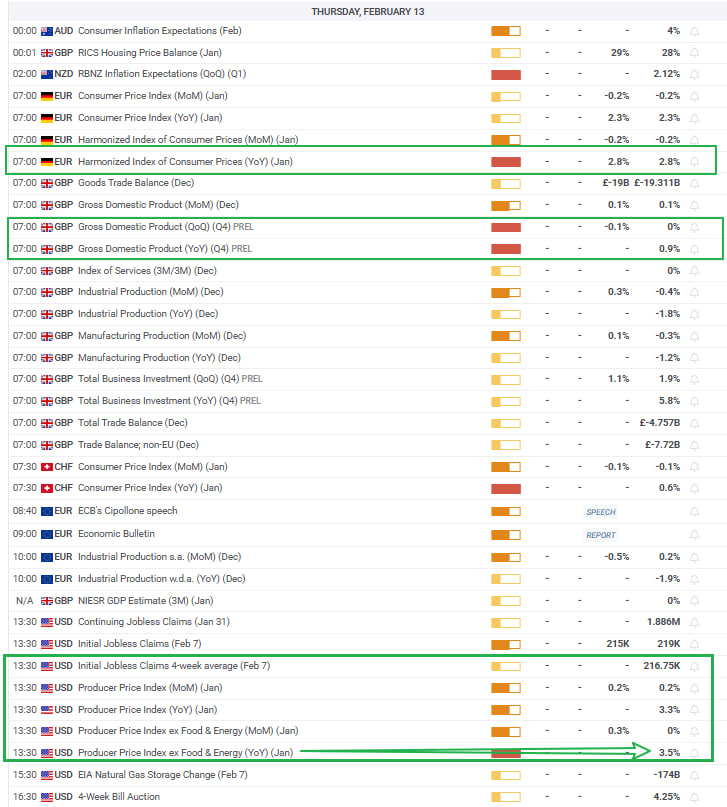

We'll start by analyzing market trends tonight, reviewing today's CPI data movements and sharing the Golden Trinity Portfolio Investment Theory to help you better navigate future investment opportunities.

The UK stock market performed well today. The FTSE 100 opened slightly higher in the morning and gradually climbed throughout the day, closing up 0.36% on multiple positive factors. Two key reasons drove this rally: First, some heavyweight stocks surged on positive news. Second, the government announced a £350M fund to boost affordable and social housing projects. This policy not only signals the government's commitment to housing development but also creates new growth opportunities for the real estate and construction sectors. However, increased housing supply may pressure home prices in the future, weakening demand and posing a risk of home price declines.

Meanwhile, the National Institute of Economic and Social Research (NIESR) raised its UK GDP growth forecast, expecting a 1.5% expansion in 2025, supported by fiscal stimulus and continued business investment. Inflation is projected to drop to 2.4% by year-end, suggesting the Bank of England may only need one more small rate cut. The market reacted positively to this outlook, pushing stocks higher. However, UK markets also felt the impact of the latest US CPI data, increasing risk-off sentiment. The energy and utility sectors faced selling pressure, while banking and industrial stocks showed relative strength. Rising global inflation concerns have added uncertainty to the UK market, requiring investors to be more cautious.

The US market saw even greater volatility. Stocks continued to decline today, mainly due to higher-than-expected Jan CPI data. The Dow dropped over 400 points intraday, while the Nasdaq and S&P 500 also fell, sparking fears that the Federal Reserve might keep interest rates high for longer. According to the CME FedWatch tool, the probability of no rate cut in Mar is now 99.5%, almost entirely ruling out any easing.

At the same time, Fed Chair Powell reiterated in his congressional testimony that policy won't change due to short-term data swings, making it clear that officials will stay cautious about rate cuts. This stance was a real buzzkill for the market, adding to uncertainty and tension.

Trump's tariff policy has also become a key factor fueling inflation. Recently, President Trump announced a 25% tariff on steel and aluminium imports, raising fears of renewed global trade tensions. The European Union quickly responded with threats of retaliatory tariffs on US goods, further escalating uncertainty. Economists widely believe Trump's tariff policy could push up import prices, fueling inflation and making it harder for the Fed to begin rate cuts. With the US stock market and bonds caught between policy shifts and economic data, market sentiment has turned more cautious, driving up risk aversion.

Overall, today’s market was primarily driven by the impact of the US Jan CPI data. The unexpected rise in inflation not only added more uncertainty to the Fed’s future policy but also made market sentiment suddenly tense. According to data from the US Labor Department, Jan CPI rose 3.0% year over year, higher than the 2.9% expected. Month-over-month growth was 0.5%, also well above the 0.3% forecast. What’s more concerning is that core CPI, which excludes volatile food and energy prices, jumped 3.3% year over year and 0.4% month over month, both beating expectations. This data shows that underlying inflation pressure in the US is still there, and inflation is far from the Fed’s 2% target range. This will no doubt have a major impact on future monetary policy.

