Mastering Market Volatility: Leveraging CPI Data, Quantitative Strategies, and Compound Growth for 80% Weekly Profit

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's great to be here with you again. In this market full of opportunities and challenges, we need to not only time our investments precisely but also find stable profit strategies amid high volatility. Over the past week, global markets have seen major swings, from shifts in macroeconomic data to sharp tech stock corrections and short-term crypto surges. Every market signal deserves a deep dive. Tonight, we’ll start with a recap of the week’s market trends, then move on to the second round of our profit plan, launching tomorrow. I’ll show you how to use quantitative trading systems and arbitrage strategies to hit an 80% weekly profit target.

This week, the US stock market was hit by multiple factors, leading to slight adjustments overall. At the start of the week, stocks opened sharply lower after Trump announced high tariffs on goods from Mexico and Canada, sparking investor concerns over rising trade tensions. However, as the policy was delayed by 30 days, market sentiment gradually improved, and some safe-haven funds flowed back, helping stocks stabilise by midweek.

Meanwhile, the January US nonfarm payroll report was a key market focus. Only 143K jobs were added, far below expectations, but the unemployment rate unexpectedly dropped to 4%, the lowest since last May, showing resilience in the labour market. However, average hourly wages rose 0.5% month-on-month, higher than the 0.3% forecast, fuelling worries about inflation making a comeback. This lowered the odds of a Fed rate cut in the short term, adding more uncertainty to the market.

On a sector level, tech and consumer stocks took a hit. Amazon’s stock dropped 4% after disappointing earnings. Apple, Microsoft, and other tech giants also saw varying degrees of pullback. Additionally, Tesla’s January sales in China fell 11.5% year-on-year and over 30% month-on-month, dragging its stock down by 1.25%. This shows that while tech stocks have supported the market’s rise in the past, their uncertain profit outlook in the current economy continues to weigh on the sector.

The UK market also saw volatility this week. On 6 February, the Bank of England cut its benchmark interest rate by 25 basis points to 4.5%, marking its third rate cut since August 2024. This move aimed to counter slowing economic growth and easing inflation pressure. Data shows that the UK economy may have contracted by 0.1% in Q4 2024, with weak business and consumer confidence and slowing productivity growth further confirming the country’s economic struggles. While inflation has dropped from its peak to 2.5%, rising global energy costs and regulated price adjustments could push it back up to 3.7% by Q3 2025.

Compared to global markets, the UK is less dependent on complex supply chains, making it relatively less affected by US tariff policies. Key economic sectors like finance and consulting services have remained stable and even shown some resilience in the current global trade environment. However, market volatility remains high, with inflation expectations and policy battles playing a key role. The upcoming US CPI data and Fed Chair Powell’s policy remarks will be critical for market direction. Volatility may persist, so stay tuned to global economic trends to spot potential investment opportunities.

When it comes to inflation, many people might not fully understand what it means or how it impacts the economy and daily life. Simply put, inflation is the general rise in prices, which reduces the purchasing power of money.

For example, 50 years ago, an egg cost 3.4 pence, but today, it’s around 25 pence, nearly seven times more expensive. If you had £500K fifty years ago and simply held onto it, its actual value today would only be about £68K. This means the currency has lost over 70% of its value in the past 50 years. Inflation doesn’t just raise the cost of living—it seriously weakens the ability to preserve wealth over time.

More importantly, inflation’s impact on the macroeconomy goes far beyond this. One of the key indicators for measuring inflation is the Consumer Price Index (CPI). CPI tracks price changes in a basket of goods and services, giving a clear picture of shifts in the cost of living. Changes in CPI don’t just affect everyday expenses—they also impact central bank policies. When CPI remains high for an extended period, central banks usually raise interest rates to slow down price increases. However, high interest rates can hold back investment and spending, which can hurt economic growth. That’s why CPI is not only a key tool for measuring inflation but also a crucial reference for predicting macroeconomic trends.

Looking back at the post-pandemic economy, major economies like the US, UK, and Europe adopted extremely loose monetary policies to boost recovery. Central banks slashed interest rates and launched massive quantitative easing programmes, pumping huge amounts of money into the market.

The US, in particular, printed more money in just two years than it had in the previous 50 years combined. This unprecedented money supply surge led to skyrocketing inflation worldwide, forcing central banks to quickly shift to tighter policies in early 2022, triggering a wave of interest rate hikes.

