Diamond Ridge Academy: Quant Trading System Public Test Results

Hello, outstanding students of Diamond Ridge Financial Academy!

I’m Charles Hanover, and I’m honoured to join you on this journey to explore the world of quantitative trading. The global economy is shifting rapidly, from geopolitical tensions to opportunities driven by technological innovation. How will our quantitative trading system perform? Let’s find out together as we analyse the public test results. Now, let’s start with today’s market trends, explore the patterns of money flow, and analyse upcoming investment opportunities.

The UK stock market held strong today, with the FTSE 100 index nearly hitting an all-time high before closing at 8,557, up 24 points. Investor confidence was boosted by the strong performance of European markets, as the STOXX 600 index hit another record high, fuelling optimism.

At the same time, tech stocks played a key role in today’s gains, despite some market swings caused by the DeepSeek incident. Mergers and acquisitions were also in focus—Dowlais is rumoured to be a takeover target for a US company, sparking more interest in corporate valuations. Meanwhile, WH Smith’s stock surged thanks to strong growth in its travel business, and Beazley PLC led the market, demonstrating how industry trends continue to shape individual stock performance.

On the policy side, Chancellor Rachel Reeves hasn’t ruled out possible tax hikes while supporting Heathrow Airport’s expansion. The government is balancing economic growth with financial stability. Meanwhile, the banking and retail sectors are facing challenges—Lloyds Bank announced plans to close 136 branches, and Tesco will lay off 400 employees, reflecting a major shift as businesses adapt to the digital age.

Energy reforms are also drawing attention. Regulators have suggested cutting hydrogen costs by 58%, which could impact energy stock valuations and push the government to introduce new industry support policies. Overall, with global trends, policy shifts, and M&A activity at play, the FTSE 100 is likely to remain strong in the near term.

In the US market, stocks were mixed as investors stayed cautious ahead of the Federal Reserve’s interest rate decision. Nasdaq futures were up pre-market, but recent volatility in tech stocks led to a pullback after the opening. The S&P 500 dipped slightly, while the Dow held steady, indicating that investors are leaning toward safer assets.

Tech stocks remain the biggest driver of market swings. Nvidia plunged 16.9% on Monday, then bounced back 8.9% on Tuesday, but pre-market trading suggests further declines. Investors remain wary of overvalued tech stocks. On the flip side, ASML and other chip equipment makers rallied after strong earnings, proving that long-term confidence in tech remains. Meanwhile, T-Mobile US and Starbucks defied the broader market trend with strong earnings, showing that consumer demand is still holding up.

The market's core focus remains the Fed’s policy direction. Right now, investors widely expect no rate changes at this meeting, with the key question being whether Powell signals future rate cuts. Given the potential inflationary pressure if Trump takes office, the market has pushed back rate cut expectations to June, keeping risk appetite subdued in the short term.

Meanwhile, the US 10-year Treasury yield dropped 4 basis points to 4.51%, indicating that uncertainty about the economic outlook persists. In this environment, US stocks may remain volatile in the short term, with the market’s attention focused on interest rate policy and the upcoming earnings reports from tech giants.

Many students have expressed confusion about market operations in this kind of market, especially with individual stock trading, where profits are limited, and some are even facing losses. This isn't surprising given the global economic and political uncertainty, which deeply impacts financial markets. Understanding these complex factors is crucial for adjusting our investment strategies and improving our operations.

To understand why profits are tough to come by, we need to look at both the macro environment and how the market works. First, global uncertainty comes from ongoing geopolitical tensions and constant policy shifts by major economies. Since the pandemic, strategic tensions among major economies like the US, EU, UK, Russia and China have intensified. Take the Russia-Ukraine conflict, for example. It hasn’t only driven up energy and food prices but also worsened global inflation. But at its core, this isn’t just a regional war; it’s actually a battle of interests between the US and Russia.

The US has imposed heavy sanctions in an attempt to weaken Russia’s economy, while Russia has fought back by using its energy exports as leverage. This has pulled several Middle Eastern countries into the situation, turning economic issues into military conflicts. At the same time, the US has also been targeting China with trade sanctions, raising tariffs, blocking chip technology and disrupting supply chains. These moves don’t just hurt China’s growth; they also shake up global industries, making the economy even more unstable.