The market responded swiftly and decisively to the CPI data. The US Dollar Index surged immediately after the release, breaking above 108.40 and gaining 55 basis points in the short term, indicating strong market expectations for the Fed to maintain high rates. In contrast, spot gold plummeted due to the stronger dollar, dropping over 1% intraday to a low of $2.863.99K/oz, suggesting that investors favoured holding USD assets when the CPI data was released. The US 10-year Treasury yield also spiked, rising 6.1 basis points to 4.602%, further reinforcing the expectation that the Fed will uphold high rates. However, as the market calmed, gold prices rebounded, confirming that risk-off sentiment is likely to grow, putting USD assets at risk of sell-offs.

From a technical standpoint, S&P 500 futures experienced a sharp decline, with intraday losses widening to 1%. The market’s strong reaction to the inflation data and the uncertainty surrounding Fed policy led to a short-term rise in risk-off sentiment. With the Fed’s rate hike path still uncertain, investors are inclined to reduce their exposure to high-risk assets. This trend also significantly affected the commodities market, particularly oil and gold. Oil prices were under pressure from a stronger dollar and uncertainty over the demand outlook, limiting short-term upside.

The CPI data is critical for the Fed’s policy decisions. Before the release, the market widely expected the Fed to start cutting rates later in 2025. However, the unexpected upside in Jan CPI has changed that view. Traders have now pushed back the first expected rate cut from September to December, and some are even betting the Fed might hike rates further. Although Fed Chair Powell previously said inflation pressures have eased, the rebound in CPI suggests core inflation is still stubborn, making the market even more uncertain about the Fed’s next moves.

From a fundamental perspective, the continued rise in inflation will force the Fed to keep interest rates high in the coming months, making a rate cut much less likely. The increase in core CPI shows that underlying inflation pressure is still there, which could completely erase expectations of a near-term rate cut and even shift the market’s focus toward betting on further rate hikes. This shift will undoubtedly profoundly impact global capital markets, especially asset classes that rely on a low-rate environment to drive valuation growth, such as tech stocks and high-yield bonds.

In today’s market, the quantitative trading system once again demonstrated its crucial role. Even before the data was released, the system had already provided a clear bearish signal and warning. This early warning was based on two main reasons: First, Trump’s continued push for higher tariffs since taking office has added more uncertainty to the market. Second, global inflation data has been rising across the board, and Fed Chair Powell’s cautious comments on the US economy yesterday further reinforced expectations that the CPI data would increase. Because of this, we used the quantitative trading system to start setting up short positions before the data was released, ensuring we were informed and prepared for the market shift.

In this trade, BTC’s price dropped quickly from $96.6K to $94.2K, falling more than $2K in a short time. This short position brought us substantial profits. To better manage risk, we specifically used an arbitrage strategy, making multi-asset trades across different markets and time periods to take advantage of price and time differences for steady gains.

Especially for students with larger funds, multi-layered arbitrage setups led to over 30% in single-day returns. In other words, if you had invested $300K in this CPI data trade, your profit from this one trade would have been over $90K. Once again, this proves that the combination of the quantitative trading system and arbitrage strategy not only allows us to accurately capture market opportunities but also helps minimize risk and ensure steady asset growth.

After making solid profits, some students with larger funds started thinking about how to better diversify their investments for more stable long-term returns. This is the right investment logic. A diversified portfolio can further lower risks, improve overall portfolio safety and returns, and achieve steadier wealth growth. We often say that a triangle structure is the most stable, and this principle also applies to investing. We recommend using the "Three-Part Investment Portfolio" strategy to help students balance short, mid and long-term investments, ensuring they stay ahead in any market environment.

Looking at the portfolio breakdown, the first part is short-term contract trading, which is currently our key method for generating high returns. Especially when major economic data is released, our quantitative trading system provides real-time signals, allowing us to set up trades in advance, capture short-term arbitrage opportunities and quickly grow capital. We used this exact approach to secure strong profits in today's CPI trade. The advantage of short-term trading is its efficiency and flexibility, enabling rapid capital growth in a short time. However, since the market is highly volatile, this strategy requires precise execution and strict risk control. For students with smaller funds, short-term trading is the best way to build up capital quickly and move into higher investment levels.

If short-term trading is a profit accelerator, then mid-term investing is the foundation for steady growth. We are especially bullish on AQS tokens for mid-term investments. The project behind AQS is a perfect mix of AI and finance, aligning with the market's strong demand for intelligent trading tools and the rise of the digital economy. Since our quantitative trading system's public test started on Jan 20, AQS has surged from $0.7 to $1.4, doubling in just two weeks.

With the system's full upgrade and increased market promotion, we expect AQS to keep climbing over the next month, with a target price of at least $4. Compared to the last system upgrade, when AQS tripled, the surge could be even bigger this time, potentially reaching over 5x growth in the short term. A mid-term AQS position can capture this digital asset boom and bring in steady, strong returns for students with more capital.