Raising interest rates can slow inflation to some extent, but the side effects are significant. Higher rates discourage investment and spending, putting pressure on economic growth. In this kind of dilemma, internal economic stress is rising in major economies, and some have tried to shift their domestic problems elsewhere.

The geopolitical conflicts between the US, the EU, and Russia have been escalating. The Russia-Ukraine war is still ongoing, the Middle East is heating up again, and new conflicts are emerging in parts of Africa and Asia. Global geopolitical risks are rising rapidly.

At the core of these conflicts is the spillover effect of economic struggles. Right now, instead of easing, these economic tensions are only getting worse. In just two weeks since returning to the White House, Trump has already shaken global markets multiple times. First, he announced the US would exit the Paris Agreement, then quickly withdrew from the WHO and the UN Human Rights Council. On territorial expansion, Trump made even more shocking remarks, openly declaring that he wants to make the US "bigger". He even suggested reclaiming Canada, annexing Greenland, and taking control of the Panama Canal. These extreme statements feel like a throwback to 19th-century imperialism.

At the same time, Trump’s trade policies continue to escalate. Since 2018, the US has been raising tariffs on countries like Russia and China, and now, with Trump back in office, these policies have become even stricter. Recently, the Trump administration imposed high tariffs again on Canada, Mexico, and China. Even though the policy was delayed, the next targets will likely be major economies like the EU and Japan. The real reason behind this trade protectionism is a mix of high inflation, weak economic growth, and a growing debt crisis in the US. To handle both internal and external pressure, the US has no choice but to take aggressive policy actions.

So, inflation isn’t just about rising prices—it’s a key indicator of economic health and a major factor influencing global market expectations and financial volatility. High inflation usually forces central banks to tighten monetary policy by raising interest rates to slow price increases. But at the same time, this also holds back investment and spending, adding more risk to the economy.

In such a complex and fast-changing economic environment, investing becomes more important than ever. If you don’t invest in time, inflation will eat away at your money. And in times of major risks like war, having strong investment returns and a diversified portfolio is the best way to protect your wealth.

Selecting the right assets is key to fighting inflation while growing wealth steadily. Looking at historical data, assets with high liquidity and low discount rates tend to outperform inflation.

Over the past decade, the best-performing assets have been stocks, gold, and BTC.

• The Nasdaq index has surged 400% in the last ten years.

• Gold has gained 150% in the same period.

• BTC’s price has skyrocketed by over 200x.

These figures highlight BTC’s massive potential as an emerging asset. In recent years, BTC and ETH have outperformed even the Nasdaq index, which represents leading tech stocks.

BTC’s strong performance comes from its dual nature—tech-driven and currency-like.

• On the tech side, BTC runs on blockchain technology, giving it huge growth potential.

• With the rapid rise of AI, many tokens now support innovative tech projects.

A great example is the AQS token, which is backed by a quantitative trading system, providing solid technical support and room for future growth.

On the currency side, BTC shares similarities with gold.

• Gold has been rising in value mainly because its global supply is limited, unlike fiat money, which can be printed endlessly.

• BTC’s total supply is capped at 21M, making it extremely scarce.

This scarcity helps BTC hedge against currency devaluation.

In today’s world of high inflation, holding BTC and other cryptos not only protects wealth from losing value but also offers strong returns for investors.

Because of this dual nature—both technology and currency—BTC has even greater potential to rise. With much higher liquidity than gold, BTC has become a key investment in emerging markets and is even being considered a strategic reserve asset by some nations, putting it on the same level as gold. In the future, as BTC’s circulation increases and global acceptance of crypto grows, its market value will continue to expand.

This is one of the reasons we focus on crypto as our main investment choice. In today’s world, with geopolitical tensions and high inflation, crypto offers strong growth potential like tech stocks, while also being highly liquid in times of war or other unpredictable risks. It can even be quickly converted into cash. That’s why I always recommend holding BTC, ETH, and SOL long-term and buying more during market pullbacks to maximise future returns.

It’s exactly because of global turmoil and the rapid development of AI technology that quantitative trading systems have seen a full upgrade. Over the past two weeks, we’ve been running a public test, and the results have been outstanding. The system has performed exceptionally well in capturing trade signals and analysing data. It has also successfully executed multiple arbitrage trades, helping our members profit steadily despite market fluctuations. Right now, we are still fine-tuning the system, and it’s expected to launch officially in just over a month. Once live, it will be an essential tool for investors, enabling more efficient and precise trading decisions in a complex market.