The US seems to be taking an aggressive approach, but in reality, it has little choice. After the pandemic, to boost its economy, the US printed an enormous amount of money in just two years, more than in the previous 50 years combined. This massive stimulus helped in the short term but led to soaring inflation. Meanwhile, US manufacturing has been weak, unemployment has risen, and economic growth has slowed. To make matters worse, government debt keeps climbing, putting the US at risk of shutdowns and even bankruptcy. To ease these pressures, the US has been using several strategies, boosting corporate competitiveness through the “dollar liquidity cycle” effect, fueling military demand through geopolitical conflicts and using trade sanctions to reduce its debt burden.

One of the biggest forces shaping the global economy right now is the “dollar liquidity cycle.” Since the US dollar is the world’s reserve currency, its movement has enormous ripple effects. Early in the pandemic, the US pumped trillions of dollars into the economy through money printing and stimulus. This flooded the world with excess dollars, weakening the currency and sending capital flowing into global markets, including emerging economies. This inflow of dollars boosted asset prices in those regions, creating a temporary economic boom. But this wasn’t sustainable. Once the Fed started raising interest rates, the dollar flowed back to the US, triggering capital outflows from emerging markets. As a result, these countries faced capital outflows, weaker currencies and even debt crises.

This “rising and falling tide” has deep consequences. When dollars flood into emerging markets, they experience short-term growth. However, economic crises and currency collapse often follow when the tide goes out. Even for the US, while the dollar tide helps ease inflation and capital flow issues in the short run, it could damage trust in the dollar over time. If the dollar’s global dominance is ever seriously challenged, the US model of supporting its economy through money printing and debt will become unsustainable.

The situation in the UK also does not look good. Since 2000, the UK economy has been growing slowly, and the pandemic has only worsened its long-standing economic and social issues. After Brexit, trade relations between the UK and the EU became more complicated, and the global supply chain crisis hit the country's economy hard. On top of that, massive government spending after the pandemic forced the UK to adopt a more conservative monetary policy, trying to stabilize the domestic economy while controlling high inflation.

Looking at the global market, since the pandemic began in 2020, major economies have gone through aggressive monetary policy shifts. At the start of the pandemic, central banks cut rates fast and injected vast amounts of money to ease economic pressure. These moves worked in the short term, boosting economic activity, but they also caused asset prices to surge and inflation to rise rapidly. From 2020 to 2021, global markets were flooded with liquidity, and stock prices shot up not because companies became more valuable but simply due to currency devaluation. In other words, asset prices didn't rise because their real value increased but because more money in the market pushed up prices. This inflated price surge planted the seeds for future financial risks.