The third part is long-term staking, which is ideal for students looking for stable returns. Staking not only provides passive income but also helps smooth out portfolio risks. For example, the SOL staking program offers an annual yield of 37%, meaning a steady 0.1% daily return.

More importantly, SOL itself is a high-potential digital asset, second only to Eth, with strong long-term growth potential. For students who have profited from short and mid-term trades, putting part of their funds into SOL or other high-yield staking programs is a smart move. This way, they can lock in some profits while continuously growing their wealth in the long run, ensuring steady asset appreciation.

Overall, the core of the Three-Part Investment Portfolio is the balance between short, mid and long-term investments. Short-term contract trading helps us quickly generate liquidity and short-term profits. Mid-term positions in AQS tokens allow us to participate in the long-term growth of the digital economy and capture the potential for future upside. Long-term staking locks in stable returns, ensuring the safety and steady growth of overall profits. These three elements work together to create a multi-dimensional and stable investment framework, offering students all-around growth opportunities.

In practice, students can gradually allocate their short-term trading profits into spot investments and staking. On the one hand, they can buy AQS in batches, taking advantage of market fluctuations to buy on dips. On the other hand, they can put part of their profits into staking projects, especially those with high returns and low risks, developing the habit of long-term stable investing and continuously growing their wealth.

Looking at investment trends, whether it’s the rapid advancement of technology or shifts in the global economy, digital assets are experiencing explosive growth. Especially based on today’s US CPI data, the Federal Reserve is now stuck in a dilemma. It wants to cut rates but fears inflation is getting out of control. At the same time, keeping high interest rates could put too much pressure on the economy. Meanwhile, the Trump administration is raising tariffs to shift the economic burden, further driving up goods prices and increasing inflationary pressure, which is shaking investor confidence.

What’s even more serious is that US debt has now surpassed $36T and continues to climb every year. Just paying the interest alone takes up 16% of the federal budget. What does this mean? This means that the Fed may have no choice but to keep printing money. Otherwise, it might not even be able to cover debt interest payments. This US fiscal crisis won’t just impact the country itself but will have deep effects on global markets. The UK isn’t in great shape either, having come close to bankruptcy multiple times. As more money gets printed, the US dollar’s purchasing power will keep weakening, prices will keep soaring, and capital will quickly look for safe havens in this environment. The best safe-haven asset, without a doubt, is digital assets offering both security and strong technological value. After today’s highly negative CPI data, BTC’s rapid rebound is the best proof of this trend.

Focusing capital in the short term and quickly building up principal is a more important strategy for students with limited funds. With today’s successful CPI trade, we are even more confident about the upcoming data-driven market moves. Based on this week’s schedule, Thursday will bring a series of major economic reports, including Germany’s final Jan. CPI month over month, the UK’s preliminary Q4 GDP year over year and the US Jan. PPI year over year. These reports will create multiple arbitrage trading opportunities. Using our arbitrage strategy, we expect single-trade profits to exceed 150%. In addition, Friday’s US Jan. retail sales month over month is expected to bring around 100% returns. Based on a 20% position size, total expected profits over the next two days should reach 50%.

Do the math: if you follow this week’s data trades and achieve 80% profits, your compounding returns will grow exponentially. As your principal increases, there will be more opportunities for arbitrage trading and portfolio investments, while risk will gradually decrease due to diversification. This will make your overall returns more stable. This is not only a chance for rapid, short-term growth but also a crucial step toward long-term wealth accumulation.

Especially in today’s high inflation and global economic uncertainty, actively positioning in digital assets can protect your wealth from devaluation and significantly boost your financial growth. For students with limited capital, this is a rare breakthrough opportunity. By seizing every market move and arbitrage opportunity, you can quickly build your initial funds, eliminate short-term financial stress and lay a solid foundation for future investments.

This is a key window in a time of change and a great chance to scale your wealth. The rapid rise of the digital economy and artificial intelligence will reshape global markets, driving a new wave of asset revaluation. If you position yourself early, you won’t just hedge against economic risks; you’ll ride the trend to massive growth, bringing you closer to financial freedom. Whether it’s short-term arbitrage, mid-term positioning in AQS tokens or long-term digital asset deposits, these are all powerful tools to build a diversified portfolio and achieve steady long-term growth.

Make sure to focus on tomorrow’s data-driven market moves, especially for those with limited funds or who missed today’s CPI trade. Get your capital ready, follow our next trades closely and use our quantitative trading system to capture every profit opportunity from economic data. Let’s work toward our 80% weekly profit target step by step. This isn’t just a chance to make short-term gains; it’s an opportunity to use technology and economic shifts to level up your financial status. Let’s move forward together, execute with precision and go all-in for even greater profits!