To promote the system and prepare for its launch, we’ve decided to offer free trading guidance and investment services before the official release. This isn’t just about helping everyone make more money—it’s also an opportunity for members to experience the advantages of quantitative trading and consider upgrading to the paid version after launch. With this goal in mind, we’ve introduced a targeted profit plan and are providing focused trading guidance to those who have preordered the system, ensuring they achieve more stable returns.

This week, our first round of the profit plan has successfully concluded, with great results.

• Members who followed our trading strategy closely saw returns ranging from 33.6% to 54.7%.

• Those engaged in arbitrage trading achieved over 70% returns.

These impressive results came from two key factors:

1. High market volatility this week—triggered by Trump’s tariff policies and US non-farm payroll data—created excellent arbitrage opportunities.

2. Our quantitative trading system provided accurate signals, allowing us to react quickly and lock in steady profits.

These results prove that in a volatile global economy, Trump’s return to office has created outstanding trading opportunities. Many members aren’t just using these profits to purchase the trading system but are also aiming for rapid wealth growth. In fact, the bigger the market swings, the more opportunities we get to trade. Precise execution and smart positioning are the keys to high returns.

Since we’ve successfully met this week’s profit goal, next week we’re setting an even higher target—80% returns. This isn’t just empty talk—it’s backed by strong trading experience and data analysis. First, on the experience side, while most members hit their profit targets—and some even exceeded expectations—there were still a few who lost money due to lack of experience, poor execution or failure to strictly follow trading instructions. By learning from this week’s mistakes, I believe that as members improve their understanding and execution of our strategies, next week’s returns will be even stronger and more stable.