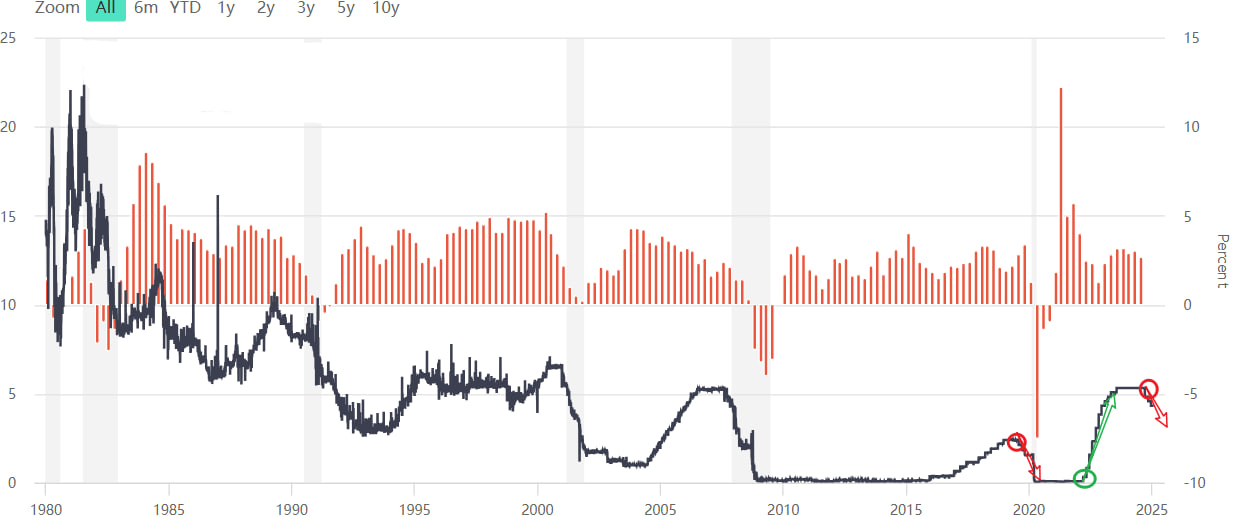

As shown in the chart above, it's a graph of US interest rate fluctuations. Starting in March 2022, with global inflation pressures rising, the Fed took the lead in raising interest rates to curb price increases. This policy shift quickly tightened market liquidity, and large amounts of dollars flowed back from global markets to the US. On one hand, this capital return weakened the stability of emerging market economies. On the other hand, it boosted the performance of the US stock market. Despite this, the pressure on the real economy due to rate hikes gradually became apparent, with corporate financing costs rising and consumer spending being suppressed. The Fed's rate hike cycle brought a temporary concentration of capital but struggled to sustain a broad rise in asset prices.

In Jun 2024, as inflation gradually eased, global economic policies once again shifted, with major economies adjusting their monetary policies to address the challenges of economic slowdown. Starting in Sep 2024, the US entered a rate-cutting cycle to reduce financing costs and release more liquidity into the market to stimulate economic recovery. This policy boosted market sentiment, causing the US stock market to strengthen from Aug to Dec last year. During this period, ample liquidity led to a significant rise in asset prices.

However, this rise didn't stem from an increase in the inherent value of the assets themselves but was the inevitable result of an increase in the money supply. The rise in asset prices appeared to be an appreciation on the surface, but in reality, it reflected the decline in currency purchasing power. For investors, this means that holding cash without investing it in the market will cause its real purchasing power to quickly erode in an environment of excessive money printing and inflation.

In this loose market environment, investing almost became a "guaranteed profit" strategy. The abundant liquidity led to large-scale inflows of funds into risk assets, and our team seized the market opportunities during this period. We capitalized on strong upward trends in tech stocks like Astera Labs (ALAB), MicroStrategy (MSTR) and Trump Technologies (DJT), creating significant returns for our students. The outstanding market performance during this time pushed many investors' returns to new heights.

Starting in mid-December last year, the market direction changed. The Fed's rate-cutting measures came to a halt, and Trump was about to take office with new economic policy proposals, including increasing tariffs and supporting US manufacturing. While these policies may boost certain industries in the short term, in the long run, this protectionist approach could disrupt the current global economic balance, raise trade barriers and further drag down global growth.

These policies broke market expectations of a loose monetary policy in the short term, changing market sentiment and causing indices to enter a range-bound movement. As shown in the chart above, from the Nasdaq index's price chart, it can be seen that from Aug to mid-Dec, the index steadily rose, but after that, it entered a clear adjustment phase.

In this overall weak market, the difficulty of making profits from individual stocks increased significantly. The index's adjustment directly impacted individual stock trends. Even strong stocks struggle to maintain continuous rises when the market lacks a clear directional trend. For example, Nvidia's stock price briefly surpassed $150 in early Dec last year, but it couldn't sustain the upward trend and entered a consolidation phase. If investors didn't cut back their positions at the high, their gains could shrink drastically or even turn into losses. Worse, after stopping losses during the drop, some investors saw the stock price rebound and rushed to buy in again, only to continue buying high and selling low, ending up in a loss cycle. A similar situation happened with stocks like DJT and COIN. If investors can't catch the rhythm of buying low and selling high, even hot tech stocks will struggle to deliver ideal returns in a complex market environment.

In this kind of market, the value of short-term trading becomes particularly important. Instead of passively waiting for a market trend, it's better to actively seize short-term opportunities in a choppy market. Buy low and sell high is one of the most effective strategies in a range-bound market, and our quantitative trading system has shown strong profitability with this strategy. During the public test, the system used technical indicators, market sentiment and real-time data to accurately capture short-term market fluctuations.

For example, the system triggers a sell signal when an asset's price hits a key resistance level but shows weak upward momentum. When market volatility spikes, the system reminds investors to take stop-loss or hedge measures. The advantage of dynamic monitoring is that it helps investors find opportunities in choppy markets while effectively reducing risks and preventing sudden losses due to rapid market changes.

As of tonight, our large-scale public test event is nearing its end. According to the data from the public test, the overall performance has met our pre-test expectations, and in some areas, it has even exceeded our initial assumptions.

Throughout the public test, the trading system's signal success rate was as high as 97.1%. This means that the system made the right trading decisions in almost all market fluctuations. Of course, some students did not strictly follow the trading instructions, resulting in lower profits or even some losses. However, despite this, the returns for the vast majority of participants still ranged from 53.1% to 71.8%, far exceeding the pre-public test expected target. Given that this success was achieved under the complex and changing market environment with Trump in office, the performance of the quantitative trading system is undoubtedly an impressive validation of success.

Many students were impressed by the performance of the quantitative trading system and hope to continue using it for trading guidance. At present, we still need to communicate further with the project team. After all, the system has just completed a large-scale public test and still requires deeper optimization and adjustments. It is expected that after a period of bug fixing, data adjustments and feature refinement, the system will be ready for official release. Once launched, this quantitative trading tool will enter the commercialization phase, meaning that investors who wish to continue using the system for trading will need to pay a fee.

For the financial academy, we will continue to provide professional investment services for our students and use this quantitative system to accumulate more loyal users for our quantitative fund. As for the project team, they hope to use the public test to demonstrate the system's value to more investors and attract more people who are willing to pay for the investment services they provide.

In the current market, where most investors are losing, and confidence is low, the performance of the quantitative trading system has undoubtedly become a beacon, offering precise trading signals and steady profit opportunities. In a global capital market that's still fluctuating and with unclear market trends, traditional investment methods often struggle to adapt to the complex and changing market. At the same time, investors increasingly recognize the advantages of intelligent trading tools. Through scientific data analysis and a strict risk control system, this system has not only improved the win rate but also reduced the uncertainty caused by market fluctuations to some extent. Looking ahead, as the global economic environment and monetary policies gradually stabilize, we have reason to believe that this system will continue to optimize trading strategies, make signals more accurate and help investors achieve more stable returns in different market cycles.

We have already started the data follow-up work to improve the system's practical application further. Since yesterday, the assistant team has been reaching out to participants of the public test to collect their experiences and feedback during the trading process. This not only helps the project team optimize system parameters but also helps investors gain a deeper understanding of the quantitative trading strategy and apply it more precisely in practice.

After all, no matter how advanced the trading tool is, it can only reach its maximum potential if used with the proper trading logic. Based on the current follow-up results, most participants have expressed recognition of the system's performance, especially during market fluctuations, where the short-term trading signals provided by the system helped them make significant profits in a volatile market. Of course, some participants missed the best trading opportunities because they didn't fully follow the trading instructions. Therefore, we encourage all participants in the public test to actively provide trading data and feedback so the project team can further improve the system and ensure that it can still produce high-quality trading signals in more complex market environments in the future.

We sincerely thank all the investors who have supported us. The financial market is constantly changing, and relying solely on personal experience and subjective judgment often makes it difficult to cope with the complex market environment. Maintaining stable profits in fluctuations requires not only keen market insight but also powerful technical support. The success of the quantitative trading system is not only a technological breakthrough but also a revolution in future investment models.

With the widespread application of technologies like AI and machine learning in finance, the future investment model will become increasingly intelligent, and our goal is to help more investors achieve stable wealth growth through advanced trading tools. In the face of the opportunities brought by technological change, we must not only follow the trend but also actively use new technologies to empower investment and gain an advantageous position in market competition.

Finally, I would like to remind everyone again that the current round of the large-scale public test will officially end at 10 PM tonight. According to the agreement before the public test, the project team has provided each participant with a $2K public test fund usage right and 30% of the profits generated during the test period belong to the participants. Therefore, to ensure the completeness of the public test data and successfully complete the profit distribution, all participants in the second round of the public test must settle all open orders by 10 PM tonight to ensure the test process ends smoothly. If you do not clear all positions, the system will force liquidation during the public test fund settlement. After the public test ends, we will conduct the final statistics of all trading data and arrange for the summary work of the public test data.

This public test is not only a comprehensive verification of the system's performance but also an in-depth exploration of market trading logic. Based on the final data results, the system's performance far exceeds the market average, still showing high adaptability and stability in complex market conditions. This further proves that technology will be the key factor determining success or failure in the future investment world. Past experiences tell us that every major change in the financial market comes with a new technological revolution, and quantitative trading is one of the most disruptive investment methods of this era. In the future, we will continue to promote the application and upgrade of this technology to ensure that every student can use intelligent trading tools to find their own profit opportunities in the market.

Thank you once again for your attention and participation in this public test. The conclusion of the public test marks not the end but the beginning of a new phase. Let’s move forward together, seize the opportunities the technological revolution presents, and utilize the most advanced trading tools to enhance our investing efficiency and precision, leading to more stable wealth growth!