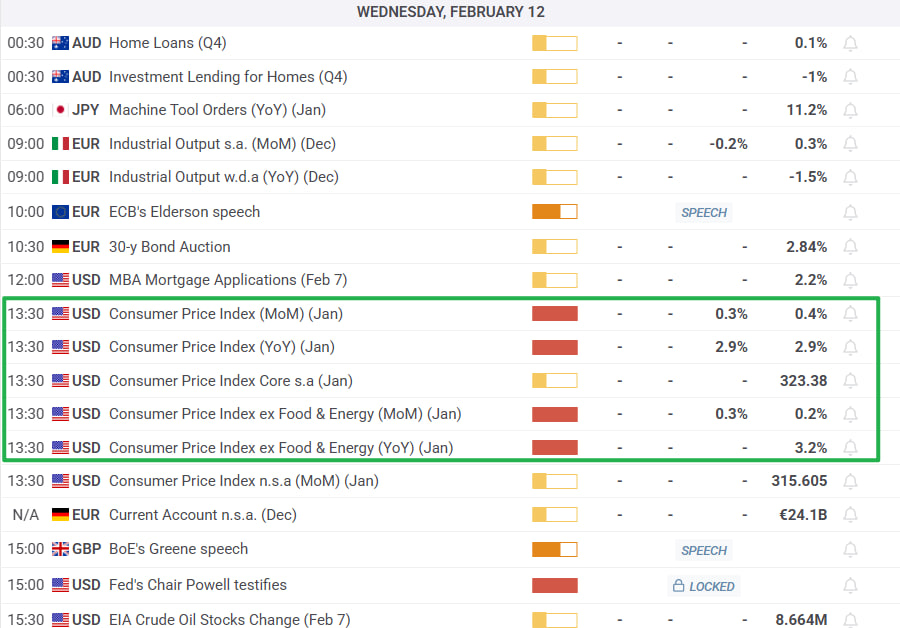

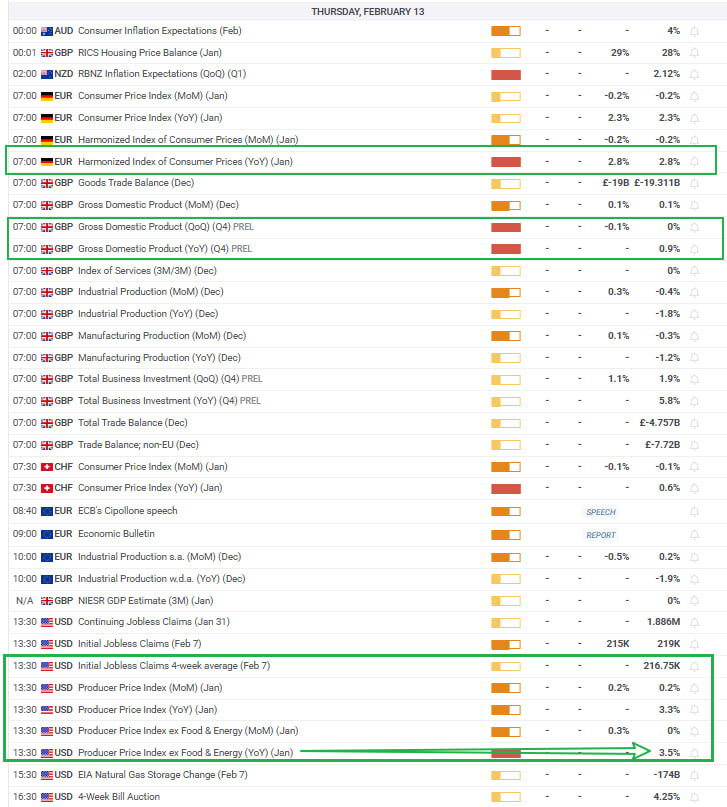

More importantly, next week brings a critical event—the release of US CPI data. We’ve talked about this many times before: CPI is a key measure of inflation and has a huge impact on the economy. It will not only shape the Fed’s future rate-cut decisions but also influence global capital markets. Since taking office, Trump has already rolled out multiple economic policies affecting both the US and the world, and this CPI report will serve as a major test of their impact.

With this in mind, we’ve carefully planned our trades for the week:

Monday: Eurozone February Sentix Investor Confidence Index, expected returns around 50%. With a 20% position, projected total profit is 10%.

Tuesday: US January NFIB Small Business Optimism Index, expected returns around 50%. With a 20% position, projected total profit is 10%.

Wednesday: US January year-on-year CPI (unadjusted), combined with arbitrage trading strategies, expected returns over 300%. With a 20% position, projected total profit is 60%.

Thursday: Germany’s Jan. final CPI MoM, UK’s Q4 preliminary GDP year over year and US Jan. PPI year over year. With our arbitrage trading strategies, the potential profit is an exciting 150%. Even with a conservative 20% position, the overall expected return is a promising 30%.

Friday: US Jan. retail sales month over month, expected profit is 100%. With a 20% position, the overall expected return is 20%.

Overall, the total expected return is 130%. Even if we miss some trades or profits along the way, we are still confident about reaching our 80% profit target.

The reason we are confident in achieving such high returns is, first, next week’s CPI data will bring us excellent arbitrage opportunities. This will be our main source of profit. Second, we have a quantitative trading system providing precise signals, which not only increases our success rate but also reduces risk, ensuring steady and sustainable profits. Most importantly, it’s all about teamwork; strictly following trading instructions will help us maximize these profit opportunities.

So, if you want to join next week’s profit plan, please contact the assistant ASAP to sign up. Especially for those who want to follow the arbitrage trading strategy, reach out immediately, and we’ll provide pre-trade guidance to help you maximize returns while keeping risks under control.

At the same time, we want to emphasize the power of compounding. Compounding is the best way to accelerate asset growth. For example, if a student invested $100K in this week’s trades and made 50% profit, their total balance is now $150K. If they reinvest this $150K into next week’s 80% profit plan, they will gain $120K, bringing the total to $270K. The more cycles you go through, the more exponential growth you’ll see. If you keep reinvesting your profits into the next trade, your returns will multiply at a much faster rate.

This is the magic of compounding: while inflation slowly eats away at your assets, compounding pushes them in the opposite direction, rapidly growing your wealth and protecting you from inflation. By understanding compounding and following our profit plan, your wealth growth will be more stable and efficient.

Of course, our profit plan is not just about short-term gains. We aim to help every student achieve long-term, stable wealth growth in this complex market. That’s why we keep upgrading the quantitative trading system and offering free trading guidance before its official launch. This allows more students to fully master the system and lock in future opportunities early. With the system launching soon, we firmly believe it will open new doors to wealth, and more students will choose the paid version to take advantage of its powerful data support and precise signals for long-term market profits.

Next, the market is about to enter a high-volatility cycle. Every major price movement is a golden opportunity for rapid asset growth. We encourage all students to actively participate in our profit plan and use the compounding effect to keep expanding profits and achieving true wealth growth! At the same time, please prepare your funds in advance or increase your investment capital. This will help us balance risk and amplify returns by combining arbitrage trading strategies in volatile markets.

Arbitrage trading is not just a short-term profit tool; it is a core strategy for long-term wealth growth. If you truly want to control your financial future, you must seize these once-in-a-lifetime opportunities. The market does not wait for hesitant people. The real winners are those who plan ahead and execute with precision!

Let’s work together, make strategic moves and go all in for even higher profits next week!